Water management company Advanced Drainage Systems (NYSE: WMS) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 4.3% year on year to $690.5 million. The company expects the full year’s revenue to be around $2.94 billion, close to analysts’ estimates. Its non-GAAP profit of $1.09 per share was 9.8% below analysts’ consensus estimates.

Is now the time to buy Advanced Drainage? Find out by accessing our full research report, it’s free.

Advanced Drainage (WMS) Q4 CY2024 Highlights:

- Revenue: $690.5 million vs analyst estimates of $675.4 million (4.3% year-on-year growth, 2.2% beat)

- Adjusted EPS: $1.09 vs analyst expectations of $1.21 (9.8% miss)

- Adjusted EBITDA: $191.5 million vs analyst estimates of $190.3 million (27.7% margin, 0.6% beat)

- The company reconfirmed its revenue guidance for the full year of $2.94 billion at the midpoint

- EBITDA guidance for the full year is $900 million at the midpoint, in line with analyst expectations

- Operating Margin: 18.4%, down from 23.1% in the same quarter last year

- Free Cash Flow Margin: 19.7%, down from 28.3% in the same quarter last year

- Market Capitalization: $8.99 billion

Scott Barbour, President and Chief Executive Officer of ADS commented, "The fiscal third quarter financial results were in line with expectations. The ADS business progressed on plan while the Infiltrator business modestly outperformed driven by double digit growth in both tanks and advanced treatment products. The construction market demand, pricing environment, material cost and operating performance played out like we thought they would going into the quarter."

Company Overview

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE: WMS) provides clean water management solutions to communities across America.

HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Sales Growth

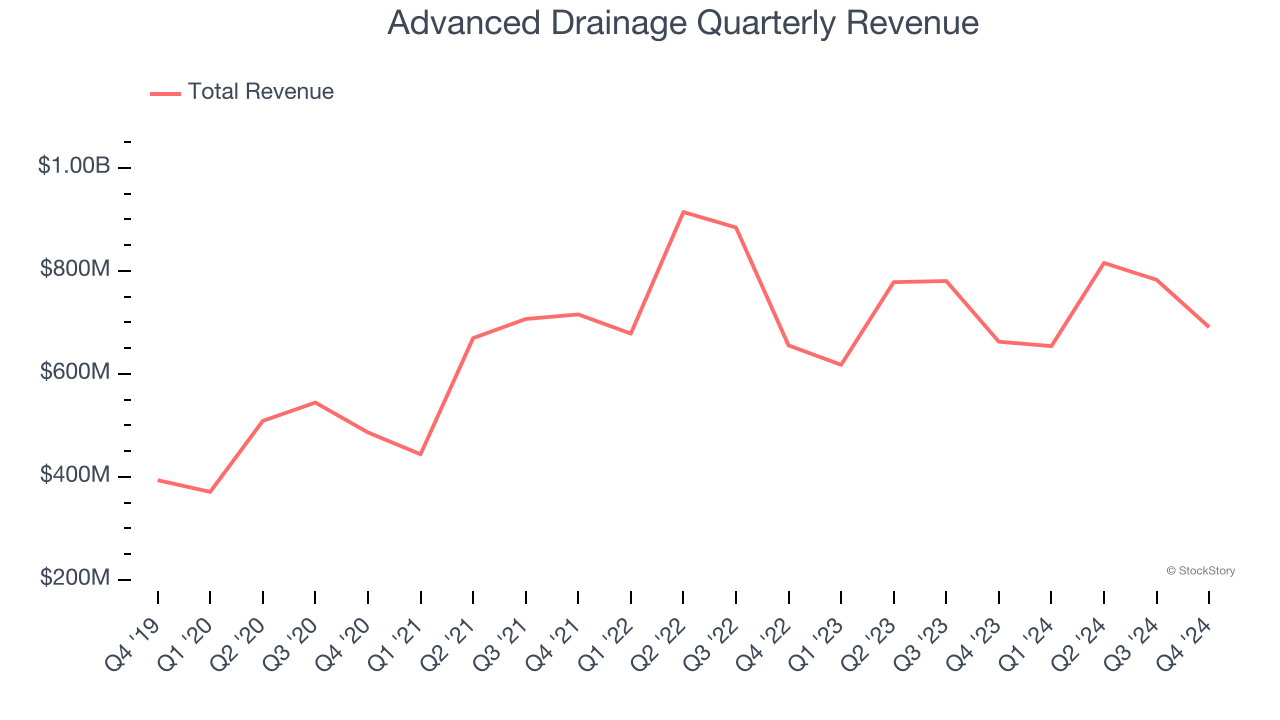

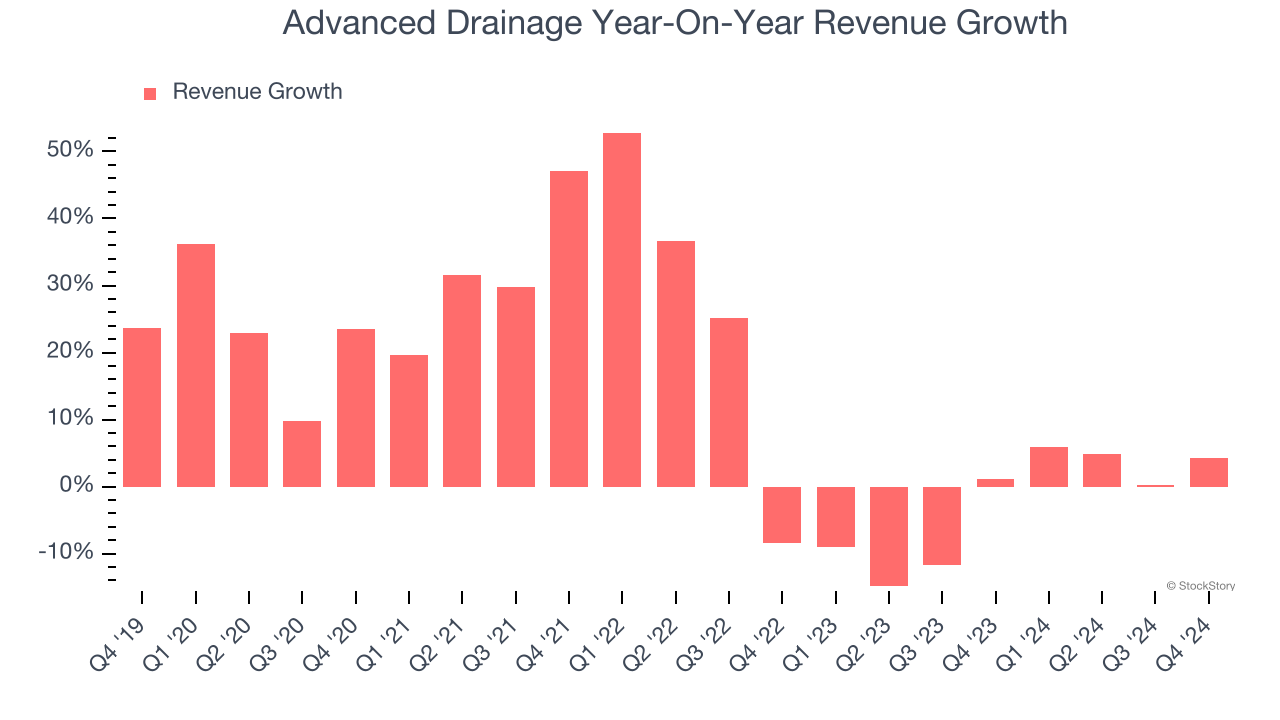

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Advanced Drainage’s 13.3% annualized revenue growth over the last five years was excellent. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Advanced Drainage’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.1% over the last two years.

Advanced Drainage also breaks out the revenue for its most important segments, Pipe and Infiltrators, which are 49.7% and 19.6% of revenue. Over the last two years, Advanced Drainage’s Pipe revenue (thermoplastic corrugated pipes) averaged 6.8% year-on-year declines. On the other hand, its Infiltrators revenue (wastewater treatment systems) averaged 5.8% growth.

This quarter, Advanced Drainage reported modest year-on-year revenue growth of 4.3% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

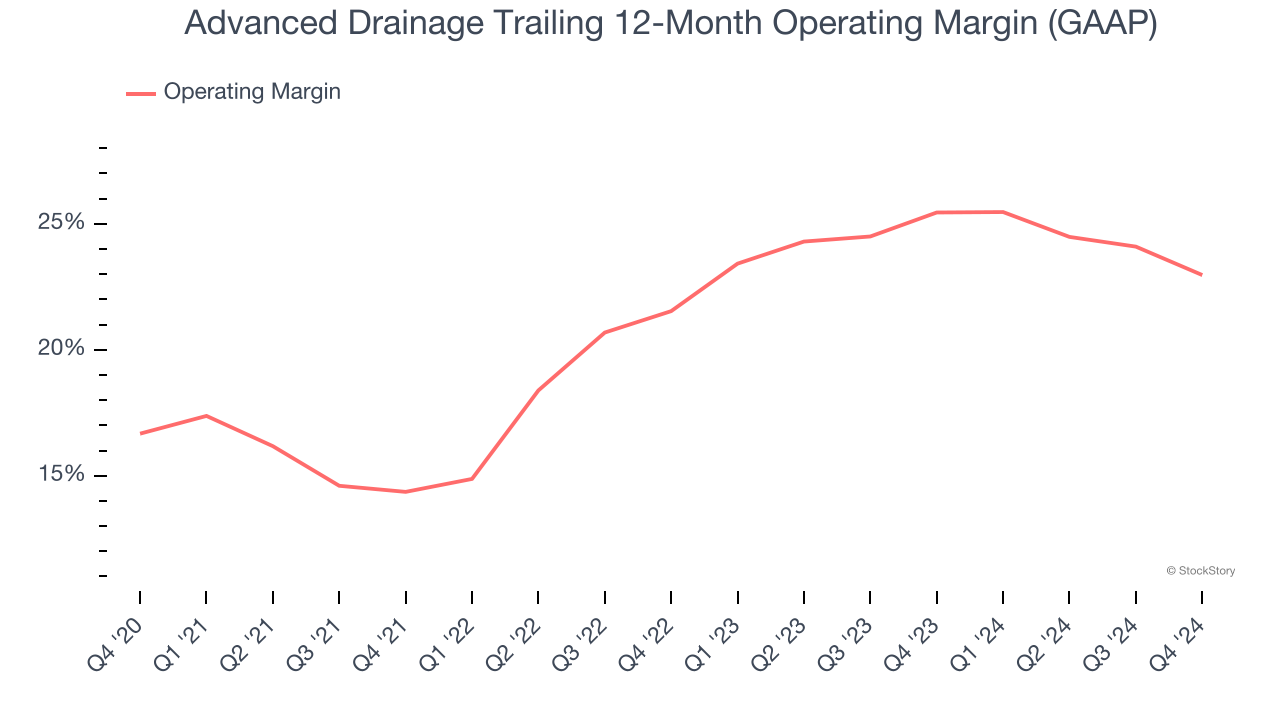

Advanced Drainage has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.6%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Advanced Drainage’s operating margin rose by 6.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Advanced Drainage generated an operating profit margin of 18.4%, down 4.8 percentage points year on year. Since Advanced Drainage’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

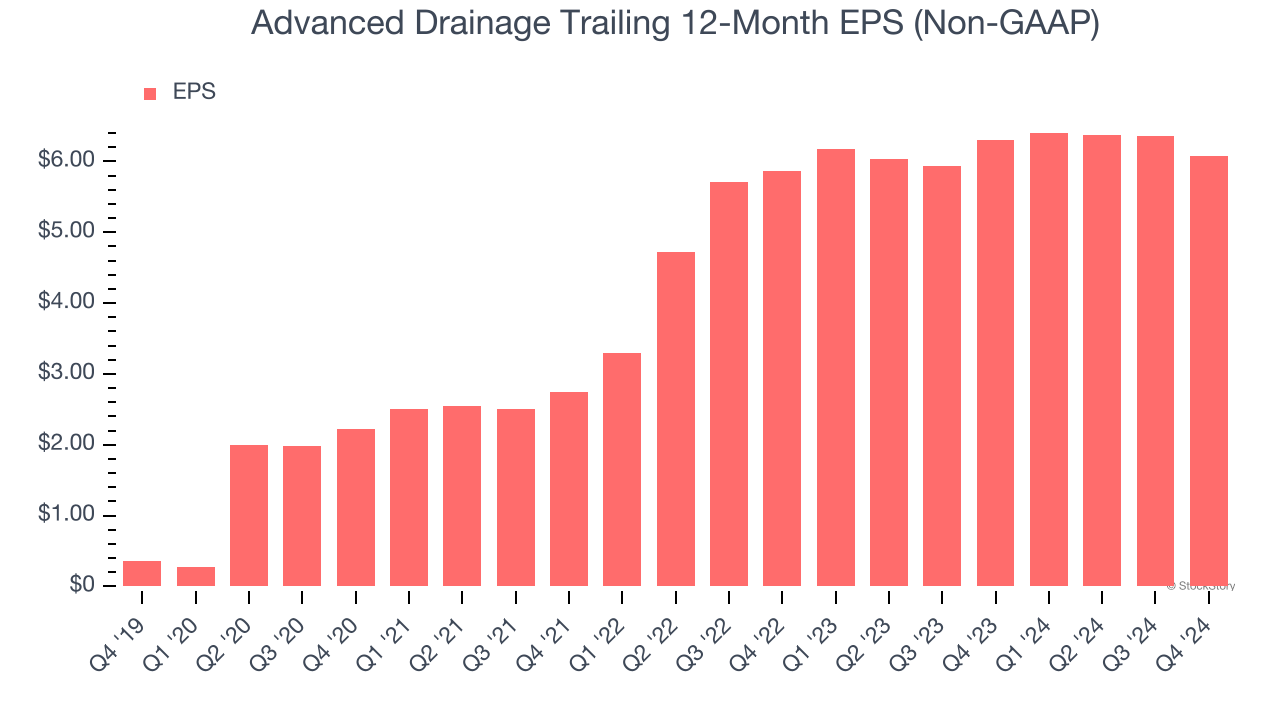

Advanced Drainage’s EPS grew at an astounding 76.2% compounded annual growth rate over the last five years, higher than its 13.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Advanced Drainage’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Advanced Drainage’s operating margin declined this quarter but expanded by 6.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Advanced Drainage, its two-year annual EPS growth of 1.7% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Advanced Drainage reported EPS at $1.09, down from $1.37 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Advanced Drainage’s full-year EPS of $6.08 to grow 6%.

Key Takeaways from Advanced Drainage’s Q4 Results

We enjoyed seeing Advanced Drainage exceed analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Looking forward, the company reaffirmed its full year revenue guidance, and full-year EBITDA guidance was in line with expectations. Overall, this quarter was mixed, without too many surprises. The stock remained flat at $116 immediately following the results.

Big picture, is Advanced Drainage a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.