With a market cap of around $24.3 billion, Teledyne Technologies Incorporated (TDY) is a diversified industrial technology company specializing in advanced electronic systems, sensors, digital imaging, and instrumentation for mission-critical applications. Headquartered in California, the company serves aerospace and defense, industrial automation, environmental monitoring, marine, medical, and scientific markets worldwide.

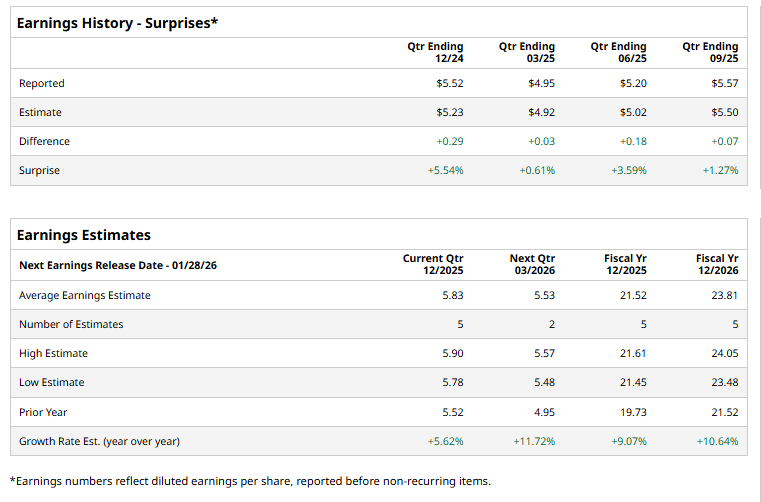

The industrial company is expected to announce its fiscal Q4 2025 earnings results soon. Ahead of this event, analysts expect TDY to report an adjusted EPS of $5.83 per share, up 5.6% from $5.52 in the year-ago quarter. It has consistently exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts expect the company to report adjusted EPS of $21.52, representing a 9.1% increase from $19.73 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 10.6% year over year to $23.81 in fiscal 2026.

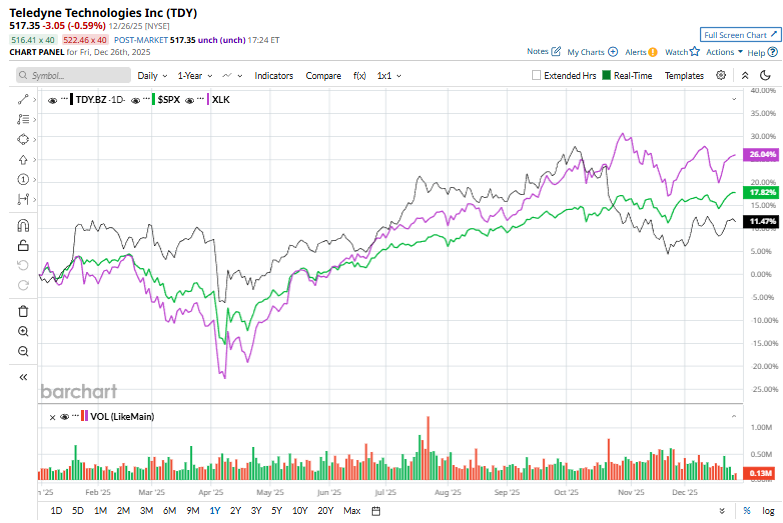

Shares of Teledyne Technologies have gained 8.6% over the past 52 weeks, trailing the broader S&P 500 Index's ($SPX) 14.8% return and the Technology Select Sector SPDR Fund's (XLK) 21.8% rise over the same period.

On Dec. 2, Teledyne DALSA, a subsidiary of Teledyne Technologies, announced the launch of the Xtium™3 PCIe Gen4 family, a next-generation frame grabber designed for high-performance industrial imaging applications. Building on the Xtium2 platform, the initial Xtium3-CLHS PX8 model supports the Camera Link HS® standard over a PCIe Gen 4.0 interface, delivering ultra-high data throughput with up to 72.2 Gbps of acquisition bandwidth and host transfer speeds of up to 13.2 GB/s in a compact single-slot, single-cable configuration. Its shares rose 1.7% in the next trading session.

Analysts' consensus view on Teledyne Technologies stock remains bullish, with a "Moderate Buy" rating overall. Out of 12 analysts covering the stock, seven recommend a "Strong Buy," one "Moderate Buy," and four "Hold." TDY’s average analyst price target of $616 indicates a premium of 19.1% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart