After Venezuelan President Nicolas Maduro was captured by U.S. forces and brought to the United States to face charges, President Donald Trump began pushing for U.S. oil producers to start working in the country.

But Exxon Mobil (XOM) may be on the outside looking in. CEO Darren Woods recently made remarks at a White House meeting that Venezuela and its massive oil reserves are currently “uninvestable,” and that Exxon would require changes to commercial terms, Venezuela’s legal system, hydrocarbon laws, and protections for foreign investment before the company could be involved.

Trump countered by saying that he may sideline Exxon entirely from the South American country’s energy sector. “I didn’t like Exxon’s response,” he said on Sunday. “You know we have so many that want it. I’d probably be inclined to keep Exxon out.” He went on to say Exxon was “playing too cute.”

Should Trump’s cold shoulder toward Exxon be a point of concern for investors?

About Exxon Mobil Stock

Headquartered in Texas, Exxon Mobil is the largest U.S.-based integrated energy company, with a market capitalization of $533 billion. The company explores, produces, trades, transports, and sells oil and natural gas. It has upstream operations in the U.S., Guyana, Nigeria, and Qatar, as well as refining complexes in the U.S., Belgium, and the Netherlands.

Exxon has more than 12,000 Exxon and Mobil-branded fuel stations in the U.S.

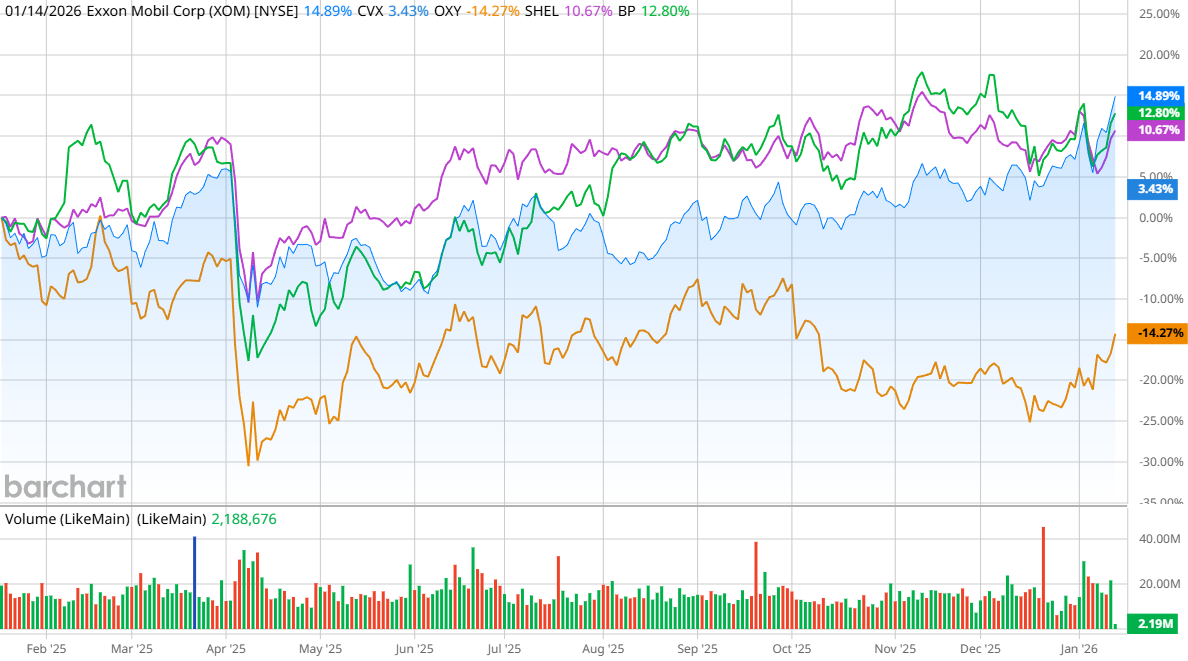

Shares are up 15.3% in the last 12 months and near all-time highs, although its one-year performance is just short of the returns of the S&P 500 ($SPX). Despite Trump’s bearish statements on Sunday, Exxon shares are continuing to move higher.

Exxon stock also outperformed major competitors in the last year, including Chevron (CVX), Occidental Petroleum (OXY), Shell (SHEL), and BP (BP).

The stock is also attractively priced, with a price-to-earnings (P/E) ratio of just 18.2, which is lower than all of its competitors except Shell, which has a P/E of about 15. The dividend yield of 3.3% is also attractive and pays out quarterly. Exxon has raised its dividend annually for the last 43 years, making it a dependable dividend stock.

Exxon Mobil Beats on Earnings

Exxon’s earnings report for the third quarter showed revenue of $85.29 billion, down from $90.01 billion a year ago, which is not a surprise considering that oil prices are down from a year ago. But the company still beat analysts’ expectations as production in Guyana and the Permian Basin reached records. That allowed Exxon to post net income of $7.55 billion, and earnings per share of $1.88, versus analysts’ expectations of $1.81.

Exxon said that it produced more than 700,000 barrels per day from its offshore assets in Guyana, and the Permian Basin operations produced nearly 1.7 million barrels per day.

Exxon has also been more efficient, as its oil profits have more than doubled since 2019 — despite the price of oil falling this year. “We feel good about the progress we are making,” Woods said. “We are delivering on all the challenging commitments we made, consistent with our track record since the pandemic, and setting the pace for the industry.”

Exxon hasn’t issued full-year guidance, but fourth-quarter earnings are scheduled for Jan. 30. However, in December, the company issued its updated corporate plan through 2030, which projects total upstream production of 5.5 million barrels of oil per day, up from a previous estimate of 5.4 million barrels. It increased its earnings growth forecast to $25 billion and its cash flow growth to $35 billion for the 2024-2030 period. The company also projects $20 billion in structural cost savings by 2030, versus its previous estimate of $18 billion in savings.

What Do Analysts Expect From XOM Stock?

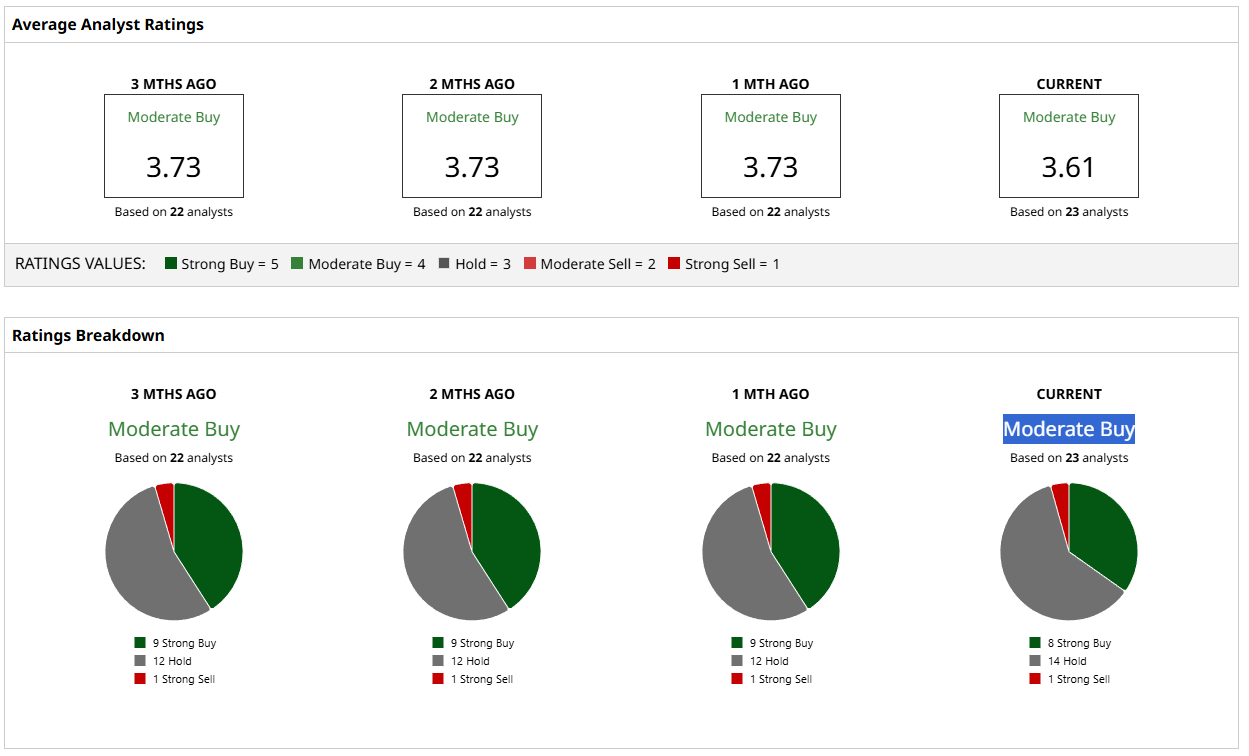

Twenty-seven analysts rate Exxon stock as a consensus “Moderate Buy,” with 15 “Buy” and 11 “Hold” ratings. Only one has a bearish rating.

Price targets, however, indicate that Exxon’s most recent runup leaves little room for improvement. The analysts’ mean price target of $131 is just over where it currently trades. The most bullish target of $158 suggests a possible 22% gain, while a bearish target of $109 warns of a possible 15% pullback.

Investors appear to be taking Trump’s threat to Exxon with a grain of salt. The president has a well-documented history of changing his mind on economic policies and his views regarding publicly traded companies.

The bottom line is that Exxon Mobil is a good pick for investors who are looking to get into the energy space, even if it doesn’t add a Venezuelan presence. The increased profitability, strong dividend history, and commitment to reducing costs make Exxon a buy in my book.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Spats With Exxon CEO Darren Woods Over Venezuela, Should You Take a Risk and Buy XOM Stock?

- Is This Nvidia-Backed AI Stock a Buy Before It Soars 177%?

- Analyzing a Butterfly Spread on Marvell Technology

- Stocks Climb Before the Open as TSMC Reignites AI Optimism, U.S. Economic Data and Earnings in Focus