Tesla (TSLA) continues to make headlines—not just for its electric vehicles, robotaxis, and robotics, but for its fast-growing energy business, one of the few bright spots in its latest earnings report. The company has reportedly reached a multi-billion-dollar supply agreement with South Korean battery manufacturer Samsung SDI, under which Samsung will provide battery cells to Tesla over the next three years.

The deal marks another step in Tesla’s efforts to expand its energy business, which includes products like Megapack and Powerwall that store electricity for later use. With global demand for large-scale energy storage surging, Tesla appears to be positioning itself to capture a much larger share of this rapidly expanding market.

For investors, the question now is what this development really means for TSLA stock. Will the deal reinforce Musk’s “more than a car company” narrative, or will it be overshadowed by ongoing concerns about Tesla’s core EV business? Let’s break it down.

About Tesla Stock

With a market cap of $1.48 trillion, Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation.

Shares of the EV maker have gained 10% on a year-to-date (YTD) basis. TSLA stock came under pressure earlier this week as Big Tech shares tumbled amid valuation concerns. News that Norway’s sovereign wealth fund, a major Tesla investor, rejected the proposed $1 trillion compensation package for CEO Elon Musk further added to the stock’s decline. Still, the stock recovered most of those losses on Wednesday as dip buyers stepped in.

TSLA stock is struggling a bit again as it has dipped a little over 3% so far today.

Tesla Reportedly Secures Major Battery Deal With Samsung SDI

On Monday, The Korea Economic Daily reported that Tesla reached a major supply agreement with Samsung SDI. The deal, valued at more than 3 trillion won (about $2.1 billion), will have the South Korean battery maker supplying cells to Tesla over a three-year period. The outlet, citing an unnamed source in the battery industry, noted that this marks the largest battery order ever for the South Korean firm.

You might assume that the agreement is related to Tesla’s electric vehicles. Not quite. This supply is reportedly intended for Tesla’s Energy Storage System (ESS) business, meaning the cells will be used in Megapack and potentially Powerwall products. ESSs are vital for storing electricity for later use, helping to stabilize power grids and balance fluctuations in energy demand.

The report highlighted that demand for ESS has been rising rapidly in North America, driven in large part by the wave of AI investments across many companies. With that, Tesla approached Samsung SDI to discuss a potential battery supply agreement. It’s worth noting that the two companies have been in talks for years, with most speculation focusing on Samsung producing 4680 cells—the cell format originally developed by Tesla. Although Samsung is expanding production of its own 46-series cells, the deal with Tesla appears to center exclusively on LFP cells for stationary energy storage applications.

The batteries will be produced at Samsung SDI’s joint venture plant with Stellantis (STLA) in Indiana, which is currently under construction, according to the report. Samsung SDI has recently announced plans to utilize a portion of the plant’s EV lines to manufacture ESS cells, aiming for a capacity of 30 GWh by the end of next year.

When asked to comment on the reported deal with Tesla, Samsung SDI initially stated that “nothing has been finalized yet,” a standard response typically given before an agreement is officially confirmed. On Tuesday, Samsung SDI confirmed that it is in discussions to supply energy storage batteries to Tesla but reiterated that the deal and its details have not yet been finalized. According to industry sources, negotiations are in the advanced stages and are likely to be finalized within the next few weeks.

Diversifying Tesla's Battery Supply Is a High Priority

The deal with Samsung SDI comes on the heels of another major ESS battery deal Tesla signed this summer with fellow South Korean supplier LG Energy Solution for lithium-iron-phosphate (LFP) batteries. Currently, Tesla relies solely on cells from CATL and BYD (BYDDY) for its energy storage products. However, the company recently emphasized the need to diversify its supply chain in response to tariffs imposed on Chinese products. Notably, Tesla incurred about $400 million in tariff-related costs in Q3, divided between its automotive and energy segments. In April, Tesla CFO Vaibhav Taneja noted that U.S. tariffs had an “outsized” impact on the company’s energy business.

Tesla’s energy storage division contributed roughly 12% of total revenue in Q3 and has been a rare bright spot amid challenges in its core EV business. Notably, the business is currently production-constrained, specifically in battery supply, yet it has still delivered impressive growth. In Q3, the energy division achieved record storage deployment levels, generating $3.4 billion in revenue—a 44% year-over-year (YoY) increase. Tesla also introduced the “Megablock” energy storage product during the quarter, a pre-engineered, medium-voltage battery that combines four Megapack 3s. In addition, CEO Elon Musk noted that Tesla has ambitious plans for the MegaPack 4, which will be capable of delivering approximately 35 kilovolts directly, removing the need for a 35 kV substation.

What Do Analysts Expect for TSLA Stock?

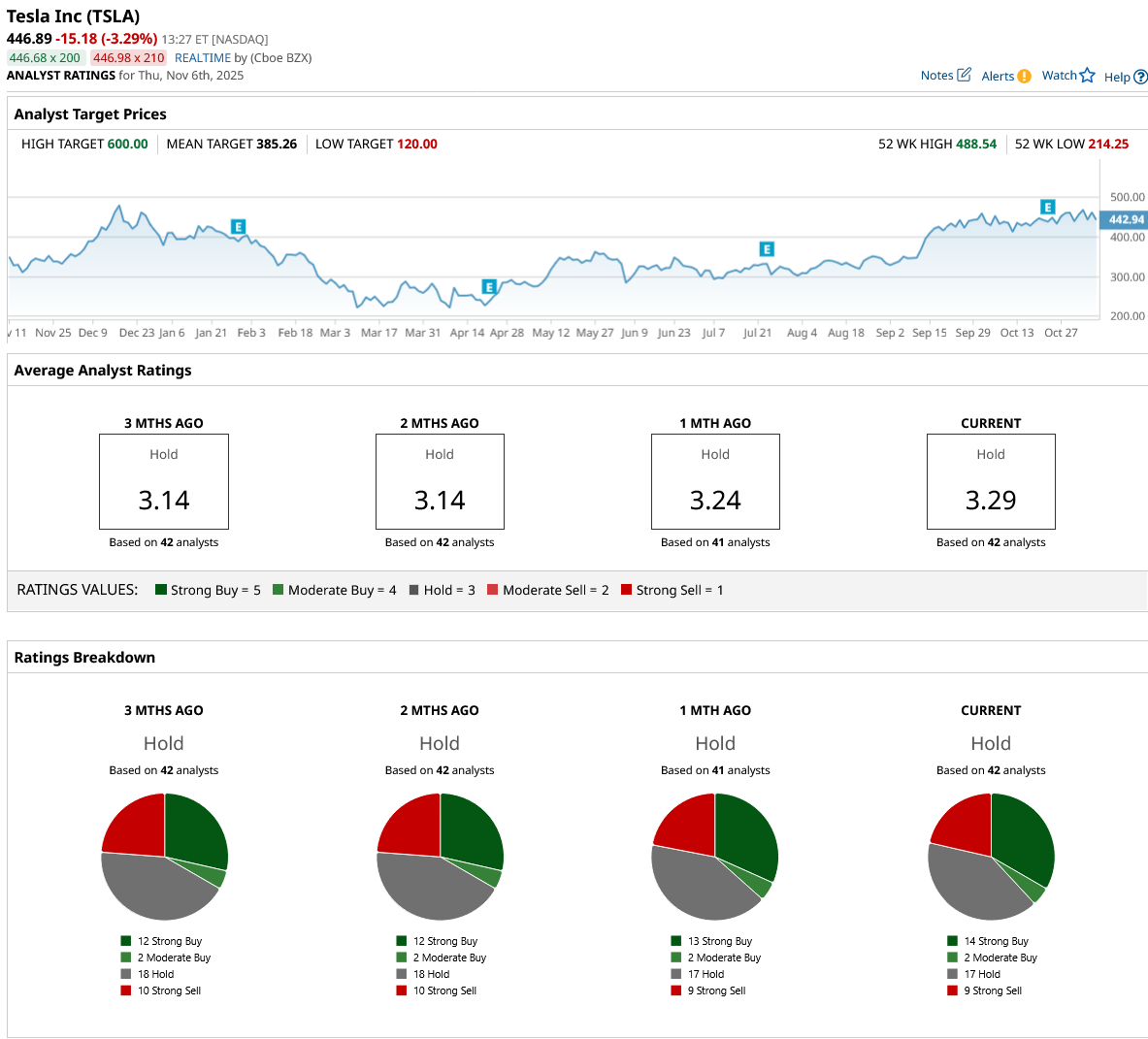

Wall Street analysts remain split on Tesla, with TSLA stock carrying a consensus rating of “Hold.” Of the 42 analysts covering the stock, 14 give it a “Strong Buy” rating and two a “Moderate Buy,” while 17 suggest holding the stock and nine rate it a “Strong Sell.” TSLA stock currently trades at a premium to its average price target of $385.26 but still offers significant upside potential to the Street-high target of $600.

Putting it all together, the recent news of a potential partnership between Tesla and Samsung SDI is a positive development for Tesla’s energy division and, by extension, for the company as a whole. Essentially, there are two ways Tesla stands to benefit directly from this. If finalized, the deal would enhance Tesla’s ability to meet the growing global demand for utility-scale energy storage. In that case, the energy business would likely continue to grow at a solid pace, accounting for a larger share of Tesla’s total revenue—further reinforcing Musk’s thesis that Tesla is far more than just a car company. The second benefit comes from reducing tariff-related costs by replacing cells sourced from CATL and BYD. This would ease pressure on the bottom line at a time when regulatory credit revenue is drying up, the core EV business is facing challenges, and the company is ramping up its investments in AI. However, it’s difficult to say whether this will have a meaningful impact on the stock, given that Tesla bulls remain primarily focused on AI, robotics, and self-driving technology.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart