Commanding a market cap of $195.4 billion, PepsiCo, Inc. (PEP) is a global food and beverage titan best known for brands like Pepsi, Gatorade, Lay’s, Doritos, Quaker, and Tropicana. The company operates through its snack and beverage divisions, boasting a strong portfolio that spans soft drinks, sports drinks, chips, cereals, and convenience foods.

Over the past 52 weeks, PEP shares have dropped 14.9%, trailing the S&P 500 Index’s ($SPX) 17.5% surge. The trend has continued into 2025, with the stock down 6.1% versus a 15.6% advance in the broader market.

However, within the food and beverage sector, PepsiCo has performed better than its peers, outpacing the First Trust Nasdaq Food & Beverage ETF (FTXG), which has declined 15.1% over the past year and 9.9% year-to-date.

On Oct. 9, PepsiCo shares popped 4.2% after the company released its FY2025 third-quarter earnings. It posted $23.9 billion in revenue and core EPS of about $2.29, both narrowly topping forecasts. Organic sales growth remained modest at around 1.3%, reflecting continued volume softness in North America, particularly in its food business. However, international markets, especially in snacks, helped offset some weakness, delivering stronger growth. The company reaffirmed its full-year outlook, highlighting ongoing cost-cutting and portfolio optimization efforts as it works to reignite momentum amid a challenging consumer environment.

Analysts expect PepsiCo’s diluted EPS to dip marginally year over year to $8.02 for the fiscal year ending December 2025. The company has delivered earnings above expectations in three of the past four quarters, while missing in one quarter.

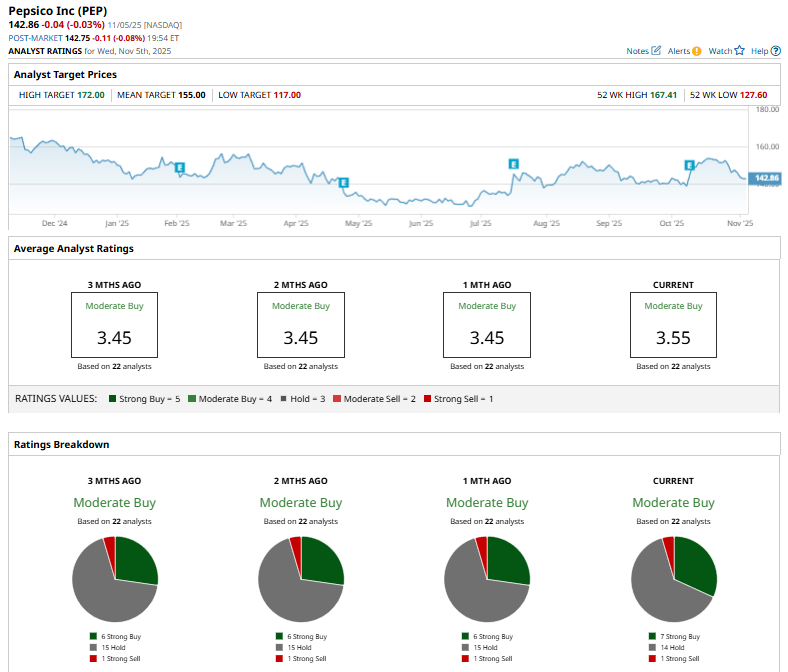

Among the 22 analysts covering PEP stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy,” 14 “Hold,” and one “Strong Sell” ratings.

The current configuration is more bullish than it was a month ago, when six analysts suggested a “Strong Buy” for the stock.

On October 14, Barclays plc (BCS) analyst Lauren Lieberman reiterated a “Hold” rating on PepsiCo and set a price target of $142.

The mean price target of $155 represents 8.5% upside to PEP’s current price, while the Street-high price target of $172 suggests an upside potential of 20.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart