Since December 2024, First Horizon has been in a holding pattern, posting a small loss of 0.9% while floating around $20.34.

Is now the time to buy First Horizon, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is First Horizon Not Exciting?

We don't have much confidence in First Horizon. Here are three reasons why you should be careful with FHN and a stock we'd rather own.

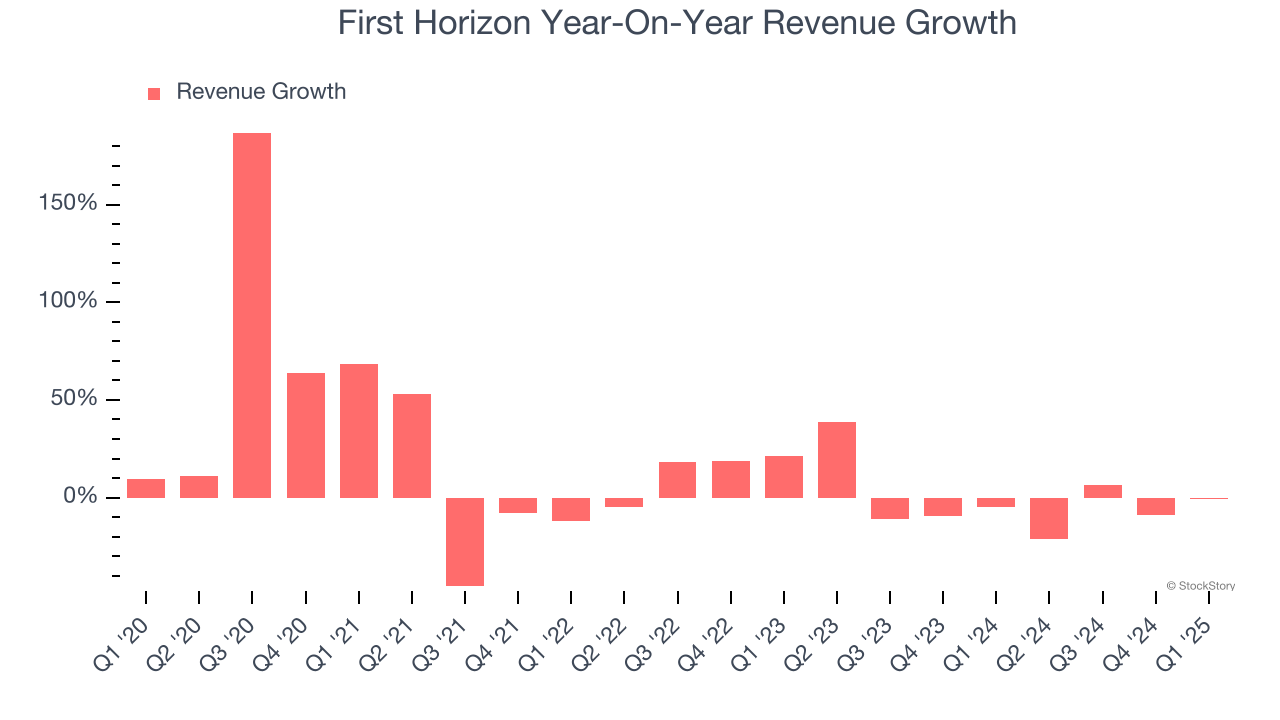

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. First Horizon’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.7% over the last two years.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect First Horizon’s net interest income to rise by 2.8%.

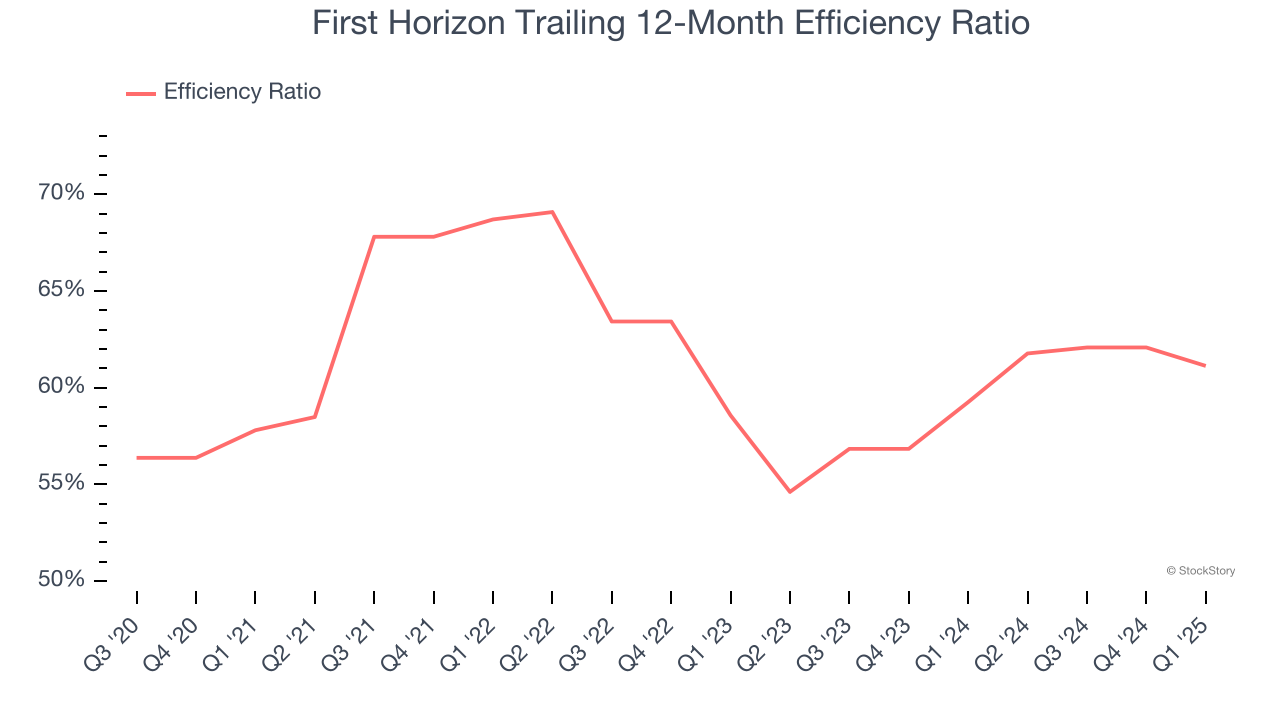

3. Deteriorating Efficiency Ratio

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

Over the last four years, First Horizon’s efficiency ratio has swelled by 3.3 percentage points, hitting 61.1% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

Final Judgment

First Horizon isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.2× forward P/B (or $20.34 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than First Horizon

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.