Semiconductor packaging and testing company Amkor Technology (NASDAQ: AMKR) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 7% year on year to $1.63 billion. Next quarter’s revenue guidance of $1.28 billion underwhelmed, coming in 14.1% below analysts’ estimates. Its GAAP profit of $0.43 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy Amkor? Find out by accessing our full research report, it’s free.

Amkor (AMKR) Q4 CY2024 Highlights:

- Revenue: $1.63 billion vs analyst estimates of $1.66 billion (7% year-on-year decline, 2.1% miss)

- EPS (GAAP): $0.43 vs analyst estimates of $0.37 (16.2% beat)

- Adjusted EBITDA: $302 million vs analyst estimates of $287.2 million (18.5% margin, 5.1% beat)

- Revenue Guidance for Q1 CY2025 is $1.28 billion at the midpoint, below analyst estimates of $1.48 billion

- EPS (GAAP) guidance for Q1 CY2025 is $0.09 at the midpoint, missing analyst estimates by 70.6%

- Operating Margin: 8.3%, in line with the same quarter last year

- Free Cash Flow Margin: 22%, up from 19.2% in the same quarter last year

- Inventory Days Outstanding: 20, in line with the previous quarter

- Market Capitalization: $6.00 billion

“In 2024, weakness in the automotive and industrial and communications end markets contributed to a full year decline. In contrast, we achieved record revenue in our computing end market with growth in ARM-based PCs and AI devices,” said Giel Rutten, Amkor’s president and chief executive officer.

Company Overview

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ: AMKR) provides outsourced packaging and testing for semiconductors.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

Sales Growth

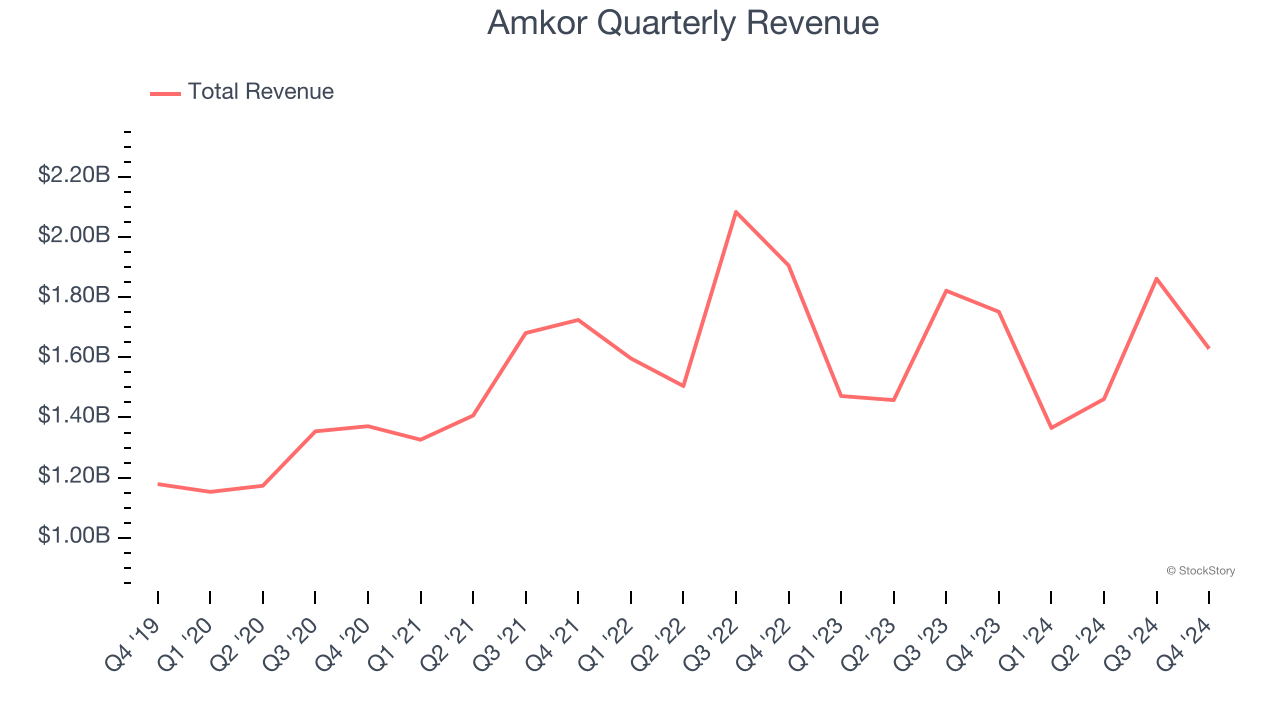

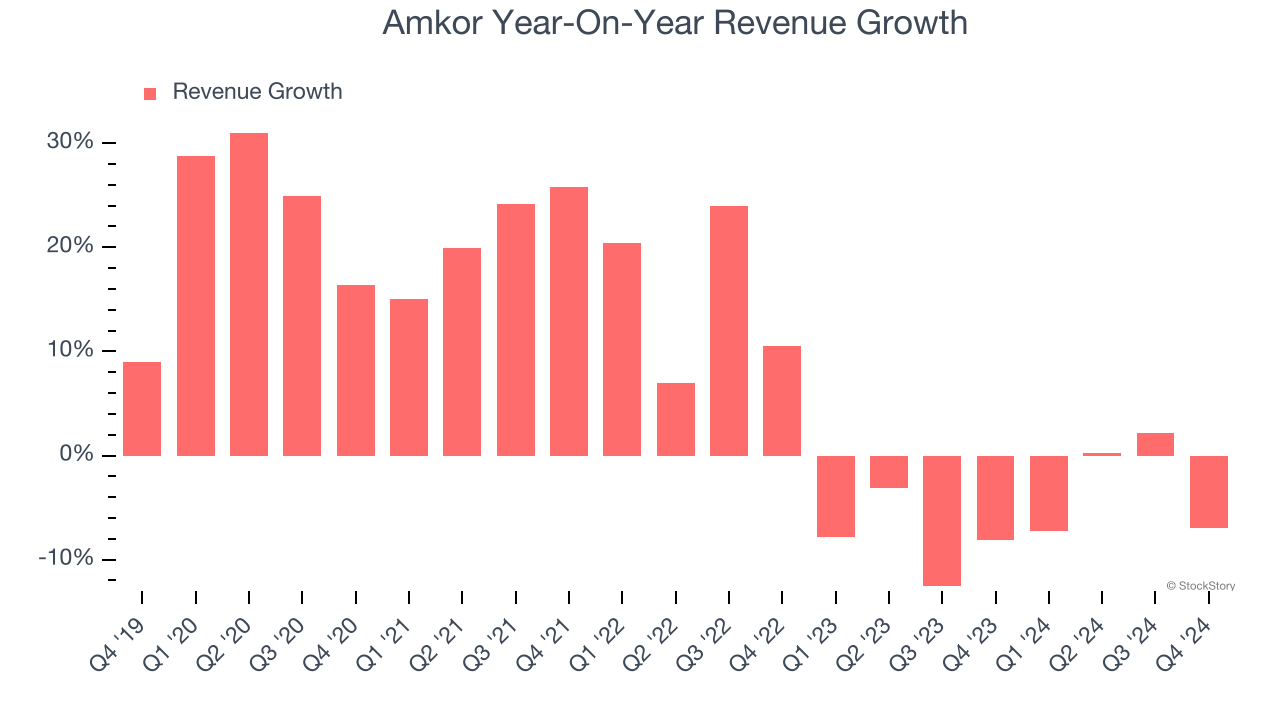

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Amkor’s 9.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Amkor’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.6% over the last two years.

This quarter, Amkor missed Wall Street’s estimates and reported a rather uninspiring 7% year-on-year revenue decline, generating $1.63 billion of revenue. Company management is currently guiding for a 6.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Product Demand & Outstanding Inventory

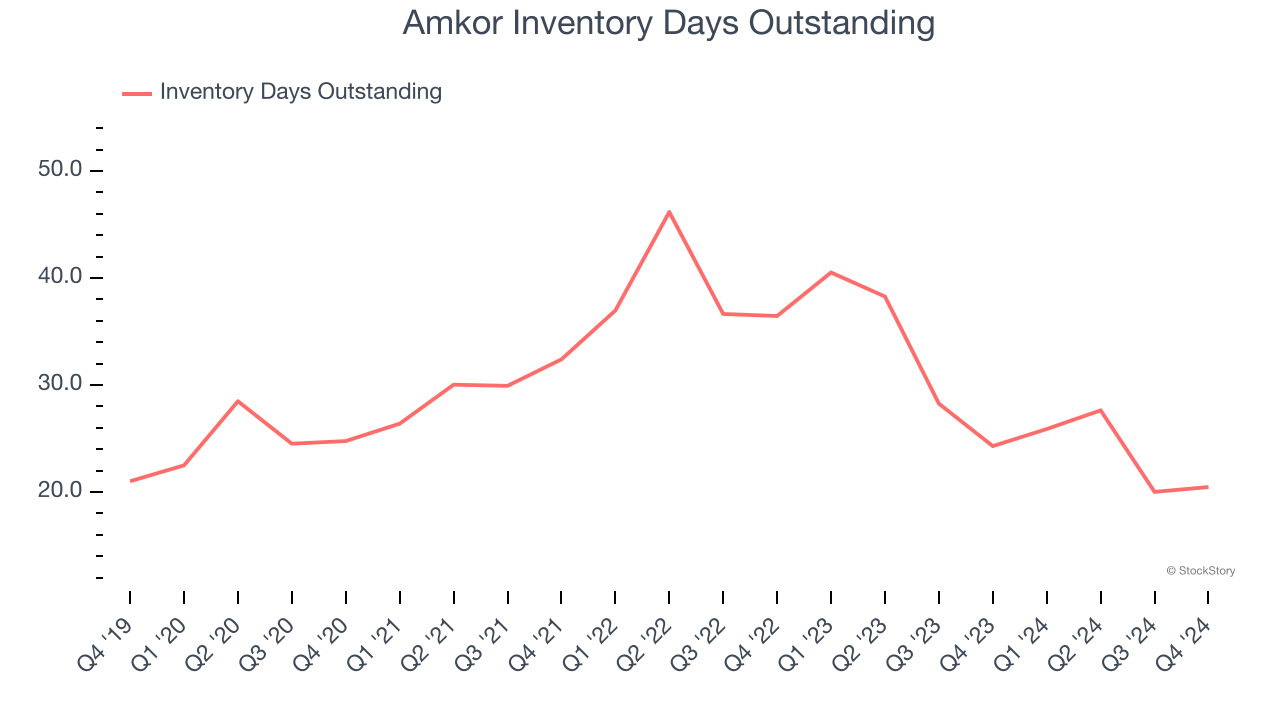

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Amkor’s DIO came in at 20, which is 10 days below its five-year average. Flat versus last quarter, there’s no indication of an excessive inventory buildup.

Key Takeaways from Amkor’s Q4 Results

We were impressed by how significantly Amkor blew past analysts’ EPS expectations this quarter. On the other hand, its revenue guidance for next quarter missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 7.6% to $22.51 immediately following the results.

Amkor underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.