Over the past six months, Banc of California’s shares (currently trading at $13.86) have posted a disappointing 11.6% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Banc of California, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Banc of California Not Exciting?

Despite the more favorable entry price, we don't have much confidence in Banc of California. Here are three reasons why you should be careful with BANC and a stock we'd rather own.

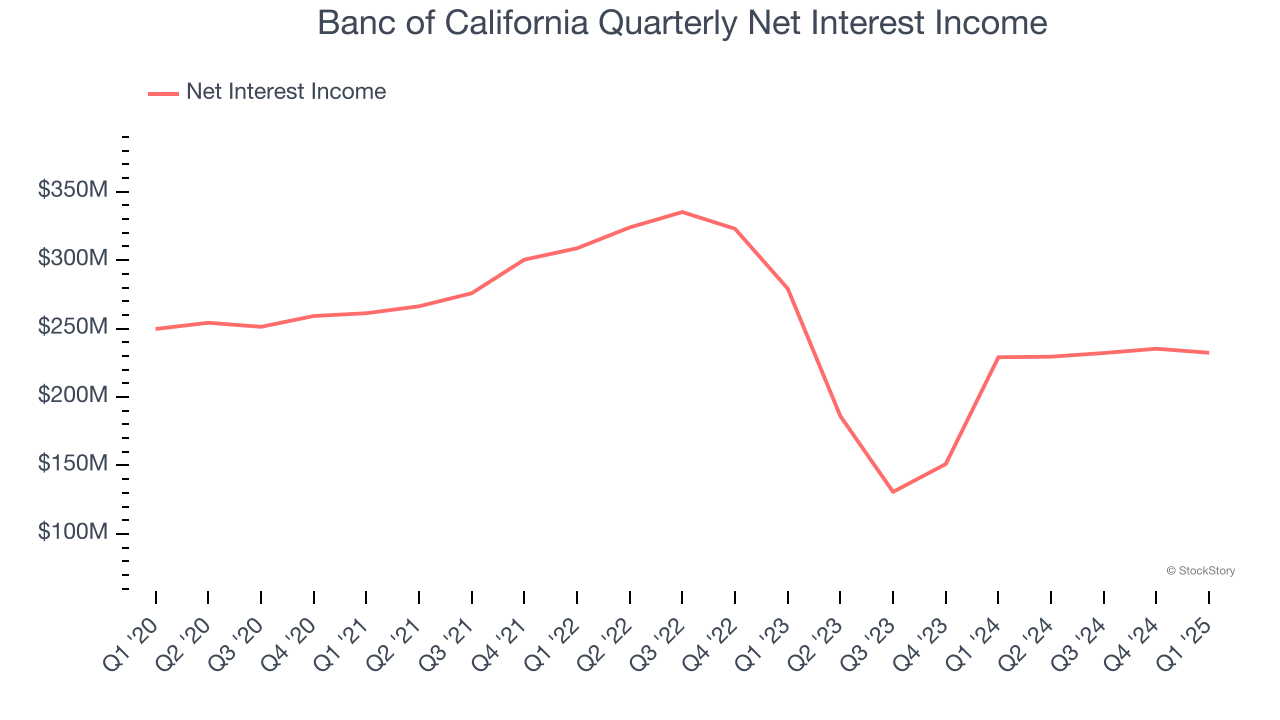

1. Declining Net Interest Income Reflects Weakness

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Banc of California’s net interest income has declined by 2.4% annually over the last four years, much worse than the broader bank industry.

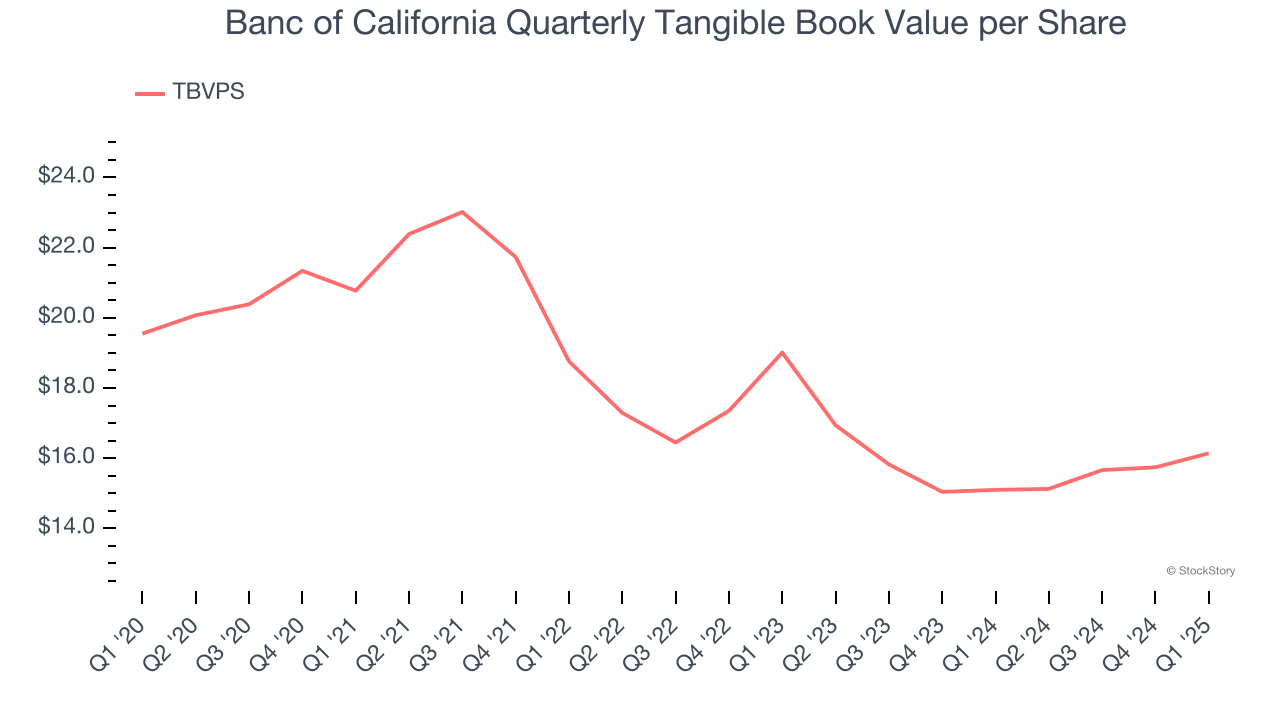

2. Declining TBVPS Reflects Erosion of Asset Value

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

Disappointingly for investors, Banc of California’s TBVPS continued freefalling over the past two years as TBVPS declined at a -7.9% annual clip (from $19.01 to $16.14 per share).

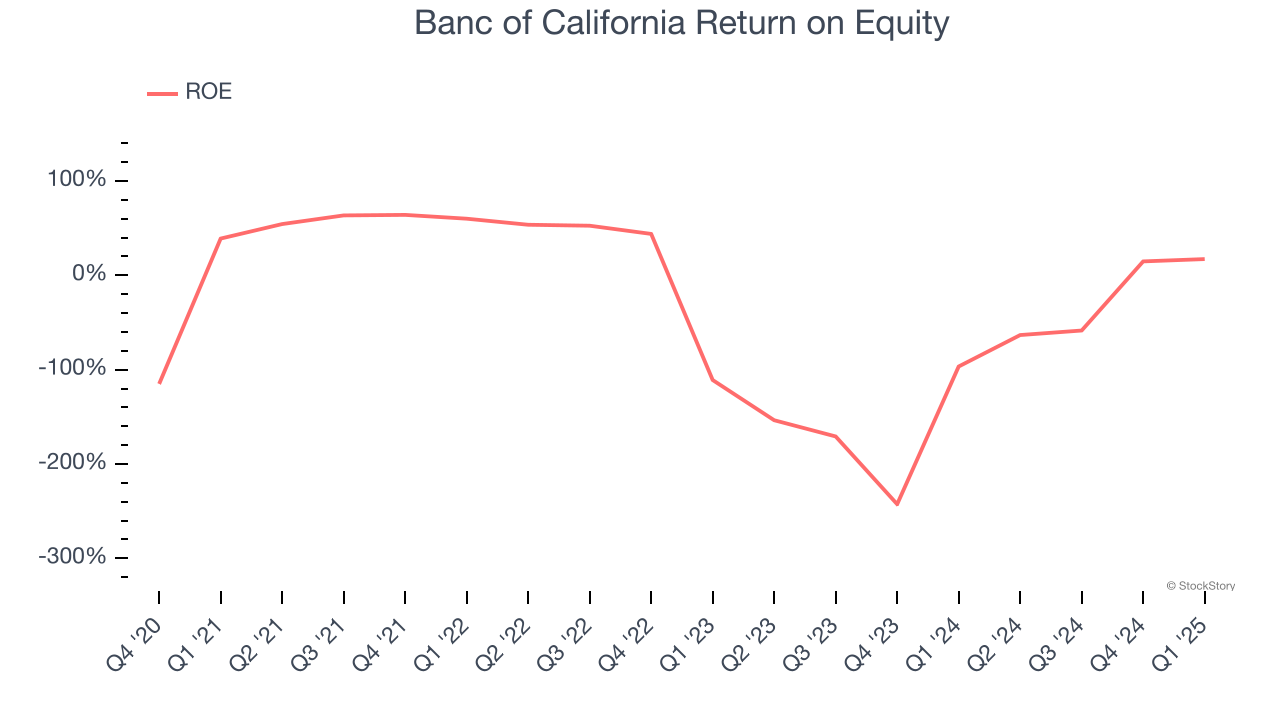

3. Previous Growth Initiatives Have Lost Money

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Banc of California has averaged an ROE of negative 4.6%, a bad result not only in absolute terms but also relative to the majority of banks putting up 7.5%+. It also shows that Banc of California has little to no competitive moat.

Final Judgment

Banc of California isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 0.7× forward P/B (or $13.86 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Banc of California

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.