Walmart (WMT) is set to report its third-quarter fiscal 2026 results on Thursday, Nov. 20. Despite the retailer’s steady quarterly performances, the stock has barely moved in the recent past. Notably, Walmart shares have increased by about 1.6% over the last three months.

The retailer continues to benefit from its broad revenue mix and the growing contribution of higher-margin businesses, both of which have helped support profitability. These attributes have helped Walmart weather a volatile consumer backdrop better than many of its peers.

However, rising costs tied to tariffs have added pressure to margins, creating a headwind that has kept the stock’s momentum subdued.

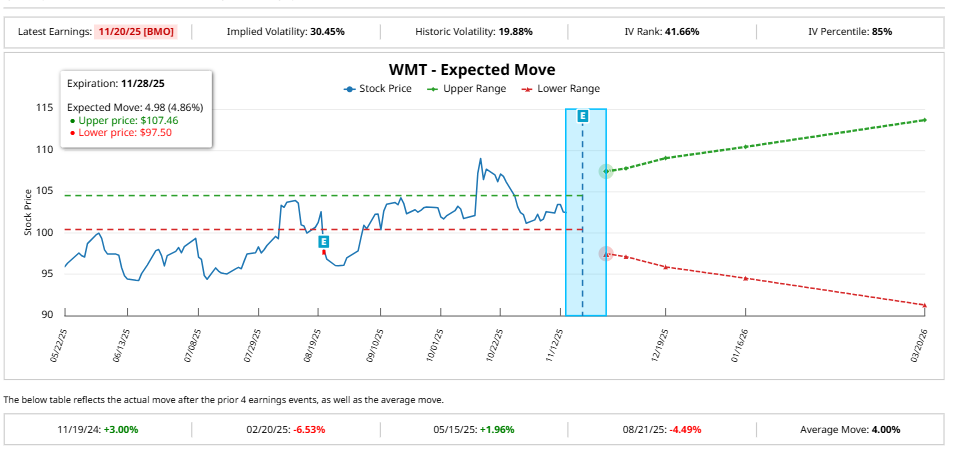

Notably, options markets are currently pricing in a 4.9% swing in either direction following the earnings release for contracts expiring Nov. 28, slightly larger than the average move of about 4% over the last four quarters. Historically, Walmart shares have fallen in two of the past four earnings reactions, reflecting the mixed sentiment heading into Thursday.

Walmart Q3: Here’s What to Expect?

Walmart heads into its third-quarter earnings with steady momentum, even as the broader economic environment remains uncertain. The retailer’s value pricing strategy, wide product range, ease of shopping, and diversified revenue stream continue to drive its top line.

Management expects Q3 revenue to increase by 3.75% and 4.75%, helped in part by a modest boost from the recently acquired VIZIO business. The company’s enormous store network is playing a significant role in supporting its growth, driving its digital sales through faster deliveries.

Notably, e-commerce could once again significantly boost Walmart’s top line. In the second quarter, online sales increased by 25% year-over-year, and this strength is expected to sustain. In the U.S. market, digital sales grew an even faster 26%, marking an acceleration after several quarters of growth in the low 20% range.

Walmart’s fulfillment channels are supporting its growth, especially from stores. In Q2, delivery from stores surged 50%. The retailer’s fast delivery is proving to be a competitive advantage. One out of every three recent store deliveries arrived within three hours, and one in five reached customers in just 30 minutes. This speed is largely made possible by Walmart’s vast store base, which doubles as an efficient fulfillment network.

Walmart’s marketplace business is also gaining traction, with sales rising nearly 20% as more third-party sellers utilize the company’s fulfillment services.

Profitability is expected to remain strong despite cost concerns. Walmart is gradually reducing its reliance on low-margin retail categories as its higher-margin businesses, such as advertising and memberships, are contributing meaningfully. Improvements in e-commerce profitability are also likely to sustain, supported by more efficient delivery operations and the rapid growth of Walmart’s advertising segment. Membership fees should further cushion its bottom line, driven by rising sign-ups, strong renewals, and increasing adoption of Walmart+’s higher-tier offerings.

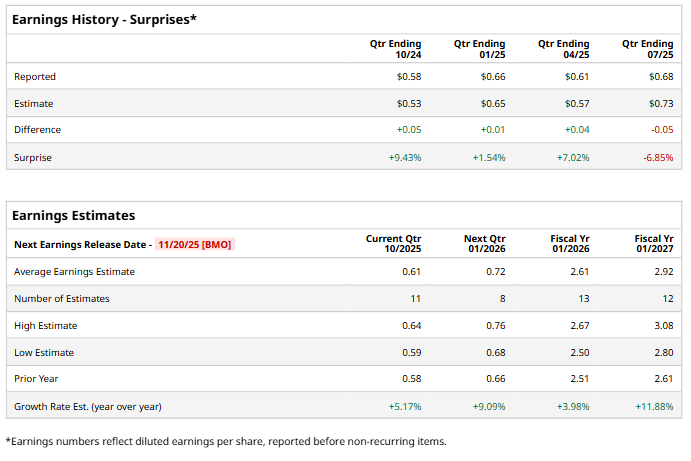

Analysts expect Walmart to report earnings of $0.61 per share for the third quarter, representing a 5.2% increase from the same period last year. The company has topped Wall Street expectations in three of the past four quarters, though its most recent results came in slightly below estimates, with a 6.9% miss.

Overall, the setup for Q3 suggests that Walmart is maintaining steady momentum across its core business while building digital, advertising, and membership fee-based revenue streams that can support long-term growth and profitability.

Is Walmart Stock a Buy, Sell, or Hold?

Walmart will continue to benefit from its competitive pricing strategy, the rapid expansion of its digital business, and the rising contribution of higher-margin segments. By combining a massive store network with an increasingly efficient online operation, Walmart has built a solid foundation for steady growth.

Analysts are optimistic about Walmart stock ahead of its Q3 earnings release, making it a solid long-term investment. However, with shares trading at a forward price-earnings ratio near 39.3 times and earnings expected to grow about 11.9% in fiscal 2027, Walmart is not a bargain play.

In short, Walmart appears well-positioned for continued growth, but investors should exercise caution ahead of its earnings.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why MP Materials’ (MP) Implosion Presents a Rare Upside Opportunity for Quants

- Wedbush Says to Push Through the ‘Whiteknuckle Moment’ and Keep Buying Palantir Stock

- Micron Stock Jumped 24% in a Month: Should You Buy, Sell, or Hold MU?

- The Crypto Selloff Is Weighing Down Robinhood Stock, but Bridgewater Is Betting Big