The electromobile industry has become a focus point once again as China comes to the rescue to encourage and boost domestic demand. The country’s leading planning authority for economic matters, the National Development and Reform Commission, has proposed a trade-in subsidy program of RMB 62.5 billion ($8.9 billion) for 2026. The program will be funded through ultra-long-term special treasury bonds, and this will mitigate challenges posed by a weak China’s housing market and deflation.

This comes on the back of a very aggressive expansion in the year 2025, with consumer subsidies more than doubling on a year-over-year basis to a total of about $42.8 billion to encourage the sales of cars, smartphones, and home appliances.

The message for investors is crystal clear: the focus for the Chinese government is on the stability of its industrial and consumer demand trends, and the automotive sector and electric vehicles are on the radar here.

Consequently, Chinese EV stocks such as Nio (NIO), XPeng (XPEV), BYD (BYDDY), and Li Auto (LI) are back in investors’ focus. The question that looms large in 2026 is whether these companies are capable of sustaining any earnings momentum.

About Li Auto Stock

LI Auto is one of the major companies in the new energy vehicles sector in China, especially recognized for the development of its upscale SUV models and the use of the Extended Range Electric Vehicles (EReV) design. Present in Beijing, it has developed an overall network of sales and service platforms, including 542 outlets in 157 cities and over 3,400 supercharging stations. The market capitalization of LI Auto is about $17.7 billion.

From a performance perspective, Li Auto shares have been finding it difficult to find their footing. The current trading price of the shares is around $17.40, which is closer to the lower end of the 52-week range of $16.11 to $33.12.

Valuations provide mixed insights. Li: With a price/sales ratio of only 0.91x, it appears undervalued against global EV companies. But its forward price/earnings ratio of about 119x indicates heavily trimmed earnings forecasts for the short term. With earnings pressures, it’s not being valued as a growth compounder; it’s being valued as a turnaround story linked very closely to earnings revival.

Li Auto EPS Misses Expectations on Lower Margins

The latest earnings figures, issued by Li Auto, highlighted the challenges it faces. For the third quarter of 2025, the company’s total revenue declined by 36.2% year-over-year (YoY) to RMB 27.4 billion, or $3.8 billion, with a 37.4% decline in vehicle sales. The company delivered 93,211 vehicles, a significant drop of 39% from the same period in the previous year.

Profitability was weakened. Margins on vehicles dropped to 15.5% compared to over 20% a year ago, and the gross margin decreased to 16.3%. The company indicated that the cost associated with recalls attributable to Li MEGA impacted their profitability, and if not for that cost, the gross margin would have been more like 20.4%.

The bottom line turned negative as Li Auto reported an operating and net loss of RMB 1.2 billion ($172 million) and RMB 624 million ($87.7 million), respectively, rather than the substantial profits seen in the same period of the previous year. Its free cash flow turned negative to -RMB 8.9 billion (-$1.3 billion).

There have been no strong indicators of forward guidance from the management as it takes a very cautious approach amid the pricing competition that continues to be very intense in the Chinese electric-vehicle market. Now, investors will look to 2026 to provide an indication of the potential for stabilizing volumes, margins, and cash flow.

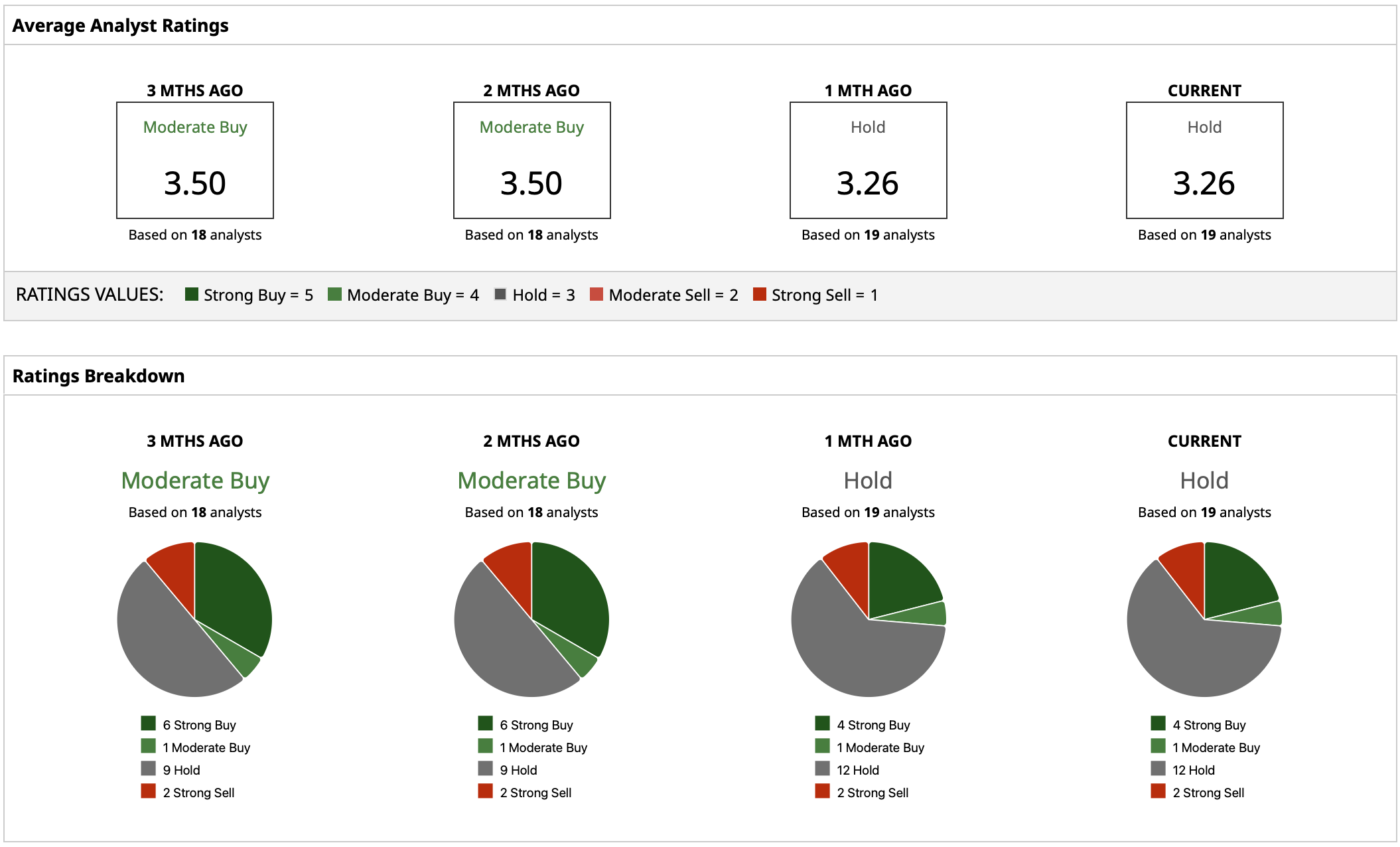

What Are Analysts’ Forecasts for LI Stock?

However, Wall Street analysts are indecisive about Li Auto's prospects. LI stock has a “Hold” rating consensus that indicates hesitancy and a lack of conviction, as analysts are torn between hopes of a recovery and worries about its margin sustainability. Li Auto’s mean target price of $22.53 suggests a potential gain of around 30% from the current stock price. The highest target price is set at $32, while the lowest is around $17, which is essentially where the stock is at present.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- LRCX Outperformed in 2025, but Valuation and Options Activity Flag 2026 Risks

- Micron Stock Just Moved Into Overbought Territory After Massive 2025 Run. Is It Too Late to Buy MU Shares?

- Super Micro Computer Just Launched a New AI Server. Should You Buy SMCI Stock Today?

- China Is Backing EV Stocks Again. Does That Make Li Auto a Buy for 2026?