Juby Gold Project Highlights -

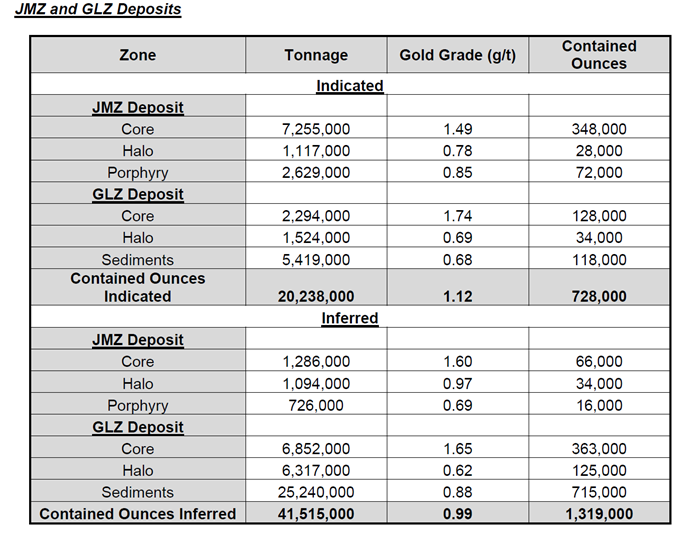

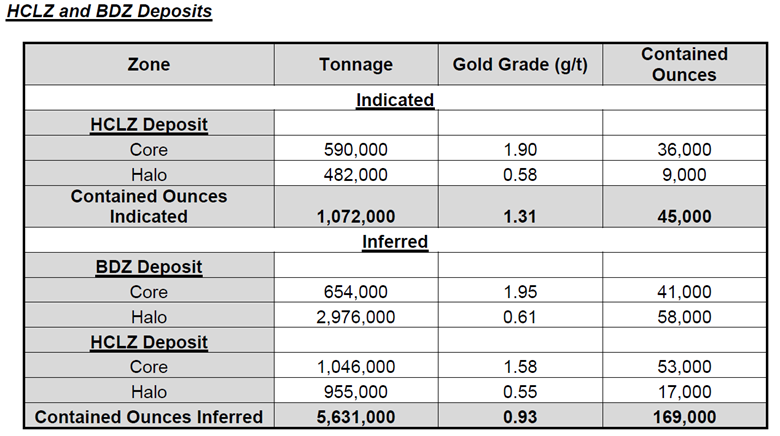

2020 Historical Indicated mineral resource of 773,000 oz of gold in 21,310,000 tonnes with an average grade of 1.13 g/t gold and an inferred mineral resource containing 1.49 million oz of gold in 47,146,000 tonnes with an average grade of 0.98 g/t gold using a cutoff grade (COG) of 0.4 g/t gold.

Mineral resources were calculated with a $1450 US gold price with significant potential to increase resources in current gold price regime of +$3000 US/ ounce.

Resources occur in 4 mineralized zones along an 8.7-kilometre-long strike length with historical drilling indicating significant potential for resource growth.

The Proposed Acquisition (as defined below) includes 25% ownership of the Knight Joint Venture containing the Tyanite property which historically produced 232,000 oz at 5 g/t gold.

Readers are cautioned to refer to the "Cautionary Note Regarding Historical Estimates," "Cautionary Note Regarding Drill Results and Grades," and all other disclaimers included in this news release for important information regarding the limitations and verification status of the data presented above and elsewhere herein.

TORONTO, ON / ACCESS Newswire / July 8, 2025 / McFarlane Lake Mining Limited ("McFarlane" or the "Company") (CSE:MLM)(OTCQB:MLMLF) is pleased to provide an update further to its July 7, 2025 announcement regarding the proposed acquisition of the Juby Gold Project (the "Proposed Acquisition") from Aris Mining Holdings Corporation, a wholly-owned subsidiary of Aris Mining Corporation ("Aris") (TSX: ARIS) (NYSE: -A: ARMN), which is being completed pursuant to a definitive asset purchase agreement dated July 7, 2025.

Project Description

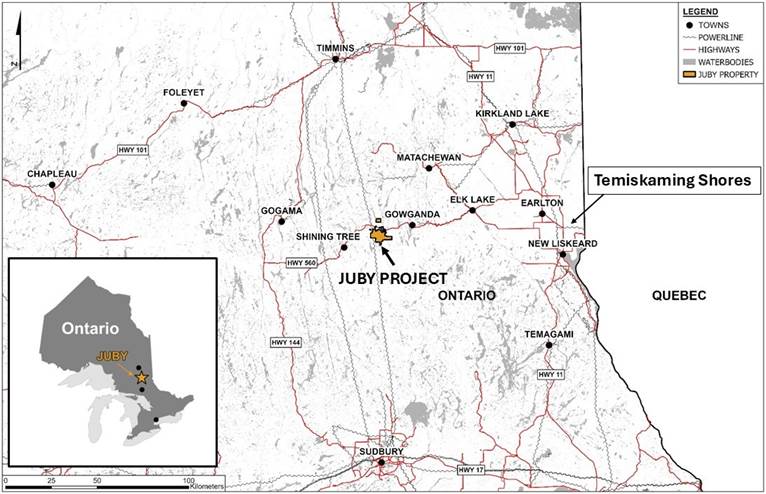

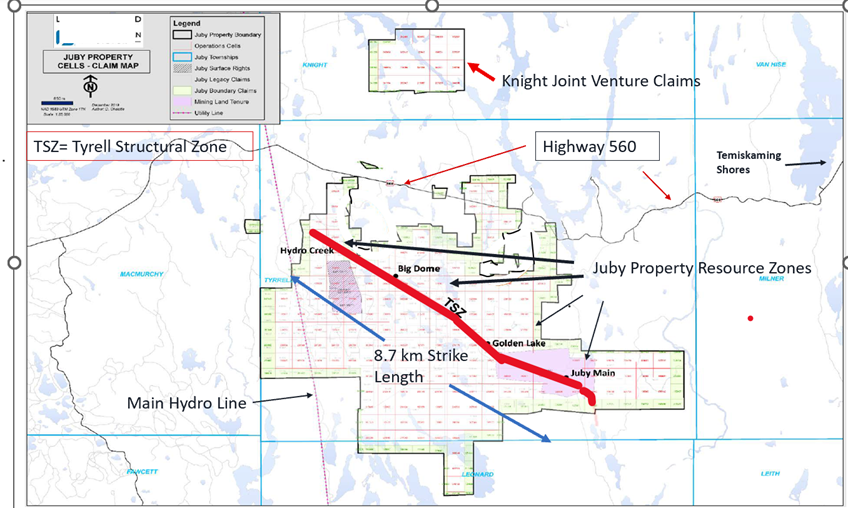

One of Ontario's largest undeveloped gold properties, the Juby Gold project is strategically located in Northeastern Ontario approximately 100 kilometers west of the city of Temiskaming Shores (Figure 1). Near by infrastructure include provincial highway 560 (4 km from site) and high voltage power lines serviced by Ontario Hydro (7 km from site) shown in Figure 2.

Geologically the project is in the prolific Abitibi Greenstone Belt, which has produced over 200 million ounces of gold. There are 4 defined gold mineralized zones on the Juby property namely, Juby, Golden Lake, Big Dome and Hydro Creek (Figure 2).

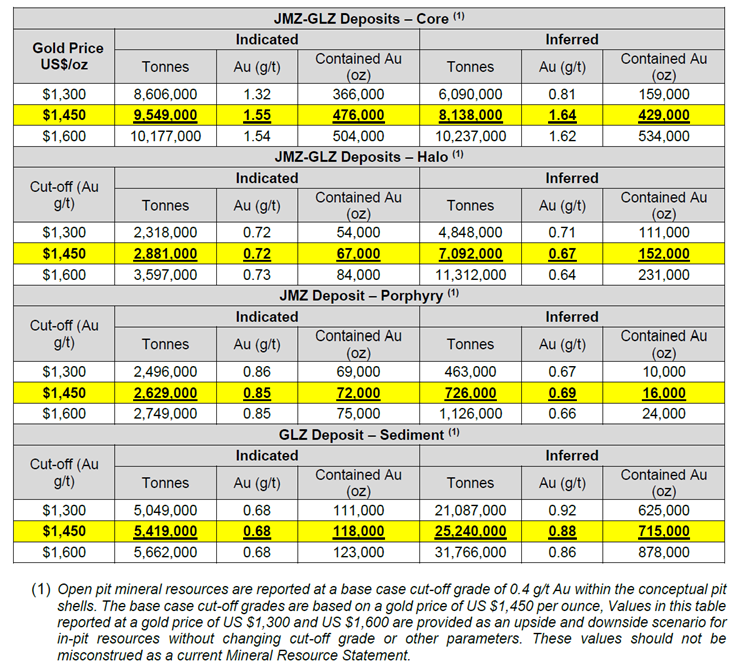

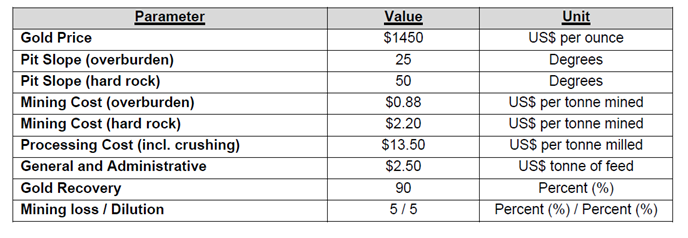

A historical National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") technical report (the "technical report") co-authored by GeoVector Management and SGS Geological Services in July 2020, has assessed the following gold resources on the Juby Project (as detailed in Table 1 and Table 2 below). In summary, the indicated mineral resource contains 773,000 oz of gold in 21,310,000 tonnes with an average grade of 1.13 g/t gold and an inferred mineral resource containing 1.49 million oz of gold in 47,146,000 tonnes with an average grade of 0.98 g/t gold both using a cutoff grade (COG) of 0.4 g/t gold. All four zones would be amenable to open pit mining methods. Open pit shells have been defined within the technical report, with the relevant parameters detailed in Note 2 below.

Figure 1 - Location of Juby Gold Project.

Figure 2 - Claim Map Juby Gold Project and Knight Joint Venture.

The inclusion of this property into McFarlane's property portfolio greatly enhances McFarlane's position in the gold exploration space. It moves the Company from an explorer of gold into an explorer and developer of gold resources.

"Our team is excited to bring Juby into our property portfolio. This is a significant step forward for McFarlane in building its gold resource base. Our technical team knows the area and its geology well. This property, along with the nearby Knight Joint Venture property are in an area that is well serviced by electrical power and provincial highways, which help expedite the development of the property. We look forward to working with the local Indigenous communities and all stakeholders to develop the properties in an engaging and sustainable manner" said Mark Trevisiol, CEO of McFarlane.

Table 1 - Juby and Golden Lake Zone Deposits - (see Note 1)

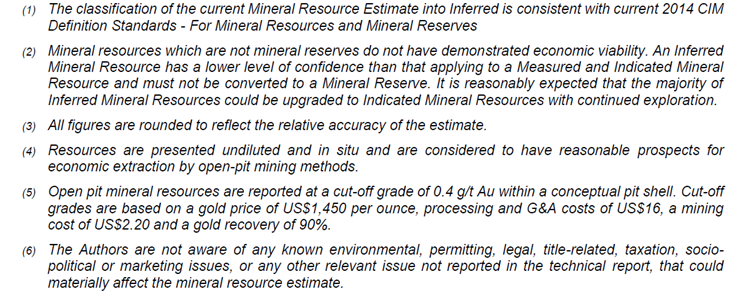

The technical report also includes a sensitivity analysis based on gold price. Table 3 below illustrates how increases in gold prices expand the gold resources in the Juby Gold Project. The analysis in Table 3 is for illustrative purposes only and was prepared using long-term gold prices as of July 2020. The estimates and analysis contained herein are not intended to represent a current resource estimate under NI 43-101 and should not be relied upon for investment purposes. Updating the resource statement based on current long-term gold prices in the range of US$2300 to US$2500 per ounce of gold will require the preparation and filing of a new or updated technical report, prepared in accordance with NI 43-101, by a qualified person. McFarlane expects to prepare an updated technical report as soon as practicable following the closing of the Proposed Acquisition or as may be required by NI 43-101. Readers are cautioned to refer to the "Cautionary Note Regarding Historical Estimates," "Cautionary Note Regarding Drill Results and Grades," and all other disclaimers included in this news release for important information regarding the limitations and verification status of the data presented in this news release.

Table 2 - Hydro Creek Lacarte and Big Dome Zone Deposits (see Note 1)

Table 3 - In Pit Resource sensitivity vs Gold Price (0.4 g/t gold cutoff)

The following notes pertain to Table 1 and Table 2.

Note 1:

Note 2: Parameters used for deposits listed in Table 3 and Table 4

Juby Gold Project Metallurgy

From the technical report referenced herein (July 2020 GeoVector Management and SGS Geological Services) numerous metallurgical tests were conducted on samples taken from 2 of the 4 ore zones within the Juby Gold Project, namely the Juby main zone and the Golden Lake zone. Overall, the tests demonstrated an average gold recovery of 92.6% when the ore was reduced to 80% passing 25 micrometers. The metallurgical tests employed a combination of gravity separation and cyanidation.

Knight Joint Venture

As highlighted above, the Proposed Acquisition includes Aris Mining Holdings Corp.'s 25% interest in the Knight Joint Venture (the "Knight JV"). The remaining 75% of the Knight JV is owned by Orecap Invest Corp. (TSXV:OCI), which is a merchant bank focused on critical and precious metals.

There is one main property underlying the Knight JV, called the Tyranite property, which is located within 3 km of the Juby Gold Project. As outlined in the technical report, the Tyranite property is a past producer of gold where 232,000 ounces was extracted at a gold grade of 5 g/t. There is an existing headframe and shaft on the property which goes to 343 meters depth. The close proximity of this property to the Juby Gold Project presents potential future synergies in processing of ores within a potential common milling operation near the Juby site.

Cautionary Note Regarding Historical Estimates:

The historical production figures and resource estimates presented in this news release for the Juby Gold Project and Tyranite properties are considered historical in nature and have not been verified by a qualified person under NI 43-101. Neither Aris or McFarlane are treating these historical estimates as current mineral resources or mineral reserves and they should not be relied upon. A qualified person has not completed sufficient work to classify the historical estimates as current mineral resources or reserves.

Cautionary Note Regarding Drill Results and Grades:

The drill results, grades, and interceptions disclosed herein for the Juby Gold Project and Tyranite properties are from prior exploration programs and have not been verified by a qualified person under NI 43-101. These results are historical in nature, are not current, and should not be relied upon as indicative of future exploration success or as current mineral resources or reserves. Further, the grades and interceptions presented may not reflect the potential for economic extraction and are presented for illustrative purposes only. Additional exploration work, including verification drilling, sampling, and independent analysis by a qualified person, will be required to verify these results and bring them into compliance with NI 43-101.

Historical Technical Data

Under NI 43-101 guidelines the technical data and information provided in this announcement is considered to be historical. The data and information was taken from a report titled "Technical Report on the Update Mineral Resource Estimate on the Juby Gold Project", co-authored by GeoVector Management and SGS Geological Services having an effective date of July 14, 2020.

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark P. Geo, consulting geologist to the company and Mark Trevisiol, P.Eng., an officer of the company. Both individuals are a "qualified person" as defined under NI 43-101. Where historical information has not been verified, the report clearly indicates so.

About McFarlane Lake Mining Limited

McFarlane is a gold exploration company focused on the exploration and development of its portfolio of properties. The Juby Gold Project as detailed herein, the past producing McMillan and Mongowin gold properties, located 70 km west of Sudbury, Ontario, the past producing West Hawk Lake property located immediately west of the Ontario-Manitoba border, and the High Lake gold property located east of the Ontario-Manitoba border and 8 km from the West Hawk Lake property. McFarlane also owns the Michaud/Munro mineral property situated 115 km east of Timmins along the so-called "Golden Highway". McFarlane is a "reporting issuer" under applicable securities legislation in the provinces of, British Columbia, Alberta and Ontario.

To learn more, visit: https://mcfarlanelakemining.com/

Additional information on McFarlane Lake can be found by reviewing its profile on SEDAR+ at www.sedarplus.com.

Other Information Regarding the Proposed Acquisition

Aris and McFarlane are arm's-length parties. No finders' fees were paid in connection with signing the definitive asset purchase agreement pertaining to the Proposed Acquisition. Aris will become a 19.9% shareholder (maximum) as a result of the successful completion of the transaction.

The Company continues to evaluate its financing options in connection with the Proposed Acquisition. Any details regarding a financing arrangement will be disclosed in a subsequent press release, once determined and in consideration of prevailing market conditions.

The Company does not expect that the Proposed Acquisition will require shareholder approval under applicable corporate law or the policies of the Canadian Securities Exchange (the "CSE"). However, any proposed financing in connection with the Proposed Acquisition may be subject to shareholder approval in accordance with CSE policies. While no such approval is currently required, should it become necessary, the Company intends to obtain it by way of written consent, as permitted. The need for such approval remains to be determined and will depend on the total number of securities issued in connection with the Proposed Acquisition, including any concurrent financing completed in connection therewith.

Cautionary Note Regarding Forward-Looking Information:

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, including but not limited to the Proposed Acquisition, the terms and timing thereof, any related financing plans, the requirement for shareholder approval, and the anticipated method of obtaining such approval (if required), as well as the Company's intentions with respect to regulatory approvals, including acceptance by the CSE. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of McFarlane to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption "Risks Factors" in the Company's Annual Information Form dated as of November 27, 2024, which is available for view on SEDAR+ at www.sedarplus.com. These risks and uncertainties include, but are not limited to, risks related to the ability to obtain necessary regulatory approvals (including final acceptance of the Proposed Acquisition by the CSE), risks related to financing arrangements and market conditions, and risks generally associated with the execution of business transactions in the mining sector.

Forward-looking statements contained herein are made as of the date of this press release and McFarlane disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management's estimates or opinions should change, or otherwise.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

Further Information

For further information regarding McFarlane Lake, please contact:

Mark Trevisiol,

Chief Executive Officer, President and Director

McFarlane Lake Mining Limited

(705) 665 5087

info@mcfarlanelakemining.com

SOURCE: McFarlane Lake Mining Limited

View the original press release on ACCESS Newswire