The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how sales and marketing software stocks fared in Q1, starting with Upland (NASDAQ: UPLD).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Upland (NASDAQ: UPLD)

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ: UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

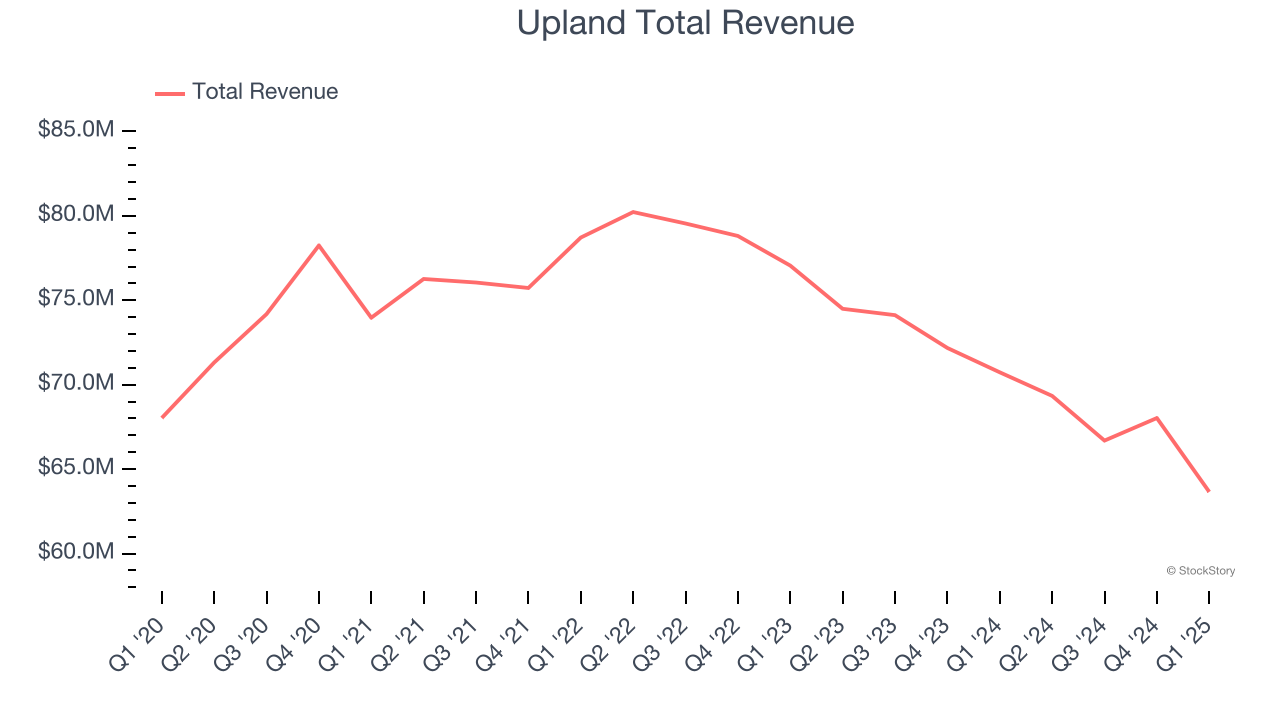

Upland reported revenues of $63.66 million, down 10% year on year. This print exceeded analysts’ expectations by 3.1%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations.

"In Q1, we beat our Revenue and Adjusted EBITDA guidance midpoints," said Jack McDonald, Upland's chairman and chief executive officer.

Upland delivered the slowest revenue growth and weakest full-year guidance update of the whole group. The stock is down 28.6% since reporting and currently trades at $1.70.

Read our full report on Upland here, it’s free.

Best Q1: Yext (NYSE: YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE: YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

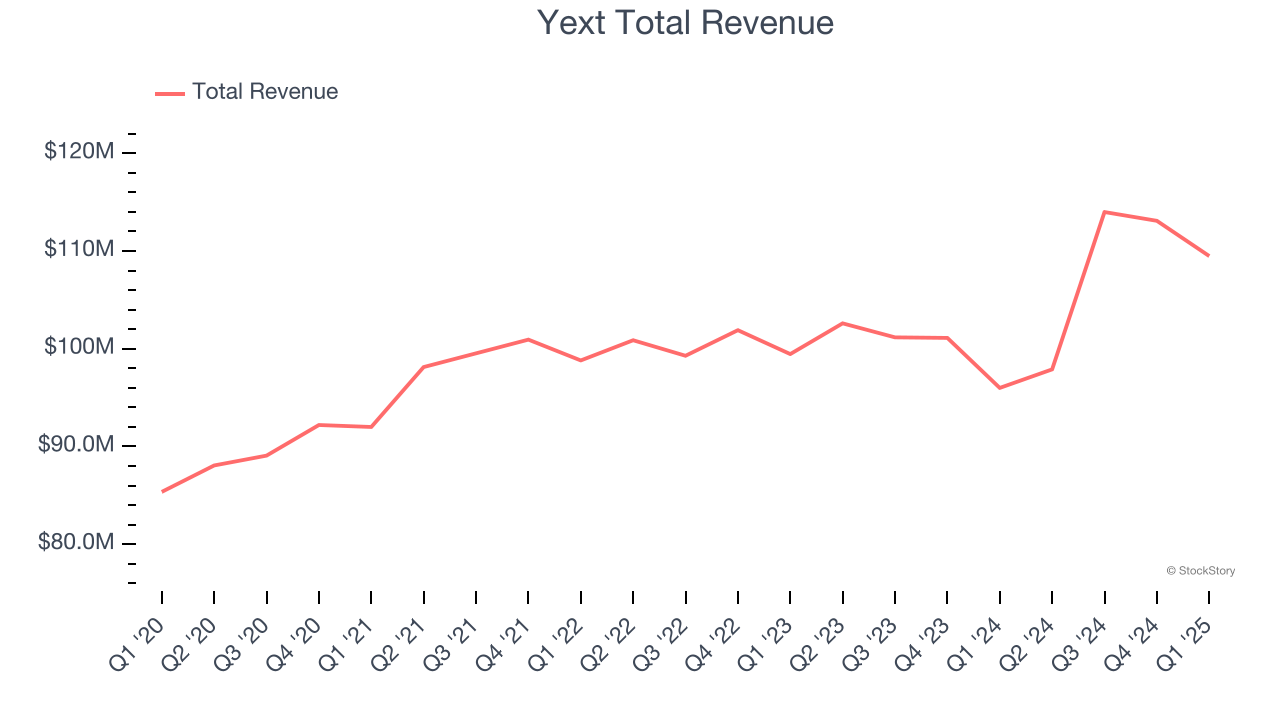

Yext reported revenues of $109.5 million, up 14.1% year on year, outperforming analysts’ expectations by 1.8%. The business had an exceptional quarter with a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ billings estimates.

The market seems happy with the results as the stock is up 21.4% since reporting. It currently trades at $8.27.

Is now the time to buy Yext? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Braze (NASDAQ: BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ: BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Braze reported revenues of $162.1 million, up 19.6% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 26.9% since the results and currently trades at $26.41.

Read our full analysis of Braze’s results here.

ZoomInfo (NASDAQ: ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ: ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $305.7 million, down 1.4% year on year. This number topped analysts’ expectations by 3.2%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ annual recurring revenue estimates.

The company added 1 enterprise customer paying more than $100,000 annually to reach a total of 1,868. The stock is flat since reporting and currently trades at $10.28.

Read our full, actionable report on ZoomInfo here, it’s free.

PubMatic (NASDAQ: PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $63.83 million, down 4.3% year on year. This result beat analysts’ expectations by 2.8%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is flat since reporting and currently trades at $11.

Read our full, actionable report on PubMatic here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.