- One of America’s Largest Buyers and Sellers of Pre-Owned Boats.

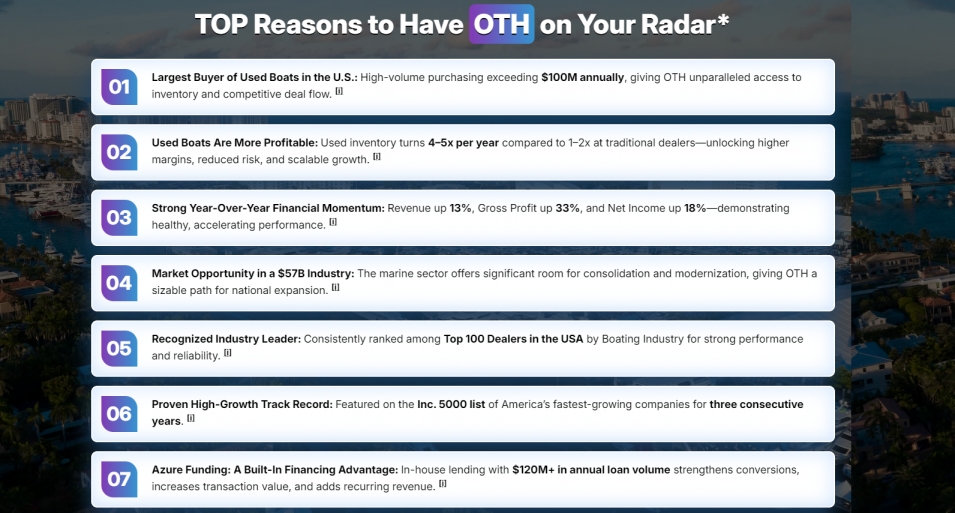

- Company Acquires More Than $100 Million in Boats and Yachts Annually.

- Well Positioned to Serve the U.S. Marine Industry Valued at $57 Billion.

- AI-Assisted Valuation Tools and Data-Driven Sales Platform Bring Speed and Transparency to Transactions.

- Operating a Nationwide Network of Offices and Marinas Across Multiple States.

- Consistently Earned Recognition on The Inc. 500, Ranked Among the Top 100 Dealers in the USA.

- Digital BD Deep Investor Research Report Issued on December 8, 2025.

- Share Buyback Program Authorized Up to $1 Million Value.

- Strong Q4 2025 Sales Momentum for Autograph Yacht Group.

- New Luxury Brokerage Secures $100 Million in Listings and Closes 22 Deals Worth $35 Million since October Launch.

- Record Nine Month Revenues of $82.6 Million, Up 19.3% YOY.

- Third Quarter Number of Boats Totaled 112 Units, Up 51% YOY.

- 20 Annual Revenue Projected Between $140 Million and $145 Million.

- “One Big Beautiful Bill” Reinstated 100% Bonus Depreciation for Boats Bought by January 19, 2026.

Off The Hook YS Inc. (NYSE American: OTH), Founded in 2012 by Jason Ruegg, has become one of America’s largest buyers and sellers of pre-owned boats. Headquartered in Wilmington, North Carolina, with operations throughout the East Coast and South Florida, OTH acquires more than $100 million in boats and yachts annually. OTH leverages AI-assisted valuation tools and a data-driven sales platform to bring speed and transparency to yacht transactions, supported by a nationwide network of offices and marinas offering brokerage, wholesale, and performance yacht sales.

OTH has consistently earned recognition on the Inc. 500, ranked among the Top 100 Dealers in the USA. OTH continues advancing after its successful 2025 IPO, supported by strong technology adoption, expanding market reach, and participation in a U.S. marine industry valued at $57 billion.

Additionally, the U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033 at a 7.52% CAGR, highlighting substantial long-term growth potential. OTH appears well-positioned to capitalize on this opportunity in a large and growing market.

Additionally, Digital BD Deep has just issued a detailed new investor research report on OTH titled: Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry - Structural Arbitrage in the Marine Liquidity Market

Read the full OTH report with at this direct link: https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf

OTH Share Buyback Plan

On January 8th OTH announced a share repurchase program for Company to repurchase up to $1.0 million of its outstanding OTH common stock from time to time. The timing and amount of any repurchases will be determined by the Company’s management at its discretion.

“Today’s stock price and market capitalization do not, in management’s view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead,” said Brian John, Chief Executive Officer of OTH. “We believe we are building a category-defining platform in the pre-owned boat market, powered by technology, inventory expertise, and a growing national footprint. This share repurchase authorization underscores our confidence in the Company’s strategy and our commitment to disciplined capital allocation on behalf of shareholders.”

OTH expects to fund repurchases from existing cash on hand and future cash flows. OTH will continue to prioritize investments that support profitable growth, including inventory expansion, technology initiatives, and strategic real estate and operational build-outs.

Substantial Q4 2025 Momentum in Luxury Yacht Sales for Autograph Yacht Group

On January 5th OTH announced strong fourth-quarter 2025 momentum at Autograph Yacht Group, the Company’s internally created luxury yacht brokerage division launched in October 2025.

In its first quarter of operations, OTH Autograph rapidly established traction in the upper end of the market focusing on yachts generally ranging from $500,000 to $20 million and up, while also strengthening the broader OTH platform through meaningful operational synergies with the Company’s AI-driven used-boat wholesale trading capabilities and Azure Funding, the Company’s marine finance division.

While traditional yacht brokerages typically cannot embrace trade-ins, Autograph Yacht Group does, powered by the OTH platform, a proprietary, industry-leading AI engine that supports Autograph’s brokerage operations, creating a clear competitive advantage. The system is designed to intelligently match buyers and sellers by analyzing client preferences, vessel data, market conditions, and transaction history which enhances deal velocity, pricing accuracy and overall client experience.

The OTH Autograph boutique brokerage model blends expert valuation, strategic marketing, and personalized service designed specifically for high-discretion clients seeking a more curated sales experience. OTH Autograph currently operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, providing local expertise in one of the most active luxury boating corridors in the U.S.

Third Quarter Financial and Operating Results with Revenues of $24.0 Million

Record Nine Month Revenues of $82.6 million, up 19.3% YOY Third Quarter Number of Boats totaled 112 units, up 51% YOY Issues 2026 Full Year Revenue Guidance

On December 15th OTH announced financial results for the third quarter ended September 30, 2025.

2025 Third Quarter Highlights

|

Completed IPO on November 14, 2025. |

||

|

Revenue was $24.0 million, compared to $25.8 million in 2024. |

||

|

Third quarter number of boats sold grew 51.1% to 112. |

||

|

Second highest quarterly boat sales in the Company’s history, following a record 117 units in the seasonally strong second quarter. |

||

|

Net loss of $0.07 million with adjusted EBITDA of $0.5 million. |

||

|

Gross profit of $3.0 million compared to $2.9 million in 2024. |

||

|

Opened premier yacht broker division, Autograph Yacht Group in South Florida |

||

|

Added ten new brokers to our growing team of brokers. |

2025 Nine Month Highlights

|

Record revenue of $82.6 million, an increase of 19.3%. |

||

|

Record number of boats sold, grew 24.4% to 310. |

||

|

Net income of $0.8 million. |

||

|

Adjusted EBITDA was $2.6 million, compared to $3.1 million in 2024. |

||

|

Gross profit of $8.4 million for the nine months ended September 30, 2025, compared to $6.9 million for the nine months ended September 30, 2024, an increase of $1.5 million.

2026 Full Year Guidance For 2026 the OTH expects that annual revenue will be between $140 million and $145 million. |

Off The Hook Yachts Reminds Boat Buyers that the “One Big Beautiful Bill”

Reinstated 100% Bonus Depreciation for Boats Bought by January 19, 2026

On December 1st OTH reminded U.S. boat buyers that the “One Big Beautiful Bill Act” (OBBBA), signed into law in July 2025, has reinstated 100% bonus depreciation for qualifying business assets—including boats and yachts—through January 19, 2026.

This powerful tax incentive allows eligible buyers to deduct the entire purchase price of a qualifying vessel in the first year it is placed into service, provided it is used more than 50% for legitimate business purposes. Together with aggressive year-end pricing and the unmatched OTH nationwide inventory, 2025–2026 represent a historic window of affordability for business buyers.

For more information on OTH visit: www.offthehookyachts.com and https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: Off The Hook YS Inc.

Contact Person: Abigail Lafferty

Email: Send Email

Phone: (561) 374-0513

Address:1701 J.E.L Wade Drive

City: Wilmington

State: NC 28401

Country: United States

Website: https://www.offthehookyachts.com/