Tesla (TSLA) is no longer just an automaker, it’s a market-moving technology name whose share price often swings on product news, regulatory headlines, and CEO sentiment.

Recently, Tesla was again in the news after U.S. auto-safety regulators opened an investigation into about 179,000 Model 3 sedans following a consumer petition alleging that the mechanical emergency door release can be difficult to locate and use in emergencies. The National Highway Traffic Safety Administration (NHTSA) said the issue could pose safety risks if occupants are unable to exit the vehicle after a crash. The probe has pushed Tesla back into the regulatory spotlight just as its shares hover near record highs.

Analysts note that if a defect is confirmed, Tesla could face costly recalls or fixes, e.g., retrofitting clearer manual releases, which would weigh on near-term profits. This investigation ties into broader negative headlines, notably a lawsuit filed by victims’ families over a fatal 2016 Model S crash blamed on door-handle design.

With 2026 on the horizon, investors are now weighing whether this latest scrutiny is a short-term setback or a meaningful signal for how to position TSLA stock going forward.

Tesla Stock Performance

Tesla remains one of the most closely watched growth stocks in the market, backed by its scale, brand strength, and long-term ambitions in AI, autonomy, and energy. Shares of Tesla have moved up and down a lot, as investor mood keeps changing. Even with this volatility, the electric-vehicle maker has still managed to deliver decent performance so far in 2025. Year-to-date (YTD) stock is up 17.67%. Investors cheered on record vehicle deliveries, strong free cash flow, optimism around robotaxis and AI initiatives, renewed confidence in Full Self-Driving, and enthusiasm following Elon Musk’s updated long-term vision.

However, the main concern of analysts about Tesla is its valuation, which is significantly stretched compared to its sector peers. The Price to Earnings (P/E) non-GAAP forward ratio is 296.40, vastly higher than the sector median of 17.77, indicating that the stock is trading at nose-bleed levels. In short, TSLA trades at a steep premium, but bulls argue future technology like robotaxis and FSD justifies this premium, while skeptics see it as pricing in lofty, uncertain outcomes.

Tesla Delivered Mixed Q3

Tesla’s latest quarterly results for Q3 2025 showed strong deliveries and cash generation, even as profitability came under pressure.

Revenue reached about $28.1 billion, up 12% from a year earlier. Automotive sales contributed roughly $21.2 billion, while the energy storage business continued to shine with revenue of about $3.4 billion, and services brought in around $3.5 billion.

Net income came in at $1.37 billion, down 37% year-over-year (YOY), reflecting higher costs and lower regulatory credit revenue.

Operating cash flow remained strong at $6.24 billion, and after capital spending of $2.25 billion, free cash flow hit a record $3.99 billion. Tesla ended the quarter with about $41.6 billion in cash and short-term investments.

Management offered limited formal guidance, but CFO Vaibhav Taneja said capital spending is expected to be around $9 billion for 2025, with a larger increase planned in 2026 to support AI and expansion efforts.

Wall Street expects full-year 2025 revenue of roughly $94.9 billion and earnings of about $1.13 per share, pointing to continued pressure on profitability.

Still, Elon Musk struck an optimistic tone, saying the company is laying the foundation for long-term growth. CFO Vaibhav Taneja highlighted progress on the “Year of the Y,” noting that multiple Model Y variants helped support demand and keep volumes resilient despite a challenging environment.

Headwinds Grow, Hopes Remain

Tesla is navigating a challenging market as its U.S. retail sales plunged 23% in November to a near four-year low of 39,800 vehicles, despite introducing lower-priced “Standard” variants. Cox Automotive analysts warned that demand for these cheap trims cannibalized higher-margin models, highlighting waning consumer interest after federal credits ended.

In Europe, stiff competition also chipped away at Tesla’s market share. On the positive side, Tesla’s robotaxi program quietly expanded achieving driverless rides in Austin and regulatory fixes like labeling hidden door releases have been rolled out. However, public controversies – including Musk’s political comments – have drawn protests that analysts say hurt Tesla’s brand.

Wall Street Divided on Tesla Stock Perspective

Wall Street analysts remain divided on TSLA. On the one side, bulls remained hopeful, but others showed caution on steep valuation.

Morgan Stanley’s Andrew Percoco recently shifted Tesla to “Equal-Weight” but raised his price target to $425 from $410, saying the stock deserves a premium despite a choppy outlook.

Goldman Sachs maintains a Neutral rating with a $400 target, noting progress in autonomous technology but warning that much optimism is already priced in.

Bullish firms like Wedbush continue to rate Tesla Outperform, with a $600 target, while Deutsche Bank recently upgraded the stock to “Buy” and lifted its target to $500.

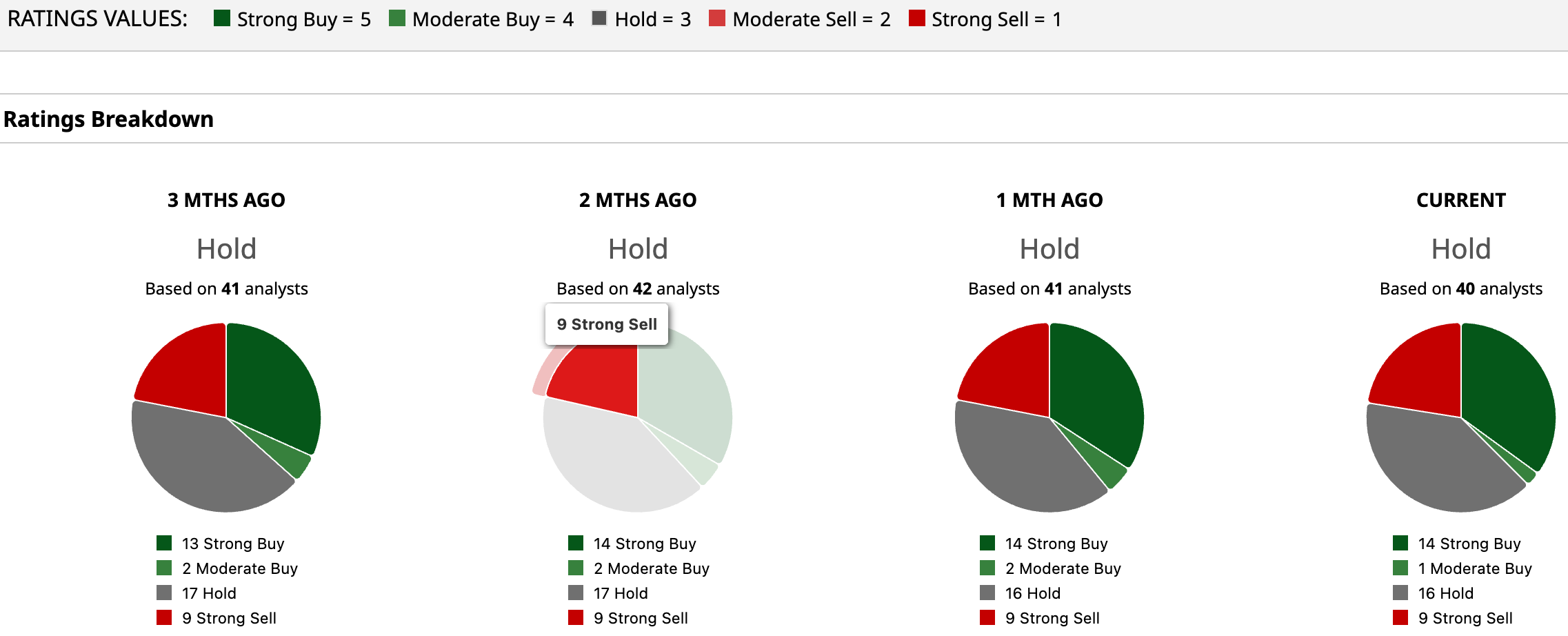

Overall, the consensus price target is $395.32, with a “Hold” rating from all 40 analysts covering Tesla. This means stock is trading much above its mean target and has 16.8% downside risk here. But the bulls' target of $600 shows a 26.27% upside if Tesla delivers stronger vehicle deliveries, improved margins, and progress on robotaxi and AI initiatives in 2026.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Tesla Faces a New Investigation Over Door Safety, How Should You Play TSLA Stock Heading into 2026?

- Trump Just Sent This Lesser-Known Stock Plunging. Should You Buy the Dip?

- Why is Crude Oil Stuck in Neutral?

- Analysts Are Betting Big on Rivian Stock Ahead of 2026. Should You Get In on RIVN Here Too?