Rivian Automotive (RIVN), the electric vehicle (EV) manufacturer best known for producing Amazon's (AMZN) delivery vans, has drawn significant scrutiny and intrigue with its decision to award CEO RJ Scaringe a potential $4.6 billion pay package over the next decade. The package is tied entirely to performance, mirroring in spirit the incentive structure that once propelled Elon Musk at Tesla (TSLA), though on a smaller scale.

Under this plan, Scaringe will have the opportunity to purchase up to 36.5 million RIVN shares at $15.22 per share. The stock options will vest over ten years and are contingent on the company meeting a series of milestones in terms of share price, ranging from $40 to $140, and financial targets, including operating income and cash flow over a seven-year horizon.

Following the board’s approval, RIVN’s stock surged to a fresh 52-week high of $18.13 yesterday, Nov. 11, with analysts taking note. Barclays called the package a constructive step, while BNP Paribas highlighted its alignment with Rivian’s upcoming R2 launch in 2026, which is expected to redefine the company’s competitive position.

So, let us explore if Rivian shifts gears toward profitability or if it is just another daring roll of the dice in the high-voltage EV race.

About Rivian Stock

Headquartered in Irvine, California, Rivian Automotive designs, develops, and manufactures EVs, including the R1T pickup and R1S SUV. With a market cap of approximately $19.9 billion, it provides software, vehicle repair, and fleet management services.

Over the past 52 weeks, RIVN stock has gained 61%. In the last three months, it advanced 42%, and in just the past five trading days, it rose 11% as it made its new 52-week high yesterday.

Currently, RIVN trades at 4.13 times forward sales, a figure that signals a premium compared to the broader industry. The valuation suggests that investors might be willing to pay for Rivian’s growth prospects, underpinned by its strong product lineup, evolving partnerships, and expanding production capacity.

However, with heightened expectations also comes heightened scrutiny, making execution the critical driver of future returns.

Rivian Surpasses Q3 Earnings

On Nov. 4, the EV maker released its third-quarter fiscal 2025 results, and the next day, its stock charged ahead by 23.4%. Rivian generated $1.56 billion in revenue, up 78.3% from last year and ahead of analysts’ forecasts of $1.46 billion.

The company produced 10,720 vehicles at its manufacturing facility in Normal, Illinois, and delivered 13,201 vehicles to customers, marking what management expects to be its strongest delivery quarter of the year.

Gross profit came in at $24 million, a significant turnaround from the $392 million loss in the prior year’s period. The automotive segment posted a $130 million gross profit loss, but that represented a $249 million improvement from the same quarter a year earlier. This loss was offset by $154 million in contributions from its joint venture with Volkswagen AG (VWAGY) and from its expanding software and services business.

The company’s bottom line, though still negative, showed signs of progress. Rivian reported a net loss attributable to common stockholders of $1.17 billion, up 6.6% from the previous year’s quarter. Adjusted loss per share stood at $0.70, beating analyst expectations of $0.72.

As of the end of the third quarter, Rivian held $7.7 billion in total liquidity, including nearly $7.1 billion in cash, cash equivalents, and short-term investments. This is a solid cushion that CEO RJ Scaringe said positions the company “really well” for the highly anticipated R2 launch.

Looking ahead, analysts expect Q4 fiscal 2025 GAAP loss per share to widen 31.8% year-over-year (YoY) to $0.83. However, for the full fiscal year 2025, the company’s GAAP loss per share is projected to narrow 28.9% from the prior year to $3.26 and further tighten in fiscal 2026, narrowing another 13.8% to $2.81.

What Do Analysts Expect for RIVN Stock?

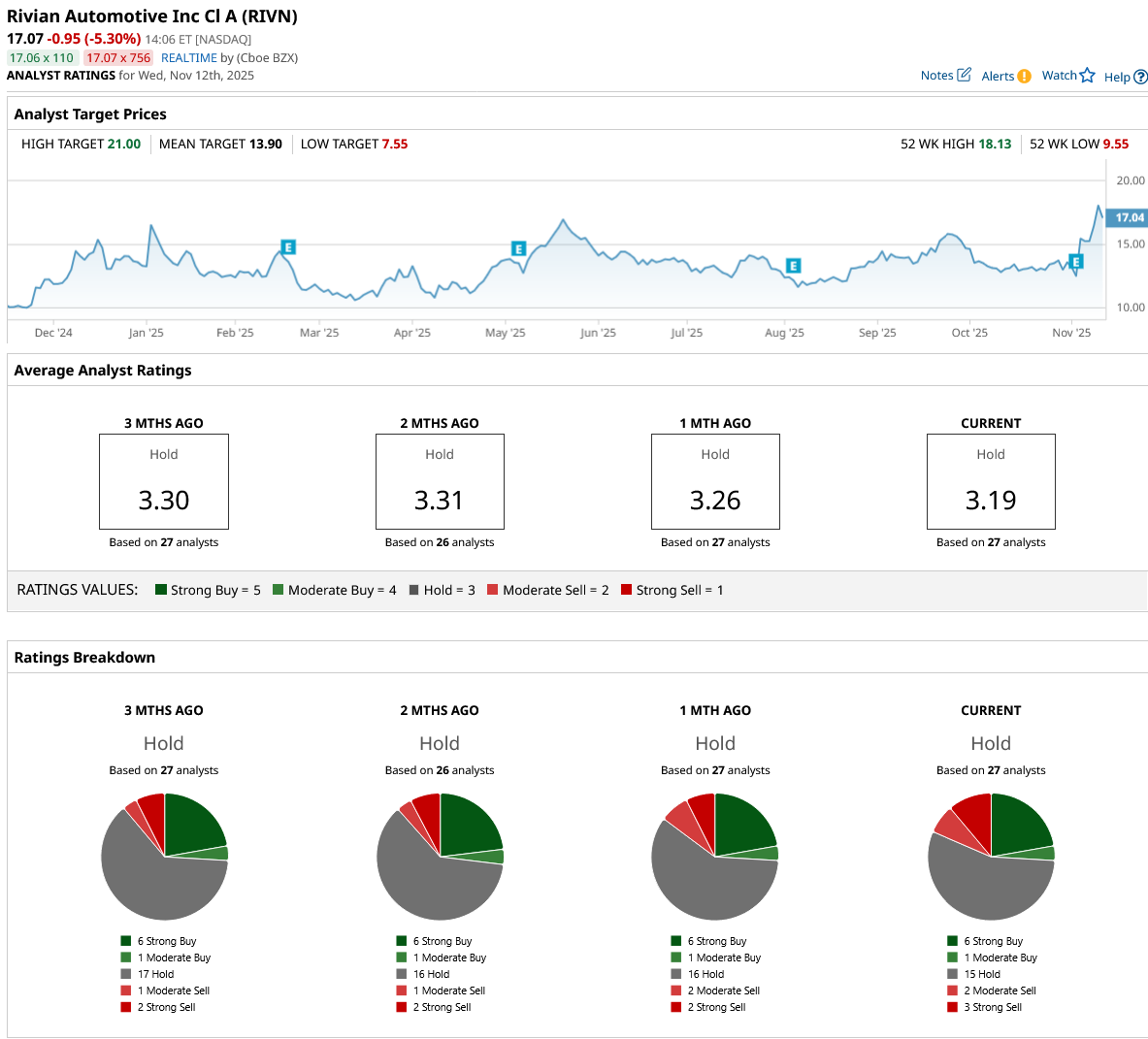

Analyst sentiment toward RIVN remains divided, reflecting both optimism and caution. The consensus rating stands at “Hold.” Among 27 analysts covering the stock, six have issued a “Strong Buy,” one has a “Moderate Buy,” 15 recommend “Hold,” two suggest “Moderate Sell,” and three assign a “Strong Sell.”

RIVN is already trading above its average price target of $13.90. Meanwhile, the Street-high target of $21 represents an even greater potential gain of 24% from current price levels if Rivian successfully executes its strategic roadmap.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla’s China Sales Just Hit a 3-Year Low. Should You Ditch TSLA Stock Now?

- As Trump Calls Insurers ‘BIG,’ ‘BAD,’ and ‘Money Sucking,’ How Should You Play UnitedHealth Stock?

- Rivian Wants to Be the Next Tesla With Huge Pay Package for CEO RJ Scaringe. Should You Buy RIVN Stock?

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?