NXP Semiconductors N.V. (NXPI), headquartered in Eindhoven, the Netherlands, designs, manufactures, and supplies high-performance mixed-signal and standard product solutions. Valued at $51.5 billion by market cap, the company's innovative products and solutions are used in a wide range of applications, including automotive, industrial, IoT, mobile, and communication infrastructure.

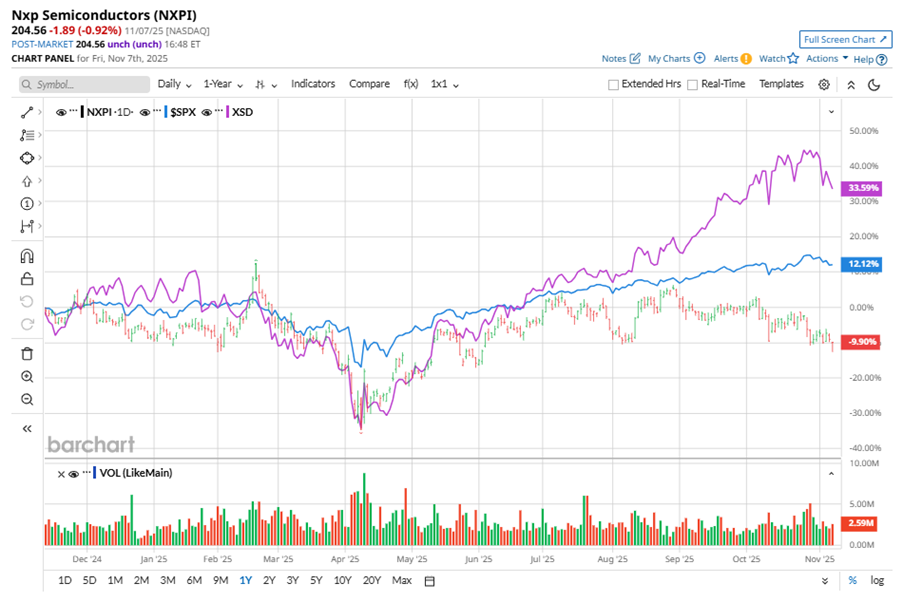

Shares of this leading player in automotive processing and networking have underperformed the broader market over the past year. NXPI has declined 13.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.7%. In 2025, NXPI stock is down 1.6%, compared to the SPX’s 14.4% rise on a YTD basis.

Narrowing the focus, NXPI’s underperformance is also apparent compared to the SPDR S&P Semiconductor ETF (XSD). The exchange-traded fund has gained 30.9% over the past year. Moreover, the ETF’s 31.5% returns on a YTD basis outshine the stock’s single-digit losses over the same time frame.

On Oct. 27, NXPI shares closed up more than 1% after reporting its Q3 results. Its adjusted EPS of $3.11 met Wall Street expectations. The company’s revenue was $3.17 billion, beating Wall Street forecasts of $3.15 billion. For Q4, NXPI expects its adjusted EPS to be in the range of $3.07 to $3.49.

For the current fiscal year, ending in December, analysts expect NXPI’s EPS to decline 11.4% to $10.22 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

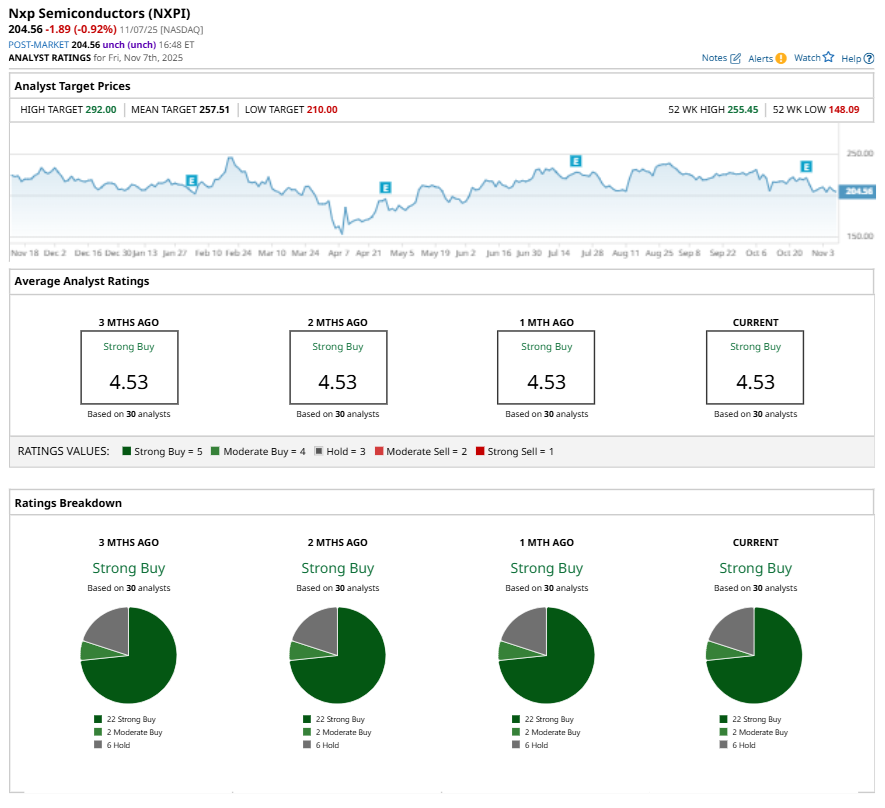

Among the 30 analysts covering NXPI stock, the consensus is a “Strong Buy.” That’s based on 22 “Strong Buy” ratings, two “Moderate Buys,” and six “Holds.”

The configuration has been consistent over the past three months.

On Oct. 29, Jefferies Financial Group Inc. (JEF) analyst maintained a “Buy” rating on NXPI and set a price target of $265, implying a potential upside of 29.5% from current levels.

The mean price target of $257.51 represents a 25.9% premium to NXPI’s current price levels. The Street-high price target of $292 suggests an ambitious upside potential of 42.7%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart