Valued at a market cap of $122.5 billion, Prologis, Inc. (PLD) is an industrial real estate company that owns, develops, and manages logistics and distribution facilities. The San Francisco, California-based company serves major e-commerce, retail, and supply-chain customers by providing strategically located warehouses and fulfillment centers near key population hubs and transportation corridors.

This industrial REIT has underperformed the broader market over the past 52 weeks. Shares of PLD have gained 11.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 15.4%. However, on a YTD basis, the stock is up 3.3%, outpacing SPX’s 1.1% uptick.

Zooming in further, PLD has outperformed the State Street Real Estate Select Sector SPDR ETF (XLRE), which declined marginally over the past 52 weeks and gained 1.6% on a YTD basis.

Shares of PLD rose marginally on Jan. 21, after its Q4 earnings release. The company’s total revenue increased 2.4% year-over-year to $2.3 billion, driven by robust growth in rental and other revenues. Meanwhile, its core FFO of $1.44 decreased 4% from the year-ago quarter, meeting analyst estimates.

For fiscal 2026, ending in December, analysts expect PLD’s FFO per share to grow 5.2% year over year to $6.11. The company’s FFO surprise history is promising. It met or topped the consensus estimates in each of the last four quarters.

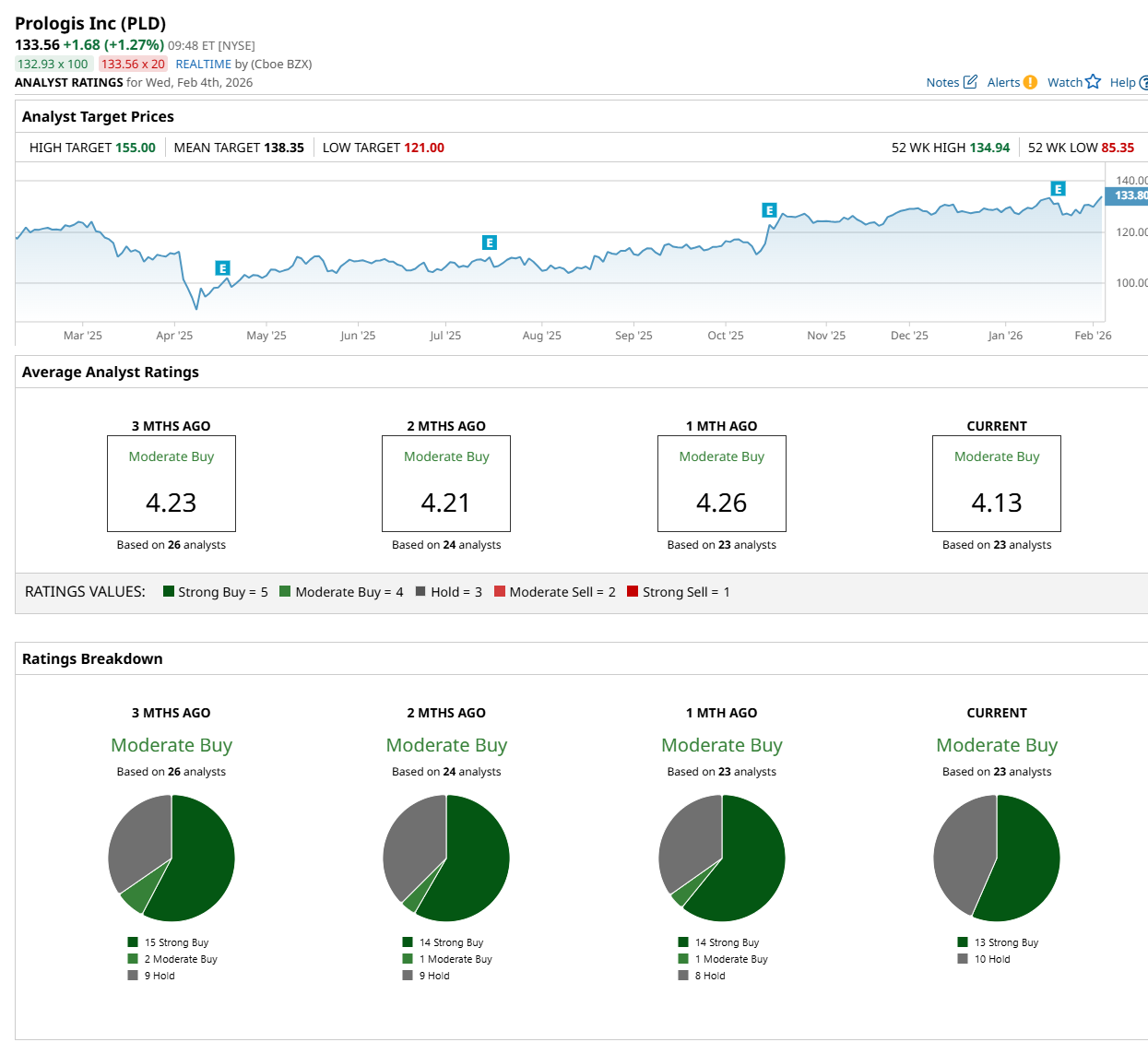

Among the 23 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 13 “Strong Buy” and 10 "Hold” ratings.

The configuration is slightly less bullish than a month ago, with 14 analysts suggesting a "Strong Buy” rating.

On Feb. 2, RBC Capital analyst Michael Carroll maintained a “Sector Perform” rating on PLD and raised its price target to $135, indicating a 1.1% potential upside from the current levels.

The mean price target of $138.35 represents a 3.6% premium from PLD’s current price levels, while the Street-high price target of $155 suggests a 16.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amazon’s ‘Melania’ Film Earns $7 Million Opening Weekend, But The Benefits For Shareholders Could Be Billions

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?