Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Lincoln Educational (NASDAQ: LINC) and its peers.

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 8 education services stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

Lincoln Educational (NASDAQ: LINC)

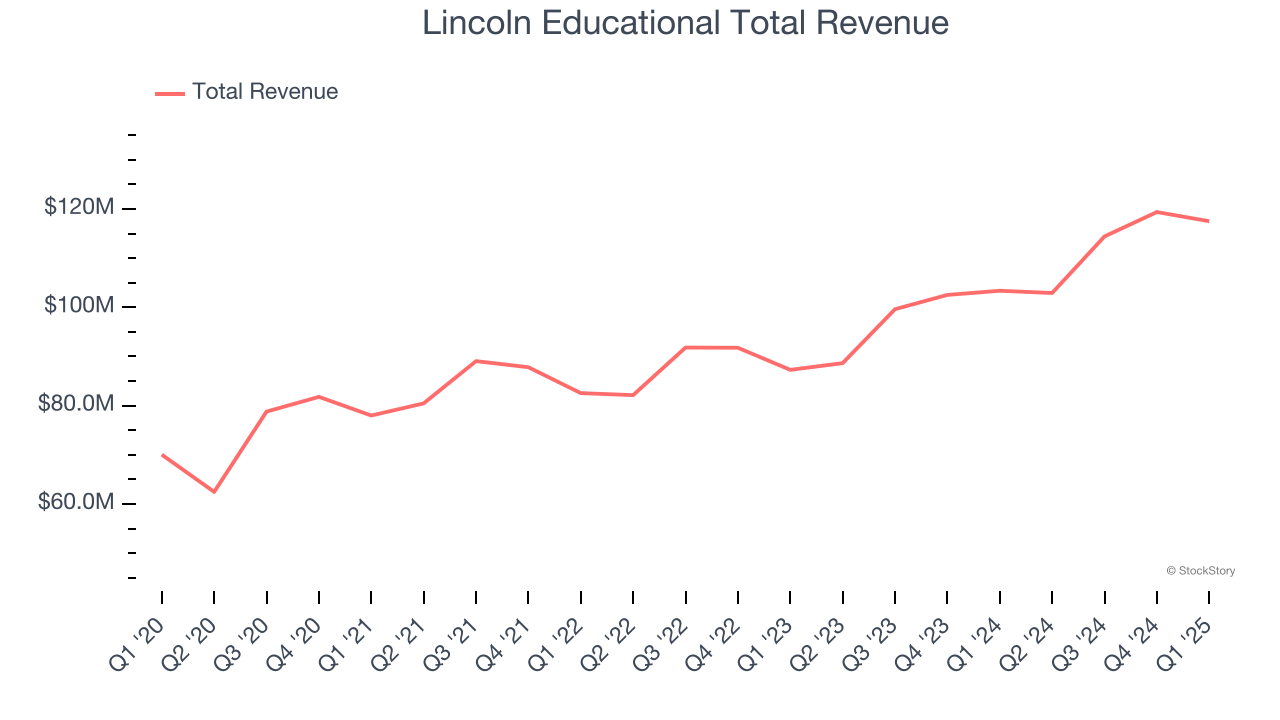

Established in 1946, Lincoln Educational (NASDAQ: LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

Lincoln Educational reported revenues of $117.5 million, up 13.7% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

“We delivered a strong start to 2025 with exceptional student start growth, double digit revenue growth and a 63% increase in adjusted EBITDA,” said Scott Shaw, President and CEO.

Interestingly, the stock is up 9.1% since reporting and currently trades at $22.82.

Is now the time to buy Lincoln Educational? Access our full analysis of the earnings results here, it’s free.

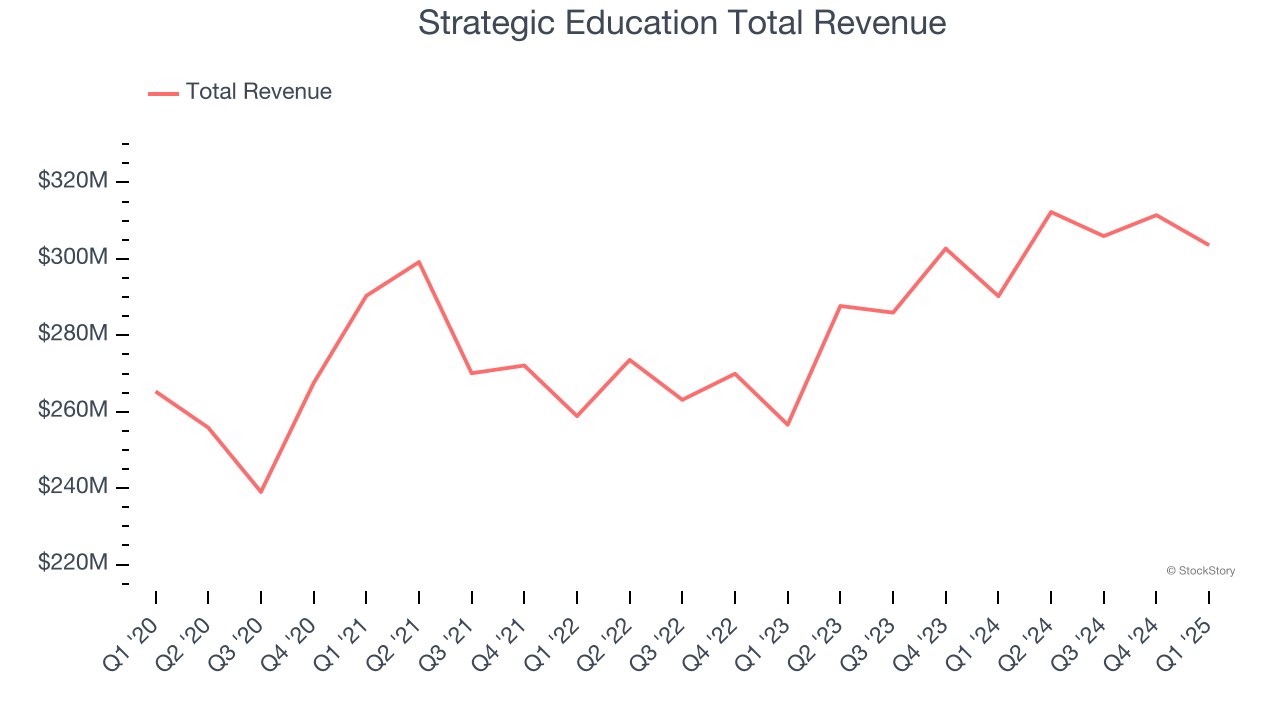

Best Q1: Strategic Education (NASDAQ: STRA)

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ: STRA) is a career-focused higher education provider.

Strategic Education reported revenues of $303.6 million, up 4.6% year on year, outperforming analysts’ expectations by 1%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 6% since reporting. It currently trades at $85.06.

Is now the time to buy Strategic Education? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Grand Canyon Education (NASDAQ: LOPE)

Founded in 1949, Grand Canyon Education (NASDAQ: LOPE) is an educational services provider known for its operation at Grand Canyon University.

Grand Canyon Education reported revenues of $289.3 million, up 5.3% year on year, exceeding analysts’ expectations by 0.8%. It was a satisfactory quarter as it also posted EPS guidance for next quarter exceeding analysts’ expectations.

The stock is flat since the results and currently trades at $185.47.

Read our full analysis of Grand Canyon Education’s results here.

Perdoceo Education (NASDAQ: PRDO)

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ: PRDO) is an educational services company that specializes in postsecondary education.

Perdoceo Education reported revenues of $213 million, up 26.6% year on year. This print topped analysts’ expectations by 2.4%. Overall, it was a strong quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations.

Perdoceo Education achieved the fastest revenue growth among its peers. The stock is up 27.5% since reporting and currently trades at $32.07.

Read our full, actionable report on Perdoceo Education here, it’s free.

Universal Technical Institute (NYSE: UTI)

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Universal Technical Institute reported revenues of $207.4 million, up 12.6% year on year. This number beat analysts’ expectations by 2.8%. It was an exceptional quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Universal Technical Institute delivered the highest full-year guidance raise among its peers. The stock is up 11.1% since reporting and currently trades at $32.90.

Read our full, actionable report on Universal Technical Institute here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.