Fintech mortgage provider Rocket Companies (NYSE: RKT) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 21.3% year on year to $1.61 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $2.2 billion at the midpoint, or 4.5% above analysts’ estimates. Its non-GAAP profit of $0.07 per share was 46.5% above analysts’ consensus estimates.

Is now the time to buy Rocket Companies? Find out by accessing our full research report, it’s free for active Edge members.

Rocket Companies (RKT) Q3 CY2025 Highlights:

- Net Interest Income: $35.68 million vs analyst estimates of $26.7 million (33.6% beat)

- Revenue: $1.61 billion vs analyst estimates of $1.66 billion (21.3% year-on-year growth, 3.5% miss)

- Adjusted EPS: $0.07 vs analyst estimates of $0.05 (46.5% beat)

- Revenue Guidance for Q4 CY2025 is $2.2 billion at the midpoint, above analyst estimates of $2.10 billion

- Market Capitalization: $45.7 billion

"Rocket delivered a standout quarter, balancing short and long term execution in a category of one. I am very proud of the Rocket team for surpassing the high end of our adjusted revenue guidance range, accelerating Redfin momentum and closing the Mr. Cooper transaction—the largest independent mortgage company deal in history," said Varun Krishna, CEO and Director of Rocket Companies.

Company Overview

Born in Detroit during the 1980s and evolving into a tech-driven financial powerhouse, Rocket Companies (NYSE: RKT) is a fintech company that provides digital mortgage lending, real estate services, and personal finance solutions through its technology platform.

Sales Growth

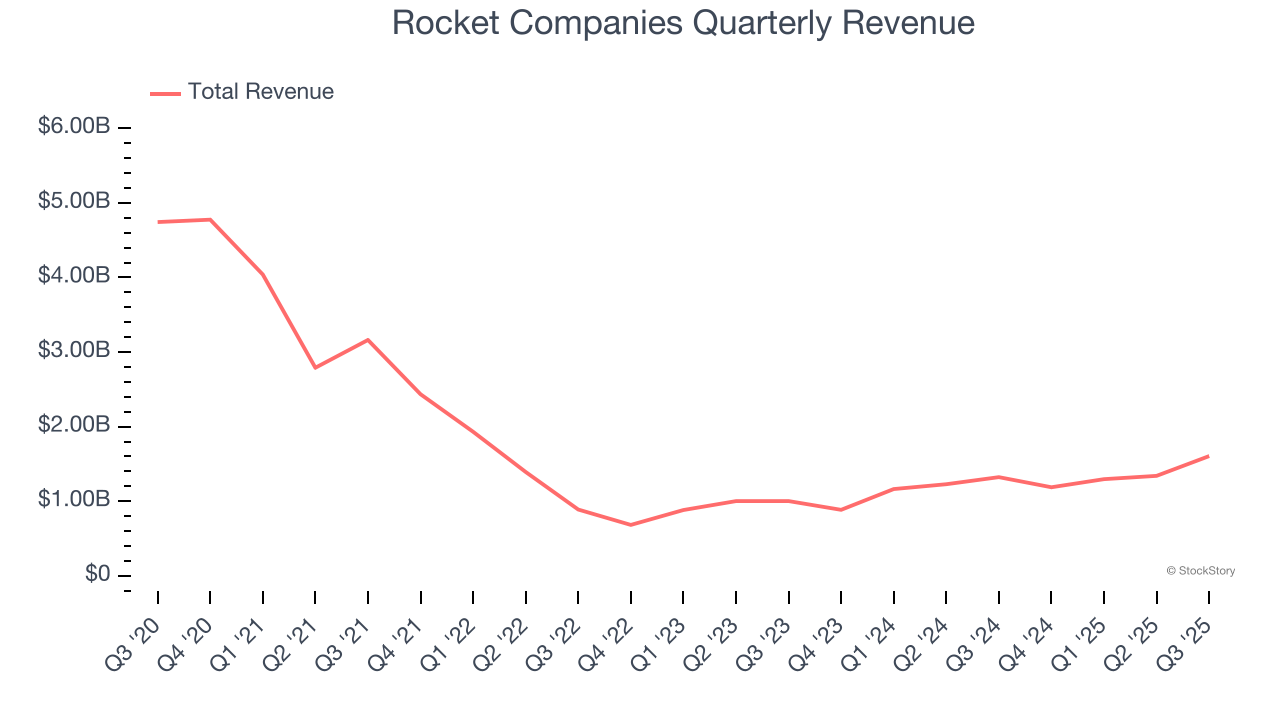

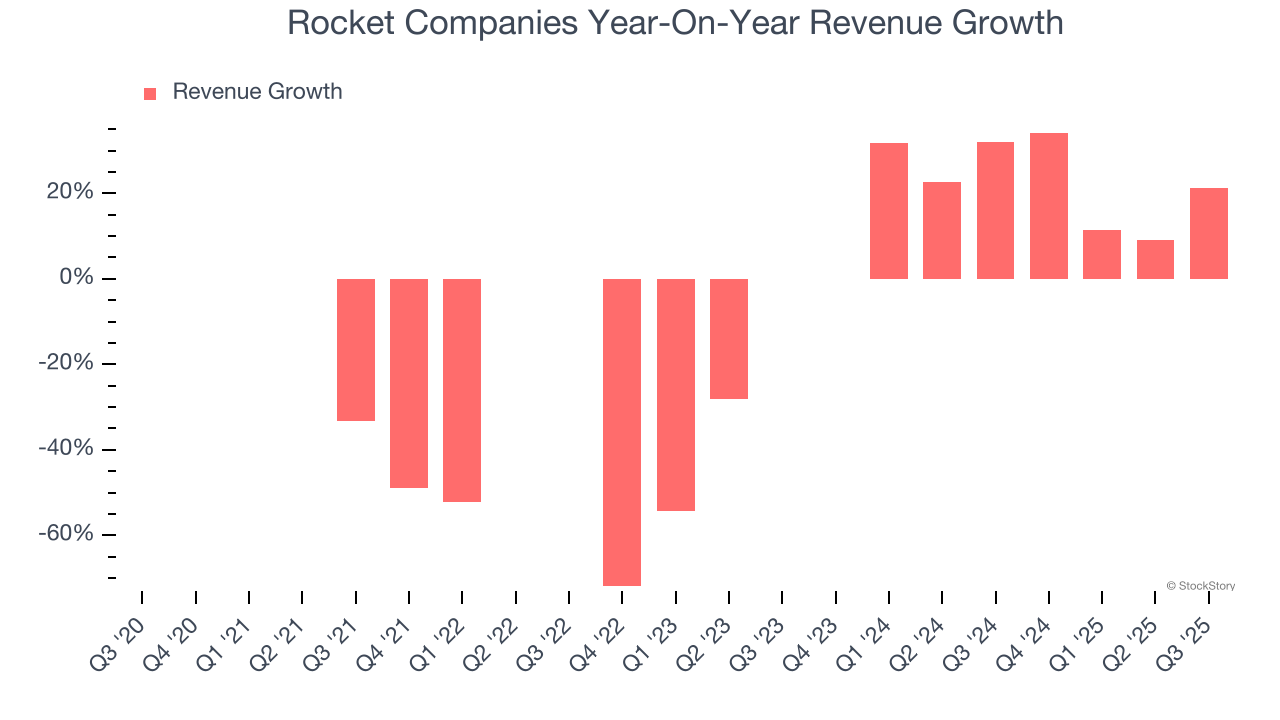

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Rocket Companies struggled to consistently generate demand over the last five years as its revenue dropped at a 17.2% annual rate. This wasn’t a great result, but there are still things to like about Rocket Companies.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Rocket Companies’s annualized revenue growth of 23.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Rocket Companies generated an excellent 21.3% year-on-year revenue growth rate, but its $1.61 billion of revenue fell short of Wall Street’s high expectations. Company management is currently guiding for a 85.3% year-on-year increase in sales next quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Rocket Companies’s Q3 Results

It was good to see Rocket Companies beat analysts’ EPS expectations this quarter. We were also excited its net interest income outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.3% to $16.45 immediately after reporting.

Sure, Rocket Companies had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.