Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today provided an update on the exploration programs at its Palmarejo gold-silver complex located in southwest Chihuahua, Mexico.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230809176670/en/

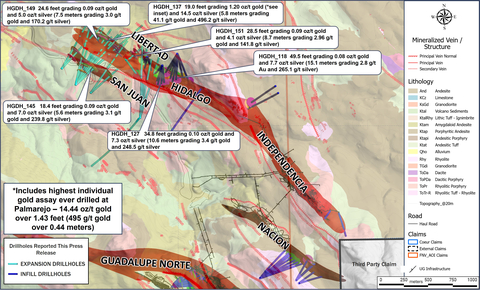

Figure 1: Highlighted drillhole results from the Hidalgo deposit (Photo: Business Wire)

Drill results from the Hidalgo deposit – discovered in 2019 and representing the northwest extension of the Independencia deposit – have contained the highest gold grades ever encountered at Palmarejo and have defined two new mineralized structures. Hidalgo has rapidly grown to become Palmarejo’s second largest source of mineral reserves after the Guadalupe deposit, where mining has taken place since 2014. In addition, mapping and sampling of East Palmarejo has defined numerous mineralized trends and high-priority targets set to be drilled beginning in 2024. Geological observations and sampling results to date indicate high potential for new discoveries in this prospective area.

Key Drill Highlights1,2

-

Hidalgo Drilling Leads to New Discoveries and Record High Gold Grades – Drilling at Hidalgo confirms the highest gold grades ever intersected at Palmarejo and continues to extend high-grade mineralization along strike to the northwest in the direction of the Palmarejo processing facility. Hidalgo now comprises three individual veins: Hidalgo and two discoveries made earlier this year – San Juan and Libertad – which over the last fifteen months have collectively extended mineralization by 800 meters along strike. All veins remain open along strike and down dip. Notable results from expansion and infill drilling include the following true width intercepts:

- Hole HGDH_118 (Hidalgo) returned 49.5 feet at 0.08 ounces per ton (“oz/t”) gold and 7.7 oz/t silver (15.1 meters at 2.8 g/t Au and 265.1 g/t silver)

- Hole HGDH_127 (Hidalgo) returned 34.8 feet at 0.10 oz/t gold and 7.3 oz/t silver (10.6 meters at 3.4 g/t gold and 248.5 g/t silver)

- Hole HGDH_137 (Hidalgo) returned 19.0 feet at 1.20 oz/t gold and 14.5 oz/t silver (5.8 meters at 41.1 g/t gold and 496.2 g/t silver)

- Hole HGDH_145 (San Juan) returned 18.4 feet at 0.09 oz/t gold and 7.0 oz/t silver (5.6 meters at 3.1 g/t gold and 239.8 g/t silver)

- Hole HGDH_149 (Libertad) returned 24.6 feet at 0.09 oz/t gold and 5.0 oz/t silver (7.5 meters at 3.0 g/t gold and 170.2 g/t silver)

-

Hole HGDH_151 (Hidalgo) returned 28.5 feet at 0.09 oz/t gold and 4.1 oz/t silver (8.7 meters at 3.0 g/t gold and 141.8 g/t silver)

-

Successful Conversion and Expansion Drilling at La Nacion and Zapata Deposits – Successful infill and expansion drilling programs were completed on these structures, which are sub-parallel splay veins to Independencia and Guadalupe. Infill drilling at La Nacion continued to upgrade inferred resources at depth in both the south-central and northern areas, with expansion drilling along strike to the north. Notable results from infill drilling include:

- Hole LBDH_237 (Nacion) returned 7.2 feet at 0.04 oz/t gold and 5.2 oz/t silver (2.2 meters at 1.51 g/t gold and 177.3 g/t silver)

- Hole LBDH_239 (Nacion) returned 10.8 feet at 0.05 oz/t gold and 15.0 oz/t silver (3.3 meters at 1.71 g/t gold and 513.9 g/t silver)

- Hole DC3-ZPA-0018 (Zapata) returned 12.5 feet at 0.24 oz/t gold and 20.0 oz/t silver (3.8 meters at 8.1 g/t gold and 685 g/t silver)

- Hole DC3-ZPA-0042 (Zapata) returned 18.7 feet at 0.06 oz/t gold and 3.8 oz/t silver (5.7 meters at 2.02 g/t gold a 131.3 g/t silver)

- Hole DC3-ZPA-0048 (Zapata) returned 24.3 feet at 0.06 oz/t gold and 2.5 oz/t silver (7.4 meters at 1.98 g/t gold and 86.4 g/t silver), and 5.3 feet grading 0.12 oz/t gold and 9.0 oz/t silver (2.2 meters grading 4.16 g/t Au and 307.4 g/t Ag)

For a complete table of all drill results, please refer to the following link: https://s201.q4cdn.com/254090064/files/doc_downloads/2023/08/08/2023-08-09-Exploration-Update-Appendix-Final.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

“Coeur has invested over $60 million in exploration and infill drilling at Palmarejo since 2018, which has led to strong reserve and resource growth with multiple new discoveries and meaningful extensions to its mine life,” said Mitchell J. Krebs, President and Chief Executive Officer. “Recent drilling at the Hidalgo discovery continues to demonstrate some of the best gold grades we’ve ever seen, with some intercepts that support the potential for further extensions to its current eight-year mine life. Coeur’s nearly $250 million overall investment in exploration over the last five years remains a key differentiator within the sector and positions the Company for higher-return organic growth in the coming years.”

At year-end 2022, Palmarejo’s proven and probable reserves totalled 18.2 million tons with average gold and silver grades of 0.052 ounces per ton and 3.61 ounces per ton, respectively, equalling 0.95 million ounces of gold and 65.7 million ounces of silver. Over the past five years, the Company’s strong commitment to exploration at Palmarejo has led to an increase in gold and silver proven and probable reserves by approximately 35% and 40%, respectively. On a measured and indicated basis, resources grew by approximately 815,000 ounces of gold and 47.7 million ounces of silver, corresponding to a 219% increase in gold and 176% increase in silver during that same time period.

Palmarejo is Coeur’s largest producing mine with a landholding encompassing over 270 square kilometers (105 square miles or approximately 67,200 acres), of which approximately only 7% has been drilled to date. Over the last fifteen months, the main focus of drilling has been the Hidalgo deposit, which is situated northwest of the Independencia deposit and adjacent to existing mine infrastructure. Drill assay intervals continue to produce some the best grade-thicknesses at Palmarejo ever as demonstrated by hole HGDH-137 highlighted in Figure 1 with 19 feet (5.8 meters) at an average gold grade of 1.20 oz/t ton (41.1 g/t) of gold including the highest gold assay encountered to date at Palmarejo of 14.44 oz/t (495 g/t) of gold sampled over a true thickness of 1.43 feet (0.44 meters). Due to the ongoing success of this drilling, the Company is evaluating opportunities to include the zone in earlier mine plans than previously anticipated.

The North Guadalupe – Zapata area shown in Figure 2 has had no drilling to date and like Hidalgo, is adjacent to existing mine infrastructure and offers an opportunity to add new, low risk ounces. The North Guadalupe – Zapata target is located at the western extension of the Guadalupe underground mine workings along the projected extensions and anticipated intersection of the Guadalupe and Zapata veins, forming west-plunging “clavos” similar to those that typify the high-grade portions of the Guadalupe deposit currently being mined immediately to the east.

Expansion drilling currently underway along the Las Animas vein, located at the southern end of the Guadalupe deposit, is targeting additional mineralization below the current production level between elevations of 1,050 and 950 meters. Approximately 28,200 feet (8,600 meters) of drilling is planned from three drill platforms during the second half of 2023.

Drilling during the remainder of 2023 will focus on expansion drilling in the Hidalgo area, including the San Juan and Libertad discoveries made earlier this year, the new target at Guadalupe North – Zapata, and deep drilling at Las Animas. A total of 111,500 feet (34,000 meters) of drilling is planned.

“Our key aims during the second half of 2023 are to continue building mine life through drilling at Hidalgo, Las Animas and the Guadalupe North – Zapata target by having four drill rigs active for the remainder of the year,” said Aoife McGrath, Senior Vice President of Exploration. “In addition, we continue to build exploration momentum in the eastern portion of the Palmarejo land package which to date has seen minimal systematic exploration. This ground, added to Coeur’s portfolio through the 2015 acquisition of Paramount Gold and Silver, is unencumbered by the Franco Nevada gold stream and contains significant mineralization and historical resources. An intensive program of mapping and sampling has shown very encouraging results and has outlined several mineralized trends, totaling over 12 miles (20 kilometers) of combined strike length for detailed assessment and drilling beginning in 2024.”

District Exploration

Much of Coeur’s extensive landholdings in the Palmarejo District have not been explored. Since 2022, a comprehensive geological mapping and sampling program has been underway by a team of Coeur geologists and field assistants at regional and detailed scales (Figure 3) including basic geological mapping to determine lithology, structure and new trends of mineralization. This work is designed to generate targets that will be followed by detailed evaluation, ranking and drill testing in due course. During the past 15 months, roughly 31.6 square miles (82 square kilometers) of mapping has been conducted in this area with highly encouraging results, including several new mineralized trends identified such as the Camuchin and La Curra - La Verde trends, which are being ranked for systematic scout and follow-up drilling in 2024. It is envisaged that much of future new exploration and drilling at Palmarejo will focus on the eastern part of the district where the potential for new discoveries is deemed highest, given results and geological observations to date.

Camuchin Trend

In late 2022, 1:1,000 scale mapping was initiated along the northwest - southeast trending Camuchin Trend, located 3.7 miles (6 kilometers) to the northeast of the Palmarejo Mine. The Camuchin Trend is a major northwest-trending zone of fault-veins that run parallel to the Independencia Trend some 2.5 miles (4 kilometers) to the southwest and has been mapped over a strike-length of 4.3 miles (7 kilometers). Mineralized fault breccias and veins with sulphides that delimit a major structure approximately 33 feet (10 meters) in width are exposed in a river section and have returned strongly anomalous Ag, Au and Mo values (up to 273ppm Ag, 0.6 ppm Au) as well as moderate to strongly anomalous lead, zinc, arsenic, barium and antimony.

Several other parallel silicified breccia structures are exposed in the river section over a width of about 820 feet (250 meters). Silver values up to 8.8 oz/t (273 g/t) occur around elevations of 3,280 feet above sea level (“fasl”) (1,000 meters above sea level (“masl”)) where the deeper parts of the epithermal system have been exposed. At higher elevations (up to 5,413 feet (1,650 meters)) to the southeast, argillic alteration and silicified breccias continue but are less anomalous and partly concealed by volcanic cover. A similar topographic control on mineralization occurs in the Palmarejo District where the main window of economic mineralization is observed between 2,953 fasl (900 masl) and 4,265 fasl (1,300 masl). The Camuchin Trend is considered a prime target for additional surface exploration and drill testing. As a next step, given the relatively poor exposure over much of the trend, Coeur intends to conduct a systematic soil geochemical survey followed by drilling.

La Curra - La Verde Trend

Regional mapping has focused on the south-east extension of the Guadalupe Trend from the surface workings observed at the Las Animas vein to the southeast. Veins and silicified breccias have been traced for at least 3.4 miles (5.5 kilometers) that show widths between 6 and 13 feet (2 and 4 meters) and are linked by zones of argillic alteration. Sampling has demonstrated anomalies in antimony, arsenic, cadmium, barium as well as weak silver and gold, a signature typically observed in the upper zones of the veins at Hidalgo and represent high priorities for drill testing. An additional north-northwest-trending silicified structure named Los Llanos was mapped northeast of La Verde for some 2 miles (3.5 kilometers), which increases the target area of interest.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with four wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska and the Wharf gold mine in South Dakota. In addition, the Company wholly-owns the Silvertip silver-zinc-lead exploration project in British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts, results and plans, exploration expenditures, drill results, investments, resource delineation, expansion, upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade and recovery variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, the potential effects of the COVID-19 pandemic, including impacts to the availability of our workforce, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

The scientific and technical information concerning our mineral projects in this news release have been reviewed and approved by a “qualified person” under S-K 1300, namely our Director, Technical Services, Christopher Pascoe. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company’s material properties which are available at www.sec.gov.

Notes

The ranges of potential tonnage and grade (or quality) of the exploration results described in this news release are conceptual in nature. There has been insufficient exploration work to estimate a mineral resource. It is uncertain if further exploration will result in the estimation of a mineral resource. The exploration results described in this news release therefore does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

For additional information regarding 2022 mineral reserves and mineral resources, see https://www.coeur.com/operations/operations/reserves-resources/. For additional information regarding 2017 mineral reserves and resources, see https://s201.q4cdn.com/254090064/files/doc_downloads/2023/08/08/2022-08-09-exploration-update-2017-rr-appendix-final.pdf.

- For a complete table of all drill results included in this release, please refer to the following link: https://s201.q4cdn.com/254090064/files/doc_downloads/2023/08/08/2023-08-09-Exploration-Update-Appendix-Final.pdf.

- Rounding of grades, to significant figures, may result in apparent differences.

Conversion Table |

||||

1 short ton |

= |

0.907185 metric tons |

||

1 troy ounce |

= |

31.10348 grams |

||

View source version on businesswire.com: https://www.businesswire.com/news/home/20230809176670/en/

Contacts

Coeur Mining, Inc.

Attention: Jeff Wilhoit, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com