Over the past six months, DocuSign’s shares (currently trading at $71.99) have posted a disappointing 11.9% loss, well below the S&P 500’s 22.6% gain. This might have investors contemplating their next move.

Is now the time to buy DocuSign, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is DocuSign Not Exciting?

Even with the cheaper entry price, we're cautious about DocuSign. Here are three reasons there are better opportunities than DOCU and a stock we'd rather own.

1. Weak ARR Points to Soft Demand

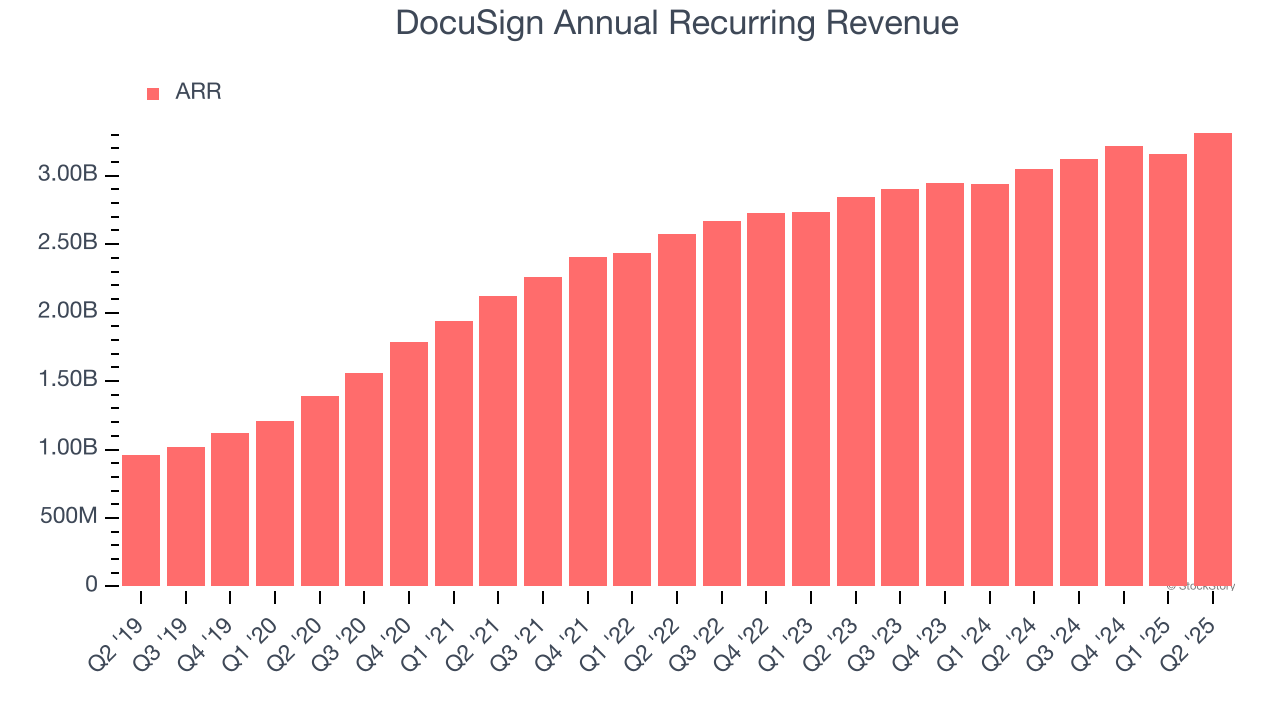

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

DocuSign’s ARR came in at $3.31 billion in Q2, and over the last four quarters, its year-on-year growth averaged 8.3%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect DocuSign’s revenue to rise by 6.6%, close to its 21.6% annualized growth for the past five years. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

3. Operating Margin Rising, Profits Up

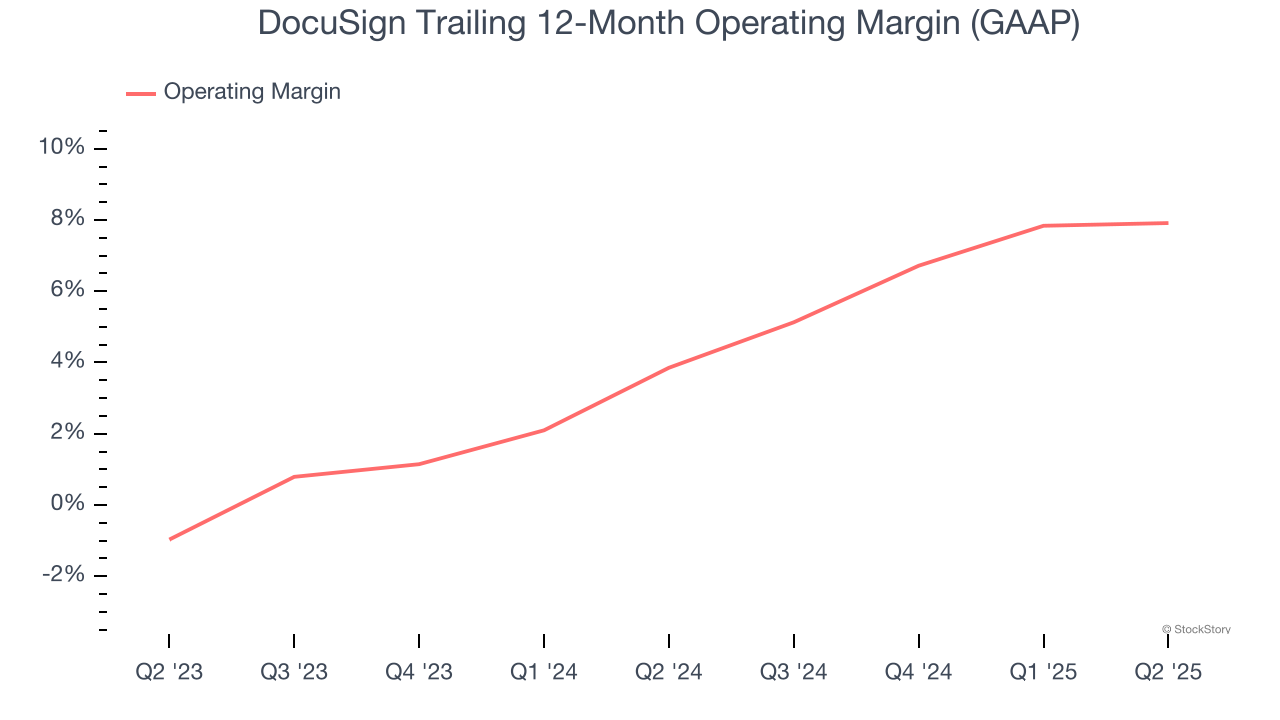

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, DocuSign’s operating margin rose by 4.1 percentage points over the last two years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 7.9%.

Final Judgment

DocuSign’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 4.6× forward price-to-sales (or $71.99 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than DocuSign

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.