Valued at a market cap of $34.9 billion, EQT Corporation (EQT) is a leading U.S. natural gas production company. Headquartered in Pittsburgh, Pennsylvania, it is the largest producer of natural gas in the United States, primarily operating in the Appalachian Basin, with a strong focus on the Marcellus and Utica Shales in Pennsylvania, Ohio, and West Virginia.

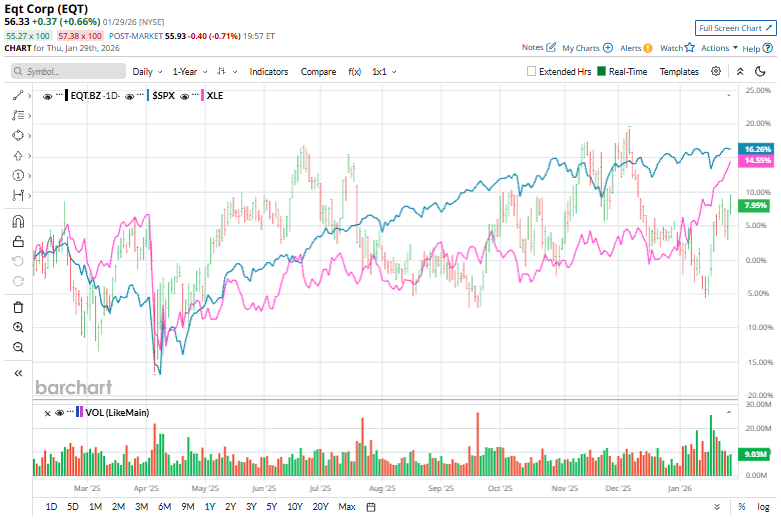

The energy giant has underperformed the broader market over the past year. EQT stock prices have soared 11.3% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16.3% gains. Over the past six months, the stock has surged 6.1%, compared to $SPX’s 9.4% rally.

Narrowing the focus, EQT has also trailed the sector-focused Energy Select Sector SPDR Fund’s (XLE) 12.6% gains over the past 52 weeks and 13.6% rise over the past six months.

On Jan. 21, EQT Corp shares rose more than 6% as U.S. natural gas stocks rallied for a second straight day, driven by a sharp surge in natural gas prices, which jumped over 24% to a six-week high.

For FY2025 that ended in December, analysts expect EQT to deliver an adjusted EPS of $2.90, up 80.1% year-over-year. Furthermore, the company has a solid track record of earnings surprises. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

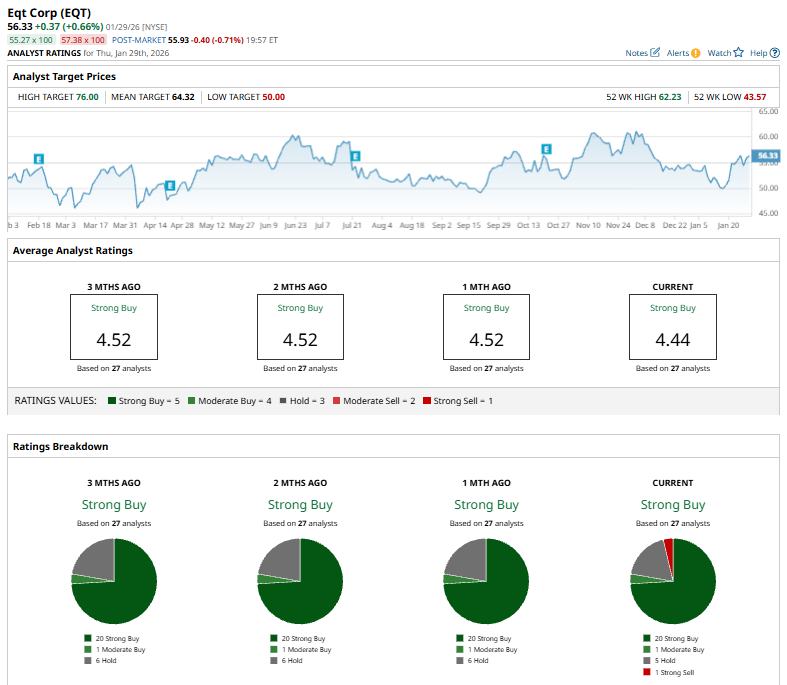

Among the 27 analysts covering the EQT stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buys,” one “Moderate Buy,” five “Holds,” and one “Strong Sell.”

On Jan. 22, Stephens & Co. lowered its price target on EQT to $68 from $69 but maintained its “Overweight” rating.

EQT’s mean price target of $64.32 suggests a 14.2% upside potential. Meanwhile, the street-high target of $76 represents a notable 34.9% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart