Michael Burry, the investor who famously predicted the 2008 financial crisis, has eliminated his position in UnitedHealth Group (UNH) according to recent 13F filings. The quarterly filing states that Burry has liquidated 350,000 call options in UNH stock worth approximately $109 million that he held at the end of the second quarter.

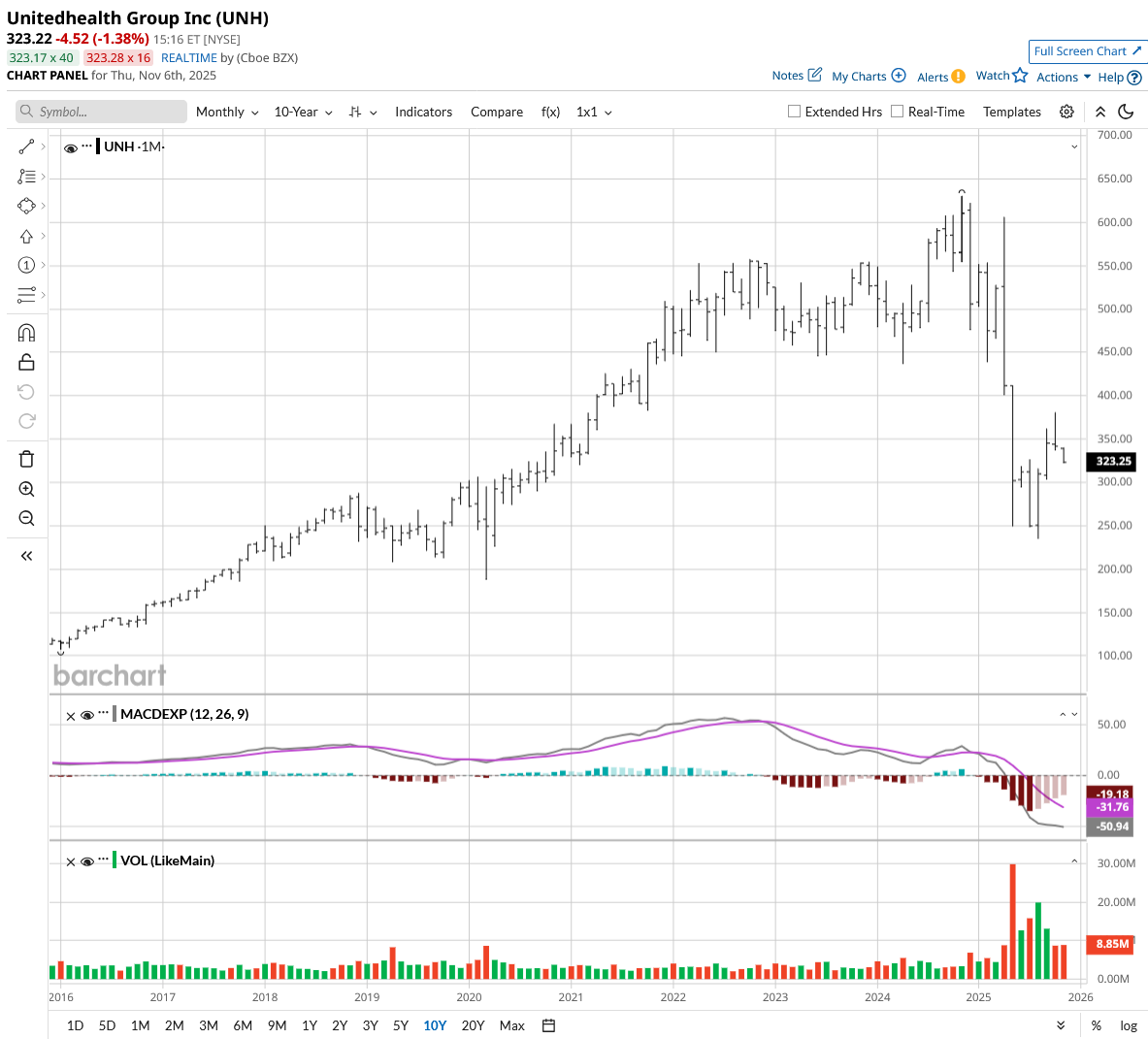

This exit comes as UnitedHealth shares have plummeted 36% year-to-date (YTD), making it one of the worst performers in the Dow Jones Industrial Average. The managed care giant has faced mounting pressures from rising medical costs across the industry and ongoing regulatory scrutiny.

Burry's timing raises questions about whether this represents a warning signal for other investors or creates a compelling opportunity in America's largest health insurer trading near its lowest valuations in years.

Is UNH Stock a Good Buy Right Now?

Valued at a market cap of $300 billion, UnitedHealth is America's largest healthcare company, operating through four segments:

- UnitedHealthcare provides health insurance to employers, individuals, seniors, and Medicaid recipients.

- Optum Health delivers care management and value-based care services

- Optum Insight offers technology, data analytics, and consulting to healthcare organizations

- Optum Rx manages pharmacy benefits, including prescription fulfillment and specialty pharmacy services across the healthcare system.

Down almost 50% from all-time highs, UNH stock offers a forward yield of nearly 3%, making it attractive to both value and income investors. In Q3 of 2025, UnitedHealth reported adjusted earnings of $2.92 per share, which beat estimates. It grew sales by 12% year-over-year (YoY) to $113 billion, even as the medical care ratio declined to 89.9% from 85.2% over the last 12 months.

Management detailed extensive efforts to restore profitability after mispricing issues led to elevated medical cost trends throughout 2025. The Medicare Advantage business experienced approximately 7.5% full-year trend, well above historical norms, while Medicare Supplement products saw trends exceeding 11%.

For 2026, UnitedHealth expects Medicare Advantage medical cost trends around 10%, reflecting continued elevated care utilization, fee schedule changes, and aggressive provider coding practices.

UnitedHealth expects Medicare Advantage membership to contract by approximately 1 million members in 2026, including both individual and group markets, as the company exits underperforming plans and reduces benefits to restore margins. Management aims to return Medicare margins to the upper half of the 2% to 4% range by 2027.

Commercially fully insured businesses should return to normal 7% to 9% margins by 2027 after targeted repricing, although 2026 will see margins remain about 150 basis points below that range.

The Optum Health business faces the most challenging path forward. Value-based care margins are running under 1% for 2025, well below the 5% target, as the division strayed from its original disciplined model through rapid expansion.

Management is narrowing provider networks, exiting lower-performing PPO contracts affecting 200,000 members, and refocusing on employed or contractually dedicated physicians. Total Optum Health value-based care membership is expected to decline by approximately 10% in 2026 before returning to growth in 2027.

UnitedHealth maintains a strong balance sheet, with a debt-to-capital ratio of 44.1%, and generated operating cash flow of $5.9 billion during the quarter. The company expects to resume share buybacks in the second half of 2026 once debt metrics improve.

Management anticipates that the current analyst consensus captures an appropriate baseline for 2026 earnings, with formal guidance expected in January alongside plans for targeted asset sales and international market exits.

Is UNH Stock Undervalued Right Now?

Analysts tracking UNH stock forecast revenue to increase from $400 billion in 2024 to $540 billion in 2029. In this period, adjusted earnings are forecast to expand from $27.66 per share to $31.6 per share. Analysts also expect the annual dividend per share to increase from $8.18 in 2024 to $10.63 in 2029.

If UNH stock is priced at 18.8x forward earnings, which is similar to its 10-year average, the healthcare giant could return 82% over the next 40 months. After adjusting for dividends, cumulative returns could be closer to 95%.

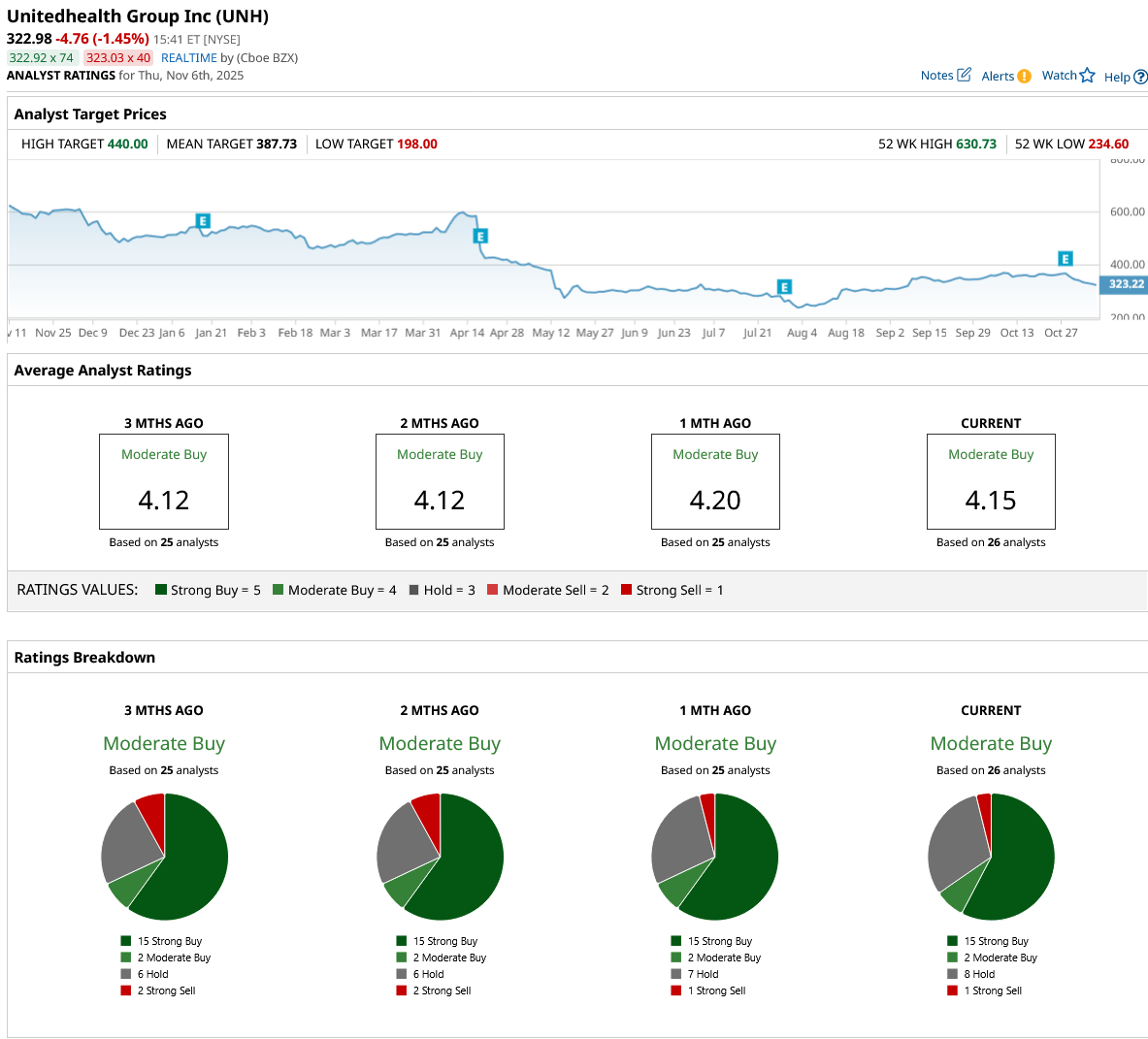

Out of the 26 analysts covering UNH stock, 15 recommend “Strong Buy,” two recommend “Moderate Buy,” eight recommend “Hold,” and one recommends “Strong Sell.” The average UNH stock price target is $387.73, above the current price of $322.98.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here