More dealers are positive than negative as valuation and earnings expectations improve, driving a rise in acquisition activity; Toyota and Lexus continue lead as the most sought-after franchises, while domestic franchises see greatest valuation improvements, according to the recently released 2025 Kerrigan Dealer Survey

US auto dealer sentiment reached an important inflection point in 2025: for the first time in four years, more dealers expect profits and valuations to increase rather than decline, according to the 2025 Kerrigan Dealer Survey. The survey, which queried over 525 auto dealers, assesses their sentiment on the future value of their franchises, expectation for earnings, as well as the impact of tariffs and the use of AI.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260105720178/en/

According to the 2025 Kerrigan Dealer Survey: Auto Dealer Sentiment Turns Positive in 2025 as Survey Reveals Profit and Valuation Expectations Improve for the First Time Since 2021

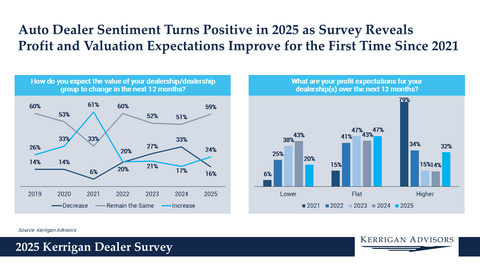

Twenty-four percent of dealers expect their values to increase, 59% expect them to remain stable and only 16% anticipate a decline, a significant improvement from last year when 33% projected a decline. These positive results indicate a rising optimism in auto retail that is projected to drive an increase in acquisition activity in 2026.

The survey also found that dealer profit expectations improved sharply, with double the number of dealers, 32%, projecting higher earnings in 2026 than in 2025. This is a significant turnaround from 2024’s pessimism, when 43% expected earnings to decline: only 20% expect a decline in 2026.

“Dealer optimism is rebounding markedly as we enter 2026,” said Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors. “These positive expectations for auto retail valuations and earnings are consistent with the improvements Kerrigan Advisors is witnessing in dealer sentiment, particularly as consumer demand, rather than government regulations, drive new vehicle sales, and the industry gains greater clarity on US tariff policy.” Kerrigan also noted that this inflection point is consistent with Kerrigan Advisors’ Blue Sky Reports, which marked 2024 as the trough for dealership profits and valuations.

Improving dealer sentiment is translating into more dealers looking to expand their groups by acquiring at least one dealership in 2026. According to the survey, 32% of dealers say they plan to add one dealership over the next 12 months, up six percentage points from 2022’s lows.

Impact of Tariffs, Infrastructure Upgrades and AI

The survey revealed that tariffs had a relatively limited impact on dealers, with 43% reporting that tariffs had no impact on their business. While 16% of dealers said tariffs have increased their interest in acquisitions, only 2% reported that tariffs are prompting them to sell. Even with this growth bias, dealers remain cautious regarding capital investments with fewer respondents planning to increase capital investments due to tariffs. These results are consistent with survey results regarding OEM-mandated real estate upgrades and EV infrastructure investments. 42% of dealers expect these investments to negatively impact future profitability, while only 13% anticipate a positive earnings impact, particularly as US electric vehicle (“EV”) sales growth declines.

Kerrigan Advisors also surveyed dealers regarding their utilization of AI and found that AI adoption has moved from experimental to mainstream across auto retail. Forty-three percent of dealers are already deploying AI in their operations, while an additional 47% plan to do so, leaving just 10% with no current or planned AI use. As adoption accelerates, Kerrigan Advisors expects AI to drive meaningful operational change in 2026 and beyond.

Dealer Views Diverge Sharply by Franchise

Consistent with last year’s survey results, the majority of dealers expect individual franchise valuations to remain stable or increase over the next 12 months. However, valuation expectations diverge meaningfully by franchise, largely driven by variances in profitability projections and trust in the OEM. Domestic manufacturers, namely General Motors, Ford and Stellantis, were the most improved in the survey with every domestic franchise posting an increase in valuation expectations for 2026. By contrast, import brands saw a decline in valuation expectations, a shift that may reflect the Trump administration’s economic policies favoring US manufacturers. Nowhere was this clearer than with the Volkswagen Group. Each of its franchises (Volkswagen, Audi and Porsche) experienced significant increases in dealers projecting valuation declines for 2026, partly a reflection of the OEM’s limited US production and exposure to weakening US EV sales.

General Motors’ franchises recorded the largest year-over-year gains in the survey. Chevrolet was one of the top performers, ranking 6th in expected valuation increases, up from last year’s 12th position – the largest ranking improvement of any franchise. Buick GMC and Cadillac also saw strong improvements in valuation expectations and dramatic increases in trust levels compared to last year.

Toyota continues to lead the industry in every category of the survey. Both its namesake franchise and Lexus reported the highest valuation increase expectations, the most trust and the highest buyer demand. Toyota and Lexus’ high level of trust is now greater than 3x higher than the industry average and its valuation increase expectations is more than 2.25x higher than industry average.

“What we’re seeing is a clear separation between those franchises that dealers are willing to invest in and those they’re increasingly cautious about, particularly given changes in US economic policy related to imports and weakening consumer demand for EVs,” said Ryan Kerrigan, Managing Director. “Manufacturers that seek to grow dealer profits, manage inventory levels and produce high-demand vehicles, such as Toyota, continue to earn dealers’ trust, experience high buyer demand and a concomitant increase in value, while franchises lacking those attributes face declining sentiment and valuation. The buy/sell market is rational and our survey results reflect dealers’ rationality about franchise values and their clear expectations for 2026.”

Notable changes in franchises' expected valuations from the 2025 Kerrigan Dealer Survey:

- Toyota and Lexus remain the most sought-after franchises, leading both the non-luxury and luxury segments by a significant margin. Toyota also earned the highest trust rating in the survey with 86% of respondents having a high level of trust in the franchise.

- Domestic franchises were the only segment to post year-over-year improvements in valuation expectations, with Chevrolet recording one of the largest gains and ranking among the top franchises for expected valuation increases for the first time.

- Kia continued to rank among the top performing franchises, with 34% of dealers expecting valuations to increase and a high-trust rating of 27%, more than double Hyundai’s. Hyundai’s upside expectations weakened with just 19% of dealers projecting valuation growth.

- Nissan and Infiniti ranked among the weakest franchises across the survey results, with more than 60% of dealers expecting valuation declines for both brands. Nissan received the highest “no trust” rating in the survey (64%).

- Volkswagen Group experienced one of the sharpest deteriorations in dealer sentiment, with Volkswagen, Audi and Porsche all posting significant increases in dealers projecting valuation declines for 2026. Volkswagen’s no-trust ratings reached 47%, while Porsche recorded the largest decline in high-trust ratings of any franchise.

“The 2025 Kerrigan Dealer survey indicates the industry as a whole is returning to a period of earnings and valuation growth with more dealers projecting an increase, rather than a decrease in 2026. This is particularly the case for the most trusted franchises and those benefiting from the Trump Administration’s economic policies, both regarding tariffs and EVs,” Erin Kerrigan added. “The survey clearly demonstrates that all franchises are not created equal. Kerrigan Advisors expects the 2026 buy/sell market will have both winners and losers; however, for the most part, the industry as a whole is a winner with average dealership profits pointed in the right direction and blue sky values on the upswing, tracking far above pre-pandemic levels.”

Methodology

The data for The Kerrigan Dealer Survey was gathered from Kerrigan Advisors’ annual survey of auto dealers in conjunction with the issuance of The Blue Sky Report. The Kerrigan Dealer Survey is based on over 525 anonymous responses from franchised auto dealers in Kerrigan Advisors’ proprietary dealer database. Responses were collected from June 2025 to November 2025.

- To download the full Kerrigan Dealer Survey report, click here.

- To download a preview of The Blue Sky Report®, published by Kerrigan Advisors, click here.

- To access The Kerrigan Index™, click here.

About Kerrigan Advisors

Kerrigan Advisors is the leading sell-side advisor and thought partner to auto dealers nationwide. Since its founding in 2014, the firm has led the industry with the sale of over 320 dealerships generating more than $10 billion in client proceeds, including two of the largest transactions in auto retail history – the sale of Jim Koons Automotive Companies to Asbury and Leith Automotive to Holman. The firm advises the industry’s leading dealership groups, enhancing value through the lifecycle of growing, operating and, when the time is right, selling their businesses. Led by a team of veteran industry experts, Kerrigan Advisors is the only firm in auto retail exclusively dedicated to sell-side advisory, providing its clients with the assurance of a conflict-free approach.

Kerrigan Advisors monitors conditions in the buy/sell market and publishes an in-depth analysis each quarter in The Blue Sky Report®, which includes Kerrigan Advisors’ signature blue sky charts, multiples, and analysis for each franchise in the luxury and non-luxury segments. To download a preview of the report, click here. The firm also releases monthly The Kerrigan Index™ composed of the seven publicly traded auto retail companies with operations focused on the US market. The Kerrigan Auto Retail Index is designed to track dealership valuation trends, while also providing key insights into factors influencing auto retail. To read the 2025 Kerrigan Dealer Survey, click here. To read the 2025 Kerrigan OEM Survey, click here. Kerrigan Advisors also is the co-author of NADA’s Guide to Buying and Selling a Dealership.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260105720178/en/

Dealer optimism is rebounding markedly as we enter 2026

Contacts

Kerrigan Advisors Media Contact:

Melanie Webber (melanie@mwebbcom.com), mWEBB Communications, 949-307-1723