As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Airbnb (NASDAQ: ABNB) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.1% since the latest earnings results.

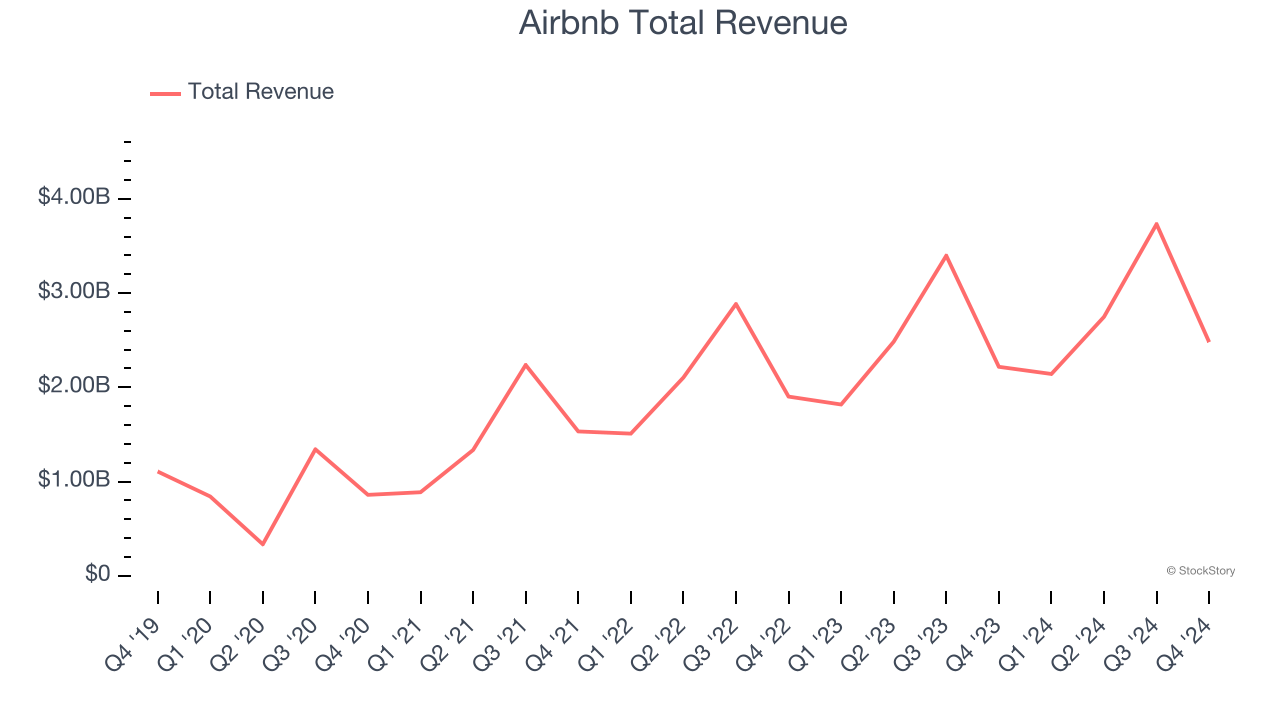

Airbnb (NASDAQ: ABNB)

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $2.48 billion, up 11.8% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of nights and experiences booked estimates.

The stock is down 15% since reporting and currently trades at $119.76.

Read why we think that Airbnb is one of the best consumer internet stocks, our full report is free.

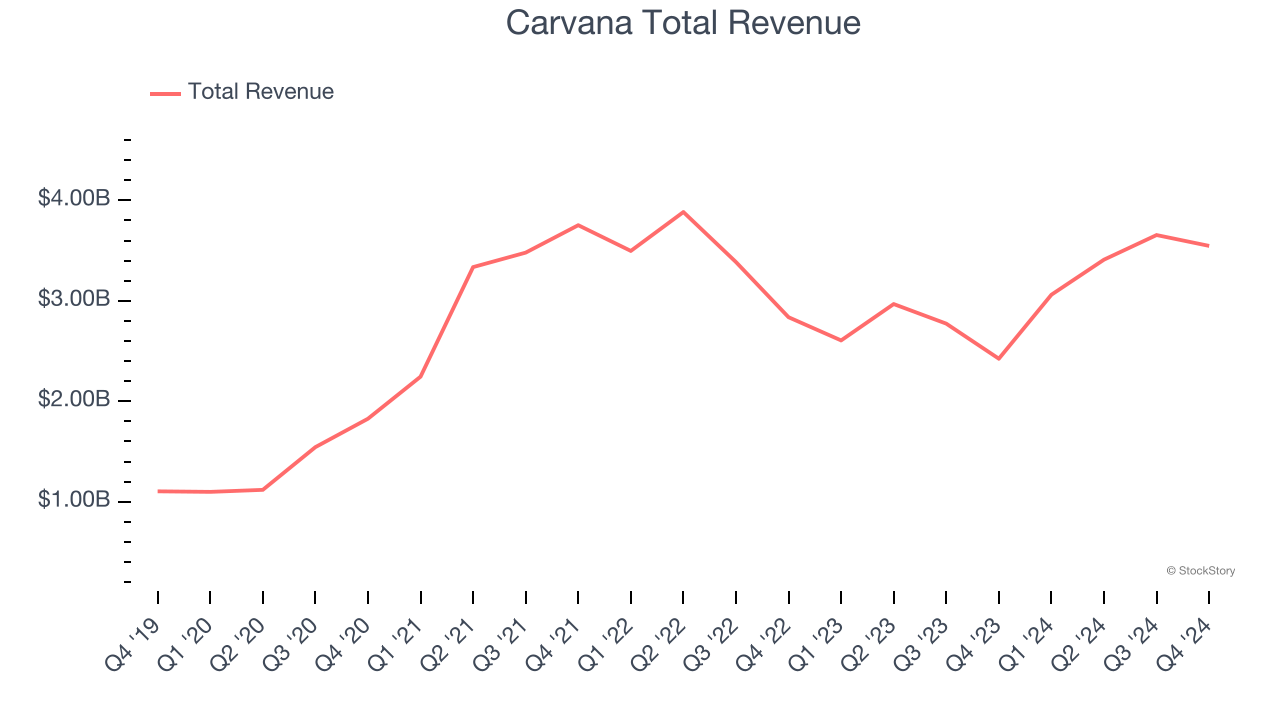

Best Q4: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $3.55 billion, up 46.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 24.8% since reporting. It currently trades at $211.85.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Skillz (NYSE: SKLZ)

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $20.37 million, down 34.5% year on year, falling short of analysts’ expectations by 18.7%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 110,000 monthly active users, down 19.7% year on year. As expected, the stock is down 11.8% since the results and currently trades at $4.50.

Read our full analysis of Skillz’s results here.

Uber (NYSE: UBER)

Notoriously funded with $7.7 billion from the Softbank Vision Fund, Uber (NYSE: UBER) operates a platform of on-demand services such as ride-hailing, food delivery, and freight.

Uber reported revenues of $11.96 billion, up 20.4% year on year. This result beat analysts’ expectations by 1.6%. More broadly, it was a satisfactory quarter as it also logged strong growth in its users but EBITDA in line with analysts’ estimates.

The company reported 171 million users, up 14% year on year. The stock is up 5% since reporting and currently trades at $73.27.

Read our full, actionable report on Uber here, it’s free.

EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $147.5 million, up 165% year on year. This print surpassed analysts’ expectations by 10%. It was an exceptional quarter as it also logged EBITDA guidance for next quarter exceeding analysts’ expectations.

EverQuote pulled off the fastest revenue growth among its peers. The stock is up 27.7% since reporting and currently trades at $25.73.

Read our full, actionable report on EverQuote here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.