MicroStrategy, now doing business as Strategy (MSTR), is following its strategy of betting large on Bitcoin (BTCUSD). The company has consolidated its position as the largest corporate holder of this cryptocurrency. Although Bitcoin is going through a rough patch, aptly named the “crypto winter,” Strategy accumulated about $109 million in the digital asset over the Dec. 22-28 period.

The tokens were accumulated at an average price of $88,568 per coin and were funded through a common stock offering. This purchase brings the company’s total Bitcoin holdings to 672,497 tokens, valued at $50.40 billion.

At this juncture, should you consider investing in the stock?

About Strategy Stock

Strategy leads in AI-driven enterprise analytics and business intelligence software from its Tysons Corner, Virginia headquarters. It creates, markets, and supports cloud-based solutions, including Strategy One and Strategy Mosaic, through subscriptions, licenses, and services for global clients, while maintaining the largest corporate Bitcoin holdings.

The February 2025 rebrand marked a pivot from pure business intelligence to a blend of analytics and Bitcoin treasury management, positioning it as the first public Bitcoin treasury firm. Drawing on its software experience, it integrates AI analytics with crypto strategies, providing Bitcoin access through stocks and bonds. The company has a market capitalization of $43.66 billion.

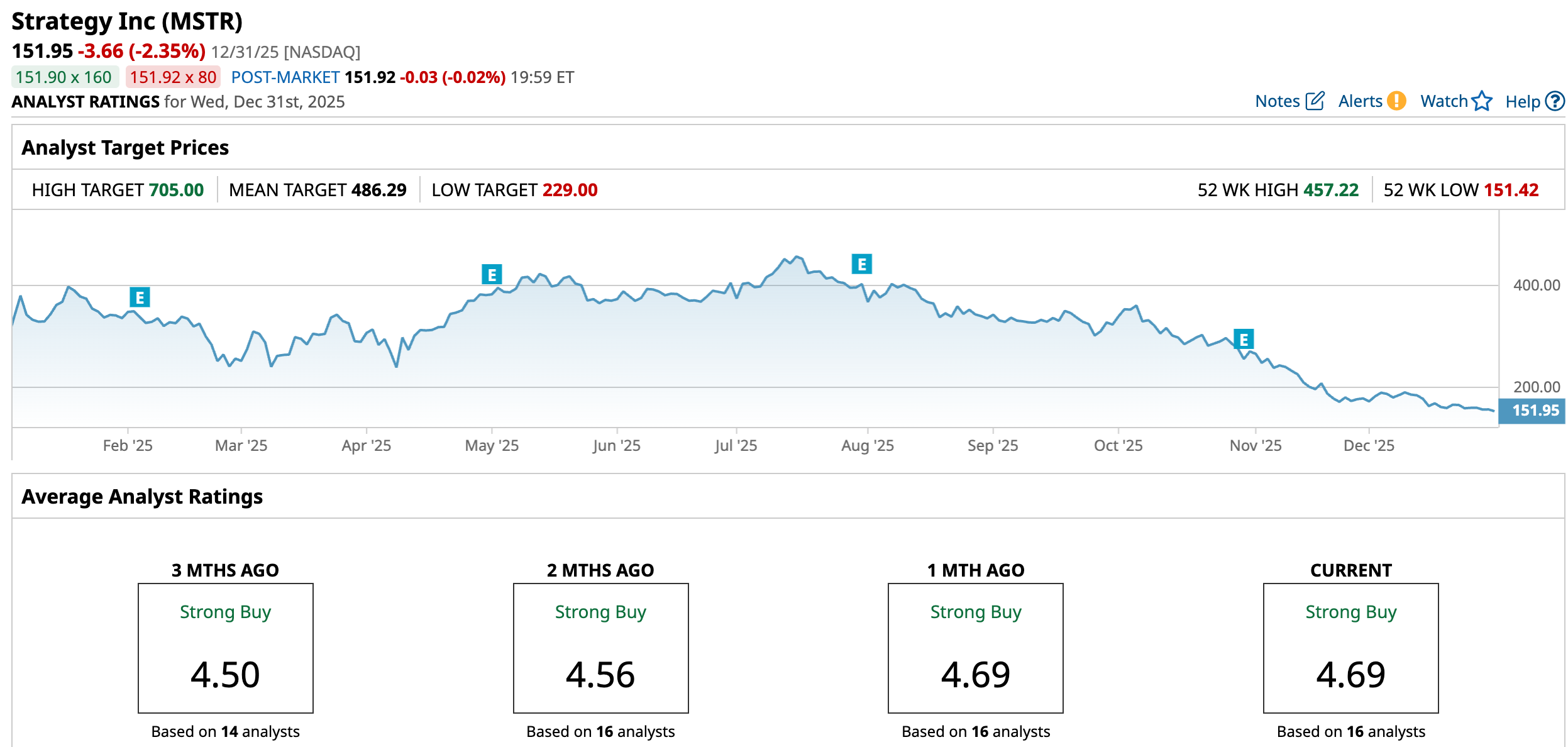

In the second half of 2025, MSTR’s stock has been in a free fall as Bitcoin experiences a tough period, crashing from a high of $124,000 to a low of about $84,000. Over the past 52 weeks, the stock has declined 49.84%, and over the past six months, it has dropped 62.41%. It had reached a 52-week high of $457.22 in July, but is down 66.8% from that level.

MSTR’s stock is trading at a discount to its peers. Its price-to-earnings GAAP (TTM) ratio of 5.56x is considerably lower than the industry average of 31.08x.

Strategy Accumulated More Bitcoin In The Third Quarter

On Oct. 30, Strategy released its third-quarter results for fiscal 2025. In that, the company reported holding 640,808 Bitcoin holdings as of Oct. 26. These digital assets were purchased for a total cost of $47.44 billion, or $74,032 per Bitcoin. At that point, the BTC yield was 26.0% year-to-date (YTD). Strategy also achieved a BTC gain of $12.9 billion at that point, while the full-year 2025 target stands at $20 billion.

Strategy’s quarterly revenue increased 10.9% year-over-year (YOY) to $128.69 million, exceeding Wall Street analysts’ estimate of $117.10 million. Due to gains on digital assets, the company’s income from operations increased considerably, turning a loss of $432.58 million in Q3 2024 into a profit of $3.89 billion in Q3 2025. Strategy’s EPS climbed from a loss of $1.72 to a profit of $8.42.

Looking ahead, the company has set its goal of becoming a dominant global credit issuer. Executive Chairman Michael Saylor highlighted Strategy’s ‘B-’ credit rating from S&P Global (SPGI), which might expand the addressable market for the company’s securities.

Wall Street analysts have a tepid view about Strategy’s bottom line trajectory. For the fourth quarter, its loss per share is expected to increase significantly YOY to $18.06. For the current year, its loss per share is also expected to grow considerably YOY to $30.86. However, next year’s loss per share is projected to decrease by 32.4% annually to $20.87.

What Do Analysts Think About Strategy Stock?

This month, Citigroup analyst Peter Christiansen maintained a “Buy” rating but lowered the price target from $485 to $325, indicating that while there are concerns about the stock’s upside potential, Citigroup analysts still see strong overall potential in the company.

In the same month, Bernstein analysts maintained that concerns about Strategy’s financials are overstated and that the company is steadily evolving into a cryptocurrency reserve that delivers fixed-income yield and savings products directly to investors. Analysts at the firm maintained an “Outperform” rating on the stock but lowered the price target from $600 to $450.

Last month, analysts at Monness, Crespi, Hardt upgraded MSTR’s stock from a “Sell” to a “Neutral” rating. The analysts cited a lower premium on its Bitcoin holdings and reduced downside risk as the reasons for this upgrade. H.C. Wainwright analysts reiterated their “Buy” rating and $475 price target following its Q3 results. They also called the company “aggressive buyers at these levels.”

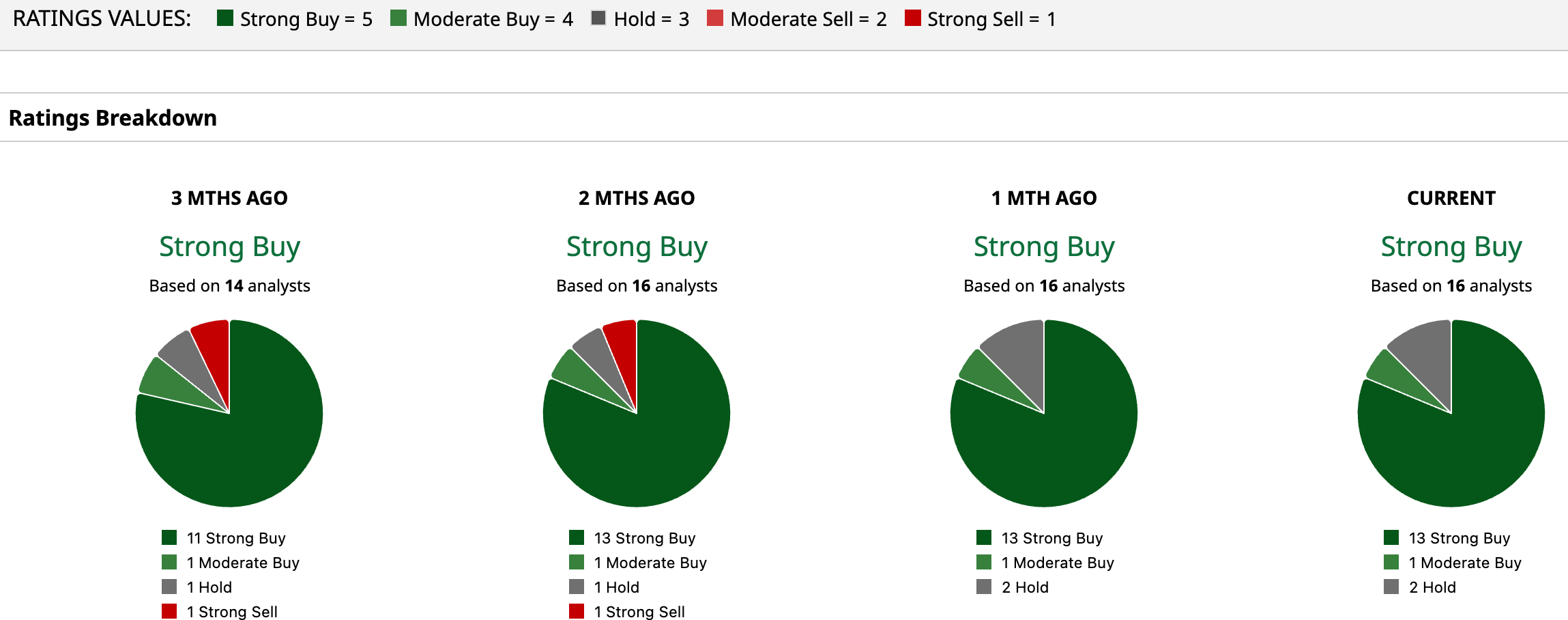

MSTR has come under the spotlight on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 15 analysts rating the stock, a majority of 12 analysts have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” while two analysts are playing it safe with a “Hold” rating. The consensus price target of $486.29 represents a 220% upside from current levels, while the Street-high price target of $705 indicates nearly a 364% upside.

Key Takeaways

Strategy’s aggressive push into Bitcoin accumulation has rewarded the company with higher income. However, it has also tied the stock to Bitcoin’s ebbs and flows. On the other hand, analysts still see hefty upsides in the stock. Therefore, investors with risk appetite might choose to invest in MSTR’s stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Make a 2.0% Income Yield in GOOGL Stock Over the Next Month

- Trump Media Stockholders Are About to Get a New Crypto from the President. Does That Make DJT a Buy Here?

- Tesla Deliveries Plunged 16% in Q4. What That Means for TSLA Stock in the New Year.

- The FDA Just Snubbed Corcept Therapeutics. Should You Buy the Dip in CORT Stock or Stay Far Away