Educational publishing and media company Scholastic (NASDAQ: SCHL) fell short of the markets revenue expectations in Q4 CY2025 as sales only rose 1.2% year on year to $551.1 million. Its non-GAAP profit of $2.57 per share was 24.2% above analysts’ consensus estimates.

Is now the time to buy Scholastic? Find out by accessing our full research report, it’s free for active Edge members.

Scholastic (SCHL) Q4 CY2025 Highlights:

- Revenue: $551.1 million vs analyst estimates of $556.7 million (1.2% year-on-year growth, 1% miss)

- Adjusted EPS: $2.57 vs analyst estimates of $2.07 (24.2% beat)

- Adjusted EBITDA: $122.5 million vs analyst estimates of $109.8 million (22.2% margin, 11.6% beat)

- EBITDA guidance for the full year is $151 million at the midpoint, below analyst estimates of $159.9 million

- Operating Margin: 15%, in line with the same quarter last year

- Free Cash Flow Margin: 10.7%, up from 7.8% in the same quarter last year

- Market Capitalization: $720.2 million

Company Overview

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ: SCHL) is an international company specializing in children's publishing, education, and media services.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Scholastic grew its sales at a weak 4.9% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Scholastic’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Scholastic’s revenue grew by 1.2% year on year to $551.1 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

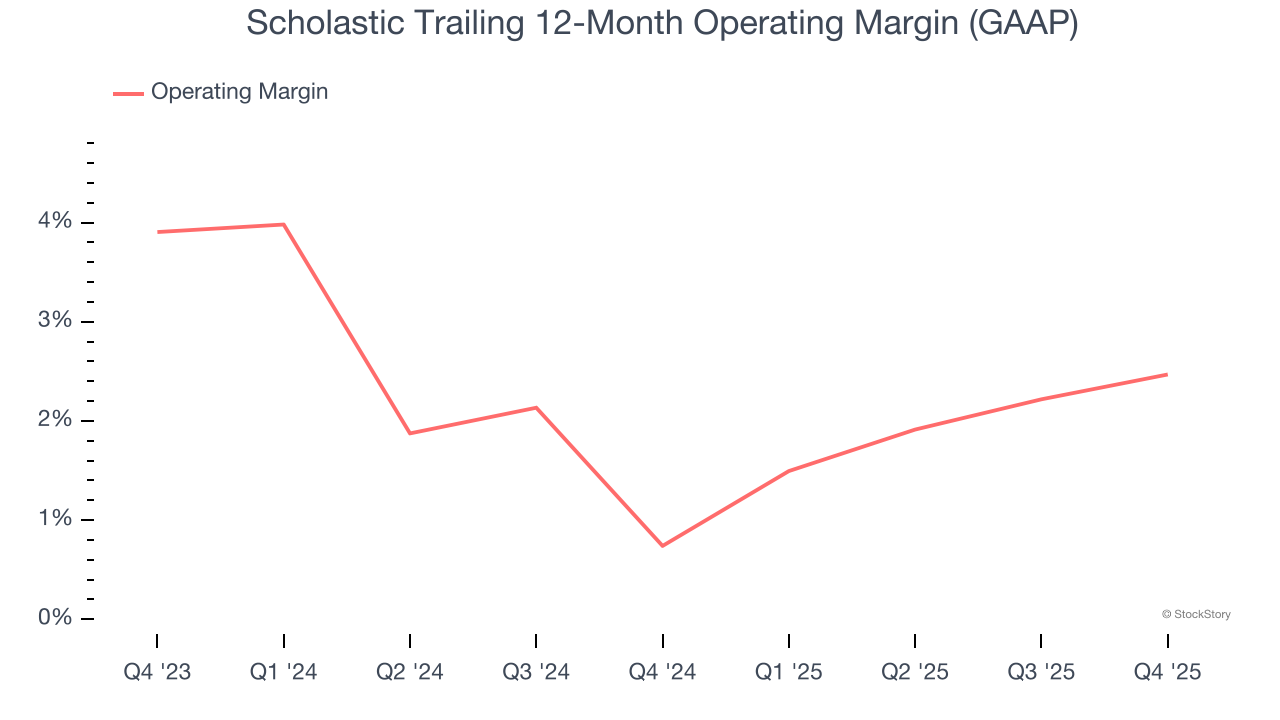

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Scholastic’s operating margin has risen over the last 12 months and averaged 1.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Scholastic generated an operating margin profit margin of 15%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

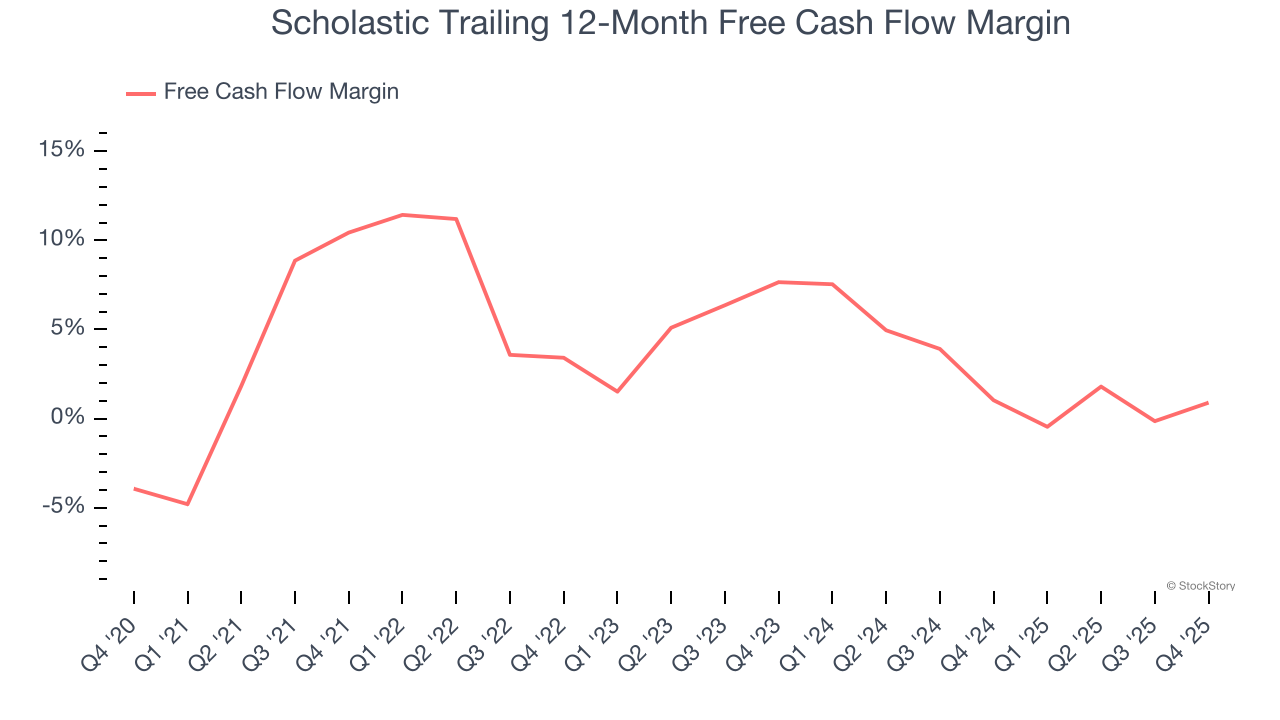

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Scholastic broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Scholastic’s free cash flow clocked in at $59.2 million in Q4, equivalent to a 10.7% margin. This result was good as its margin was 3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Scholastic’s Q4 Results

It was good to see Scholastic beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its revenue fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $29.15 immediately after reporting.

Is Scholastic an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.