Solar tracking systems manufacturer Array (NASDAQ: ARRY) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 70% year on year to $393.5 million. The company’s full-year revenue guidance of $1.27 billion at the midpoint came in 4.5% above analysts’ estimates. Its non-GAAP profit of $0.30 per share was 48.9% above analysts’ consensus estimates.

Is now the time to buy Array? Find out by accessing our full research report, it’s free for active Edge members.

Array (ARRY) Q3 CY2025 Highlights:

- Revenue: $393.5 million vs analyst estimates of $311.5 million (70% year-on-year growth, 26.3% beat)

- Adjusted EPS: $0.30 vs analyst estimates of $0.20 (48.9% beat)

- Adjusted EBITDA: $72.19 million vs analyst estimates of $56.76 million (18.3% margin, 27.2% beat)

- The company lifted its revenue guidance for the full year to $1.27 billion at the midpoint from $1.20 billion, a 5.6% increase

- Management slightly raised its full-year Adjusted EPS guidance to $0.67 at the midpoint

- EBITDA guidance for the full year is $190 million at the midpoint, below analyst estimates of $196 million

- Operating Margin: 11.6%, up from -57.3% in the same quarter last year

- Free Cash Flow Margin: 5.6%, down from 24.1% in the same quarter last year

- Market Capitalization: $1.18 billion

“ARRAY posted another outstanding quarter of strong performance across our key metrics, including significant revenue and volume growth year-over-year of 70% and 56%, respectively, delivering our second highest quarter of Adjusted EBITDA on record. Robust bookings in the quarter reflect the deep trust and expanding partnerships we have cultivated with leading developers, utilities, and independent power producers. These customers value long-term operational reliability and performance, reinforcing ARRAY’s competitive advantage in the industry. The completed acquisition of APA in August marks a pivotal moment in our growth strategy – unlocking powerful commercial synergies and accelerating our ability to deliver a more comprehensive and flexible portfolio of tracking, fixed-tilt, and foundation solutions to meet the evolving needs of our customers and the broader solar market,” said Chief Executive Officer, Kevin G. Hostetler.

Company Overview

Going public in October 2020, Array (NASDAQ: ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

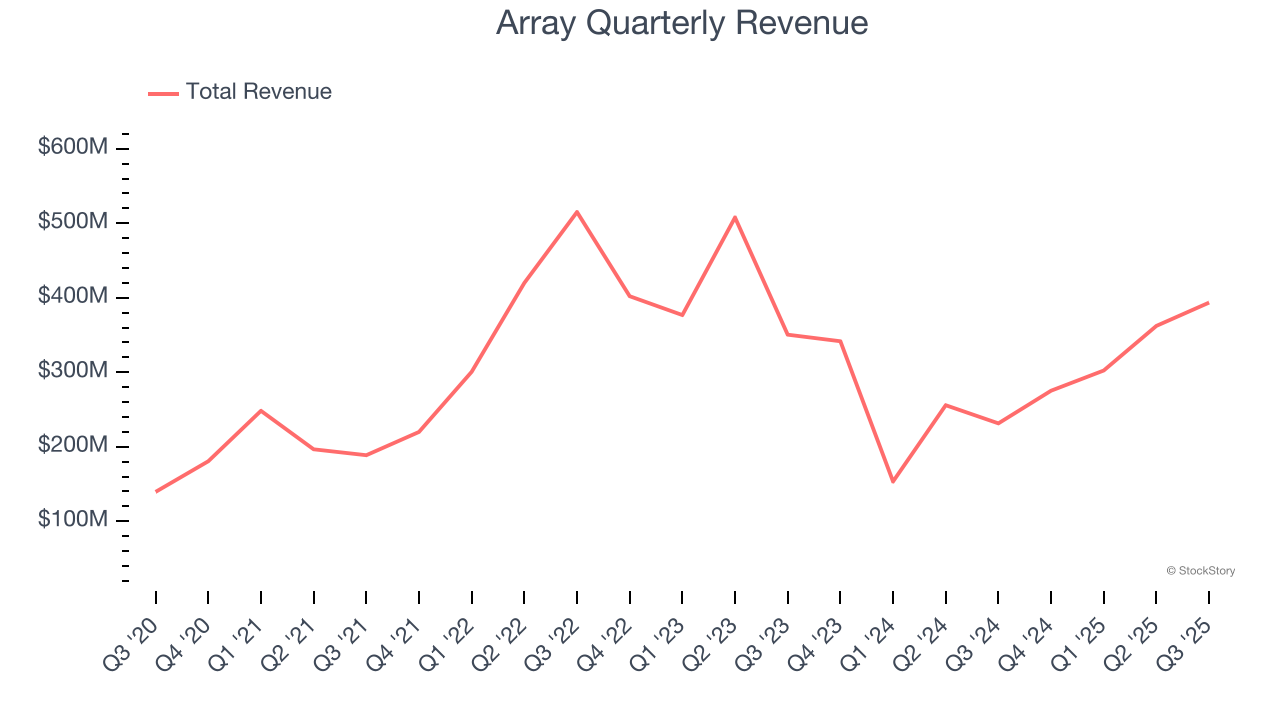

Revenue Growth

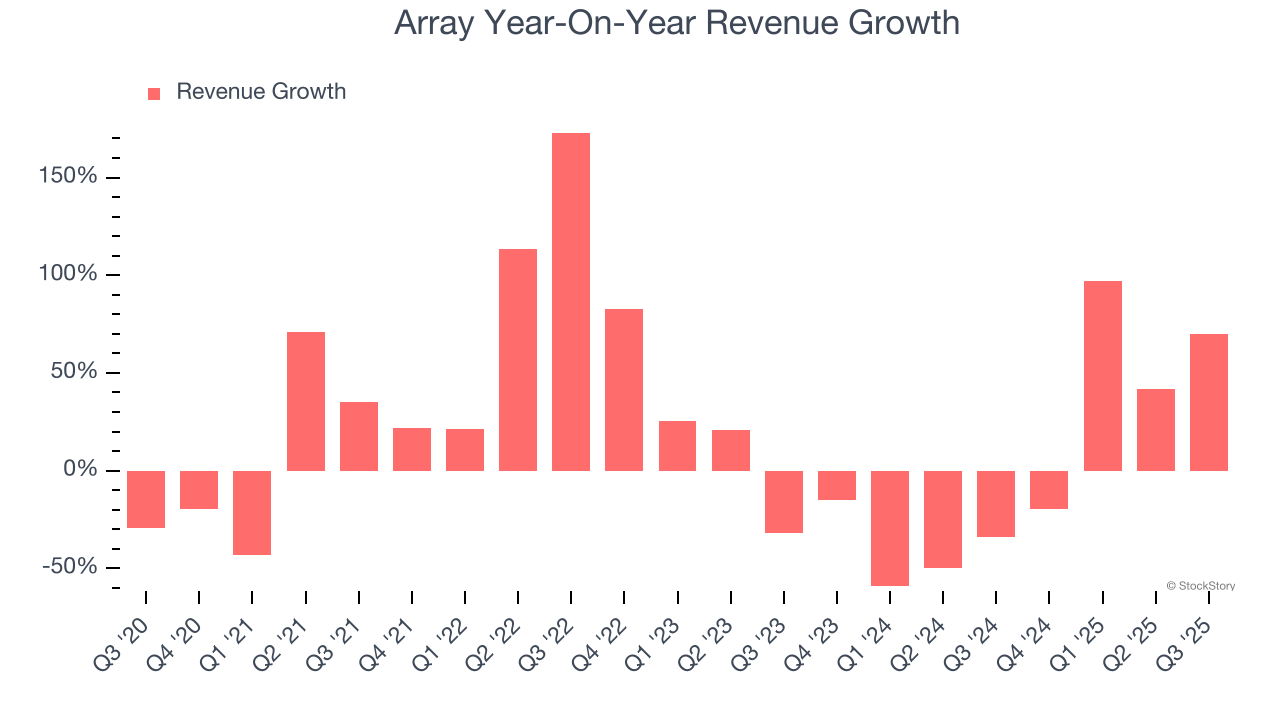

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Array’s sales grew at a decent 7.8% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Array’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.8% over the last two years.

This quarter, Array reported magnificent year-on-year revenue growth of 70%, and its $393.5 million of revenue beat Wall Street’s estimates by 26.3%.

Looking ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

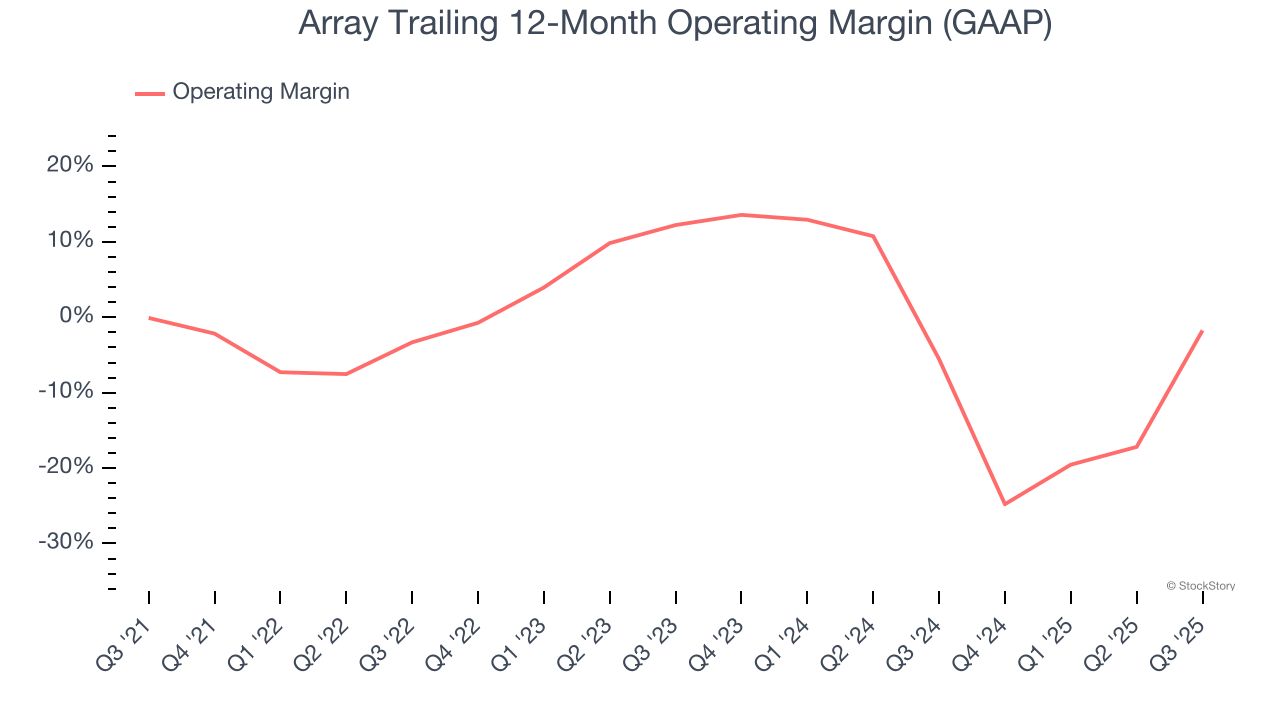

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Array was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Array’s operating margin decreased by 1.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Array’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Array generated an operating margin profit margin of 11.6%, up 68.9 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

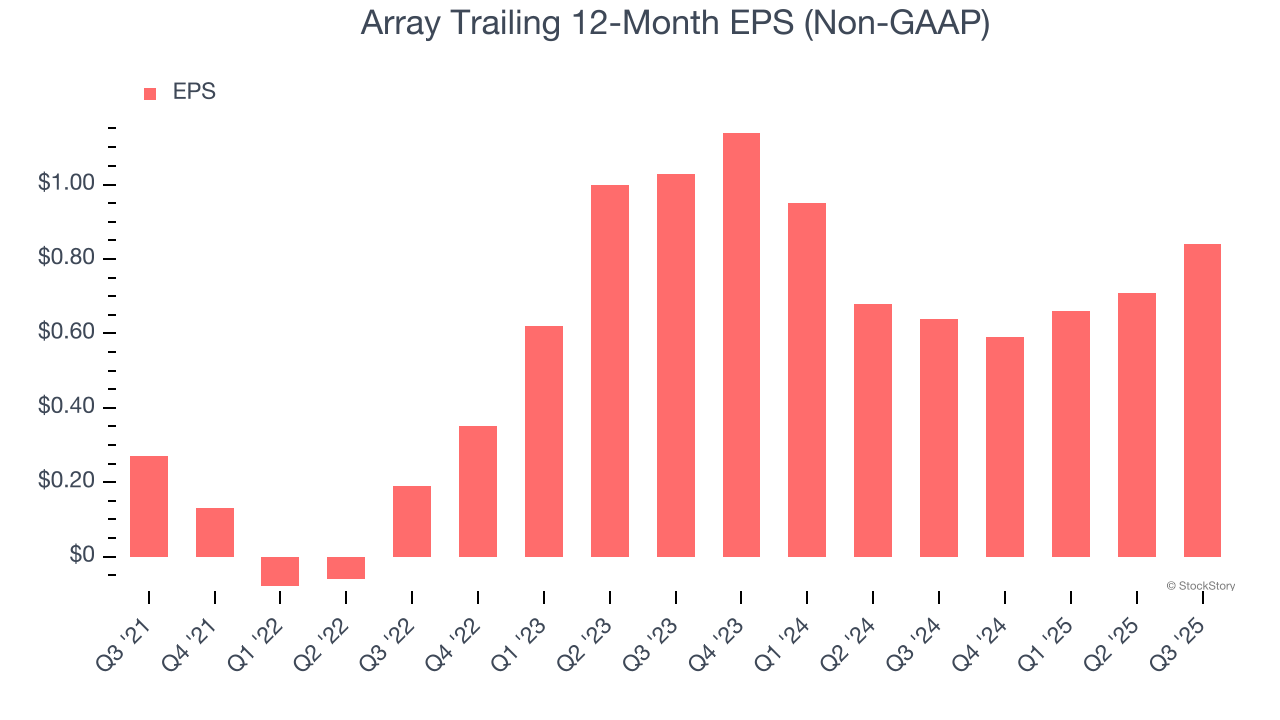

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Array’s full-year EPS grew at an astounding 32.8% compounded annual growth rate over the last four years, better than the broader industrials sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Array, its EPS and revenue declined by 9.7% and 9.8% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Array’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Array reported adjusted EPS of $0.30, up from $0.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Array’s full-year EPS of $0.84 to shrink by 5.5%.

Key Takeaways from Array’s Q3 Results

It was good to see Array beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EBITDA guidance missed. Zooming out, we think this was a solid print. The stock traded up 3.1% to $8.61 immediately after reporting.

Array had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.