Pharmacy chain Walgreens Boots Alliance (NASDAQ: WBA) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 7.2% year on year to $38.99 billion. Its non-GAAP profit of $0.38 per share was 11.3% above analysts’ consensus estimates.

Is now the time to buy Walgreens? Find out by accessing our full research report, it’s free.

Walgreens (WBA) Q2 CY2025 Highlights:

- "On March 6, 2025, WBA entered into a definitive agreement to be acquired by entities affiliated with Sycamore Partners. The merger is currently expected to close in the third or fourth quarter of calendar year 2025, pending shareholder and regulatory approvals and other conditions to closing. Upon completion of the transaction, WBA common stock will no longer be listed on the Nasdaq Stock Market, and WBA will become a private company."

- Revenue: $38.99 billion vs analyst estimates of $36.59 billion (7.2% year-on-year growth, 6.5% beat)

- Adjusted EPS: $0.38 vs analyst estimates of $0.34 (11.3% beat)

- Operating Margin: 0.1%, in line with the same quarter last year

- Free Cash Flow Margin: 0.9%, similar to the same quarter last year

- Market Capitalization: $9.78 billion

Company Overview

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ: WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $154.6 billion in revenue over the past 12 months, Walgreens is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, Walgreens likely needs to tweak its prices or enter new markets.

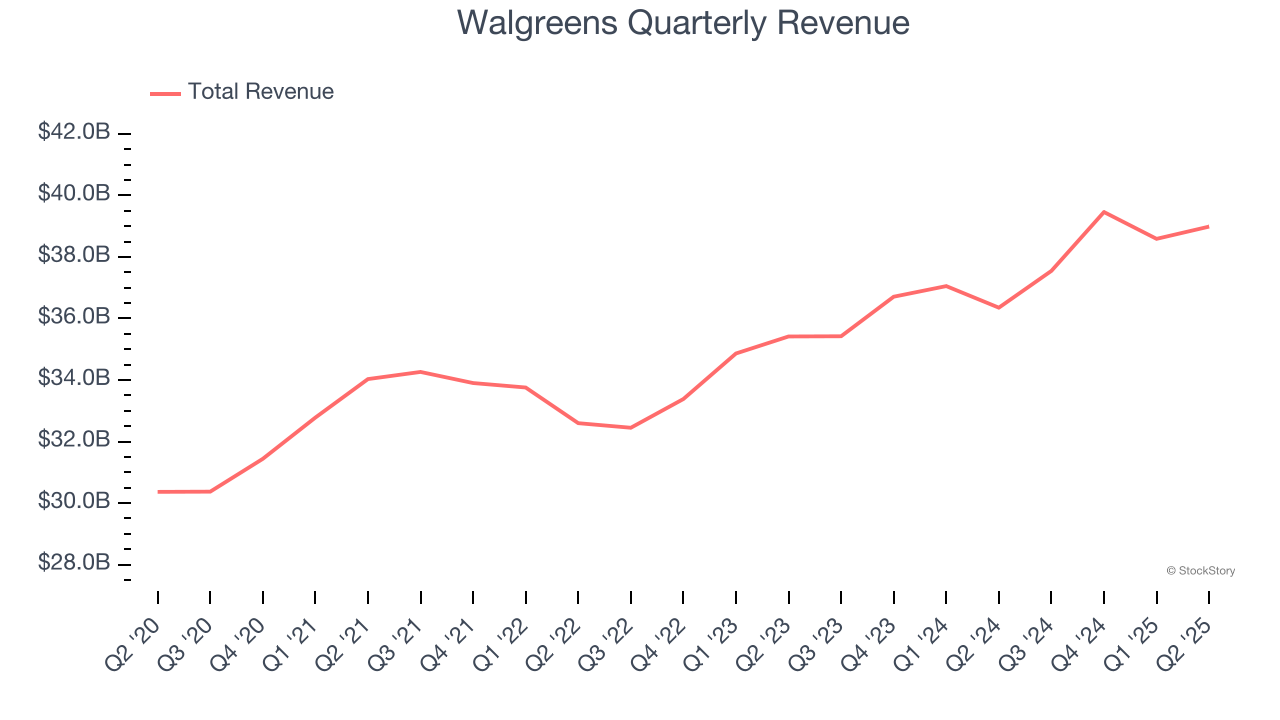

As you can see below, Walgreens grew its sales at a sluggish 3.8% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts). This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Walgreens reported year-on-year revenue growth of 7.2%, and its $38.99 billion of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and indicates its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

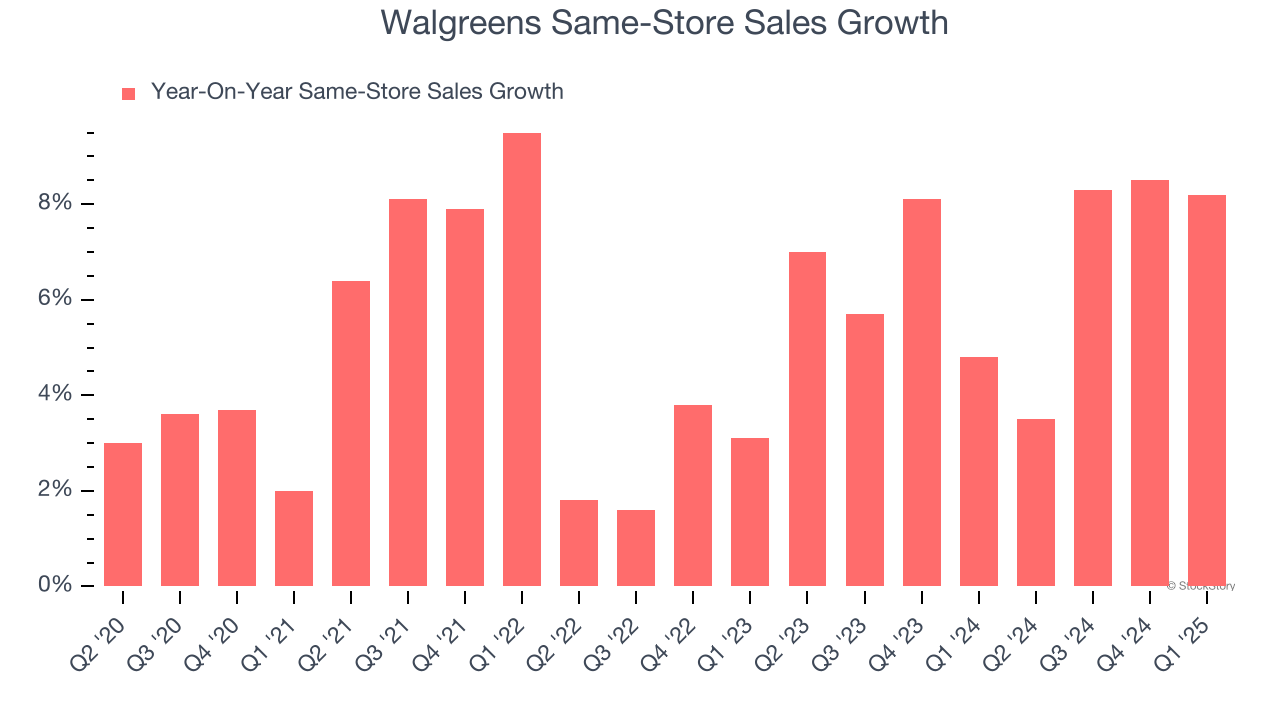

Walgreens has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6.7%.

Note that Walgreens reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Walgreens’s Q2 Results

We were impressed by how significantly Walgreens blew past analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. No guidance was provided due to the impending acquisition of the company. Zooming out, we think this was a solid quarter. The stock remained flat at $11.40 immediately after reporting.