With a market cap of $290.5 billion, Morgan Stanley (MS) is a global financial holding company offering a wide range of products and services to governments, institutions, and individuals across the Americas, Asia, Europe, the Middle East, and Africa. Its operations span Institutional Securities, Wealth Management, and Investment Management, providing services such as capital raising, financial advisory, investment products, lending, and retirement and wealth planning.

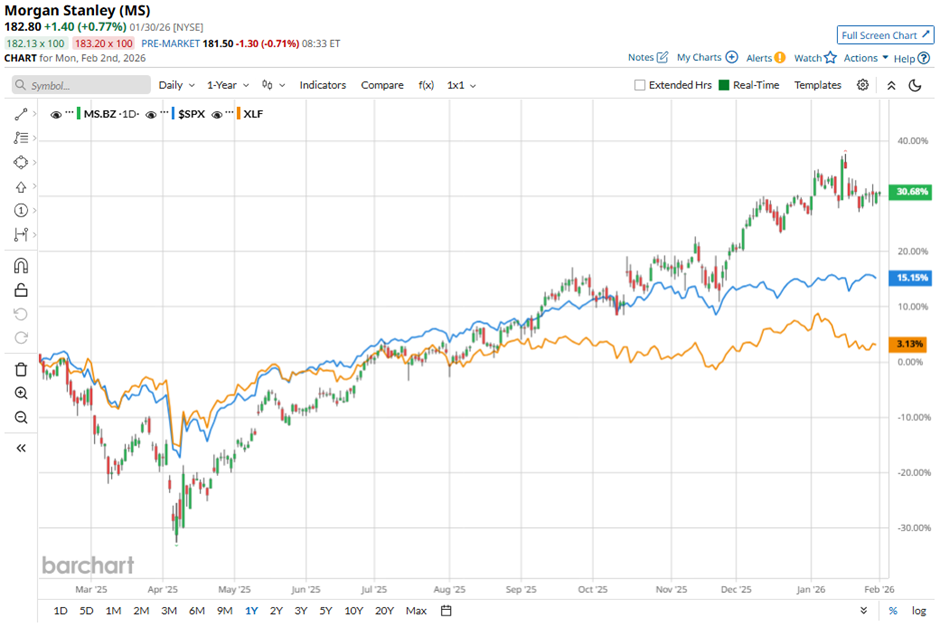

Shares of the New York-based company have outperformed the broader market over the past 52 weeks. MS stock has surged 31.1% over this time frame, while the broader S&P 500 Index ($SPX) has returned 14.3%. Moreover, shares of Morgan Stanley are up 2.2% on a YTD basis, compared to SPX’s 1.4% gain.

Focusing more closely, shares of the investment bank have outpaced the State Street Financial Select Sector SPDR ETF’s (XLF) 4% rise over the past 52 weeks.

Morgan Stanley shares climbed 5.8% on Jan. 15 after the bank delivered a strong Q4 2025 results, posting EPS of $2.68 and net revenues of $17.89 billion, both above forecasts. Investor optimism was further driven by a 47% surge in investment banking revenue to $2.41 billion, fueled by a nearly 93% jump in debt underwriting revenue to $785 million, as global M&A activity topped $5.1 trillion for the year. Strength in wealth management also boosted sentiment, with quarterly revenue rising 13% to $8.43 billion, helping push total annual revenue to a record $70.65 billion.

For the fiscal year ending in December 2026, analysts expect Morgan Stanley’s EPS to grow 8.4% year-over-year to $11.07. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

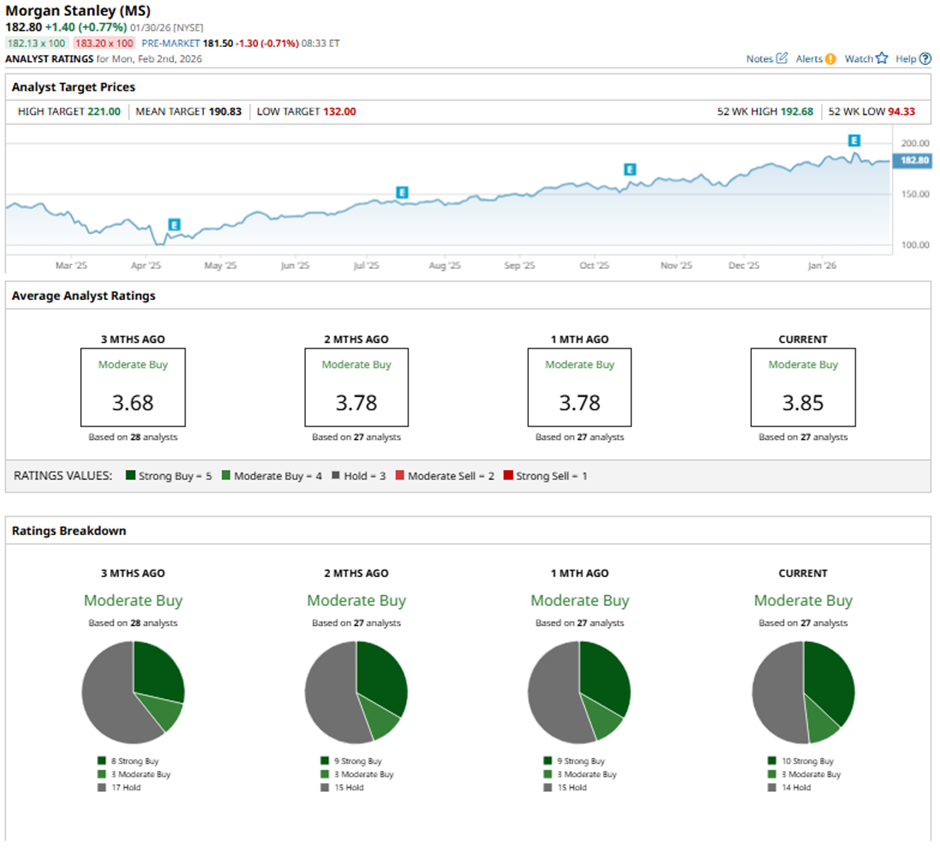

Among the 27 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, three “Moderate Buys,” and 14 “Holds.”

This configuration is more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Jan. 7, Wolfe Research analyst Steven Chubak raised Morgan Stanley’s price target to $211 with an “Outperform” rating.

The mean price target of $190.83 represents a 4.4% premium to MS’ current price levels. The Street-high price target of $221 suggests a 20.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Groundhog Day Gloom? Why the Nasdaq Is Shaking Off Phil's Shadow and Facing Reality

- SoFi’s Earnings Growth Looks Strong. Is This Dip a Buying Opportunity?

- This Is the Most Oversold Dividend Aristocrat Worth Buying

- MicroStrategy Is Trading Below NAV Again. Should You Buy MSTR Stock Here or Stay Far, Far Away?