Fresh produce company Fresh Del Monte (NYSE: FDP) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 3.8% year on year to $1.18 billion. Its non-GAAP profit of $1.23 per share was 29.5% above analysts’ consensus estimates.

Is now the time to buy Fresh Del Monte Produce? Find out by accessing our full research report, it’s free.

Fresh Del Monte Produce (FDP) Q2 CY2025 Highlights:

- Revenue: $1.18 billion vs analyst estimates of $1.16 billion (3.8% year-on-year growth, 2.2% beat)

- Adjusted EPS: $1.23 vs analyst estimates of $0.95 (29.5% beat)

- Adjusted EBITDA: $95.4 million vs analyst estimates of $81.4 million (8.1% margin, 17.2% beat)

- Operating Margin: 5.8%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, down from 10.3% in the same quarter last year

- Market Capitalization: $1.73 billion

“Fresh Del Monte’s second quarter 2025 results reflect the strength of a strategy rooted in consistency, discipline, and long-term vision. Sales growth was fueled by continued demand for our core products, including our proprietary pineapple varieties, and strong momentum across our fresh-cut business—an area where we’re seeing encouraging progress and expanding margins,” said Mohammad Abu-Ghazaleh, Fresh Del Monte’s Chairman and CEO.

Company Overview

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE: FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $4.31 billion in revenue over the past 12 months, Fresh Del Monte Produce carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

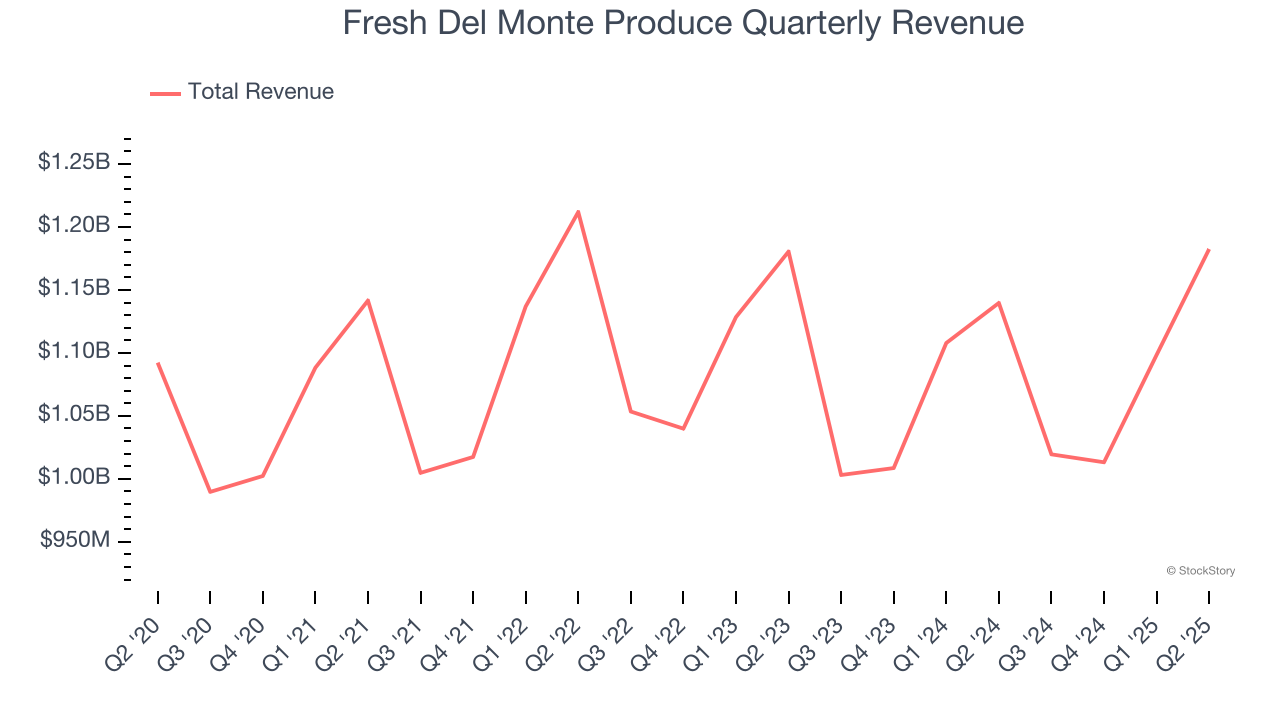

As you can see below, Fresh Del Monte Produce struggled to increase demand as its $4.31 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Fresh Del Monte Produce reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection suggests its newer products will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

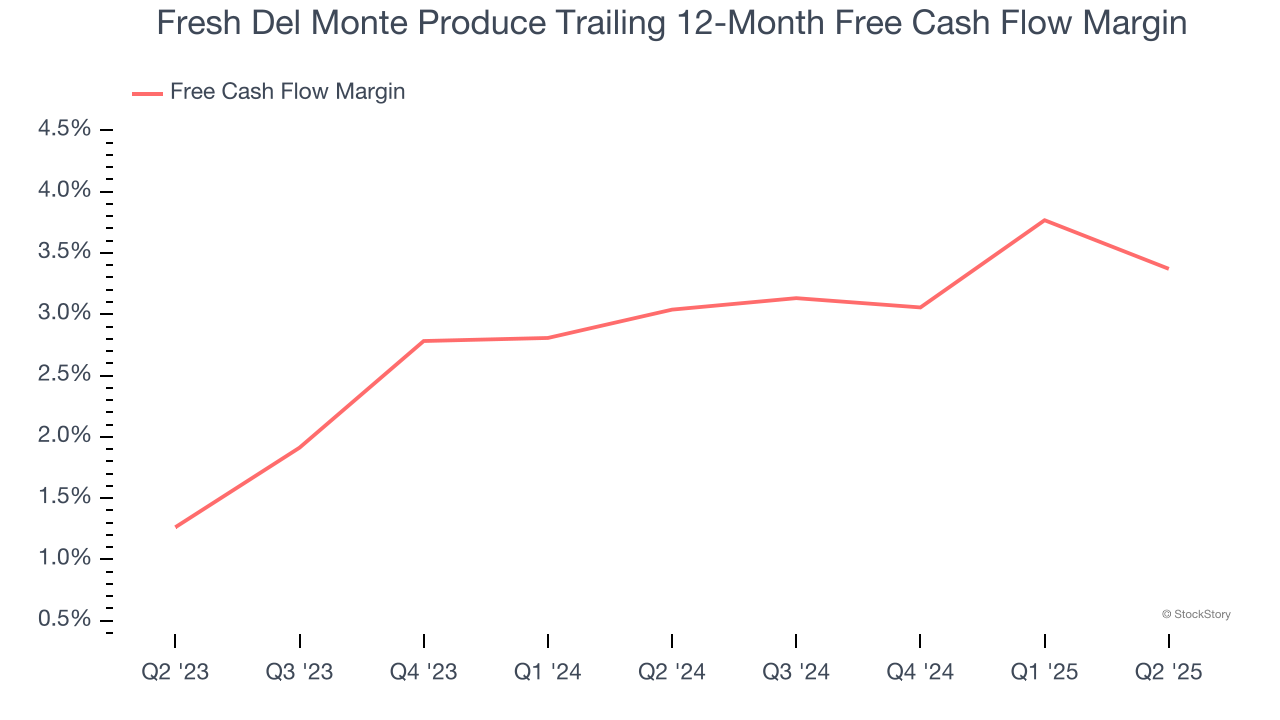

Fresh Del Monte Produce has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, subpar for a consumer staples business.

Fresh Del Monte Produce’s free cash flow clocked in at $101.5 million in Q2, equivalent to a 8.6% margin. The company’s cash profitability regressed as it was 1.7 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Fresh Del Monte Produce’s Q2 Results

We were impressed by how significantly Fresh Del Monte Produce blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 1.2% to $36.50 immediately after reporting.

Fresh Del Monte Produce put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.