Banner Bank trades at $68.26 and has moved in lockstep with the market. Its shares have returned 5% over the last six months while the S&P 500 has gained 6.9%.

Is now the time to buy Banner Bank, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Banner Bank Not Exciting?

We're sitting this one out for now. Here are three reasons why BANR doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

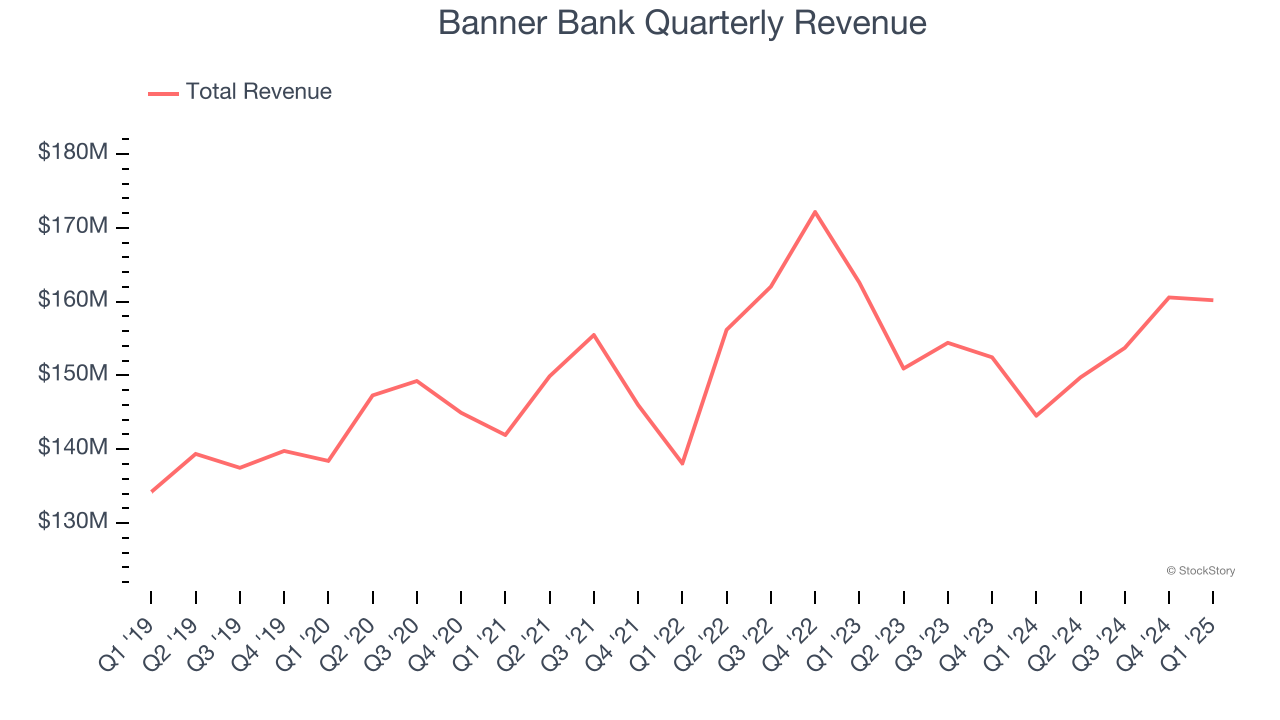

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

Regrettably, Banner Bank’s revenue grew at a tepid 2.4% compounded annual growth rate over the last five years. This fell short of our benchmarks.

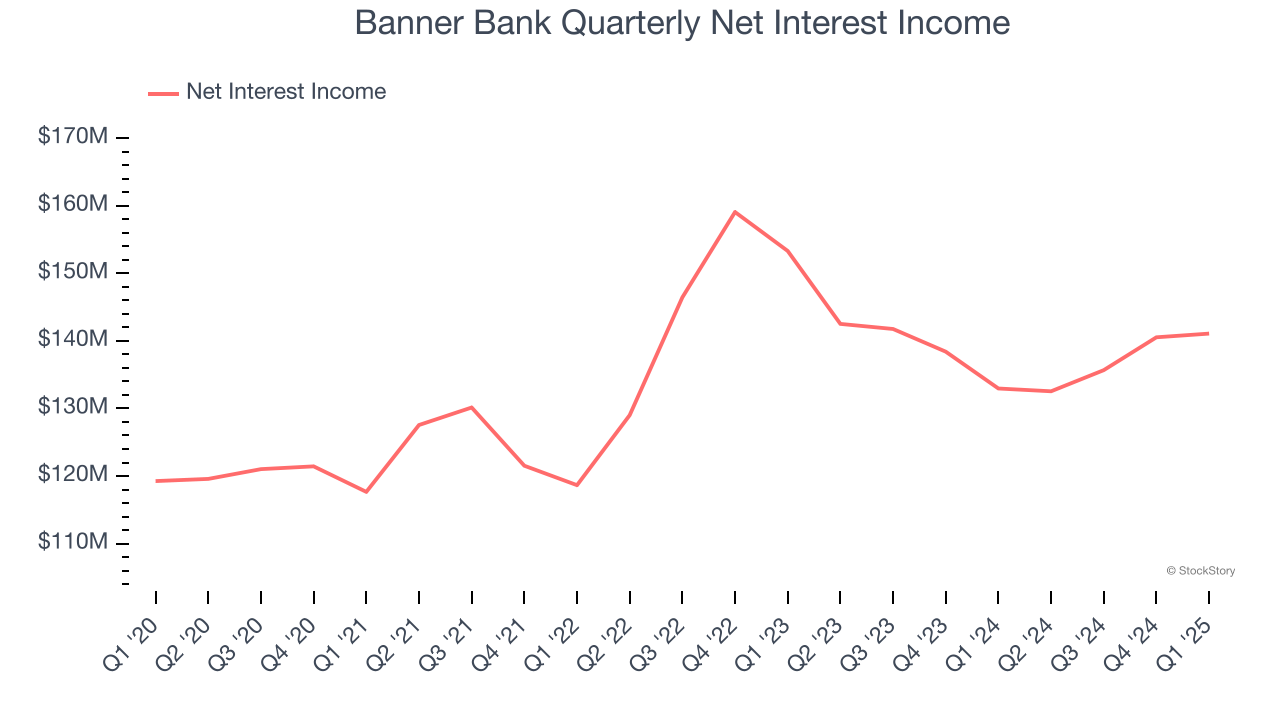

2. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Banner Bank’s net interest income has grown at a 3.5% annualized rate over the last four years, worse than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

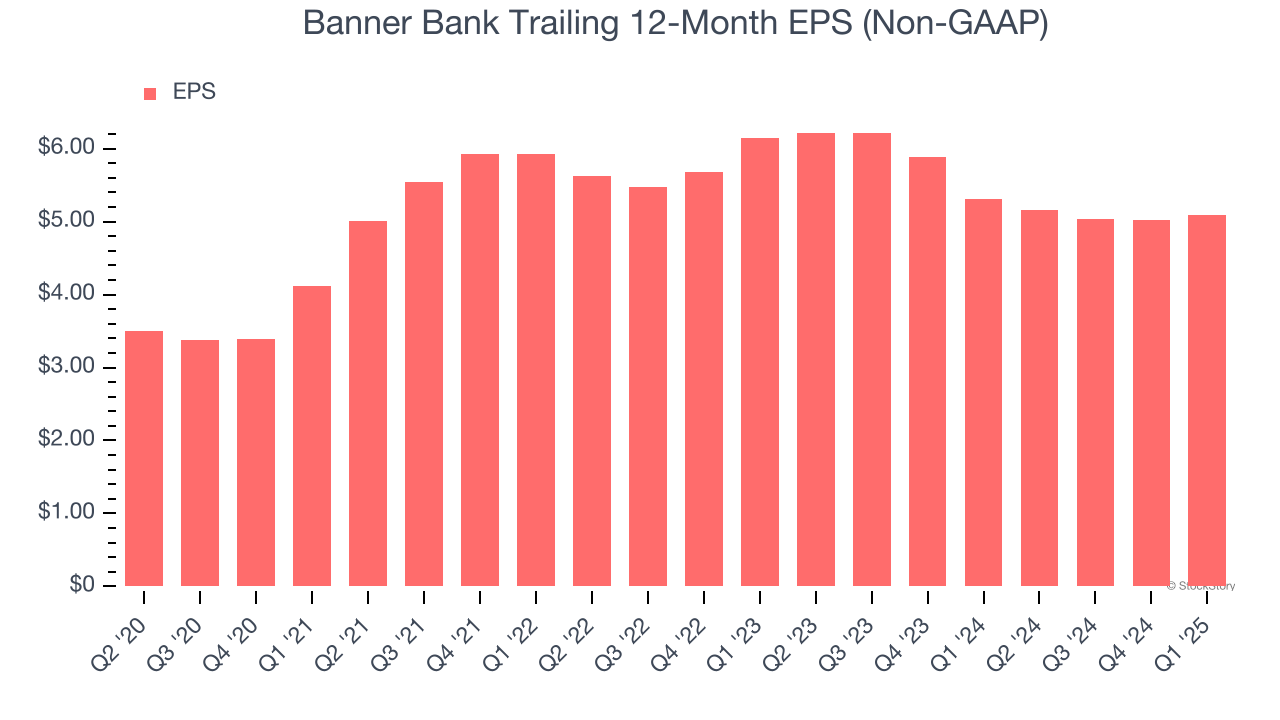

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Banner Bank, its EPS declined by more than its revenue over the last two years, dropping 9%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Banner Bank isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.2× forward P/B (or $68.26 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Banner Bank

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.