OLED provider Universal Display (NASDAQ: OLED) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 14.6% year on year to $161.6 million. The company’s full-year revenue guidance of $635 million at the midpoint also came in 4.2% below analysts’ estimates. Its GAAP profit of $1.40 per share was 16.6% above analysts’ consensus estimates.

Is now the time to buy Universal Display? Find out by accessing our full research report, it’s free.

Universal Display (OLED) Q3 CY2024 Highlights:

- Revenue: $161.6 million vs analyst estimates of $165 million (2.1% miss)

- EPS: $1.40 vs analyst estimates of $1.20 (16.6% beat)

- The company dropped its revenue guidance for the full year to $635 million at the midpoint from $660 million, a 3.8% decrease

- Gross Margin (GAAP): 77.8%, up from 73.8% in the same quarter last year

- Inventory Days Outstanding: 447, up from 383 in the previous quarter

- Operating Margin: 41.5%, up from 34.3% in the same quarter last year

- Free Cash Flow Margin: 41%, up from 25.1% in the same quarter last year

- Market Capitalization: $10.15 billion

“With strong year-to-date results, we are on track to achieve record revenues, earnings, and operating cash flow in 2024 as we continue our growth trajectory. The rate of growth this year, though, is expected to be more modest than previously projected. With recent updates to customer order expectations for the fourth quarter, we are lowering our 2024 revenue forecast range to $625 million to $645 million,” said Brian Millard, Vice President and Chief Financial Officer of Universal Display Corporation.

Company Overview

Serving major consumer electronics manufacturers, Universal Display (NASDAQ: OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

Sales Growth

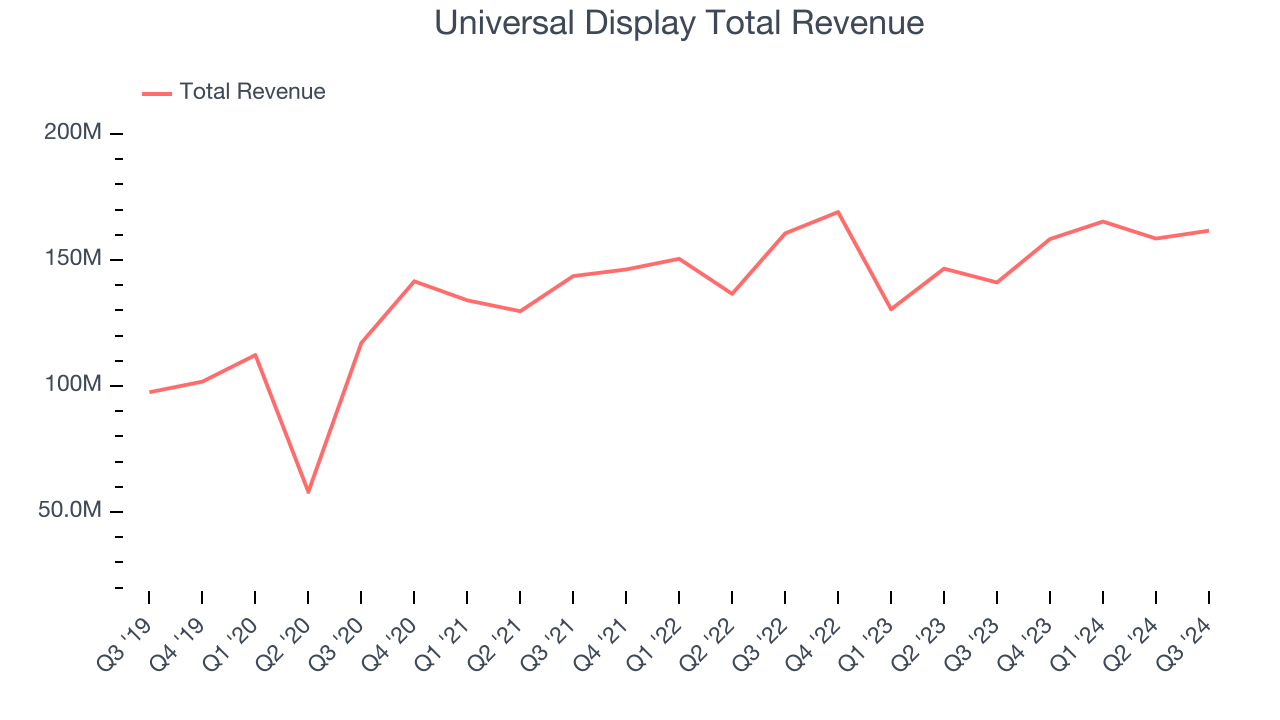

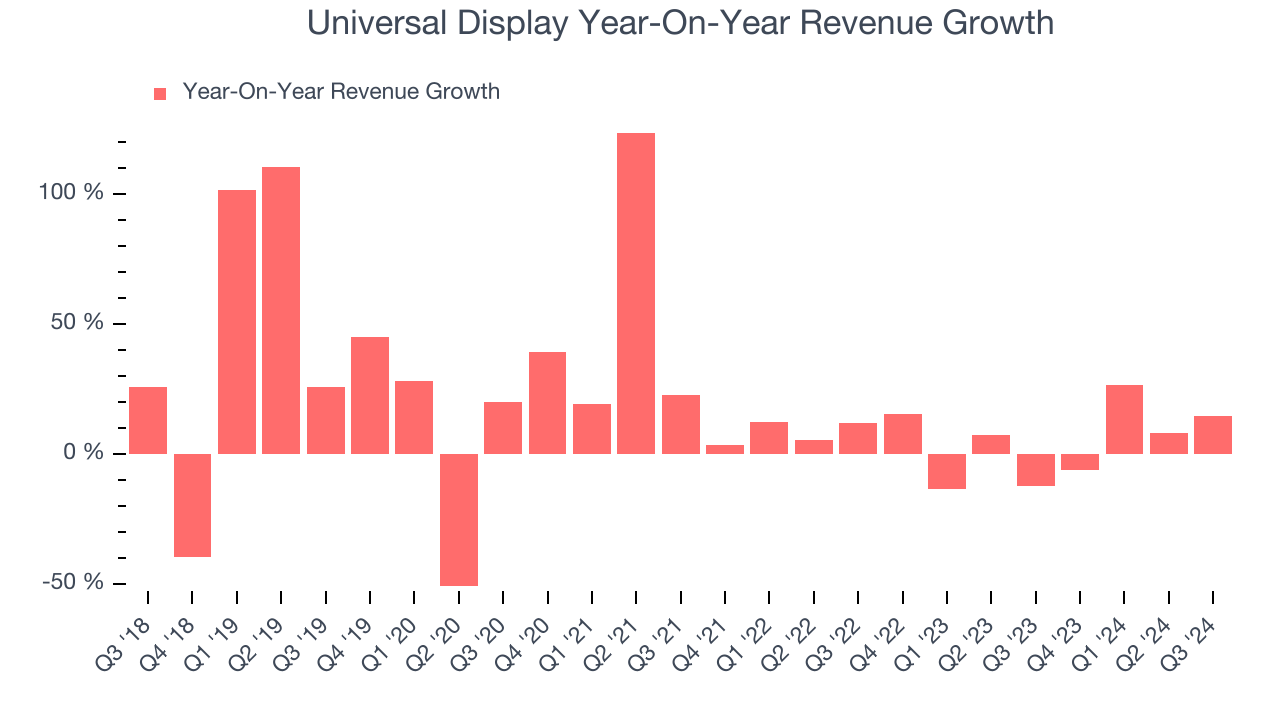

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Universal Display’s 11.5% annualized revenue growth over the last five years was solid. This is encouraging because it shows Universal Display was more successful in expanding than most semiconductor companies. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Long-term growth is the most important, but recency is necessary for semiconductors because of Moore's Law, which suggests the pace of technological innovation is so high that yesterday's hit new product could be obsolete today. Universal Display’s recent history shows its demand slowed as its annualized revenue growth of 4.1% over the last two years is below its five-year trend.

This quarter, Universal Display’s revenue grew 14.6% year on year to $161.6 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, an improvement versus the last two years. This projection is healthy and illustrates the market believes its newer products and services will catalyze higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

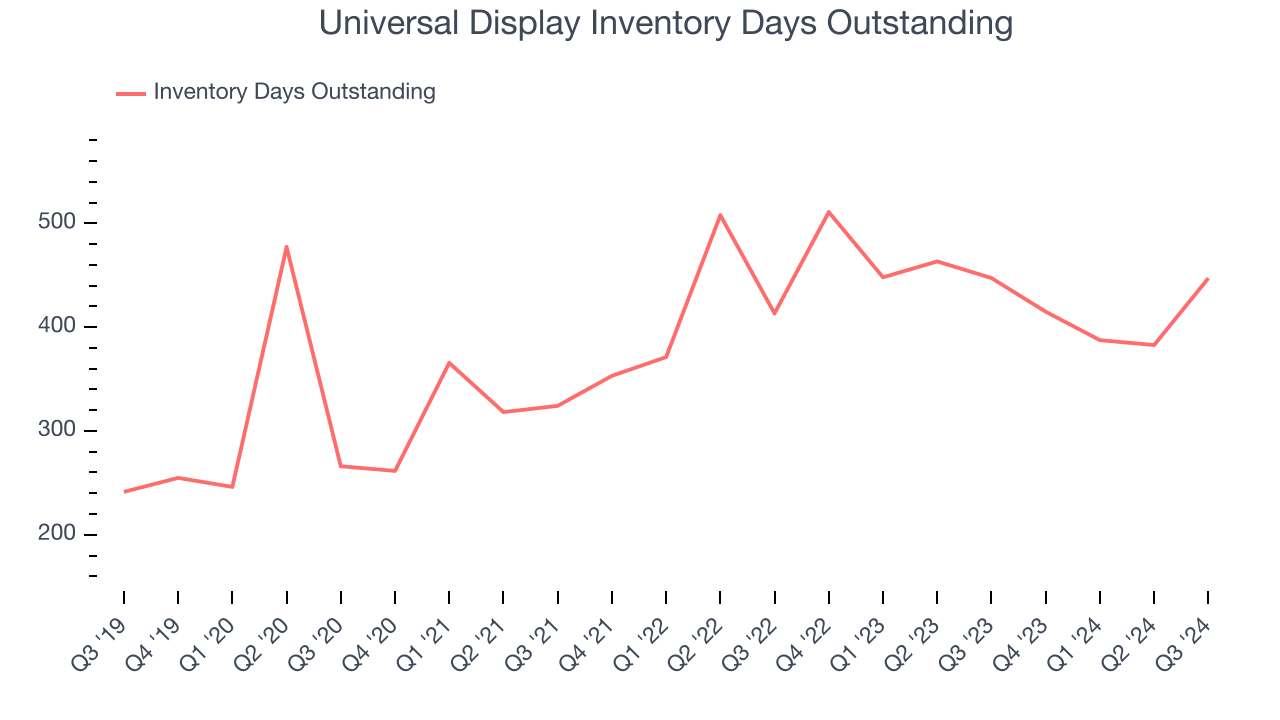

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Universal Display’s DIO came in at 447, which is 64 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Universal Display’s Q3 Results

It was great to see Universal Display improve its gross margin this quarter. On the other hand, its full-year revenue guidance missed analysts’ expectations and its full-year revenue guidance was downgraded. Overall, this was a weaker quarter. The stock traded down 6.5% to $189.84 immediately after reporting.

Universal Display may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.