As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the dental equipment & technology industry, including Dentsply Sirona (NASDAQ: XRAY) and its peers.

The dental equipment and technology industry encompasses companies that manufacture orthodontic products, dental implants, imaging systems, and digital tools for dental professionals. These companies benefit from recurring revenue streams tied to consumables, ongoing maintenance, and growing demand for aesthetic and restorative dentistry. However, high R&D costs, significant capital investment requirements, and reliance on discretionary spending make them vulnerable to economic cycles. Over the next few years, tailwinds for the sector include innovation in digital workflows, such as 3D printing and AI-driven diagnostics, which enhance the efficiency and precision of dental care. However, headwinds include economic uncertainty, which could reduce patient spending on elective procedures, regulatory challenges, and potential pricing pressures from consolidated dental service organizations (DSOs).

The 4 dental equipment & technology stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was in line.

Luckily, dental equipment & technology stocks have performed well with share prices up 13.9% on average since the latest earnings results.

Best Q1: Dentsply Sirona (NASDAQ: XRAY)

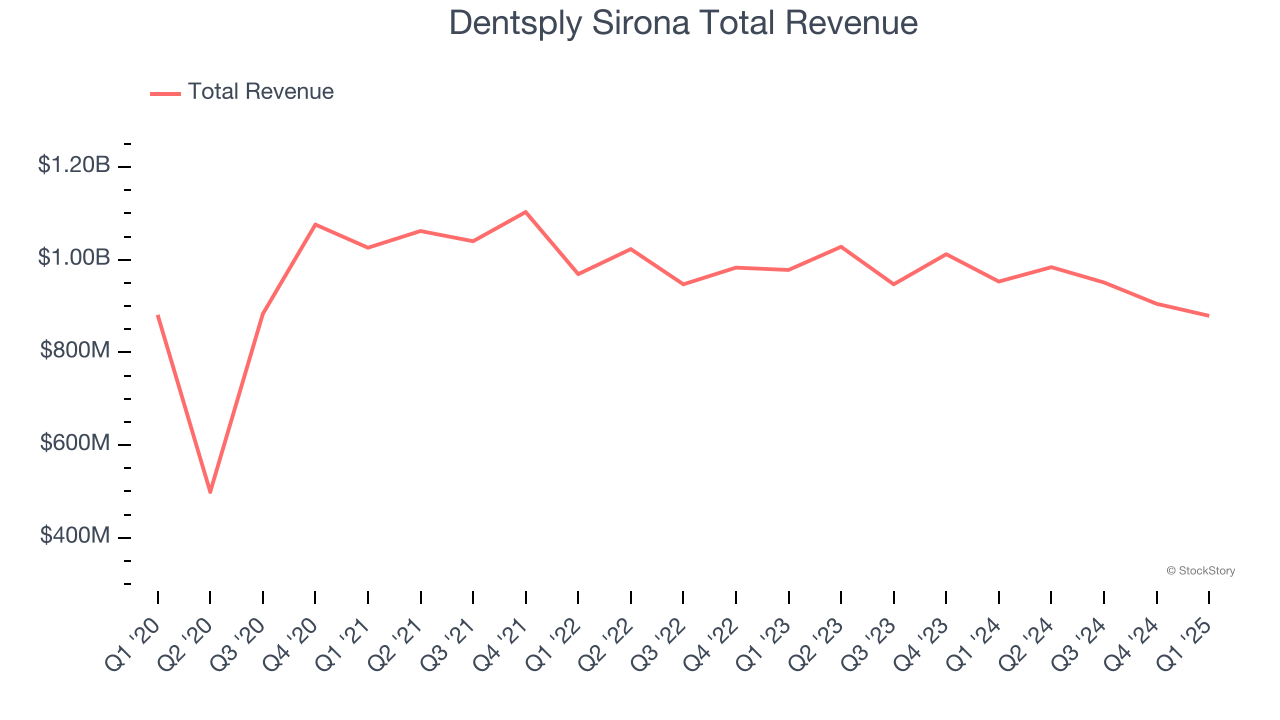

With roots dating back to 1877 when it introduced the first dental electric drill, Dentsply Sirona (NASDAQ: XRAY) manufactures and sells professional dental equipment, technologies, and consumable products used by dentists and specialists worldwide.

Dentsply Sirona reported revenues of $879 million, down 7.8% year on year. This print exceeded analysts’ expectations by 3.2%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ constant currency revenue and EPS estimates.

"In the first quarter, organic sales were roughly flat excluding the Byte sales impact, with growth in two of our three regions. Adjusted EBITDA margin expanded which primarily reflects the benefits from our transformational initiatives and internal financial discipline. We are delivering progress through customer-centric innovation, customer experience improvements, and operational efficiency, while operating in an increasingly uncertain macroeconomic environment," said Simon Campion, President and Chief Executive Officer.

Dentsply Sirona pulled off the biggest analyst estimates beat but had the slowest revenue growth of the whole group. Unsurprisingly, the stock is up 18% since reporting and currently trades at $16.15.

Is now the time to buy Dentsply Sirona? Access our full analysis of the earnings results here, it’s free.

Envista (NYSE: NVST)

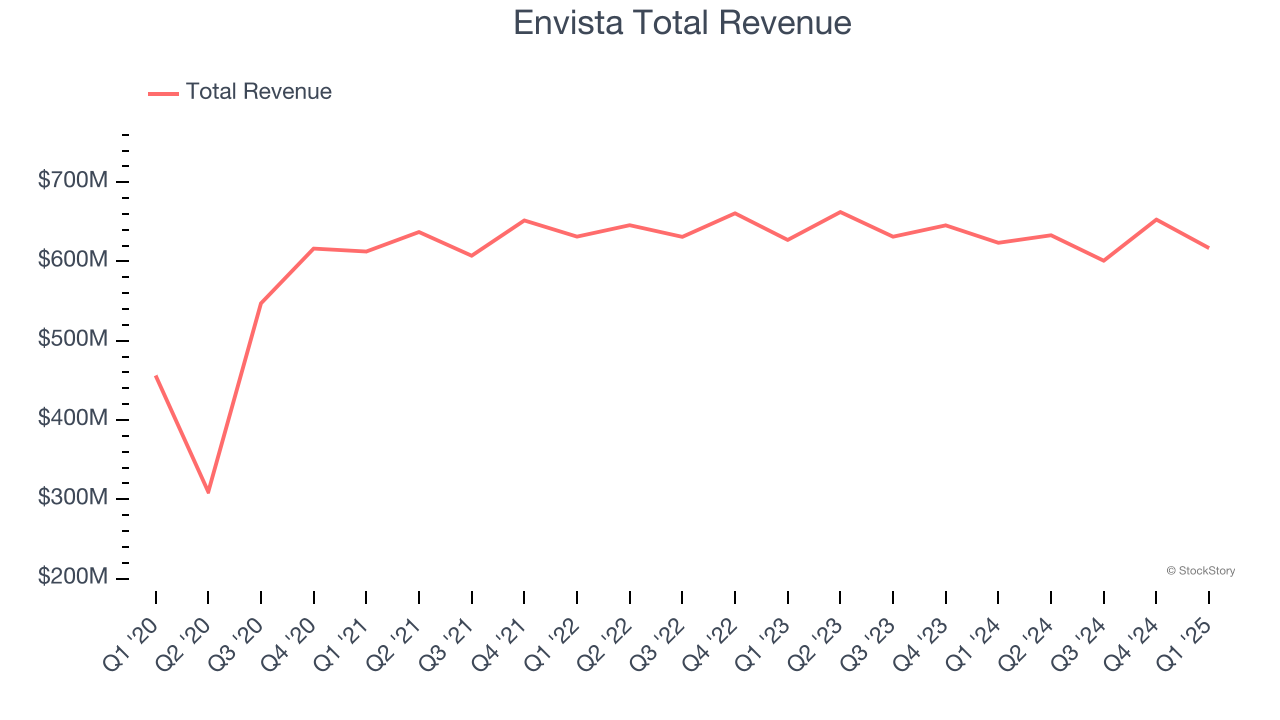

Uniting more than 30 trusted brands including Nobel Biocare, Ormco, and DEXIS under one corporate umbrella, Envista Holdings (NYSE: NVST) is a global dental products company that provides equipment, consumables, and specialized technologies for dental professionals.

Envista reported revenues of $616.9 million, down 1.1% year on year, outperforming analysts’ expectations by 1.4%. The business had a strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 18.5% since reporting. It currently trades at $19.35.

Is now the time to buy Envista? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Henry Schein (NASDAQ: HSIC)

With a vast inventory of over 300,000 products stocked in distribution centers spanning more than 5.3 million square feet worldwide, Henry Schein (NASDAQ: HSIC) is a global distributor of healthcare products and services primarily to dental practices, medical offices, and other healthcare facilities.

Henry Schein reported revenues of $3.17 billion, flat year on year, falling short of analysts’ expectations by 2%. It was a slower quarter as it posted a miss of analysts’ organic revenue estimates.

Henry Schein delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 11.5% since the results and currently trades at $72.79.

Read our full analysis of Henry Schein’s results here.

Align Technology (NASDAQ: ALGN)

Pioneering an alternative to traditional metal braces with nearly invisible plastic aligners, Align Technology (NASDAQ: ALGN) designs and manufactures Invisalign clear aligners, iTero intraoral scanners, and dental CAD/CAM software for orthodontic and restorative treatments.

Align Technology reported revenues of $979.3 million, down 1.8% year on year. This number was in line with analysts’ expectations. Overall, it was a strong quarter as it also produced a solid beat of analysts’ sales volume estimates and a decent beat of analysts’ EPS estimates.

The stock is up 7.7% since reporting and currently trades at $186.54.

Read our full, actionable report on Align Technology here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.