With a market cap of $9.5 billion, Baxter International Inc. (BAX) is a global healthcare company that specializes in medical products and therapies, with a strong focus on renal care, medication delivery, and pharmaceuticals. The company provides a wide range of healthcare solutions for hospitals, clinics, and home care settings worldwide.

Shares of the Deerfield, Illinois-based company have lagged behind the broader market over the past 52 weeks. BAX stock has decreased 48.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.7%. Moreover, the stock has fallen 36.7% on a YTD basis, compared to SPX's 16.3% rise.

Looking closer, shares of the drug and medical device maker have underperformed the Health Care Select Sector SPDR Fund's (XLV) 2.6% drop over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.69, Baxter’s shares plunged 14.5% on Oct. 30 as revenue of $2.84 billion missed forecasts. The company cut its full-year adjusted EPS guidance to $2.35 - $2.40 and reduced expected sales growth to 4% - 5% amid hurricane-related disruptions at its North Cove facility. Continued weakness in its infusion pump portfolio, including a shipment hold on the Novum IQ pump tied to two deaths, fueled investor concerns.

For the current fiscal year, ending in December 2025, analysts expect BAX’s adjusted EPS to grow 24.9% year-over-year to $2.36. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

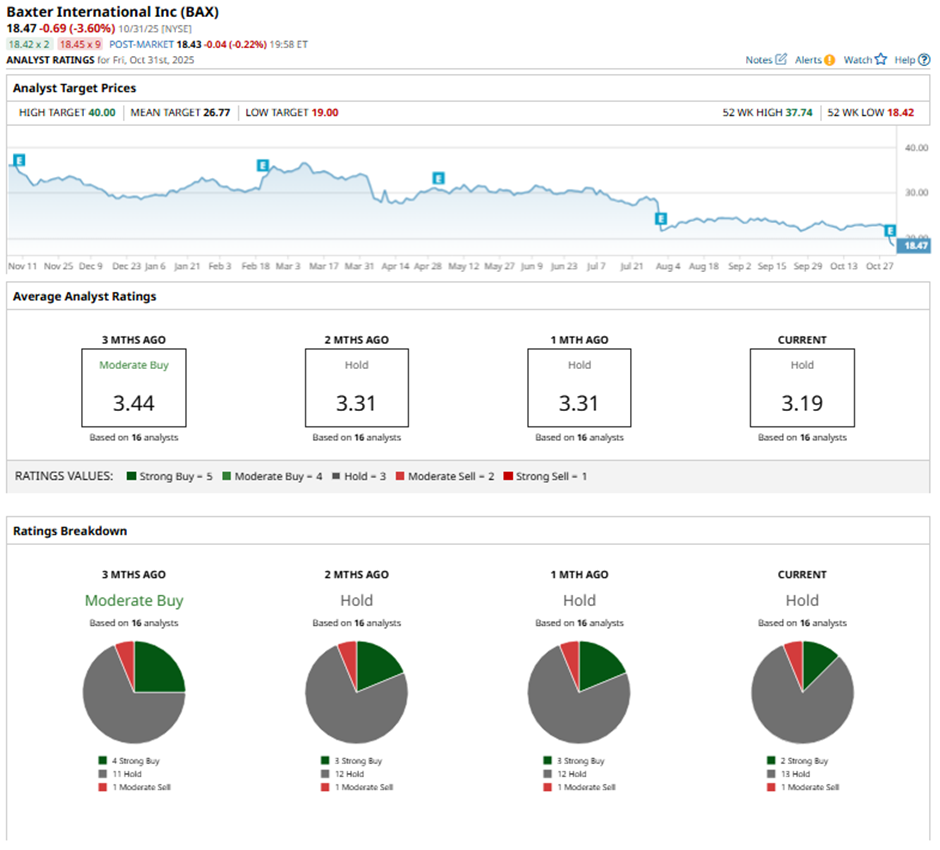

Among the 16 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 13 “Holds,” and one “Moderate Sell.”

This configuration is less bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Oct. 31, Goldman Sachs’ David Roman cut Baxter’s price target to $22 and kept a “Neutral" rating.

The mean price target of $26.77 represents a 44.9% premium to BAX’s current price levels. The Street-high price target of $40 suggests a 116.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart