While the S&P 500 is up 19.5% since May 2025, Origin Bancorp (currently trading at $35.14 per share) has lagged behind, posting a return of 8.8%. This may have investors wondering how to approach the situation.

Does this present a buying opportunity for OBK? Or does the price properly account for its business quality and fundamentals?

Why Does OBK Stock Spark Debate?

Founded in 1912 during the early boom days of Louisiana banking, Origin Bancorp (NYSE: OBK) is a financial holding company that provides personalized banking services to businesses, municipalities, and individuals across Texas, Louisiana, and Mississippi.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

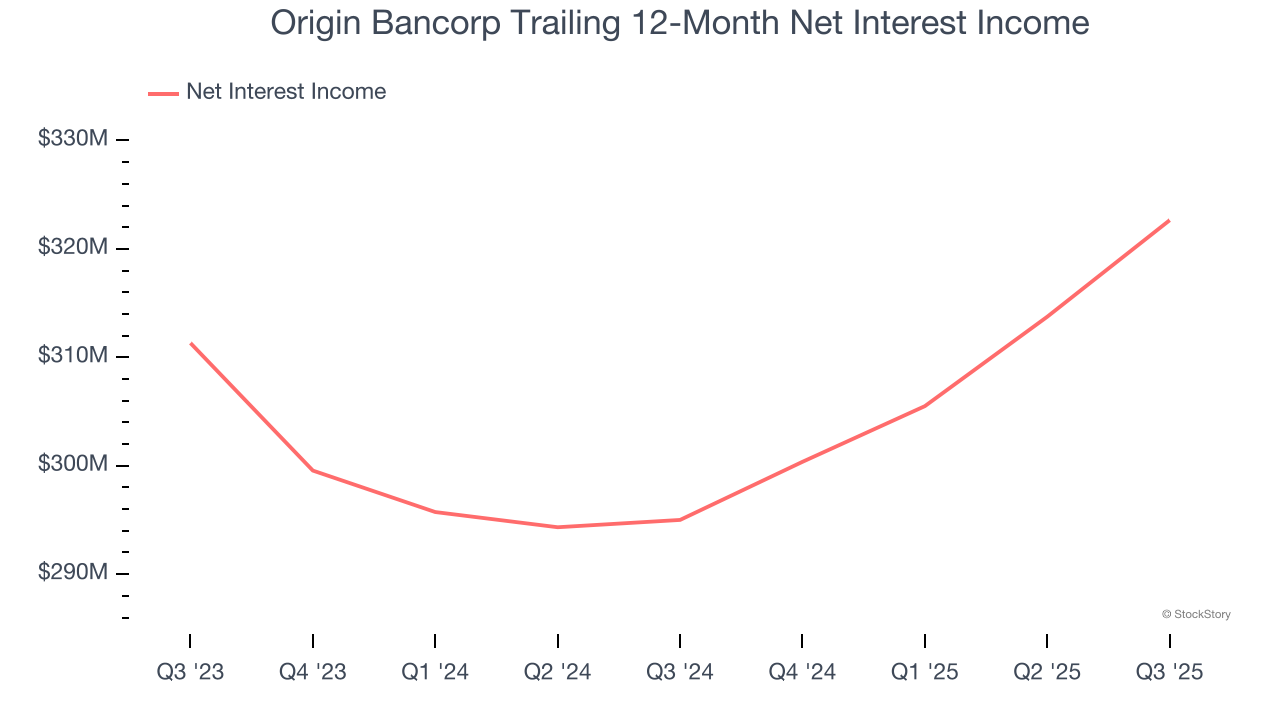

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Origin Bancorp’s net interest income has grown at a 11.8% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Forecasted Efficiency Ratio Shows Stronger Profits Ahead

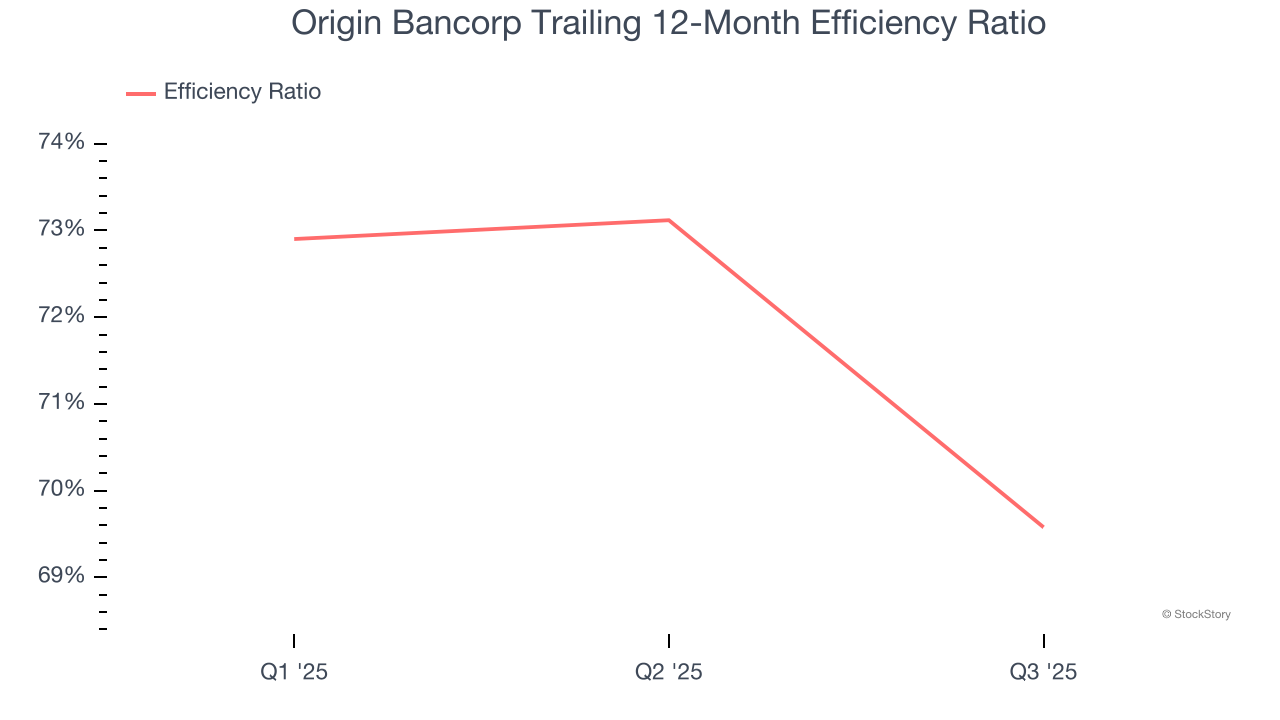

The underlying profitability of top-line growth determines the actual bottom-line impact. Banking institutions measure this dynamic using the efficiency ratio, which is calculated by dividing non-interest expenses like personnel, facilities, technology, and marketing by total revenue.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Origin Bancorp to rein in some of its expenses as it anticipates an efficiency ratio of 60.8% compared to 69.6% over the past year.

One Reason to be Careful:

Lackluster Revenue Growth

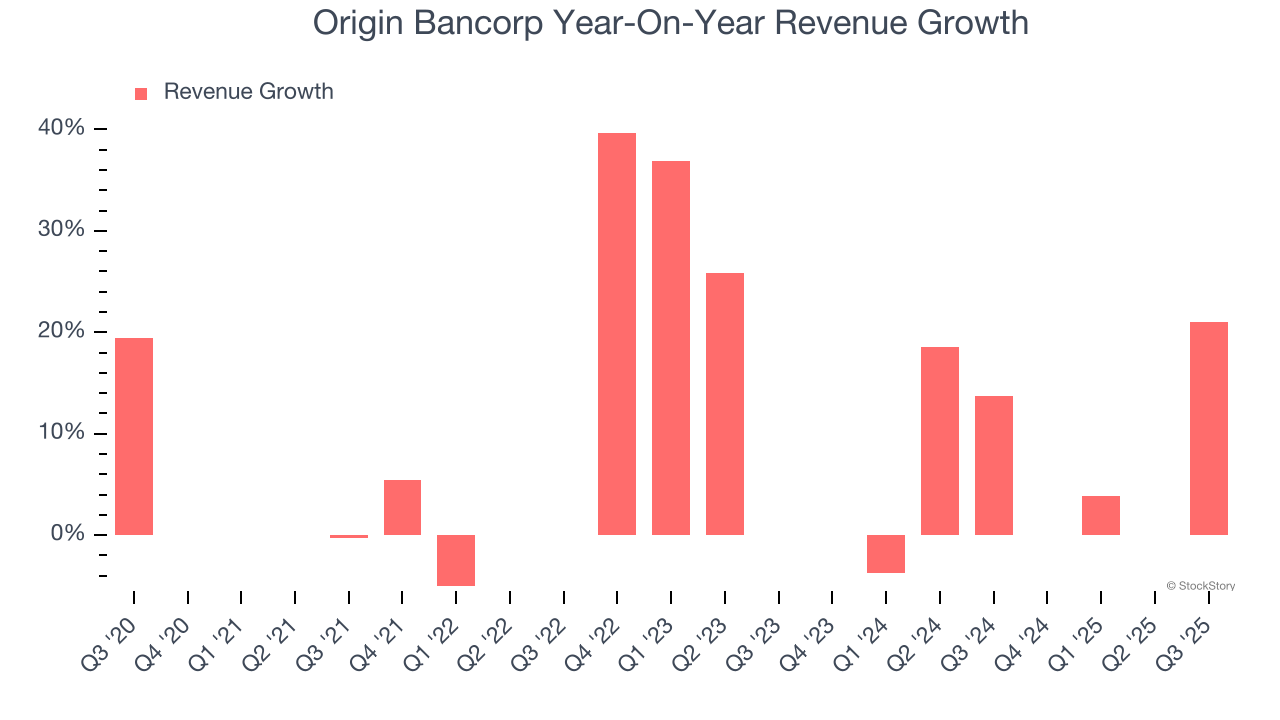

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Origin Bancorp’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

Origin Bancorp has huge potential even though it has some open questions. With its shares trailing the market in recent months, the stock trades at 0.9× forward P/B (or $35.14 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Origin Bancorp

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.