Nevada-based Las Vegas Sands Corp. (LVS) develops, owns, and operates six integrated resorts in Macau and Singapore. Valued at $40.1 billion by market cap, the company’s integrated resorts feature luxurious accommodations, casinos, entertainment, malls, celebrity chef restaurants, and other amenities.

The resort giant has notably outpaced the broader market in 2025, while marginally lagging behind over the past year. LVS stock prices have surged 20.2% on a YTD basis and 19.3% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 19.6% returns over the past year.

Narrowing the focus, LVS has also outpaced the sector-focused Consumer Discretionary Select Sector SPDR Fund’s (XLY) 8% uptick in 2025 and slightly underperformed XLY’s 21% gains over the past 52 weeks.

Las Vegas Sands’ stock prices surged 12.4% in a single trading session following the release of its robust Q3 results on Oct. 22. Driven by the solid performance of the company’s The Londoner Macao and Marina Bay Sands Singapore properties, its overall revenues observed a massive boost. Its net revenues for the quarter came in at $3.3 billion, up a massive 24.2% year-over-year and 10.4% above the Street expectations. Moreover, its adjusted EPS soared 77.3% year-over-year to $0.78, surpassing the consensus estimates by 25.8%.

For the full fiscal 2025, ending in December, analysts expect LVS to deliver an adjusted EPS of $2.89, up 27.3% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it surpassed the projections on two other occasions.

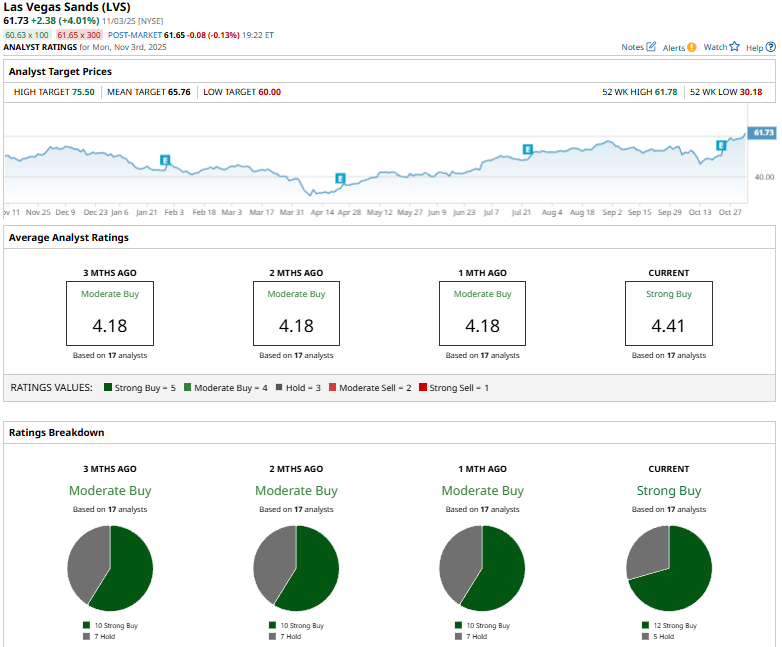

Among the 17 analysts covering the LVS stock, the consensus rating is a “Strong Buy.” That’s based on 12 “Strong Buys” and five “Holds.”

This configuration is notably more optimistic than a month ago, when only 10 analysts gave “Strong Buy” recommendations.

On Oct. 24, Goldman Sachs (GS) analyst Lizzie Dove maintained a “Neutral” rating on LVS and raised the price target from $57 to $64.

LVS’s mean price target of $65.76 represents a modest premium of 6.5% from current price levels. Meanwhile, the street-high target of $75.50 suggests a notable potential upside of 22.3%.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart