Do I like exchange-traded funds (ETFs)? Based on how much I write about them, I’d say that’s a clear yes. But are they perfect as market-trackers? No way. And with the U.S. dollar showing signs of potential upside down markets, while ETFs might be a good vehicle to play it, that’s not where I’m going to chart the course.

Case in point: Here’s the Invesco DB US Dollar Index Bullish Fund (UUP). It has been a reliable tracking device for the U.S. Dollar Index ($DXY), a trade-weighted basket of currencies, since 2007. However, it pays distributions from time to time, and that can mess up the charting. See the recent gap associated with the last one.

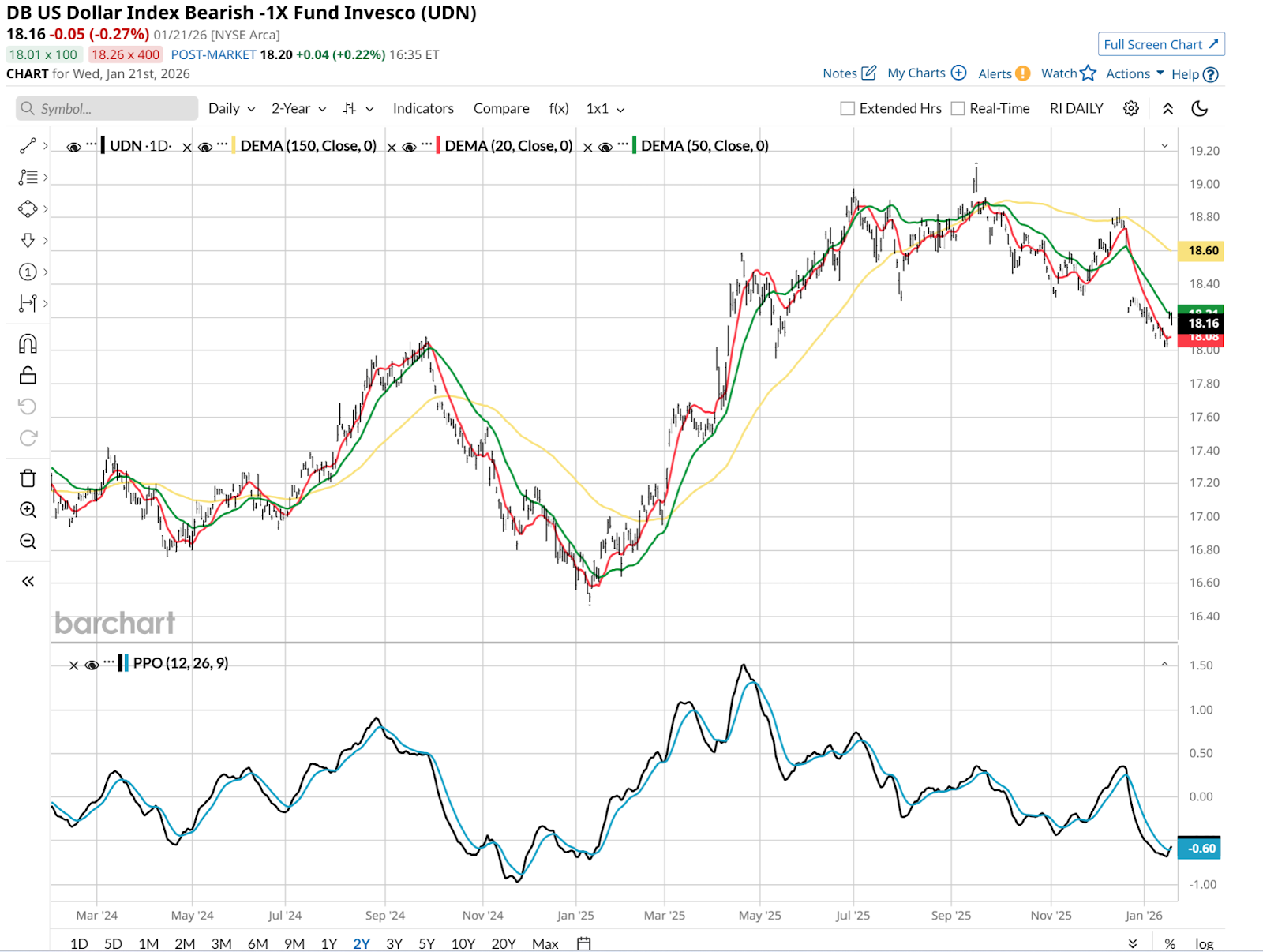

On Dec. 22, 2025, DXY dropped about a third of 1%. But UUP’s price fell by 3.7%. The distribution was the difference. And since the goal here is to use UUP, or its inverse ETF cousin Invesco DB US Dollar Index Bearish Fund (UDN) to try to profit from big moves in the dollar the rest of this year, let’s chart DXY, then turn back to the ETFs.

The index goes back a long way, into the last century. This monthly chart shows that for the first time in several years, the 20-month moving average is dropping.

The Structural Bear Case: Why the Dollar-As-King Era Is In Trouble

For years, the U.S. dollar was the only game in town, fueled by higher interest rates and "U.S. exceptionalism." But in 2026, the tides are shifting. Morgan Stanley is projecting the Dollar Index to slide toward the $94 level by the second quarter — the lowest since 2021.

The pressure comes from a combination of narrowing interest rate differentials, persistent fiscal deficits, and a pivot in global capital toward undervalued international markets. While the dollar has shown some short-term resilience in mid-January, it is currently bumping up against heavy resistance in that $100 area. If it fails again, the pressure will elevate, and the “sell dollars" trade could become a dominant macro theme.

If you believe the greenback is heading for a structural decline, you don't just sit in cash. You move into vehicles that act as a mirror image of the dollar's weakness. That’s where UDN can be a consideration.

UDN: Permission To Diversify

The chart also reflects distributions, but if we look back to early 2025, we see there’s potential for a nice cash alternative here. That was a more than 10% rally for UDN last time around. And as shown below, its beta is low, as is its correlation to the U.S. stock market. Both good diversification signals.

The path of least resistance for the dollar appears to be lower. That is directly linked to U.S. debt running amok, and global markets starting to care about that. Trade war chatter doesn’t help reverse that at all.

2026 is not 2025. This year, looking for alternatives to U.S. stocks is at a premium. The dollar, and its potential for renewing the weakness we saw last year versus a basket of other major currencies, is just one of many ways to seek alternatives in the period ahead.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Warren Buffett’s 1994 Berkshire Hathaway Prediction Finally Coming True? He Warns ‘A Fat Wallet is the Enemy of Superior Investment Results’

- As Autodesk Slashes Jobs, Should You Buy, Sell, or Hold ADSK Stock?

- As Short Sellers Take Aim at AppLovin Stock Again, How Should You Play APP?

- This Chip Stock Is Trading at New All-Time Highs