Health insurance company Clover Health (NASDAQ: CLOV) announced better-than-expected revenue in Q3 CY2025, with sales up 50.1% year on year to $496.7 million. Its GAAP loss of $0.05 per share was $0.02 below analysts’ consensus estimates.

Is now the time to buy Clover Health? Find out by accessing our full research report, it’s free for active Edge members.

Clover Health (CLOV) Q3 CY2025 Highlights:

- Revenue: $496.7 million vs analyst estimates of $471.1 million (50.1% year-on-year growth, 5.4% beat)

- EPS (GAAP): -$0.05 vs analyst estimates of -$0.03 ($0.02 miss)

- Adjusted EBITDA: $2.11 million vs analyst estimates of $10.83 million (0.4% margin, 80.5% miss)

- EBITDA guidance for the full year is $22.5 million at the midpoint, below analyst estimates of $52.9 million

- Operating Margin: -4.9%, down from -2.7% in the same quarter last year

- Free Cash Flow Margin: 2.3%, down from 15% in the same quarter last year

- Customers: 109,226, up from 106,323 in the previous quarter

- Market Capitalization: $1.8 billion

“Our model of care continues to perform well as we bring our technology-powered care to more Medicare Advantage seniors," said Clover Health CEO Andrew Toy.

Company Overview

Founded in 2014 to improve healthcare for America's seniors through technology, Clover Health (NASDAQ: CLOV) provides Medicare Advantage plans for seniors with a focus on affordable care and uses its proprietary Clover Assistant software to help physicians manage patient care.

Revenue Growth

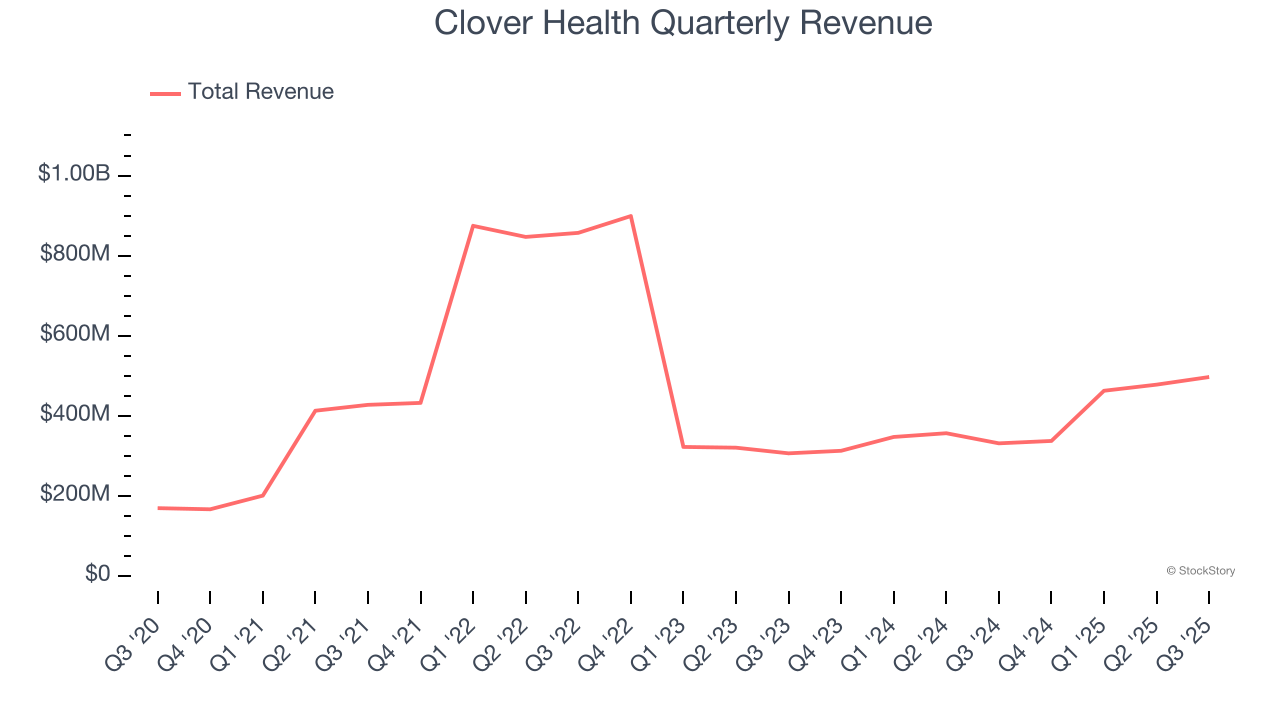

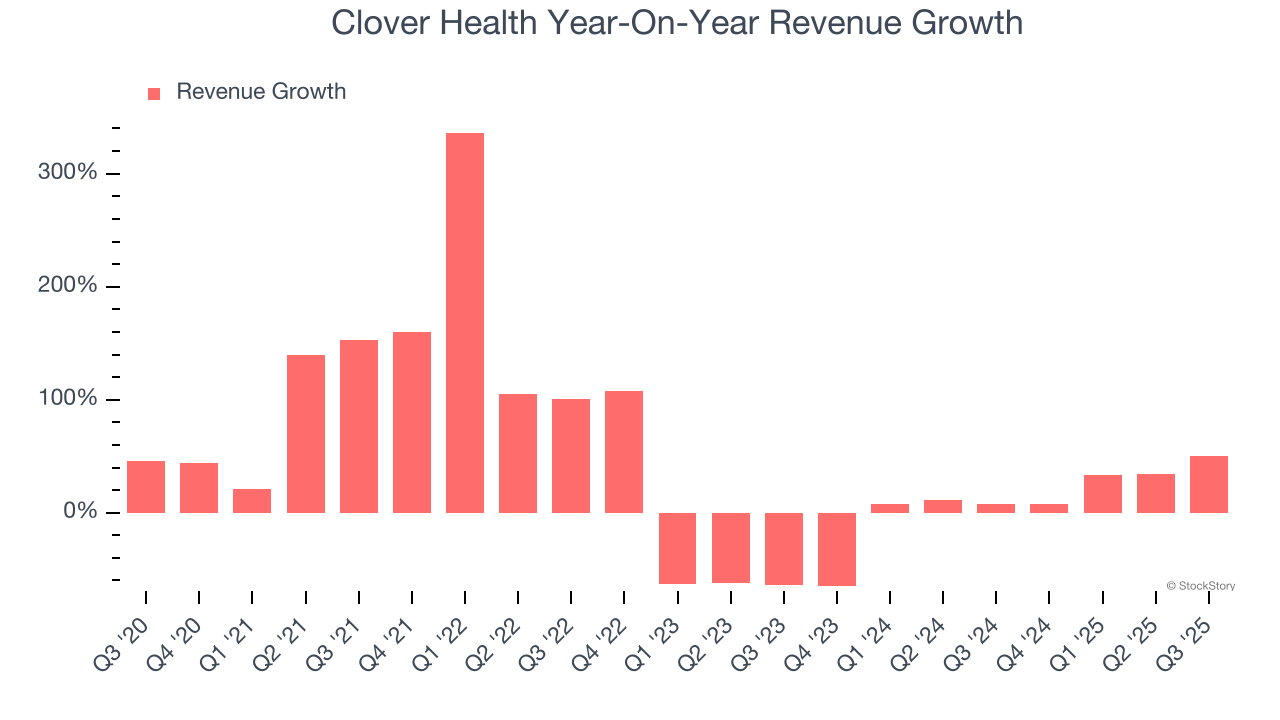

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Clover Health’s 23.3% annualized revenue growth over the last five years was excellent. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Clover Health’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2% over the last two years.

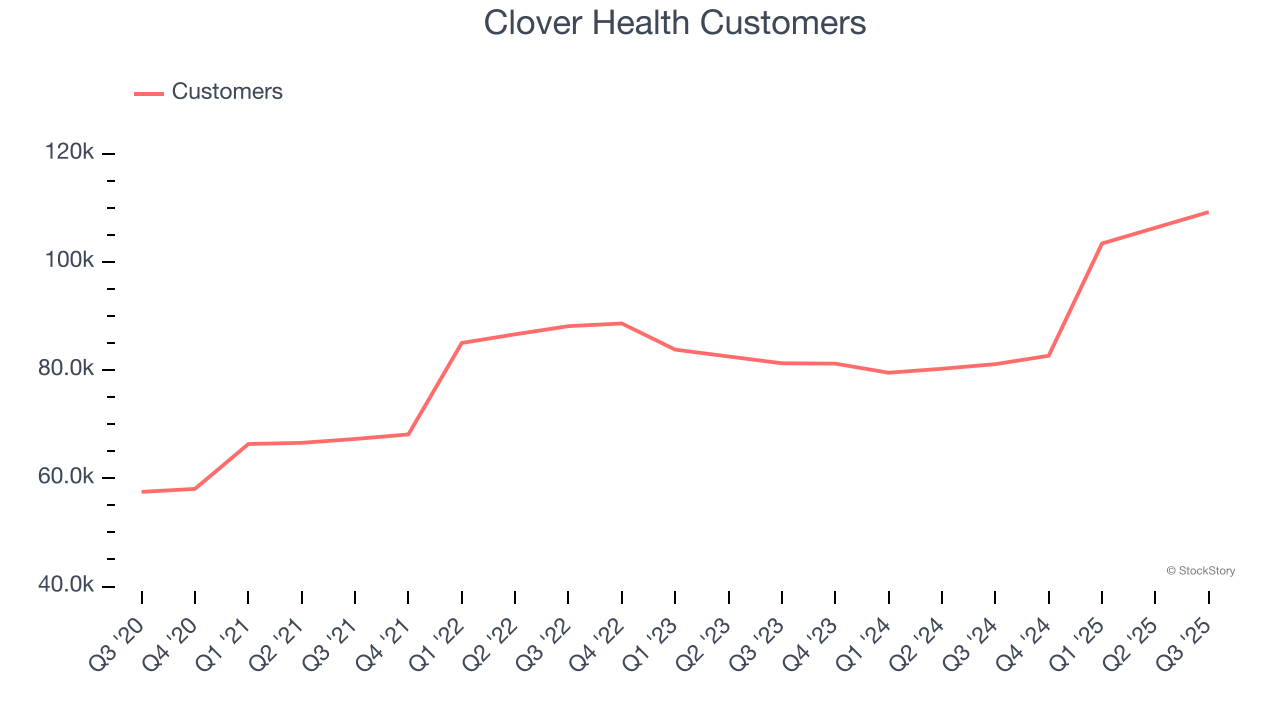

Clover Health also reports its number of customers, which reached 109,226 in the latest quarter. Over the last two years, Clover Health’s customer base averaged 10.3% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Clover Health reported magnificent year-on-year revenue growth of 50.1%, and its $496.7 million of revenue beat Wall Street’s estimates by 5.4%.

Looking ahead, sell-side analysts expect revenue to grow 31.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

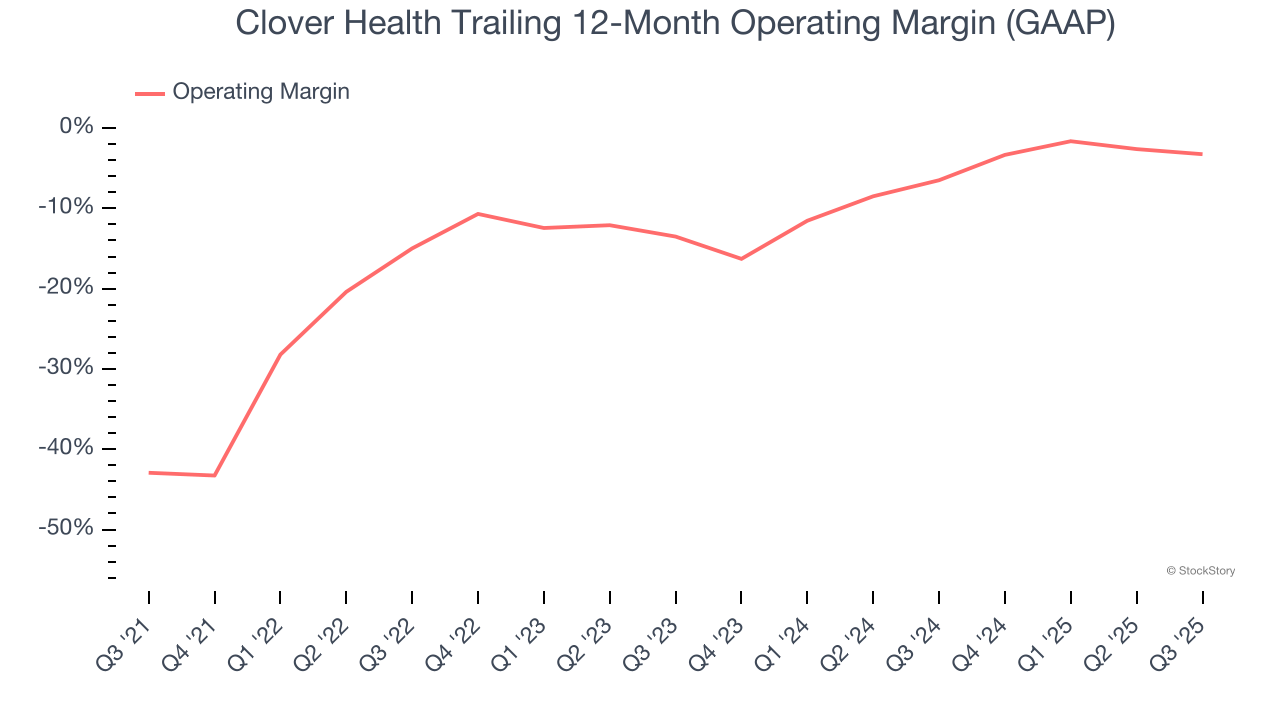

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Clover Health’s high expenses have contributed to an average operating margin of negative 14.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Clover Health’s operating margin rose by 39.7 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 10.3 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q3, Clover Health generated a negative 4.9% operating margin.

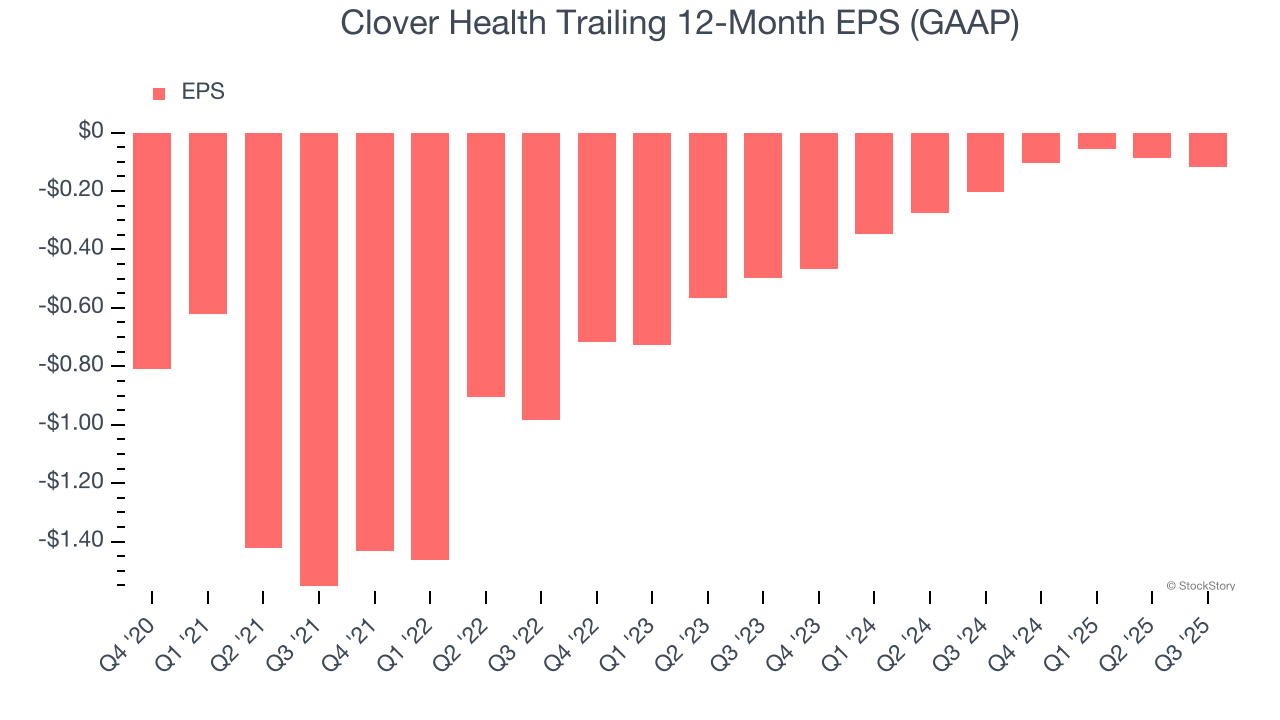

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Clover Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 21.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q3, Clover Health reported EPS of negative $0.05, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Clover Health’s full-year EPS of negative $0.12 will reach break even.

Key Takeaways from Clover Health’s Q3 Results

We were impressed by how significantly Clover Health blew past analysts’ revenue expectations this quarter. We were also glad its customer base outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 17.5% to $2.90 immediately following the results.

So should you invest in Clover Health right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.