Even though Sea (currently trading at $157.21 per share) has gained 10.3% over the last six months, it has lagged the S&P 500’s 21.3% return during that period. This might have investors contemplating their next move.

Given the relatively weaker price action, is now a good time to buy SE, or is it a pass? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Sea?

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE: SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

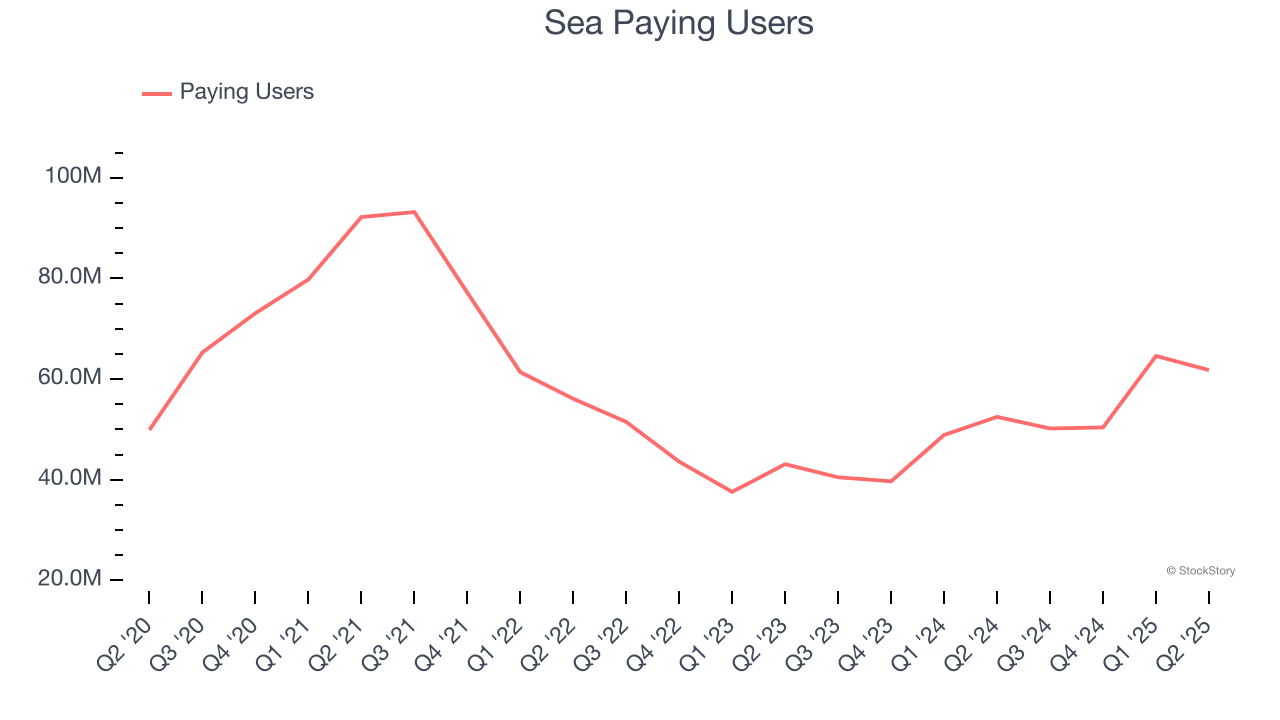

1. Paying Users Skyrocket, Fueling Growth Opportunities

As an online marketplace, Sea generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Sea’s paying users, a key performance metric for the company, increased by 15.3% annually to 61.8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sea’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

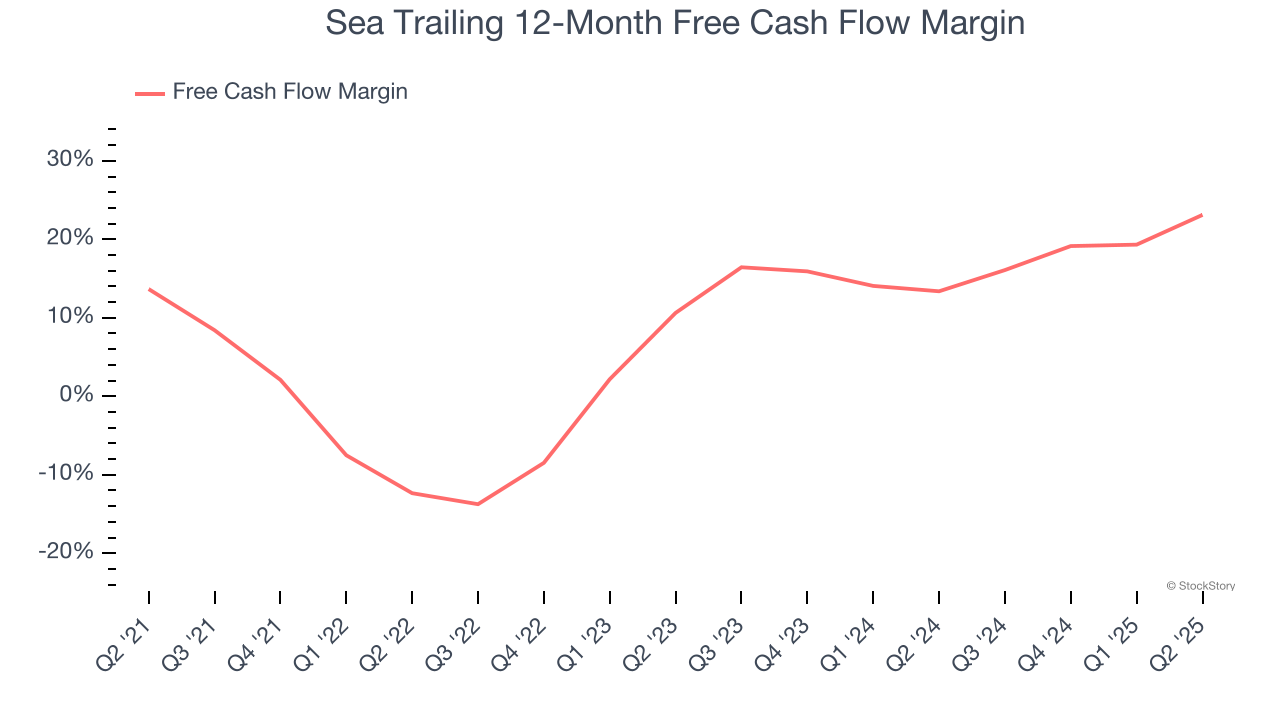

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Sea’s margin expanded by 35.5 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Sea’s free cash flow margin for the trailing 12 months was 23.1%.

Final Judgment

These are just a few reasons Sea is a high-quality business worth owning. With its shares trailing the market in recent months, the stock trades at 26.8× forward EV/EBITDA (or $157.21 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Sea

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.