The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how asset management stocks fared in Q3, starting with Artisan Partners (NYSE: APAM).

Asset management firms oversee investment portfolios for institutions and individuals. The industry benefits from the growing global wealth pool, retirement savings needs, and expansion into alternative investments (private equity, real estate, etc.). However, firms face significant pressure from the shift to lower-cost passive investment products, regulatory requirements for fee transparency, and increasing technology costs to stay competitive in portfolio management and client service.

The 5 asset management stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 2%.

Thankfully, share prices of the companies have been resilient as they are up 5.7% on average since the latest earnings results.

Artisan Partners (NYSE: APAM)

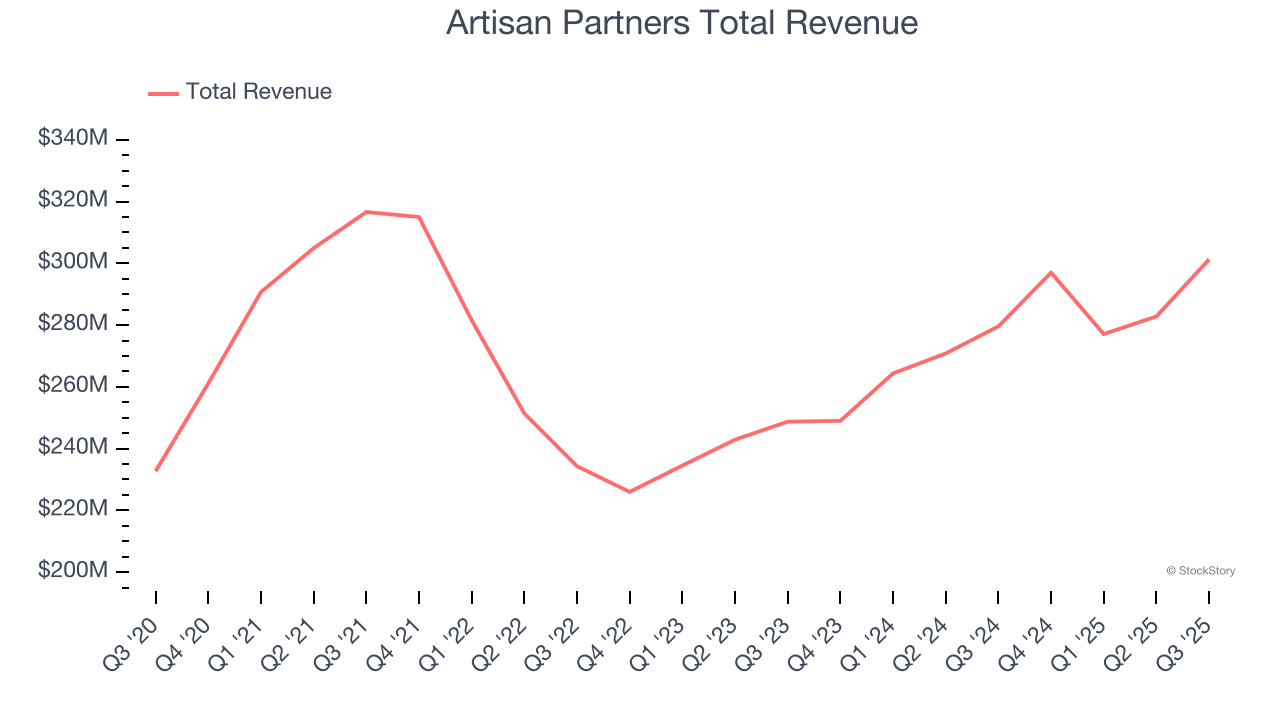

Founded in 1994 with a focus on autonomous investment teams and a "high-value-added" approach, Artisan Partners (NYSE: APAM) is an investment management firm that offers actively managed equity and fixed income strategies to institutional and individual investors.

Artisan Partners reported revenues of $301.3 million, up 7.8% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a slight miss of analysts’ revenue estimates.

Unsurprisingly, the stock is down 5.8% since reporting and currently trades at $41.62.

Is now the time to buy Artisan Partners? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Blackstone (NYSE: BX)

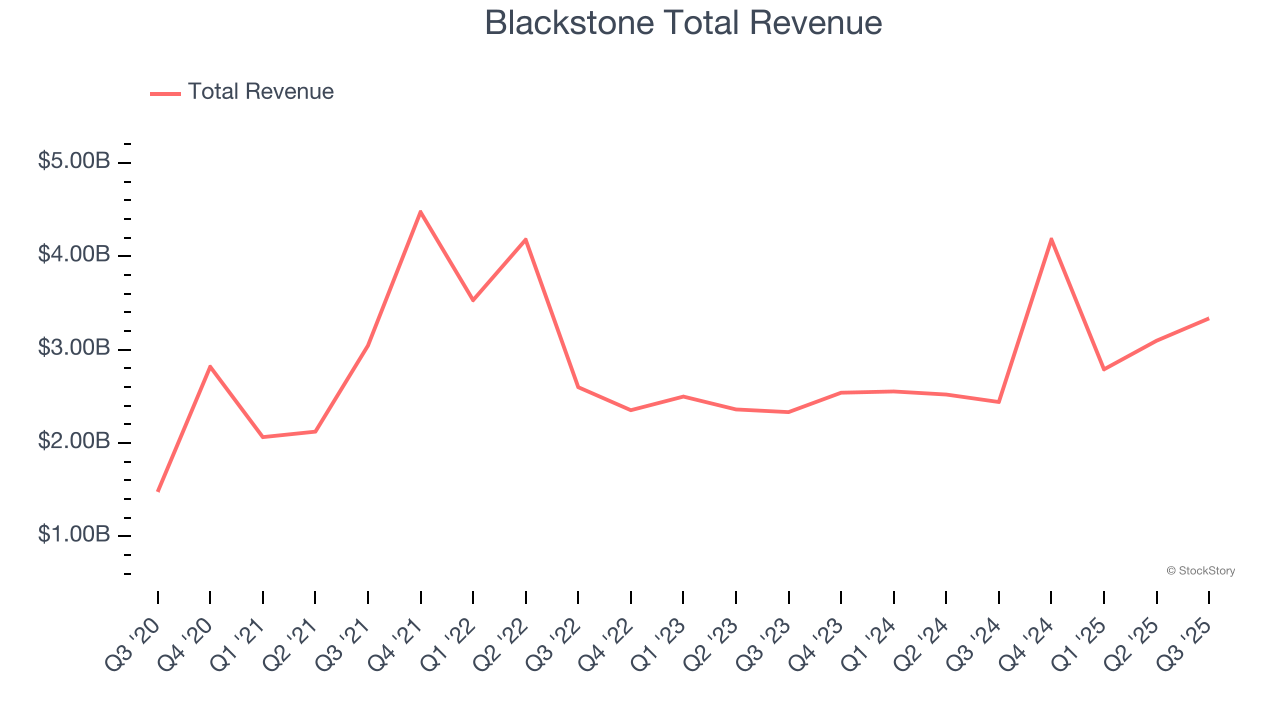

With over $1 trillion in assets under management and investments spanning real estate, private equity, credit, and hedge funds, Blackstone (NYSE: BX) is a global alternative asset manager that invests capital on behalf of pension funds, sovereign wealth funds, and other institutional investors.

Blackstone reported revenues of $3.34 billion, up 36.7% year on year, outperforming analysts’ expectations by 6.6%. The business had an exceptional quarter with a beat of analysts’ EPS and revenue estimates.

Blackstone pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.7% since reporting. It currently trades at $152.51.

Is now the time to buy Blackstone? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Carlyle (NASDAQ: CG)

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ: CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

Carlyle reported revenues of $782.5 million, down 12.6% year on year, falling short of analysts’ expectations by 20.7%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

Carlyle delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 2.2% since the results and currently trades at $57.82.

Read our full analysis of Carlyle’s results here.

Ares (NYSE: ARES)

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE: ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

Ares reported revenues of $1.14 billion, up 35.7% year on year. This number beat analysts’ expectations by 2.5%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ management fees estimates and a solid beat of analysts’ fee-related earnings estimates.

The stock is up 16.7% since reporting and currently trades at $173.56.

Read our full, actionable report on Ares here, it’s free for active Edge members.

TPG (NASDAQ: TPG)

Founded in 1992 and managing over 300 active portfolio companies across more than 30 countries, TPG (NASDAQ: TPG) is a global alternative asset management firm that invests across private equity, credit, real estate, and public market strategies.

TPG reported revenues of $512.1 million, up 12% year on year. This print topped analysts’ expectations by 2.6%. Taking a step back, it was a mixed quarter as it also produced an impressive beat of analysts’ AUM estimates but a significant miss of analysts’ EPS estimates.

The stock is up 21.1% since reporting and currently trades at $66.38.

Read our full, actionable report on TPG here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.