What a brutal six months it’s been for Hyster-Yale Materials Handling. The stock has dropped 25.7% and now trades at $56.22, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Hyster-Yale Materials Handling, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even though the stock has become cheaper, we're swiping left on Hyster-Yale Materials Handling for now. Here are three reasons why you should be careful with HY and a stock we'd rather own.

Why Is Hyster-Yale Materials Handling Not Exciting?

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE: HY) designs, manufactures, and sells materials handling equipment to various sectors.

1. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Hyster-Yale Materials Handling has poor unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16.3% gross margin over the last five years. That means Hyster-Yale Materials Handling paid its suppliers a lot of money ($83.67 for every $100 in revenue) to run its business.

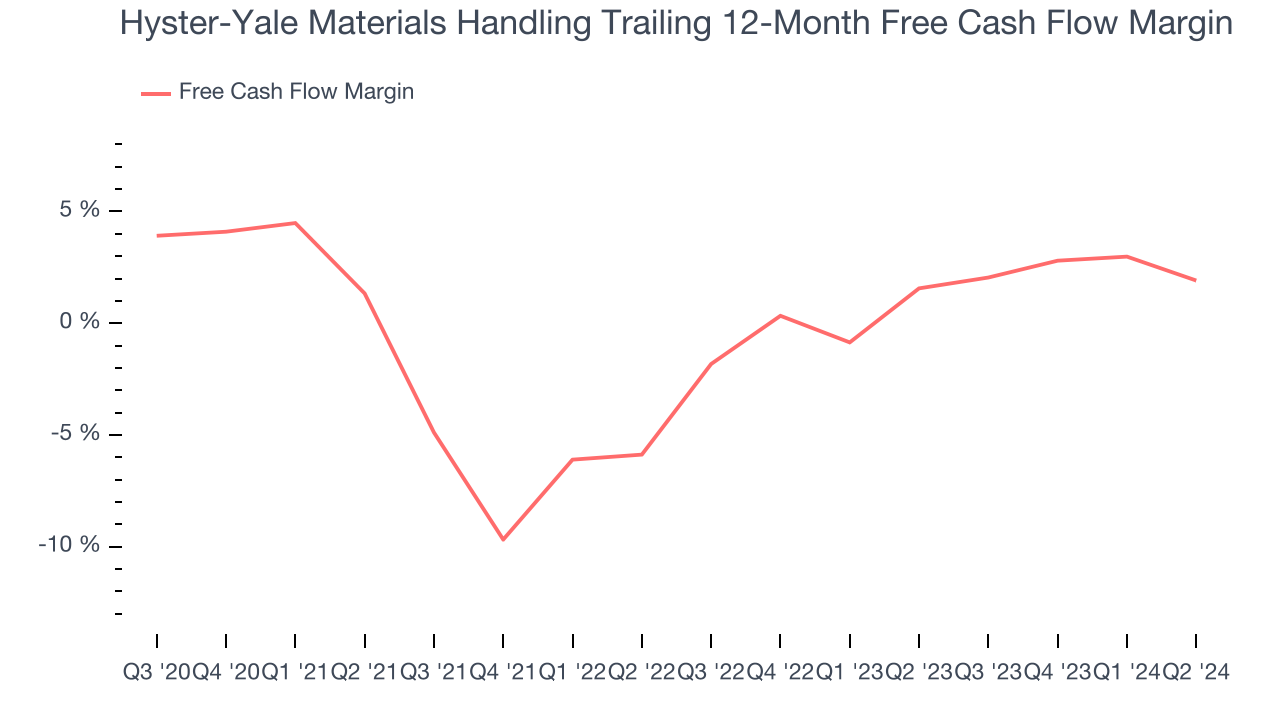

2. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Hyster-Yale Materials Handling broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

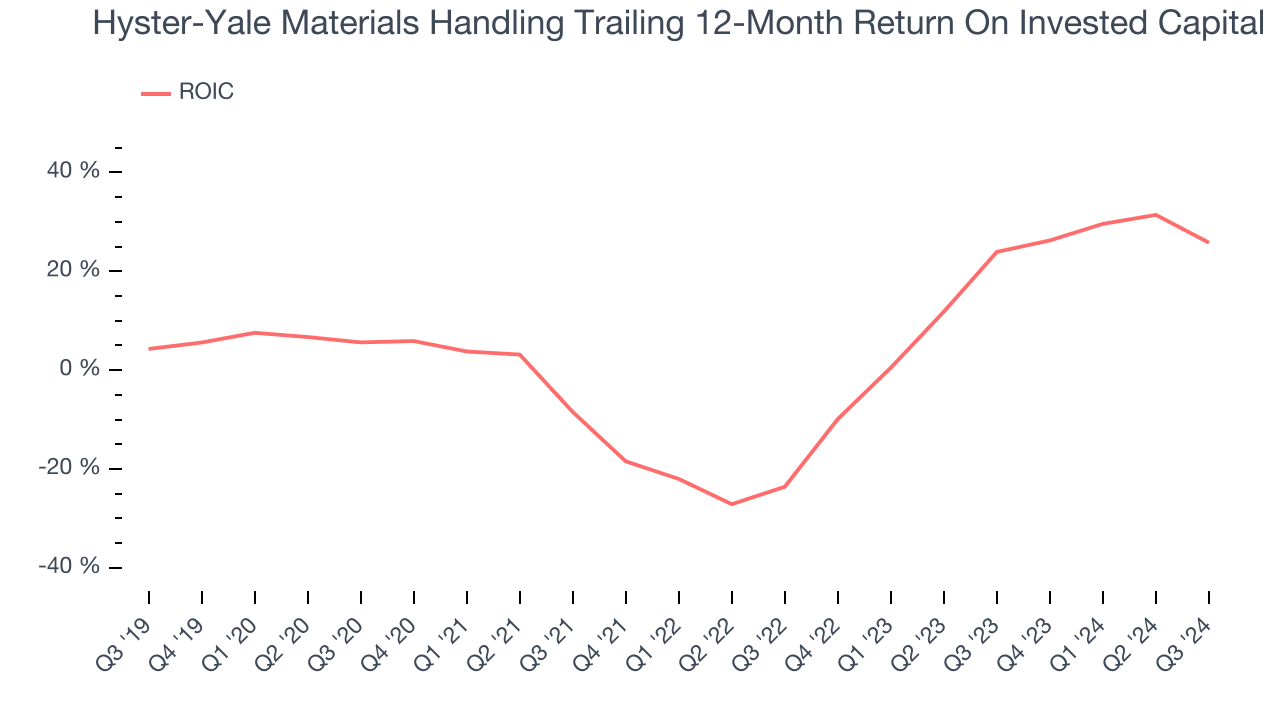

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Hyster-Yale Materials Handling’s five-year average ROIC was 4.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job investing in profitable growth initiatives.

Final Judgment

Hyster-Yale Materials Handling isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 7.3x forward price-to-earnings (or $56.22 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of Hyster-Yale Materials Handling

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.