Leading chip giant Intel Corporation (INTC) has pulled off one of the most dramatic turnarounds of the past year. Once viewed as a fading chipmaker, Intel roared back with triple-digit gains in 2025, transforming itself from a market laggard into one of Wall Street’s most talked-about comeback stories. A major force behind this revival is new CEO Lip-Bu Tan, whose aggressive structural changes have reshaped the company, along with strong backing from the Trump administration. That support has been highly visible.

President Donald Trump recently stated that “The United States Government Is Proud to Be a Shareholder of Intel,” a powerful endorsement that has drawn fresh attention to one of the world’s most important semiconductor players. In addition to government backing, the company also secured investment from Nvidia (NVDA) in late 2025, a move that thrilled investors not only for the fresh capital but also for the credibility that comes from being backed by the world’s most valuable company.

These high-profile investments may prove to be a critical financial lifeline for Intel, especially after years of strategic missteps and massive, capital-hungry manufacturing expansions that drained its resources. On the other hand, Intel’s renewed focus on strong performance and longer battery life in its processors is helping it claw back market share from rivals like Advanced Micro Devices (AMD), further strengthening its investment case and lifting Wall Street’s confidence in the stock.

So, with this powerful mix of leadership, government backing, strategic investments, and product innovation, all eyes are now on Intel as it prepares to release its fiscal 2025 fourth-quarter earnings on January 22.

About Intel Stock

Founded in 1968 by tech pioneers Robert Noyce and Gordon Moore, Intel gets its name from “Integrated Electronics” and quickly became one of Silicon Valley’s defining innovators. Headquartered in Santa Clara, California, it continues to push the boundaries of semiconductor technology. Today, Intel designs and manufactures a broad range of cutting-edge products, from microprocessors and chipsets to artificial intelligence (AI) accelerators and networking solutions, that help billions of devices connect, compute, and power the smart, connected world we live in.

At CES 2026, the world’s biggest consumer technology showcase, Intel used the global stage to highlight its latest innovations, including its next-generation Core Ultra Series 3 processors and its renewed focus on performance, battery life, and AI-powered PCs. Intel’s Core Ultra Series 3 stands out as one of the company’s most pivotal chip launches in decades.

It’s the first compute platform built on Intel 18A, the most advanced semiconductor process ever developed and manufactured in the United States. After surrendering ground to Advanced Micro Devices following years of execution slip-ups, Intel is now counting on this new generation of processors to rebuild trust with both consumers and businesses by combining high performance with efficient, long-lasting battery life.

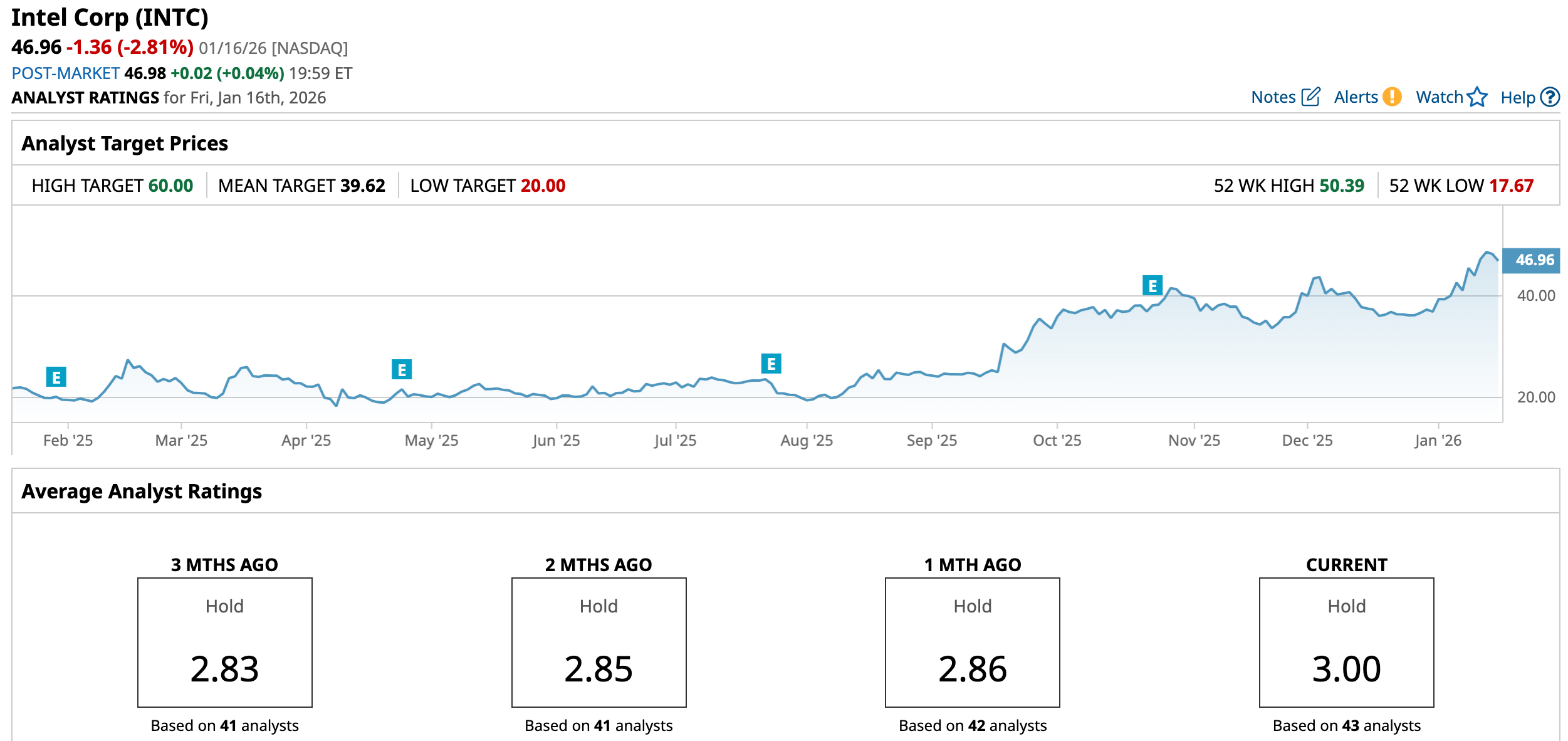

Currently commanding a market capitalization of roughly $224.3 billion, the chipmaker's shares have surged in 2025 following strong U.S. government backing. After bottoming out at a 52-week low of $17.67 in early 2025, the stock staged a stunning comeback, rallying 165.8% from that trough. For the full year, shares surged an eye-popping 138.7%, crushing the broader S&P 500 Index’s ($SPX) 16.9% gain during the same stretch.

The momentum hasn’t slowed in 2026 either. In just the first few trading days of the new year, Intel’s stock is already up an impressive 31%, easily outpacing the broader market’s modest 1.02% year-to-date (YTD) rise, a clear sign that investor enthusiasm remains red-hot.

Intel’s Q3 Earnings Snapshot

In October last year, Intel delivered a strong fiscal 2025 third-quarter earnings report that beat Wall Street on both revenue and profits, signaling that demand for its core x86 PC processors is finally rebounding. The results marked an important turning point for the chipmaker after a difficult stretch.

Revenue for the quarter came in at $13.65 billion, up 3% year-over-year (YOY) and comfortably ahead of analysts’ expectations of $13.14 billion. But the real surprise came from the bottom line. GAAP earnings surged to $0.90 per share, a stunning turnaround from a loss of $3.88 per share a year earlier, and far better than the Street’s expectation of a $0.21 loss.

Profitability also improved sharply. Gross margin jumped to 38.2%, up from just 15% in the year-ago quarter, while operating margin turned positive at 5%, compared with a deeply negative 68.2% last year. These numbers showed that Intel’s cost controls and execution are beginning to pay off.

Where did the growth come from? Intel’s Client Computing Group (CCG), which includes PC and laptop processors, posted $8.5 billion in revenue, rising 5% YOY, another sign that the PC market is stabilizing. Meanwhile, data-center CPU sales totaled $4.1 billion, down slightly 1% from last year, though Intel believes its partnership with Nvidia could help reignite growth in this critical segment.

CEO Lip-Bu Tan struck an optimistic tone, saying Intel’s Q3 results reflected “improved execution and steady progress” on its strategy. He added that the rise of AI is driving demand for compute, opening up opportunities across Intel’s x86 processors, AI accelerators, custom chips, and foundry services, all supported by its U.S.-based manufacturing and R&D footprint.

Now, all eyes are on Intel’s upcoming results. The company is set to report its fiscal 2025 fourth-quarter earnings after market hours on Jan. 22, with management forecasting revenue between $12.8 billion and $13.8 billion, a non-GAAP gross margin of 36.5%, and adjusted EPS of $0.08.

How Are Analysts Viewing Intel Stock?

Intel stock jumped over 7% on Jan. 13 after investment firm KeyBanc upgraded the shares to “Overweight.” Analysts cited strong demand for Intel’s chips in AI data centers and significant progress in its manufacturing business. With Big Tech racing to build AI servers, Intel’s CPUs are selling fast. In fact, KeyBanc says Intel is almost sold out of data center chips for the year and may even raise prices.

Adding to the excitement, reports suggest Apple (AAPL) may use Intel’s next-generation 18A-P technology to make chips for future Macs and iPads, a deal one analyst called Intel’s “first big whale” win. Strong government and Nvidia backing, improving chip yields, and growing interest from cloud companies in Intel’s packaging technology are also boosting confidence that Intel is becoming a serious player again in the global chip race.

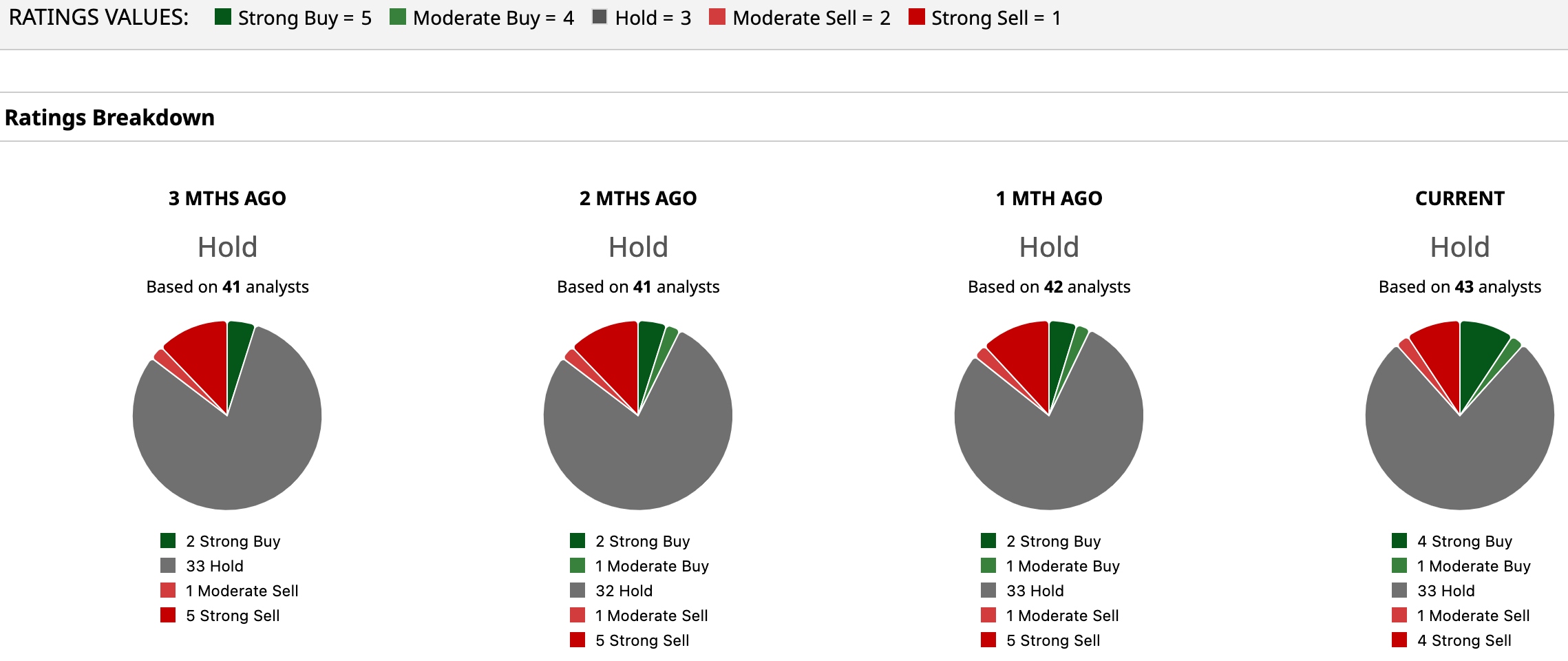

But despite Intel’s recent rally, Wall Street remains cautious overall. The stock currently carries a consensus “Hold” rating, reflecting a wait-and-see approach among analysts. Out of the 43 analysts covering Intel, only four rate it a “Strong Buy” and one calls it a “Moderate Buy,” while a dominant 33 analysts sit on the sidelines with a “Hold.” On the bearish end, one analyst has a “Moderate Sell” and four recommend a “Strong Sell.”

What makes this even more striking is that Intel has already rallied past the average price target of $39.62. Still, the most optimistic analyst sees room to run, with a Street-high target of $60, implying another 27.8% upside from here if the rally keeps going.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Meta Platforms Looks to Double Smart Ray-Ban Glasses Production, Should You Buy, Sell, or Hold META Stock?

- Politician Gilbert Cisneros Just Sold Cameco Stock. Should You?

- 2 Top Flying Car Stocks That Cathie Wood Can’t Get Enough Of

- ConocoPhillips Has a 3.42% Annual Yield, but Short-Put Investors Can Make 1.5% Monthly