Footwear company Skechers (NYSE: SKX) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 12.8% year on year to $2.21 billion. On the other hand, next quarter’s revenue guidance of $2.42 billion was less impressive, coming in 2.6% below analysts’ estimates. Its GAAP profit of $0.65 per share was 12.9% below analysts’ consensus estimates.

Is now the time to buy Skechers? Find out by accessing our full research report, it’s free.

Skechers (SKX) Q4 CY2024 Highlights:

- Revenue: $2.21 billion vs analyst estimates of $2.22 billion (12.8% year-on-year growth, in line)

- EPS (GAAP): $0.65 vs analyst expectations of $0.75 (12.9% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $9.75 billion at the midpoint, missing analyst estimates by 1.3% and implying 8.7% growth (vs 12.1% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $4.40 at the midpoint, missing analyst estimates by 9.6%

- Operating Margin: 7.5%, in line with the same quarter last year

- Locations: 5,296 at quarter end, up from 5,168 in the same quarter last year

- Market Capitalization: $11.23 billion

Company Overview

Synonymous with "dad shoe", Skechers (NYSE: SKX) is a footwear company renowned for its comfortable, stylish, and affordable shoes for all ages.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

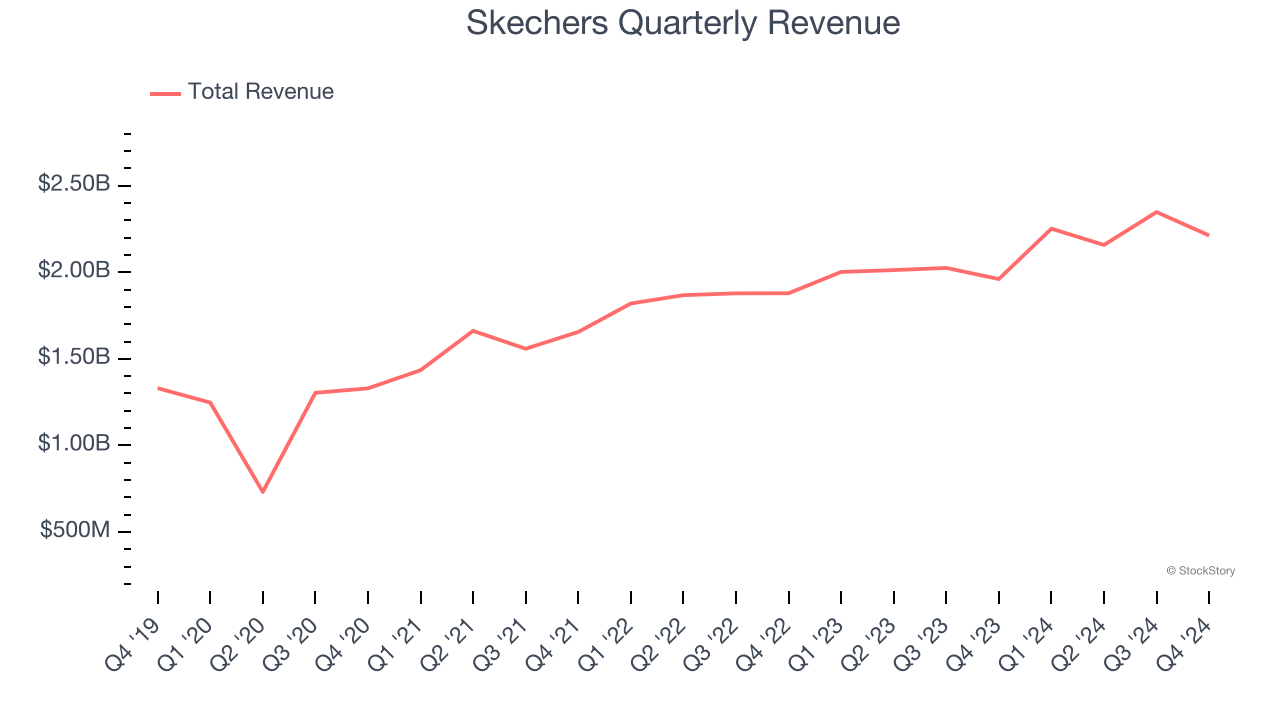

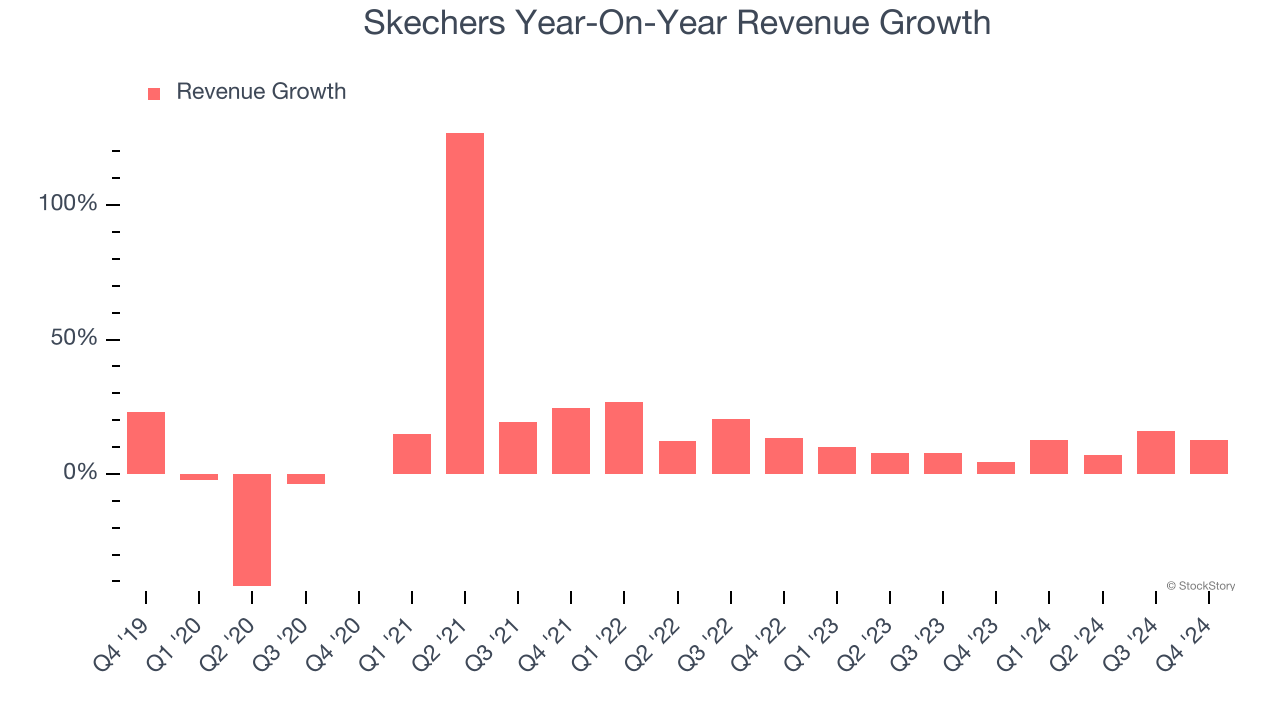

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Skechers grew its sales at a 11.4% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Skechers’s recent history shows its demand slowed as its annualized revenue growth of 9.8% over the last two years is below its five-year trend.

This quarter, Skechers’s year-on-year revenue growth was 12.8%, and its $2.21 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 7.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

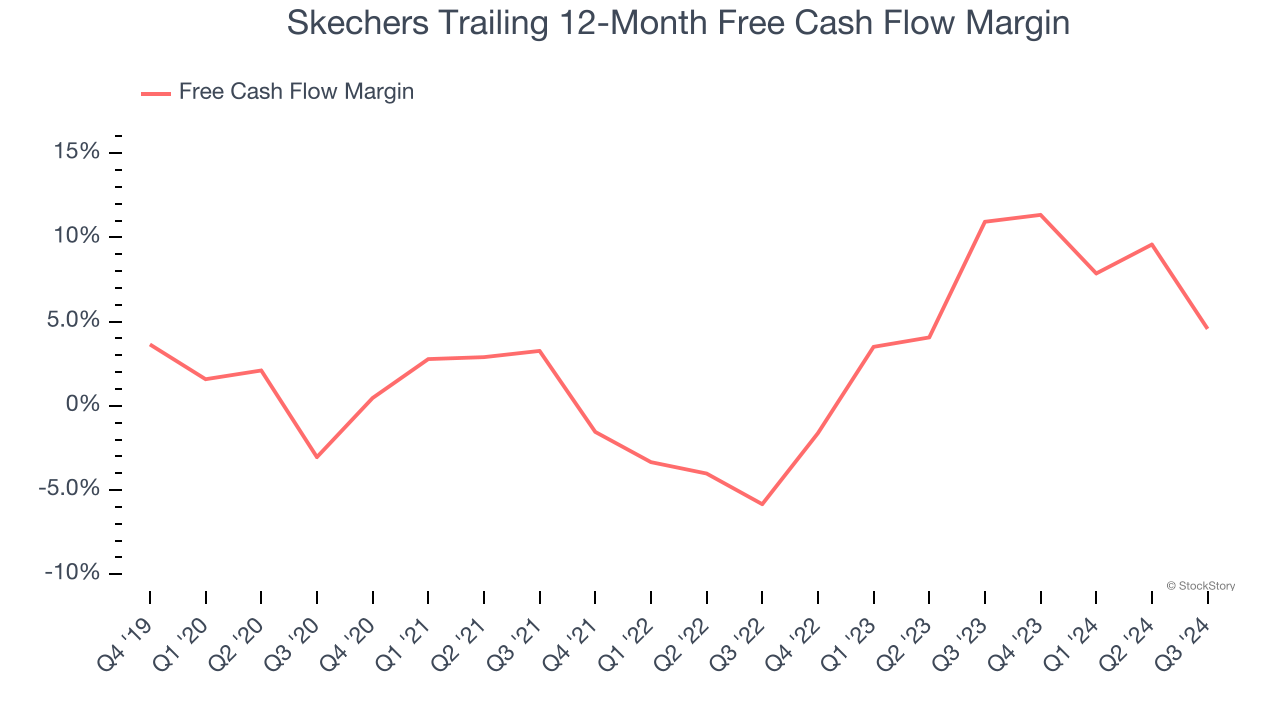

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Skechers has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.3%, subpar for a consumer discretionary business.

Key Takeaways from Skechers’s Q4 Results

We struggled to find many positives in these results. Its EPS missed significantly and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 12.3% to $66.38 immediately following the results.

Skechers didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.