Circle Internet Group (CRCL) declined by 13% yesterday, which is the stock's biggest fall since June, due to market attention shifting from the strong performance in the third quarter to potential challenges to profitability in the coming period because of low bond yields. Having benefited from another spate of increased usage of USDC, revenue more than doubled from a year earlier, but notwithstanding this, market watchers focused intently on the fall in Circle’s reserve return rate, which is an important profitability driver that is pegged to U.S. Treasury yields.

The environment is tougher for interest-rate-sensitive fintech plays, and stablecoin issuers find themselves in the middle of this transition. As hopes of further decreases in interest rates intensify in international markets, interest-income-dependent companies find themselves repriced in the market. CRCL’s recent earnings figures make this conflict clear, as CRCL’s stock is now close to $85, which is a far cry from previous highs, at a time when even the crypto market faces macro-related challenges in international markets.

About Circle Stock

Circle Internet Group is one of the top issuers of the stablecoin USDC, functioning at the nexus of blockchain infrastructure, fintech, payment systems, and international markets for digital assets. Having its headquarters in Boston, CRCL has established itself as a vital link between conventional financial systems and tokenized dollars. As the circulation of USDC has doubled in a year, CRCL is established as a vital source of liquidity for crypto-trading, cross-border money transfers, and blockchain based business transactions.

CRCL’s stock is also highly volatile, ranging between $64.00 and $298.99 in value in a period of 52 weeks. CRCL’s stock is down by more than 16% over the past five trading days, further lagging large market leaders, including the S&P 500 Index ($SPX), due to increased worries about interest-rate sensitivity as well as derisking in digital asset equities.

From an intrinsic valuation perspective, more traditional metrics offer no clear indication of value because, for example, CRCL is now quoted at a higher multiple of revenue than most established fintech companies, but a high multiple is commonly attributed to young, high-growth infrastructure companies in the digital asset sector by investors.

However, in terms of profitability, more figures appear, but it is negligible at only 1.08% in terms of profit margins, to say nothing of valuation multiples such as PE, ROE, or ROA, as CRCL is more of a hybrid financial entity itself in terms of its structure.

CRCL does not distribute dividends.

Circle Beats on Earnings With Strong USDC Growth

Circle posted a strong third quarter, characterized by increasing adoption of USDC in the United States. The circulating supply of USDC increased to $73.7 billion, reflecting an impressive year-over-year (YoY) growth of 108%. In terms of revenue, total revenue as well as reserve revenue increased by an impressive 66% to $740 million, although net income increased by an even more impressive 202% to $214 million. Even more impressive is that adjusted EBITDA increased by an impressive 78% to $166 million.

The company pointed out several commercial developments in this period as well. Over 100 companies participated in the launch of the Arc Public Testnet, including key industry players in banking, payment systems, digital assets, and technologies. Circle further announced that it is evaluating a native token for the Arc Network, which would provide fresh revenue opportunities in programmable finance, as well as for settlement infrastructure. The Circle Payments Network (CPN) also keeps gaining momentum, as it onboarded 29 clients, is evaluating eligibility for another 55, and has another 500 in line.

The momentum in partnerships also continued, as Circle integrated Brex, Deutsche Börse Group, Finastra, Fireblocks, Hyperliquid, Kraken, Itaú Unibanco, and Visa (V), to name a few. However, what dominated CRCL stock sentiment as a macroeconomic concern was the decrease in Circle’s reserve return rate to 4.15%, as low treasury rates could mean low earnings in the future for the company. Circle did not announce earnings at this time.

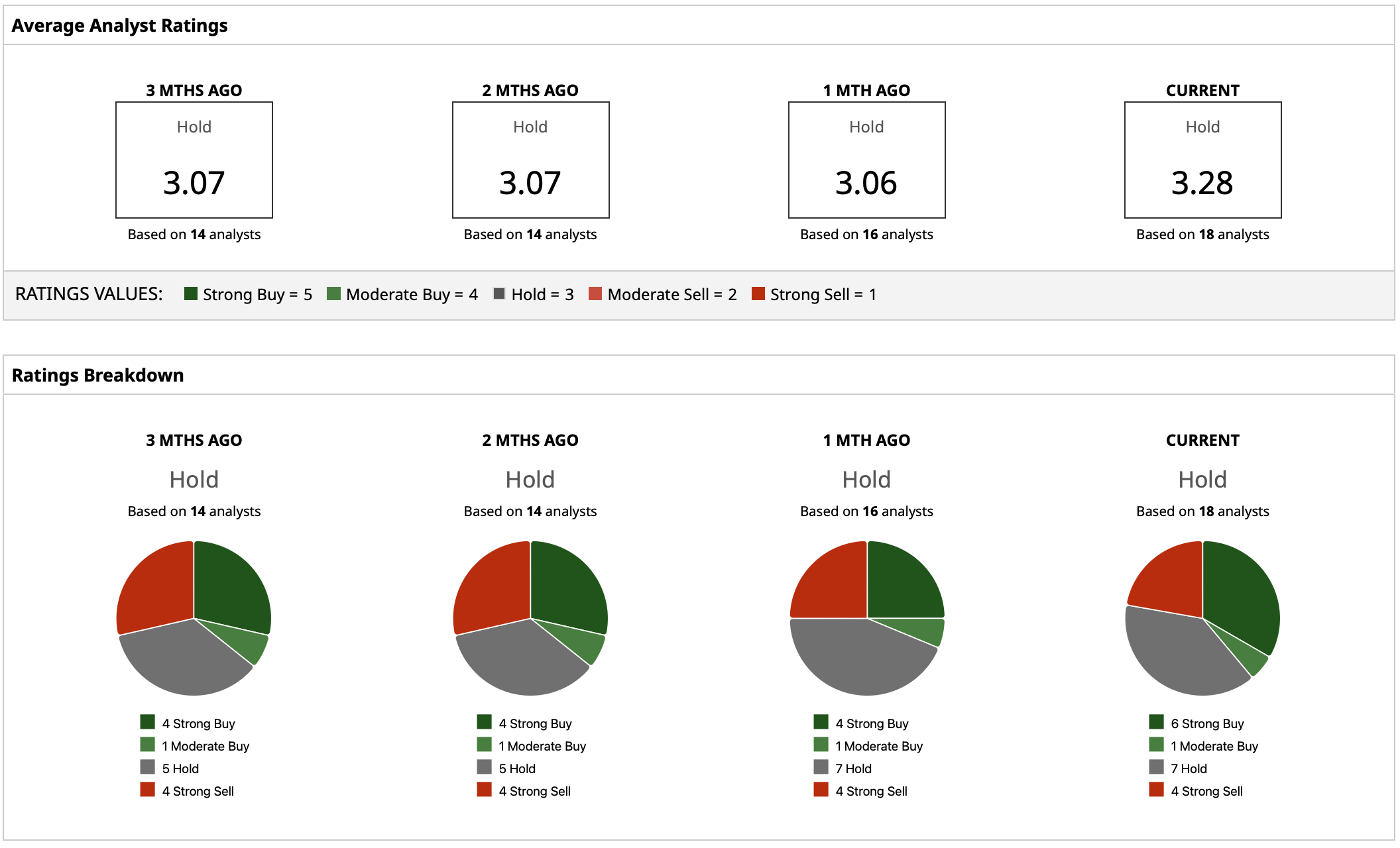

What Do Analysts Expect for CRCL Stock?

Analysts continue to be optimistic about Circle even in the face of current volatility with a “Hold” rating consensus and a mean target of $167.28, ranging from a low of $88 to a high of $280. At $167.28, it provides upside potential of no less than 95% from current market values of approximately $82.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’

- Get Ready for a Short Squeeze in Sweetgreen Stock

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?