Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Tri Pointe Homes (NYSE: TPH) and the best and worst performers in the home builders industry.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 12 home builders stocks we track reported a slower Q1. As a group, revenues beat analysts’ consensus estimates by 1.4%.

Thankfully, share prices of the companies have been resilient as they are up 5.3% on average since the latest earnings results.

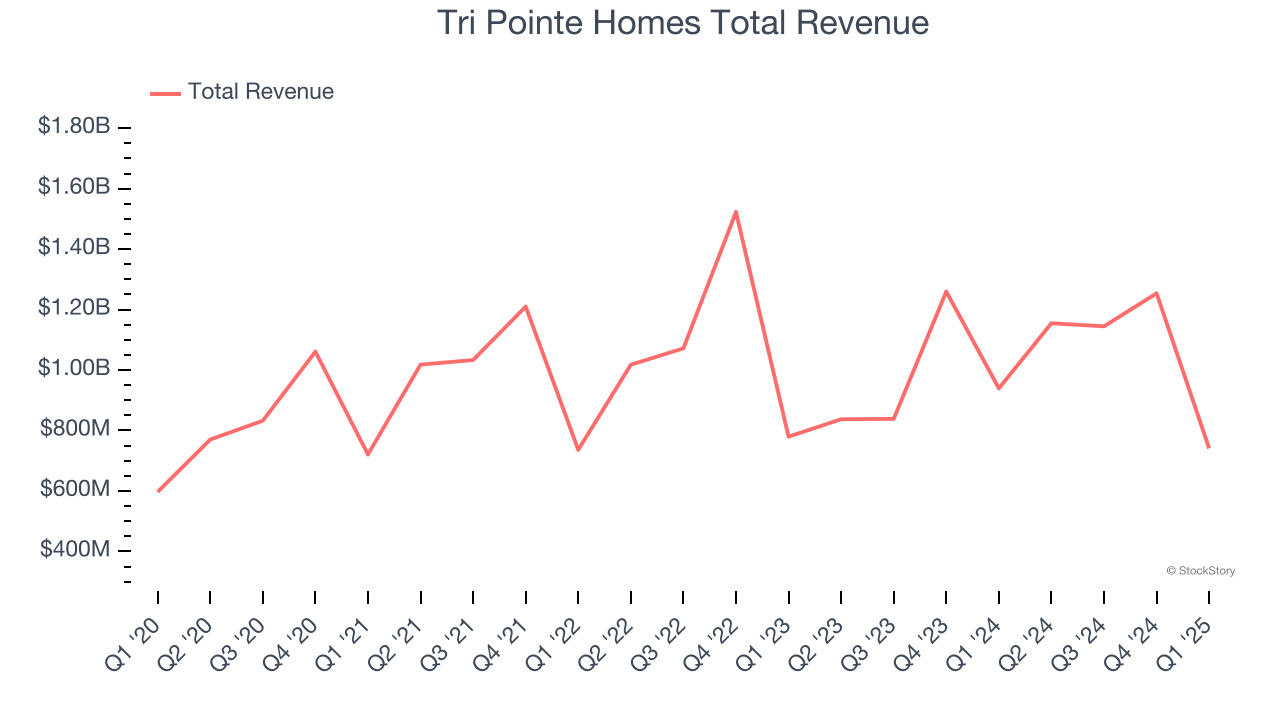

Tri Pointe Homes (NYSE: TPH)

Established in 2009 in California, Tri Pointe Homes (NYSE: TPH) is a United States homebuilder recognized for its innovative and sustainable approach to creating premium, life-enhancing homes.

Tri Pointe Homes reported revenues of $740.9 million, down 21.1% year on year. This print exceeded analysts’ expectations by 4%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

“Tri Pointe delivered solid first quarter financial results, either meeting or exceeding all our stated guidance,” said Doug Bauer, Tri Pointe Homes Chief Executive Officer.

Tri Pointe Homes delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 7% since reporting and currently trades at $32.98.

Is now the time to buy Tri Pointe Homes? Access our full analysis of the earnings results here, it’s free.

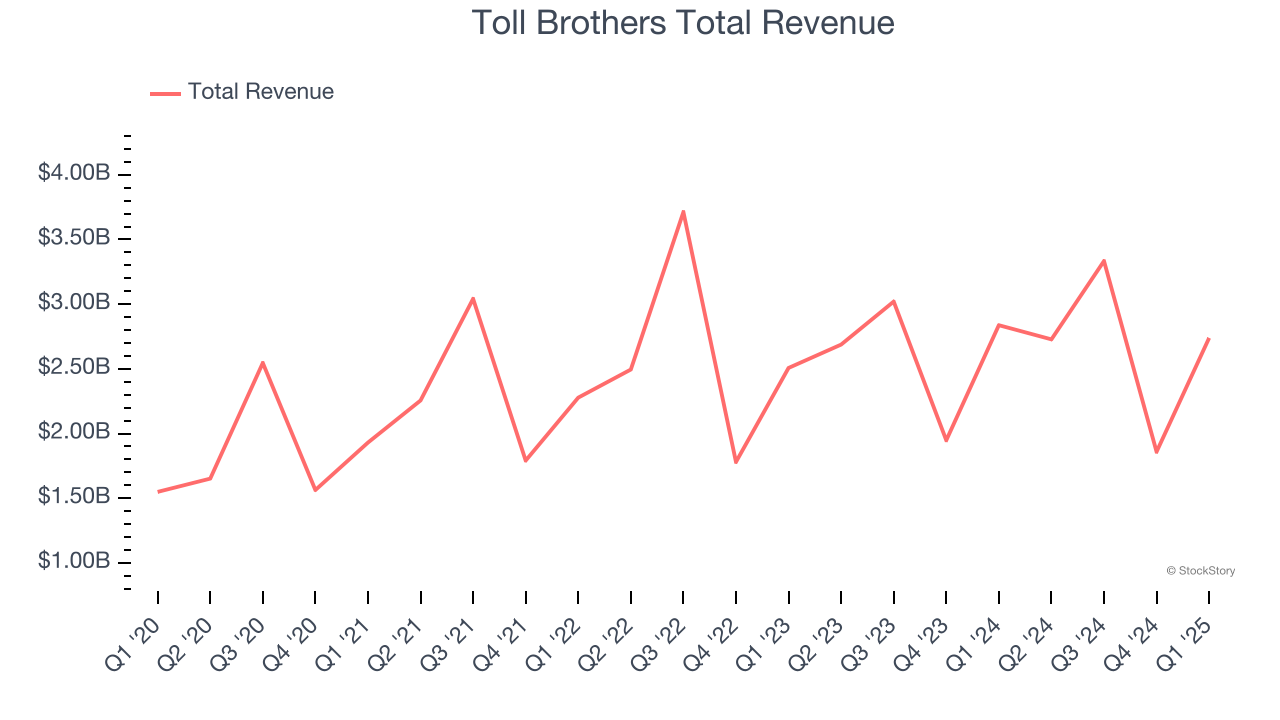

Best Q1: Toll Brothers (NYSE: TOL)

Started by two brothers who started by building and selling just one home in Pennsylvania, today Toll Brothers (NYSE: TOL) is a luxury homebuilder across the United States.

Toll Brothers reported revenues of $2.74 billion, down 3.5% year on year, outperforming analysts’ expectations by 9.9%. The business had an incredible quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

Toll Brothers achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 12.8% since reporting. It currently trades at $117.79.

Is now the time to buy Toll Brothers? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: LGI Homes (NASDAQ: LGIH)

Based in Texas, LGI Homes (NASDAQ: LGIH) is a homebuilding company specializing in constructing affordable, entry-level single-family homes in desirable communities across the United States.

LGI Homes reported revenues of $351.4 million, down 10.1% year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

LGI Homes delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.5% since the results and currently trades at $55.97.

Read our full analysis of LGI Homes’s results here.

Taylor Morrison Home (NYSE: TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE: TMHC) builds single family homes and communities across the United States.

Taylor Morrison Home reported revenues of $1.90 billion, up 11.5% year on year. This result beat analysts’ expectations by 5.7%. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates.

Taylor Morrison Home achieved the fastest revenue growth among its peers. The stock is up 7.9% since reporting and currently trades at $63.45.

Read our full, actionable report on Taylor Morrison Home here, it’s free.

NVR (NYSE: NVR)

Known for its unique land acquisition strategy, NVR (NYSE: NVR) is a respected homebuilder and mortgage company in the United States.

NVR reported revenues of $2.40 billion, up 3% year on year. This print surpassed analysts’ expectations by 0.8%. More broadly, it was a disappointing quarter as it logged a significant miss of analysts’ adjusted operating income estimates.

The stock is up 6.7% since reporting and currently trades at $7,623.

Read our full, actionable report on NVR here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.