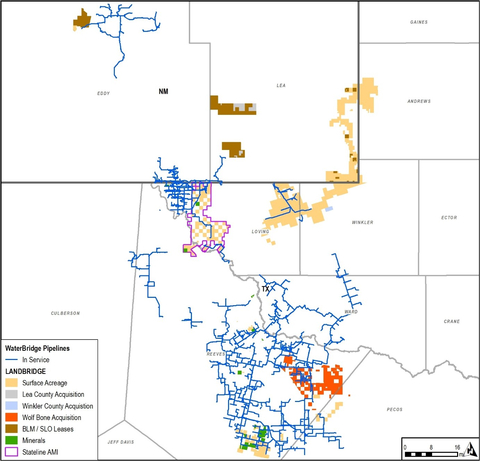

Increases holdings to ~272,000 surface acres, including recently-announced agreement to acquire the Wolf Bone Ranch

Publishes webcast to investor relations site providing overview of recent acquisitions

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced it has closed its previously-announced acquisition of approximately 5,800 largely contiguous surface acres in Lea County, New Mexico, expanding LandBridge’s holdings into a new area of the Delaware Basin.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241122337181/en/

(Graphic: LandBridge)

The land supports existing water infrastructure, including produced water handling facilities and supply water infrastructure. LandBridge believes the acreage is well-positioned to drive further revenue growth through additional water infrastructure, including a potential distribution hub for water supply into New Mexico by WaterBridge, an affiliate of LandBridge and a leading water midstream platform.

Together with the recent acquisition in Winkler County, Texas, and agreement to acquire the Wolf Bone Ranch, LandBridge has now announced or closed acquisitions totaling ~53,080 acres in the fourth quarter of 2024 at a blended 2025E EBITDA1 multiple of 7.6x, which is expected to result in the following:

- Total owned surface acreage of ~272,000 following closing of the Wolf Bone Ranch acquisition;

- Greater than 20% accretion to 2025E FCF1 per common share; and

- An increase in 2025 Adjusted EBITDA1 guidance to between $170 million and 190 million assuming the closing of the Wolf Bone Ranch acquisition in the fourth quarter of 2024.

The acquisitions have been or are expected to be funded with a mix of equity and debt financing, including proceeds from LandBridge’s recently-announced private placement of 5.8 million Class A shares, resulting in an estimated pro forma LQA net leverage1, 2 of 2.7x, with an estimated $113 million in pro forma liquidity. Following the closing of the private placement, LandBridge’s management team and financial sponsor, Five Point Energy, will own an approximate 70% ownership interest in LandBridge.

(1) Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. See a note on non-GAAP financial measures below.

(2) See a note on Pro Forma LQA Net Leverage below.

Additional information regarding the details of this acquisition and other recently closed and announced acquisitions has been provided via webcast on the Investor’s section of LandBridge’s website at https://ir.landbridgeco.com/overview/default.aspx.

About LandBridge

LandBridge owns approximately 227,000 surface acres across Texas and New Mexico, located primarily in the heart of the Delaware sub-basin in the Permian Basin, the most active region for oil and natural gas exploration and development in the United States. LandBridge actively manages its land and resources to support and encourage oil and natural gas production and broader industrial development. Since its founding in 2021, LandBridge has served as one of the leading land management businesses within the Delaware Basin. LandBridge was formed by Five Point Energy LLC, a private equity firm with a track record of investing in and developing energy, environmental water management and sustainable infrastructure companies within the Permian Basin.

About Five Point

Five Point Energy is a private equity firm focused on building businesses within the environmental water management, surface management and sustainable infrastructure sectors. The firm was founded by industry veterans who have had successful careers investing in, building, and running midstream infrastructure companies. Five Point’s strategy is to buy and build assets, create companies, and grow them into sustainable enterprises with premier management teams and industry-leading E&P partners. Based in Houston, Five Point targets equity investments up to $1 billion and has approximately $7 billion of assets under management across multiple investment funds. For more information about Five Point Energy, please visit: www.fivepointenergy.com.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on LandBridge’s current beliefs, as well as current assumptions made by, and information currently available to, LandBridge, and therefore involve risks and uncertainties that are difficult to predict. Generally, future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” and the words “believe,” “anticipate,” “continue,” “intend,” “expect” and similar expressions identify forward-looking statements. These forward-looking statements include any statements regarding the Wolf Bone Ranch acquisition, including the ability of the parties to consummate the acquisition in a timely manner, or at all, satisfaction of the conditions precedent to the consummation of the acquisition, including the ability to secure regulatory approvals in a timely manner or at all, the expected benefits of the acquisition, including expected accretion, integration plans, synergies, opportunities and anticipated future performance, and the private placement and the use of proceeds therefrom. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, many of which are beyond our control.

Forward-looking statements include, but are not limited to, strategies, plans, objectives, expectations, intentions, assumptions, future operations and prospects and other statements that are not historical facts, including our estimated future financial performance. You should not place undue reliance on forward-looking statements. Although LandBridge believes that its plans, intentions and expectations reflected in or suggested by any forward-looking statements made herein are reasonable, LandBridge may be unable to achieve such plans, intentions or expectations and actual results, and its performance or achievements may vary materially and adversely from those envisaged in this press release due to a number of factors including, but not limited to: our customers’ demand for and use of our land and resources; the success of our affiliates, including WaterBridge and Desert Environmental LLC, in executing their business strategies, including their ability to construct infrastructure, attract customers and operate successfully on our land; our customers’ willingness and ability to develop our land or any potential acquired acreage to accommodate any future surface use developments, such as the Wolf Bone Ranch; the domestic and foreign supply of, and demand for, energy sources, including the impact of actions relating to oil price and production controls by the members of the Organization of Petroleum Exporting Countries, Russia and other allied producing countries with respect to oil production levels and announcements of potential changes to such levels; our ability to enter into favorable contracts regarding surface uses, access agreements and fee arrangements, including the prices we are able to charge and the margins we are able to realize; the initiation or outcome of potential litigation; our ability to continue the payment of dividends; our ability to successfully implement our growth plans, including through any future acquisitions of acreage, including the Wolf Bone Ranch acquisition, and/or introduction of new revenue streams; and any changes in general economic and/or industry specific conditions, among other things. These risks, as well as other risks associated with LandBridge, are also more fully discussed in our filings with the U.S. Securities and Exchange Commission. Except as required by applicable law, LandBridge undertakes no obligation to update any forward-looking statements or other statements included herein for revisions or changes after this communication is made.

Non-GAAP Financial Measures

Reconciliations of forward-looking non-GAAP financial measures to comparable GAAP measures are not available due to the challenges and impracticability of estimating certain items, particularly non-recurring gains or losses, unusual or non-recurring items, income tax benefit or expense, or one-time transaction costs and cost of revenue. We are unable to reasonably predict these because they are uncertain and depend on various factors not yet known, which could have a material impact on GAAP results for the guidance period. Because of those challenges, a reconciliation of forward-looking non-GAAP financial measures is not available without unreasonable effort.

Pro Forma LQA Net Leverage

Calculated as total debt less cash and cash equivalents divided by Last Quarter Annualized (“LQA”) EBITDA (including the estimated LQA EBITDA contribution from the acquisition of surface acreage in 4Q24 in Winkler County (the "Winkler County Acquisition") and the Wolf Bone Acquisition). A reconciliation of such non-GAAP financial measure to its comparable GAAP measure is not available due to the challenges and impracticability of determining certain items, particularly nonrecurring gains or losses, unusual or non-recurring items, income tax benefit or expense, or one-time transaction costs and cost of revenue. We are unable to reasonably determine these because they are uncertain and depend on various unknown factors, which could have a material impact on GAAP results for the applicable period. Because of those challenges, a reconciliation of such non-GAAP financial measure is not available without unreasonable effort.

No Offer or Solicitation

This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241122337181/en/

Contacts

Scott McNeely

Chief Financial Officer

LandBridge Company LLC

Contact@LandBridgeco.com

Media

Daniel Yunger / Nathaniel Shahan

Kekst CNC

kekst-landbridge@kekstcnc.com