There were four double-digit percentage gains in FCOJ, silver, platinum, and cocoa. Oil product refining spreads and U.S. natural gas futures moved over 10% lower in December.

Record highs for silver and platinum

Silver futures posted a 23.51% gain in December, while platinum was 20.74% higher.

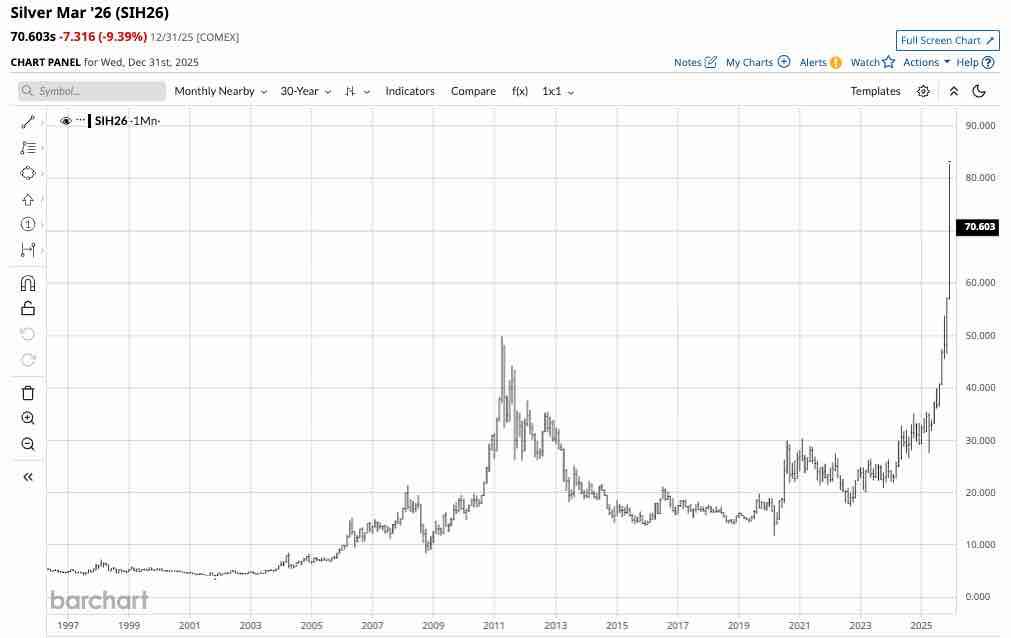

The monthly continuous COMEX silver futures chart shows that the price rose to higher highs in November and December after reaching a new record peak above the 1980 high in October. The continuous silver futures chart reached an $82.67 per ounce high in December, over 64% above the 1980 high, before correcting and settling at $70.603 per ounce on December 31, 2025.

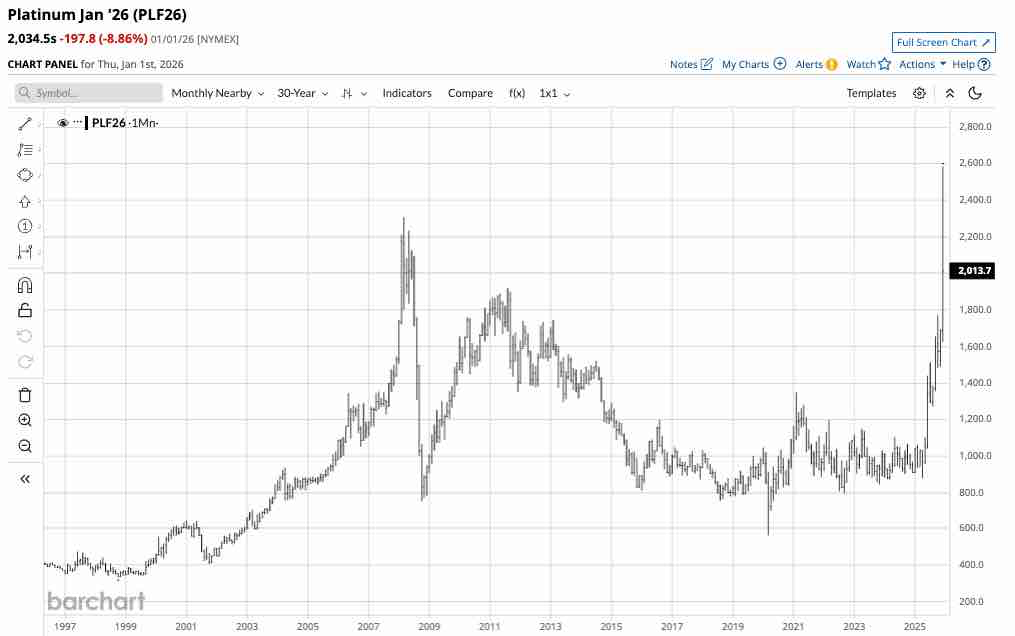

The monthly continuous NYMEX platinum futures chart illustrates the 20.74% rise in December. Platinum futures reached a record $2,584.50 per ounce high in December, eclipsing the previous all-time high of $2,308.80 from 2008. Nearby NYMEX platinum futures corrected and settled at $2,034.50 per ounce on December 31, 2025.

Meanwhile, nearby COMEX gold futures rose to another new high at $4,584 in December before settling at $4,341.10 per ounce, up 2.03% for the month. NYMEX palladium futures posted a 9.63% gain in December, settling at $1,651.40 after reaching a $2,129 per ounce high during the month.

The bottom line is that the rare metals were precious in December.

Grain and energy futures declined in December

CBOT soybean futures led the grain and oilseed sector lower with an 8.60% decline. While the CBOT soft red winter wheat futures were 5.85% lower, CBOT corn futures edged 1.68% lower.

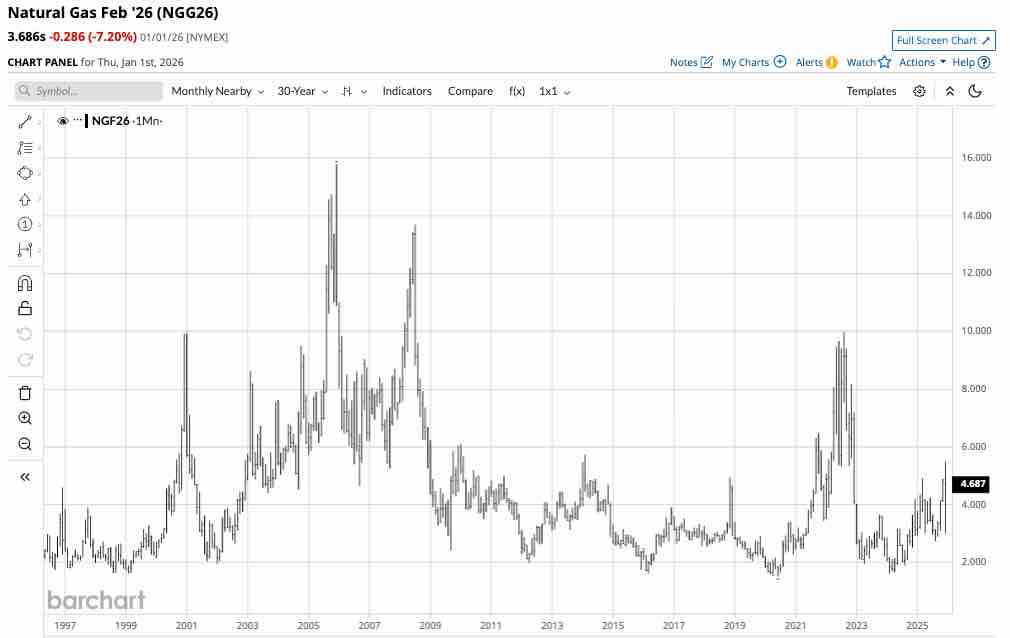

After rising to the highest price since late 2022 in December, NYMEX U.S. natural gas futures fell 16.57% in December.

Aside from being one of the worst-performing commodities in December, the monthly continuous futures chart shows that natural gas futures formed a bearish key reversal pattern, rising above the November 2025 high and closing below the November 2026 low.

WTI and Brent crude oil futures declined by 1.50% and 1.81%, respectively. Oil products, gasoline, and heating oil futures underperformed the crude oil, sending refining or crack spreads lower in December. Chicago ethanol swaps and coal for delivery in Rotterdam, the Netherlands, also posted declines during 2025’s final month.

Copper moves higher, lumber remains steady, and meats recover

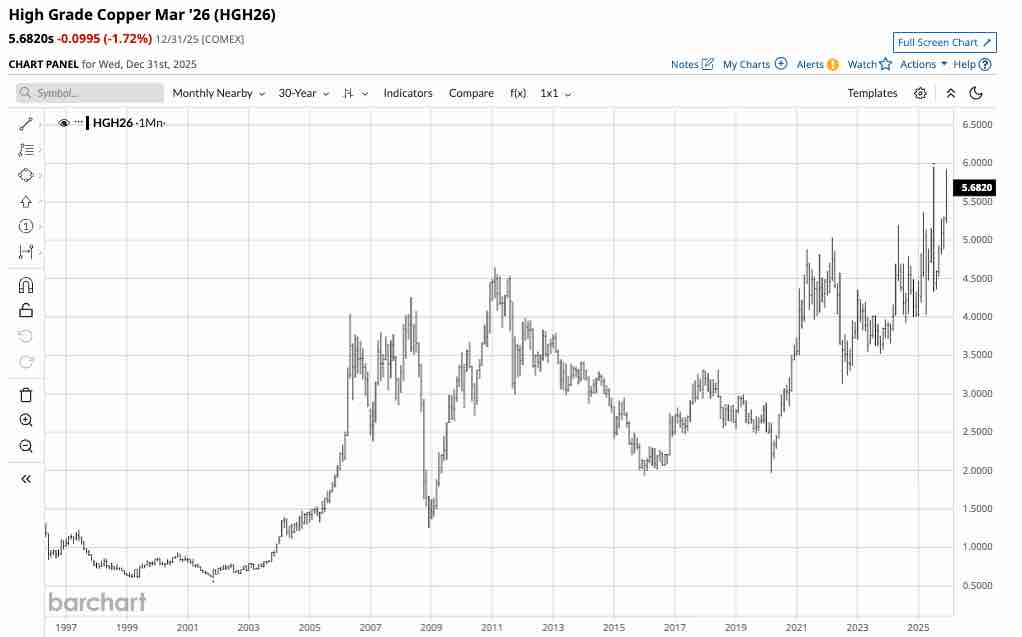

COMEX copper futures moved 7.78% higher in December, settling at $5.6820 per pound.

The monthly chart shows that COMEX copper futures reached a high of $5.9235 in December, just below the record July 2025 high of $5.9585 per pound before correcting. However, the red metal remains within striking distance of the $6 level as the market heads into 2026.

Lumber futures edged only 0.17% higher in December, settling at $576 per 1,000 board feet on the active month March 2026 futures contract. Lumber is in the heart of the offseason for construction, but the prospects for lower interest rates in 2026 likely kept lumber’s price steady.

After seasonal downside price corrections over the past few months, cattle and hog prices bounced higher in December. February live cattle futures posted a 6.31% gain, with the March feeder cattle futures rising 8.64%. February lean hog futures rose 5.06% for the month ending on December 31, 2025.

Mixed results in softs- Cryptos, the dollar index, and bonds fall, and stocks edge higher

Soft commodities remain volatile, with double-digit percentage gains in FCOJ and cocoa, and declines in Arabica coffee, world sugar, and cotton futures. FCOJ and cocoa futures prices, which plunged after reaching record highs over the past months, posted 26.94% and 10.19% respective gains. Arabica coffee futures fell 8.51%, world sugar futures were down 1.31%, while cotton futures edged 0.68% lower in December.

The leading cryptocurrencies, Bitcoin and Ethereum, declined by 3.98% and 2.66%, respectively, in December. The dollar index, which measures the U.S. dollar against the other leading world reserve currencies, fell 1.05% in December, while the U.S. government long bond futures fell 1.52% for the month. The lower dollar index and lower bonds are mixed signals for commodity prices.

The most diversified U.S. stock market index, the S&P 500 index, rose 0.65% in December.

Factors to watch in January 2026- The economic and geopolitical landscapes remain turbulent

As 2026 begins, markets are in the heart of winter, seasonality continues to favor price weakness in meats and gasoline, and strength in natural gas. Volatility is likely to remain elevated in NYMEX U.S. natural gas futures over the coming weeks.

Keep a close eye on those metals, as gold, silver, and copper remain in long-term bullish trends. The continued decline in fiat currencies’ purchasing power remains a factor supporting gold, silver, platinum, palladium, copper, and the other nonferrous metals. However, explosive gains in December increase the odds of corrections.

The bull market in stocks continues, but the economic and geopolitical landscapes provide more than a few roadblocks. The odds of a lower Fed Funds Rate will rise as President Trump appoints a new Fed Chairman to replace Jerome Powell during the first half of 2026.

Expect continued volatility in the commodities asset class in January 2026 and beyond, and you will not be surprised or disappointed.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart