Billionaire Bill Ackman delivered some sobering news for investors hoping to see Fannie Mae (FNMA) and Freddie Mac (FMCC) go public soon. Speaking on X, formerly Twitter, earlier this week, the hedge fund manager made clear these mortgage giants aren't close to ready for an IPO, even though the Trump administration has floated the idea of taking them public by late 2025 or early 2026.

Ackman pointed out that getting these companies market-ready takes serious time and effort, especially when it comes to winning over the financial community. However, Ackman outlined several ideas that could help accelerate progress.

His suggestions include having Treasury exercise its 79.9% warrants in both firms and getting their shares back on the New York Stock Exchange. This approach would let big institutional players start building positions now rather than waiting for a formal offering. It could also help Trump hit his target timeline.

At first, investors seemed to like what they'd heard, as FNMA and FMCC shares both jumped more than 7% after Ackman's presentation, and FNMA was up 13.69% when markets closed yesterday. , Today, however, is a different story, and FNMA stock cratered right back down by almost the same amount at -13.88%.

Is FNMA Stock a Good Buy?

Federal National Mortgage Association, also known as Fannie Mae, provides financing solutions for residential mortgages across America. The company works in two main areas: single-family and multifamily housing.

FNMA buys mortgages from lenders and packages them into securities, manages credit risk through underwriting standards, and handles credit losses. The firm also trades mortgage-backed securities, invests in low-income housing projects, and supports state and local housing agencies by backing their bonds. These activities help keep mortgage money flowing to homebuyers nationwide.

Valued at a market cap of $65 billion, FNMA stock trades on the OTC markets with an average three-month volume of 7.37 million.

Fannie Mae posted solid third-quarter results, indicating the mortgage giant continues to build capital while navigating a challenging housing market. In Q3 of 2025, it reported net income of $3.9 billion, up 16% from the previous quarter, bringing the net worth to $105.5 billion. This marks significant progress since January 2020, given that Fannie Mae has grown its net worth by $92 billion through retained earnings.

The company reported net revenue of $7.3 billion in Q3 and ended the quarter with a guarantee book of $4.1 trillion. These stable guarantee fees accounted for roughly 81% of total revenues, highlighting the consistency of the income stream.

Despite ongoing affordability issues that have kept homebuyers on the sidelines, Fannie Mae provided $109 billion in liquidity to the mortgage market during the quarter. This helped more than 400,000 households, including 207,000 homebuyers, half of whom were first-time buyers.

Q3 earnings got a boost from lower credit loss provisions and reduced operating expenses. Its administrative costs decreased mainly because the company reduced its workforce of employees and contractors.

Fannie Mae also changed how it handles foreclosed properties, which helped trim expenses further. Additionally, the company reported debt extinguishment gains from repurchasing some of its own mortgage-backed securities.

On the credit front, single-family loans continue to perform well with strong borrower metrics. However, the multifamily side faces greater pressure as apartment properties face softer rent growth and rising operating costs. Delinquencies and charge-offs ticked up slightly in the multifamily portfolio, though nearly all these loans carry some form of credit protection.

What’s Next for FNMA Stock?

Looking ahead, Fannie Mae doesn't expect refinancing activity to pick up meaningfully unless mortgage rates fall below 5%. About 80% of new single-family loans in the quarter were purchase mortgages rather than refinances, reflecting the rate environment. The company still faces a regulatory capital deficit of $25.4 billion and would need $190 billion to meet full capital requirements.

Management stressed its focus on building capital through strong earnings and careful risk management while continuing to support American homeowners and renters. The company's return on required equity reached 10.3% for the quarter, showing improved capital efficiency.

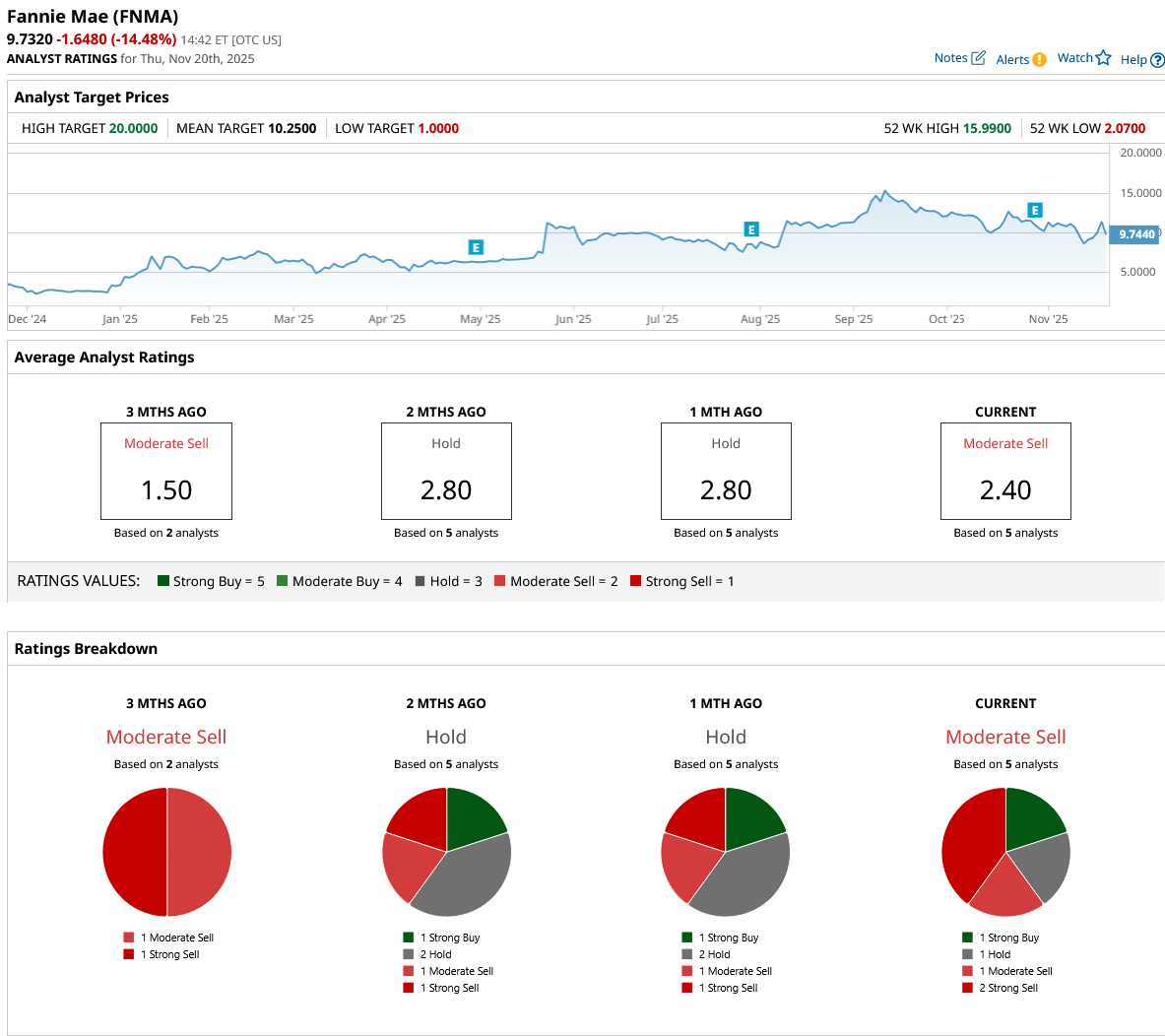

Out of the five analysts covering FNMA stock, one recommends “Strong Buy,” one recommends “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average Fannie Mae stock price target is $10.25, below the current price of $11.38.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?