ThredUp’s stock price has taken a beating over the past six months, shedding 36.7% of its value and falling to $1.31 per share. This might have investors contemplating their next move.

Is there a buying opportunity in ThredUp, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even though the stock has become cheaper, we're cautious about ThredUp. Here are three reasons why there are better opportunities than TDUP and a stock we'd rather own.

Why Do We Think ThredUp Will Underperform?

Founded to revolutionize thrifting, ThredUp (NASDAQ: TDUP) is a leading online fashion resale marketplace offering a wide selection of gently-used clothing and accessories.

1. Inability to Grow Orders Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like ThredUp, our preferred volume metric is orders). While both are important, the latter is the lifeblood of a successful Apparel and Accessories company because prices have a ceiling.

Over the last two years, ThredUp failed to grow its orders, which came in at 1.55 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests ThredUp might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

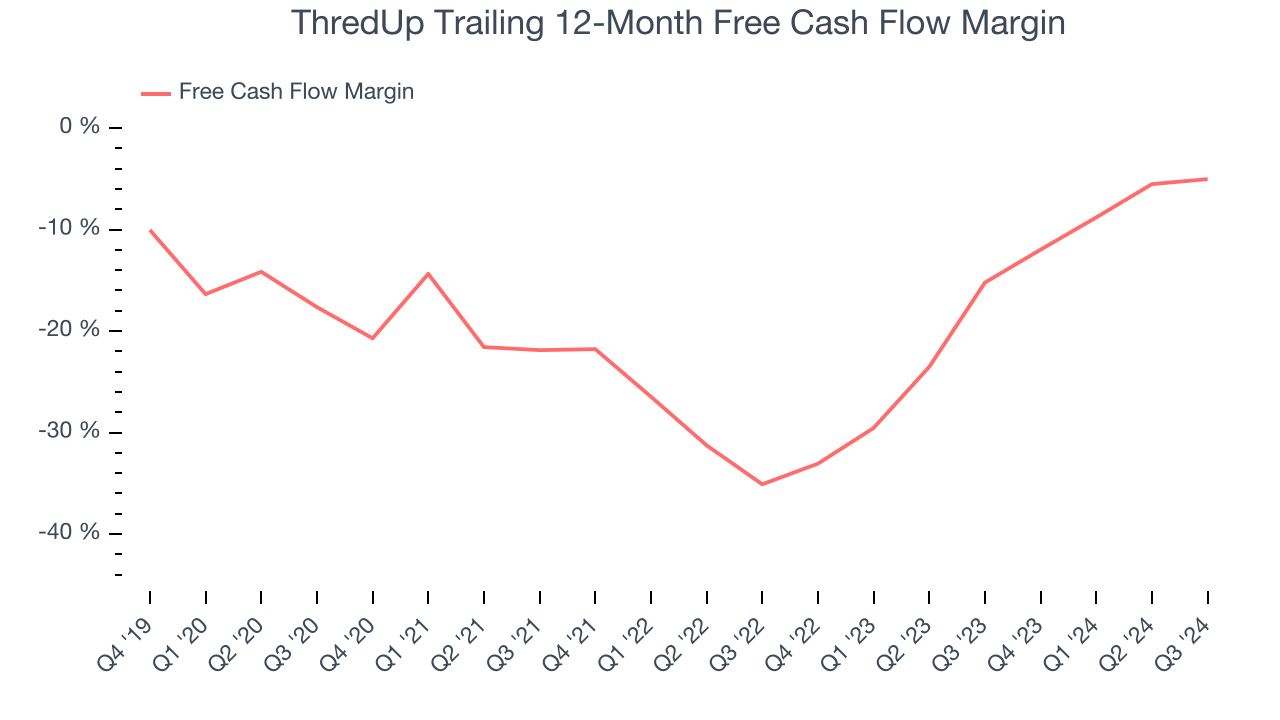

While ThredUp posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, ThredUp’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10.1%, meaning it lit $10.11 of cash on fire for every $100 in revenue.

3. Restricted Access to Capital Increases Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

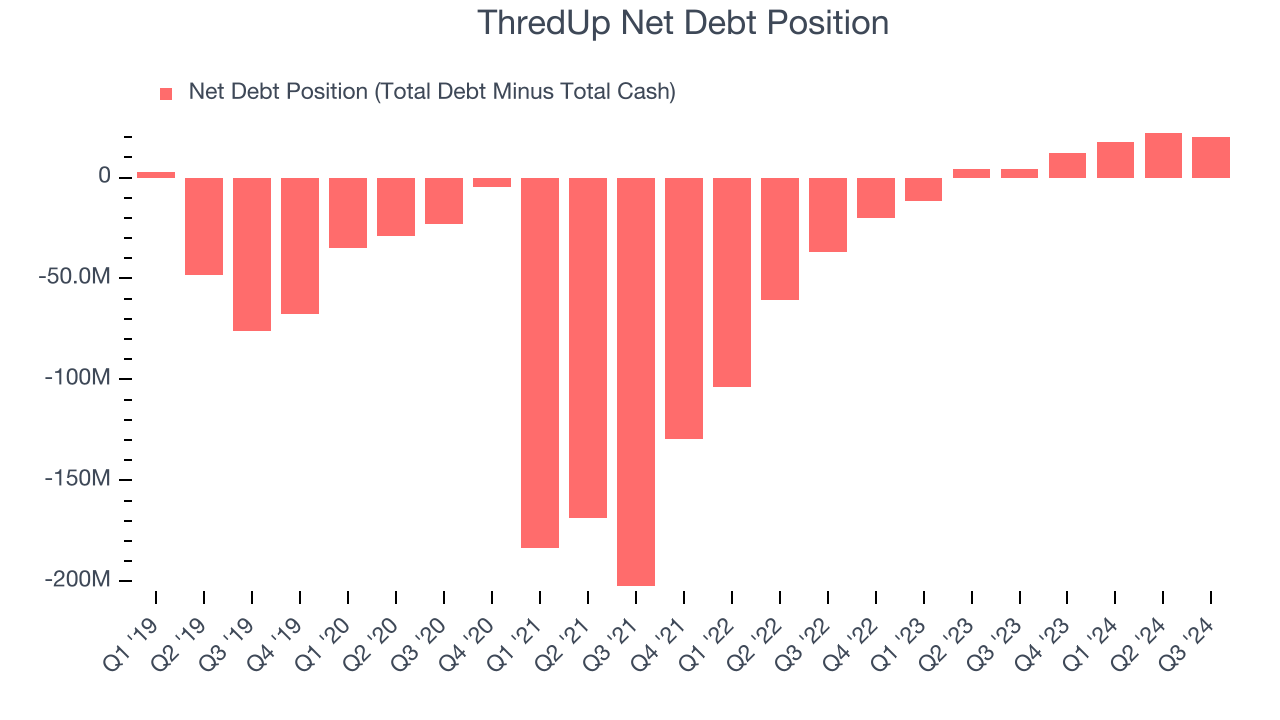

ThredUp, which has $55.3 million of cash and $75.57 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $6.89 million of EBITDA, and we seek to avoid indebted loss-making companies as investors in high-quality companies.

We implore our readers to do the same because credit agencies could downgrade ThredUp if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope ThredUp can improve its profitability and remain cautious until then.

Final Judgment

ThredUp doesn’t pass our quality test. Following the recent decline, the stock trades at $1.31 per share (or 0.5x forward price-to-sales). Regardless of price, the upside isn’t great compared to the potential downside - there are more exciting stocks to buy at the moment. We’d suggest taking a look at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than ThredUp

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.